Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable

fuels company focused on low and negative carbon intensity products

that replace fossil fuels, today announced its financial results

for the three and nine months ended September 30, 2024.

Revenues of $81.4 million for the third quarter of 2024 reflect

strong execution by all three of the company’s operating segments,

with the California Ethanol business generating $45.0 million in

revenues, the India Biodiesel business generating $32.2 million in

revenues, and the Dairy Renewable Natural Gas (RNG) business

generating $4.2 million in revenues.

“Each of the Aemetis segments increased revenue during the third

quarter of 2024 compared to the second quarter of 2024, reflecting

underlying strength and growth,” stated Todd Waltz, Chief Financial

Officer of Aemetis. “Additionally, we anticipate substantial

revenue growth from our operating dairies and new dairies under

construction when we receive LCFS provisional pathway approvals as

well as federal Inflation Reduction Act (IRA) 45Z production tax

credits for RNG,” added Waltz.

“The approval of 20 years of Low Carbon Fuel Standard mandates

last Friday by CARB is a major milestone for renewable fuels that

directly increases revenues and earnings from each of our U.S.

businesses and projects in ethanol, biogas, SAF/RD and carbon

sequestration,” said Eric McAfee, Chairman and CEO of

Aemetis. “In addition to solid growth in our U.S. businesses,

our India subsidiary generated $112 million of revenues driven by

the one-year, cost-plus contract with government-owned oil

marketing companies that ended in Q3 2024, and we appointed a Chief

Executive Officer for the India business who is leading our work

towards an IPO of the subsidiary.”

We invite investors to review the Aemetis Corporate Presentation

on the Aemetis home page prior to the earnings call.

Today, Aemetis will host an earnings review call at 11:00 a.m.

Pacific time (PT).

Live Participant Dial In (Toll Free):

+1-888-506-0062 entry code 139838Live Participant Dial In

(International): +1-973-528-0011 entry code 139838

Webcast URL:

https://www.webcaster4.com/Webcast/Page/2211/51559

For details on the call, please visit

http://www.aemetis.com/investors/conference-calls/

Financial Results for the Three Months Ended September 30,

2024

Revenues during the third quarter of 2024 were $81.4 million

compared to $68.7 million for the third quarter of 2023. Our Keyes

plant recognized $45.0 million of revenue during the third quarter

with the production of 15.5 million gallons of ethanol. Our Dairy

Natural Gas segment sold 85,993 MMBtu from nine operating dairy

digesters and also sold 935 thousand RINs and 20 thousand metric

tons of LCFS credits to report $4.2 million of revenue during the

third quarter. Our India Biodiesel business recognized $32.2

million of revenue primarily from sales to the India Oil Marketing

Companies.

Gross profit for the third quarter of 2024 was $3.9 million,

compared to a $492 thousand profit during the third quarter of

2023.

Selling, general and administrative expenses were $7.8 million

during the third quarter of 2024 compared to $9.0 million during

the same period in 2023, the decrease in spending was driven

primarily by professional services associated with the sale of tax

credits during the third quarter of 2023.

Operating loss was $3.9 million for the third quarter of 2024,

compared to operating loss of $8.5 million for the same period in

2023.

Interest expense, excluding accretion of Series A preferred

units in the Aemetis Biogas LLC subsidiary, increased to $11.7

million during the third quarter of 2024 compared to $10.2 million

during the third quarter of 2023. Additionally, Aemetis Biogas

recognized $3.3 million of accretion of Series A preferred units

during the third quarter of 2024 compared to $7.7 million during

the third quarter of 2023.

Net loss was $17.9 million for the third quarter of 2024,

compared to net income of $30.7 million for the third quarter of

2023.

Cash at the end of the third quarter of 2024 was $296 thousand

compared to $2.7 million at the close of the fourth quarter of

2023. We recorded investments in capital projects related to the

reduction of the carbon intensity of Aemetis ethanol and

construction of dairy digesters of $4.5 million for the third

quarter of 2024.

Financial Results for the Nine Months Ended September 30,

2024

Revenues were $220.6 million for the first three quarters of

2024, compared to $116.0 million for the first three quarters of

2023. The increase in revenue in 2024 was due to strong performance

from California Ethanol, India Biodiesel, and Dairy Renewable

Natural Gas throughout the nine months of 2024 compared to the same

period of 2023.

Gross profit for the first three quarters of 2024 was $1.5

million, compared to a gross profit of $1.2 million during the

first three quarters of 2023.

Selling, general and administrative expenses were $28.4 million

during the first three quarters of 2024, compared to $29.6 million

during the first three quarters of 2023, including $4.0 million of

fixed costs of goods sold charged to selling, general and

administrative during the Keyes plant maintenance period during

2023 and the recognition of a loss on asset disposals of $3.6

million during 2024.

Operating loss was $26.9 million for the first three quarters of

2024, compared to $28.4 million for the first three quarters of

2023.

Interest expense was $34.0 million during the first three

quarters of 2024, excluding accretion and other expenses of Series

A preferred units in our Aemetis Biogas LLC subsidiary, compared to

interest expense of $28.9 million during the first three quarters

of 2023. Additionally, our Aemetis Biogas LLC subsidiary recognized

$10.1 million of accretion and other expenses in connection with

preference payments on its preferred stock during the first three

quarters of 2024 compared to $20.2 million during the first three

quarters of 2023.

Net loss for the first three quarters of 2024 was $71.3 million,

compared to a net loss of $21.0 million during the same period of

2023.

Investments in capital projects of $13.5 million were made

during the first three quarters of 2024, including investments in

capital projects related to Aemetis Biogas of $10.9 million.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable

natural gas, renewable fuel and biochemicals company focused on the

operation, acquisition, development, and commercialization of

innovative technologies that replace petroleum-based products and

reduce greenhouse gas emissions. Founded in 2006, Aemetis is

operating and actively expanding a California biogas digester

network and pipeline system to convert dairy waste gas into

Renewable Natural Gas. Aemetis owns and operates a 65 million

gallon per year ethanol production facility in California’s Central

Valley near Modesto that supplies about 80 dairies with animal

feed. Aemetis owns and operates a 60 million gallon per year

production facility on the East Coast of India producing high

quality distilled biodiesel and refined glycerin for customers in

India and Europe. Aemetis is developing a sustainable aviation fuel

(SAF) and renewable diesel fuel biorefinery in California to

utilize renewable hydrogen, hydroelectric power, and renewable oils

to produce low carbon intensity renewable jet and diesel fuel. For

additional information about Aemetis, please visit

www.aemetis.com.

Non-GAAP Financial Information

We have provided non-GAAP measures as a supplement to financial

results based on GAAP. A reconciliation of the non-GAAP measures to

the most directly comparable GAAP measures is included in the

accompanying supplemental data. Adjusted EBITDA is defined as net

income/(loss) plus (to the extent deducted in calculating such net

income) interest expense, income tax expense, intangible and other

amortization expense, accretion expense, depreciation expense, loss

on asset disposal, gain on debt extinguishment, USDA cash grants

and share-based compensation expense.

Safe Harbor Statement

This news release contains forward-looking statements, including

statements regarding assumptions, projections, expectations,

targets, intentions or beliefs about future events or other

statements that are not historical facts. Forward-looking

statements include, without limitation, projections of financial

results in 2024 and future years; statements relating to the

development, engineering, financing, construction and operation of

the Aemetis ethanol, biodiesel, biogas, SAF and renewable diesel,

and carbon sequestration facilities; and our ability to promote,

develop and deploy technologies to produce renewable fuels and

biochemicals. Words or phrases such as “anticipates,” “may,”

“will,” “should,” “believes,” “estimates,” “expects,” “intends,”

“plans,” “predicts,” “projects,” “showing signs,” “targets,”

“view,” “will likely result,” “will continue” or similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based on current assumptions

and predictions and are subject to numerous risks and

uncertainties. Actual results or events could differ materially

from those set forth or implied by such forward-looking statements

and related assumptions due to certain factors, including, without

limitation, competition in the ethanol, biodiesel and other

industries in which we operate, commodity market risks including

those that may result from current weather conditions, financial

market risks, customer adoption, counter-party risks, risks

associated with changes to federal policy or regulation, and other

risks detailed in our reports filed with the Securities and

Exchange Commission, including our Annual Reports on Form 10-K, and

in our other filings with the SEC. We are not obligated, and do not

intend, to update any of these forward-looking statements at any

time unless an update is required by applicable securities

laws.

External Investor RelationsContact:Kirin SmithPCG

Advisory Group(646) 863-6519ksmith@pcgadvisory.com

Investor Relations/Media Contact:Todd Waltz(408)

213-0940investors@aemetis.com

(Tables follow)

AEMETIS, INC.CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS(unaudited, in thousands, except per

share data)

| |

|

For the three months endedSeptember

30, |

|

|

For the nine months endedSeptember

30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenues |

|

$ |

81,441 |

|

|

$ |

68,690 |

|

|

$ |

220,636 |

|

|

$ |

115,953 |

|

| Cost of goods sold |

|

|

77,563 |

|

|

|

68,198 |

|

|

|

219,176 |

|

|

|

114,800 |

|

| Gross profit |

|

|

3,878 |

|

|

|

492 |

|

|

|

1,460 |

|

|

|

1,153 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

7,750 |

|

|

|

9,021 |

|

|

|

28,400 |

|

|

|

29,595 |

|

| Operating loss |

|

|

(3,872 |

) |

|

|

(8,529 |

) |

|

|

(26,940 |

) |

|

|

(28,442 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest rate expense |

|

|

10,096 |

|

|

|

8,749 |

|

|

|

29,092 |

|

|

|

24,126 |

|

|

Debt related fees and amortization expense |

|

|

1,651 |

|

|

|

1,433 |

|

|

|

4,892 |

|

|

|

4,732 |

|

|

Accretion and other expenses of Series A preferred units |

|

|

3,267 |

|

|

|

7,739 |

|

|

|

10,055 |

|

|

|

20,188 |

|

|

Other income |

|

|

(1,225 |

) |

|

|

(1,853 |

) |

|

|

(1,176 |

) |

|

|

(2,020 |

) |

| Loss before income taxes |

|

|

(17,661 |

) |

|

|

(24,597 |

) |

|

|

(69,803 |

) |

|

|

(75,468 |

) |

|

Income tax expense (benefit) |

|

|

274 |

|

|

|

(55,308 |

) |

|

|

1,537 |

|

|

|

(54,490 |

) |

| Net Income (loss) |

|

$ |

(17,935 |

) |

|

$ |

30,711 |

|

|

$ |

(71,340 |

) |

|

$ |

(20,978 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (loss) per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.38 |

) |

|

$ |

0.79 |

|

|

$ |

(1.60 |

) |

|

$ |

(0.56 |

) |

|

Diluted |

|

$ |

(0.38 |

) |

|

$ |

0.73 |

|

|

$ |

(1.60 |

) |

|

$ |

(0.56 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

47,216 |

|

|

|

38,881 |

|

|

|

44,517 |

|

|

|

37,504 |

|

|

Diluted |

|

|

47,216 |

|

|

|

41,841 |

|

|

|

44,517 |

|

|

|

37,504 |

|

AEMETIS, INC.CONSOLIDATED CONDENSED

BALANCE SHEETS(in thousands)

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

296 |

|

|

$ |

2,667 |

|

|

Accounts receivable |

|

|

8,027 |

|

|

|

8,633 |

|

|

Inventories |

|

|

19,792 |

|

|

|

18,291 |

|

|

Prepaid and other current assets |

|

|

6,785 |

|

|

|

6,809 |

|

|

Total current assets |

|

|

34,900 |

|

|

|

36,400 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

195,939 |

|

|

|

195,108 |

|

|

Other assets |

|

|

16,586 |

|

|

|

11,898 |

|

|

Total assets |

|

$ |

247,425 |

|

|

$ |

243,406 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders' deficit |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

37,254 |

|

|

$ |

32,132 |

|

|

Current portion of long term debt |

|

|

55,797 |

|

|

|

13,585 |

|

|

Short term borrowings |

|

|

21,418 |

|

|

|

23,443 |

|

|

Other current liabilities |

|

|

17,773 |

|

|

|

15,229 |

|

|

Total current liabilities |

|

|

132,242 |

|

|

|

84,389 |

|

| |

|

|

|

|

|

|

|

|

|

Total long term liabilities |

|

|

374,092 |

|

|

|

375,994 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' deficit: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

48 |

|

|

|

41 |

|

|

Additional paid-in capital |

|

|

293,611 |

|

|

|

264,058 |

|

|

Accumulated deficit |

|

|

(546,745 |

) |

|

|

(475,405 |

) |

|

Accumulated other comprehensive loss |

|

|

(5,823 |

) |

|

|

(5,671 |

) |

|

Total stockholders' deficit |

|

|

(258,909 |

) |

|

|

(216,977 |

) |

| Total liabilities and

stockholders' deficit |

|

$ |

247,425 |

|

|

$ |

243,406 |

|

RECONCILIATION OF ADJUSTED EBITDA TO NET

INCOME/(LOSS)(unaudited, in thousands)

| |

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

| EBITDA Calculation |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(17,935 |

) |

|

$ |

30,711 |

|

|

|

(71,340 |

) |

|

|

(20,978 |

) |

| Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and amortization expense |

|

|

11,747 |

|

|

|

10,182 |

|

|

|

33,984 |

|

|

|

28,858 |

|

|

Depreciation expense |

|

|

2,274 |

|

|

|

1,747 |

|

|

|

6,121 |

|

|

|

5,208 |

|

|

Accretion of Series A preferred units |

|

|

3,267 |

|

|

|

7,739 |

|

|

|

10,055 |

|

|

|

20,188 |

|

|

Loss on asset disposal |

|

|

- |

|

|

|

- |

|

|

|

3,644 |

|

|

|

- |

|

|

Gain on debt extinguishment |

|

|

(162 |

) |

|

|

- |

|

|

|

(162 |

) |

|

|

- |

|

|

Share-based compensation |

|

|

1,982 |

|

|

|

1,806 |

|

|

|

6,928 |

|

|

|

6,223 |

|

|

Intangibles amortization expense |

|

|

12 |

|

|

|

11 |

|

|

|

36 |

|

|

|

35 |

|

|

USDA cash grants |

|

|

- |

|

|

|

(1,774 |

) |

|

|

- |

|

|

|

(1,774 |

) |

|

Income tax expense |

|

|

274 |

|

|

|

(55,308 |

) |

|

|

1,537 |

|

|

|

(54,490 |

) |

| Total adjustments |

|

|

19,394 |

|

|

|

(35,597 |

) |

|

|

62,143 |

|

|

|

4,248 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

1,459 |

|

|

$ |

(4,886 |

) |

|

|

(9,197 |

) |

|

|

(16,730 |

) |

PRODUCTION AND PRICE

PERFORMANCE(unaudited)

| |

|

Three Months ended September 30, |

|

|

Nine Months ended September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Ethanol |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gallons sold (in millions) |

|

|

15.5 |

|

|

|

13.8 |

|

|

|

44.4 |

|

|

|

16.7 |

|

|

Average sales price/gallon |

|

$ |

2.12 |

|

|

$ |

2.64 |

|

|

$ |

1.97 |

|

|

$ |

2.72 |

|

|

Percent of nameplate capacity |

|

|

113 |

% |

|

|

100 |

% |

|

|

108 |

% |

|

|

91 |

% |

| WDG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons sold (in thousands) |

|

|

106 |

|

|

|

98.0 |

|

|

|

305 |

|

|

|

122.0 |

|

|

Average sales price/ton |

|

$ |

84 |

|

|

$ |

96 |

|

|

$ |

90 |

|

|

$ |

98 |

|

| Delivered Cost of

Corn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bushels ground (in millions) |

|

|

5.5 |

|

|

|

5.0 |

|

|

|

15.6 |

|

|

|

6.4 |

|

|

Average delivered cost / bushel |

|

$ |

6.07 |

|

|

$ |

7.48 |

|

|

$ |

6.25 |

|

|

$ |

7.34 |

|

| Dairy Renewable

Natural Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MMBtu produced (in thousands) |

|

|

86.6 |

|

|

|

66.6 |

|

|

|

236.3 |

|

|

|

142.0 |

|

|

MMBtu stored as inventory (in thousands) |

|

|

67.6 |

|

|

|

67.2 |

|

|

|

67.6 |

|

|

|

67.2 |

|

|

MMBtu sold (in thousands) |

|

|

86.0 |

|

|

|

66.6 |

|

|

|

234.8 |

|

|

|

142.0 |

|

|

Biodiesel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metric tons sold (in thousands) |

|

|

26.0 |

|

|

|

15.5 |

|

|

|

73.5 |

|

|

|

42.1 |

|

|

Average Sales Price/Metric ton |

|

$ |

1,198 |

|

|

$ |

1,247 |

|

|

$ |

1,167 |

|

|

$ |

1,265 |

|

|

Percent of Nameplate Capacity |

|

|

69.3 |

% |

|

|

41.0 |

% |

|

|

65.4 |

% |

|

|

21.0 |

% |

| Refined

Glycerin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metric tons sold (in thousands) |

|

|

1.5 |

|

|

|

1.4 |

|

|

|

5.4 |

|

|

|

2.9 |

|

|

Average Sales Price/Metric ton |

|

$ |

720 |

|

|

$ |

623 |

|

|

$ |

621 |

|

|

$ |

651 |

|

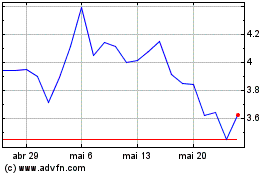

Aemetis (NASDAQ:AMTX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Aemetis (NASDAQ:AMTX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024