Bilibili Inc. (“Bilibili” or the “Company”) (NASDAQ: BILI and HKEX:

9626), an iconic brand and a leading video community for young

generations in China, today announced its unaudited financial

results for the third quarter ended September 30, 2024.

Third Quarter 2024

Highlights:

- Total

net revenues were RMB7.31 billion (US$1,041.0 million),

representing an increase of 26% year over year.

- Mobile

games revenues were RMB1.82 billion (US$259.7 million),

representing an increase of 84% year over year.

-

Advertising revenues were RMB2.09 billion

(US$298.5 million), representing an increase of 28% year over

year.

- Gross

profit was RMB2.55 billion (US$363.0 million),

representing an increase of 76% year over year. Gross profit margin

reached 34.9%, improving from 25.0% in the same period last

year.

- Net

loss was RMB79.8 million (US$11.4 million), narrowing by

94% year over year.

- Adjusted

net profit1 was RMB235.9 million (US$33.6

million), compared with an adjusted net loss of RMB863.5 million in

the same period last year.

-

Operating cash flow was RMB2.23 billion (US$317.1

million) in the third quarter of 2024, compared with RMB277.4

million in the same period last year.

- Average

daily active users (DAUs) were 107.3 million, compared

with 102.8 million in the same period last year.

“This quarter, we sustained strong growth

momentum across our community metrics and key business lines,” said

Mr. Rui Chen, chairman and chief executive officer of Bilibili.

“Both DAUs and MAUs hit record highs of 107 million and 348

million, respectively. Users' average daily time spent also reached

a new high of 106 minutes, increasing by 6 minutes compared to the

same period last year. With our thriving community and highly

engaged user base, we are well-positioned to tap into greater user

value through our diverse commercial offerings. Total revenues in

the third quarter came in at RMB7.31 billion, increasing by 26%

year over year. In particular, revenues from our mobile games and

advertising businesses increased by 84% and 28% year over year,

respectively. With our consistent effort in improving

commercialization efficiency, we achieved our first non-GAAP net

profit in this quarter. This milestone is just a new starting

point. Going forward, we will further develop our commercial

capabilities while reinforcing our community ecosystem, bringing

long-term value to all of our stakeholders.”

Mr. Sam Fan, chief financial officer of

Bilibili, said, “In the third quarter, robust growth in our

high-margin mobile games and advertising businesses accelerated our

total revenue growth and significantly expanded our margins. Our

gross profit surged by 76% year on year and our gross profit margin

rose considerably to 34.9%, up from 25.0% in the same period last

year. Consequently, we recorded an adjusted operating profit of

RMB272.2 million compared with a loss of RMB755.4 million from the

same period of 2023. The significant improvement in our financials

showed the elasticity of our business model, as well as the vast

commercialization potential within our community. We will build on

this landmark and continue to drive sustainable growth in the

future.”

Third Quarter 2024 Financial

Results

Total net revenues. Total net

revenues were RMB7.31 billion (US$1,041.0 million) in the third

quarter of 2024, representing an increase of 26% from the same

period of 2023.

Value-added services (VAS). Revenues from VAS

were RMB2.82 billion (US$402.0 million), representing an increase

of 9% from the same period of 2023, led by increases in revenues

from live broadcasting and other value-added services.

Advertising. Revenues from advertising were

RMB2.09 billion (US$298.5 million), representing an increase of 28%

from the same period of 2023, mainly attributable to the Company’s

improved advertising product offerings and enhanced advertising

efficiency.

Mobile games. Revenues from mobile games were

RMB1.82 billion (US$259.7 million), representing an increase of 84%

from the same period of 2023, mainly attributable to the strong

performance of the Company’s exclusively licensed game, San Guo:

Mou Ding Tian Xia.

IP derivatives and others. Revenues from IP

derivatives and others were RMB567.3 million (US$80.8 million),

representing a decrease of 2% from the same period of 2023.

Cost of revenues. Cost of

revenues was RMB4.76 billion (US$678.1 million), representing an

increase of 9% from the same period of 2023. The increase was

mainly due to higher revenue-sharing costs and was partially offset

by lower content costs. Revenue-sharing costs, a key component of

cost of revenues, were RMB2.91 billion (US$414.8 million),

representing an increase of 19% from the same period of 2023,

mainly due to the increase of mobile games-related revenue-sharing

costs.

Gross profit. Gross profit was

RMB2.55 billion (US$363.0 million), representing an increase of 76%

from the same period of 2023, mainly attributable to the growth in

total net revenues, while costs related to platform operations

remained relatively stable.

Total operating expenses. Total

operating expenses were RMB2.61 billion (US$372.5 million),

representing an increase of 2% from the same period of 2023.

Sales and marketing expenses. Sales and

marketing expenses were RMB1.20 billion (US$171.3 million),

representing a 21% increase from the same period of 2023. The

increase was primarily attributable to increased marketing expenses

for the Company’s exclusively licensed games.

General and administrative expenses. General and

administrative expenses were RMB505.4 million (US$72.0 million),

representing a 1% increase from the same period of 2023.

Research and development expenses. Research and

development expenses were RMB906.1 million (US$129.1 million),

representing a 15% decrease from the same period of 2023. The

decrease was mainly attributable to higher termination expenses of

certain game projects in the same period of 2023.

Loss from operations. Loss from

operations was RMB66.7 million (US$9.5 million), narrowing by 94%

from the same period of 2023.

Adjusted profit/(loss) from

operations1. Adjusted

profit from operations was RMB272.2 million (US$38.8 million),

compared with an adjusted loss from operations of RMB755.4 million

from the same period of 2023.

Total other (expenses)/income,

net. Total other expenses were RMB21.5 million (US$3.1

million), compared with RMB212.1 million in the same period of

2023. The change was primarily attributable to a gain of RMB17.8

million on fair value change in investments in publicly traded

companies in the third quarter of 2024, compared with a loss of

RMB137.4 million in the same period of 2023.

Income tax (expense)/benefit.

Income tax benefit was RMB8.4 million (US$1.2 million), compared

with income tax expense of RMB18.0 million in the same period of

2023.

Net loss. Net loss was RMB79.8

million (US$11.4 million), narrowing by 94% from the same period of

2023.

Adjusted net

profit/(loss)1. Adjusted

net profit was RMB235.9 million (US$33.6 million), compared with an

adjusted net loss of RMB863.5 million in the same period of

2023.

Basic and diluted EPS and adjusted basic

and diluted EPS1. Basic

and diluted net loss per share were RMB0.19 (US$0.03) each,

compared with RMB3.26 each in the same period of 2023. Adjusted

basic and diluted net profit per share were RMB0.57 (US$0.08) each,

compared with an adjusted basic and diluted net loss per share of

RMB2.12 each in the same period of 2023.

Net cash provided by operating

activities. Net cash provided by operating activities was

RMB2.23 billion (US$317.1 million), compared with net cash provided

by operating activities of RMB277.4 million in the same period of

2023.

Cash and cash equivalents, time deposits

and short-term investments. As of September 30, 2024, the

Company had cash and cash equivalents, time deposits and short-term

investments of RMB15.23 billion (US$2.17 billion).

Convertible Senior Notes. As of

September 30, 2024, the aggregate outstanding principal amount of

April 2026 Notes, 2027 Notes and December 2026 Notes was US$432.5

million (RMB3.03 billion).

Share Repurchase Program

The Company announced today that its board of

directors has authorized a share repurchase program under which the

Company may repurchase up to US$200 million of its publicly traded

securities for the next 24 months. The Company’s shareholders have

approved to grant an annual share repurchase mandate to its board

of directors in accordance with the Hong Kong Listing Rules at the

Company’s annual general meeting held on June 28, 2024, which shall

be valid until the Company’s next annual general meeting unless

revoked or varied. The Company also plans to obtain its

shareholders’ approval for a share repurchase mandate at its next

annual general meeting. The Company’s proposed repurchases may be

made from time to time in the open market at prevailing market

prices, in privately negotiated transactions, in block trades

and/or through other legally permissible means, depending on market

conditions and in accordance with applicable laws, rules and

regulations. The Company plans to fund the repurchases from its

existing cash balance.

1 Adjusted profit/(loss) from operations,

adjusted net profit/(loss), and adjusted basic and diluted EPS are

non-GAAP financial measures. For more information on non-GAAP

financial measures, please see the section “Use of Non-GAAP

Financial Measures” and the table captioned “Unaudited

Reconciliations of GAAP and Non-GAAP Results.”

Conference Call

The Company’s management will host an earnings

conference call at 7:00 AM U.S. Eastern Time on November 14, 2024

(8:00 PM Beijing/Hong Kong Time on November 14, 2024). Details for

the conference call are as follows:

|

Event Title: |

Bilibili Inc. Third Quarter 2024 Earnings Conference Call |

| Registration Link: |

https://register.vevent.com/register/BIe88042cc6a194f4f9cd849575a6a65f4 |

| |

|

All participants must use the link provided

above to complete the online registration process in advance of the

conference call. Upon registering, each participant will receive a

set of participant dial-in numbers and a personal PIN, which will

be used to join the conference call.

Additionally, a live webcast of the conference

call will be available on the Company’s investor relations website

at http://ir.bilibili.com, and a replay of the webcast will be

available following the session.

About Bilibili Inc.

Bilibili is an iconic brand and a leading video

community with a mission to enrich the everyday lives of young

generations in China. Bilibili offers a wide array of video-based

content with All the Videos You Like as its value proposition.

Bilibili builds its community around aspiring users, high-quality

content, talented content creators and the strong emotional bonds

among them. Bilibili pioneered the “bullet chatting” feature, a

live comment function that has transformed our users’ viewing

experience by displaying the thoughts and feelings of audience

members viewing the same video. The Company has now become the

welcoming home of diverse interests among young generations in

China and the frontier for promoting Chinese culture across the

world.

For more information, please visit:

http://ir.bilibili.com.

Use of Non-GAAP Financial

Measures

The Company uses non-GAAP measures, such as

adjusted profit/(loss) from operations, adjusted net profit/(loss),

adjusted net profit/(loss) per share and per ADS, basic and diluted

and adjusted net profit/(loss) attributable to the Bilibili Inc.’s

shareholders in evaluating its operating results and for financial

and operational decision-making purposes. The Company believes that

the non-GAAP financial measures help identify underlying trends in

its business by excluding the impact of share-based compensation

expenses, amortization expense related to intangible assets

acquired through business acquisitions, income tax related to

intangible assets acquired through business acquisitions, gain/loss

on fair value change in investments in publicly traded companies,

and gain/loss on repurchase of convertible senior notes. The

Company believes that the non-GAAP financial measures provide

useful information about the Company’s results of operations,

enhance the overall understanding of the Company’s past performance

and future prospects and allow for greater visibility with respect

to key metrics used by the Company’s management in its financial

and operational decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP

and therefore may not be comparable to similar measures presented

by other companies. The non-GAAP financial measures have

limitations as analytical tools, and when assessing the Company’s

operating performance, cash flows or liquidity, investors should

not consider them in isolation, or as a substitute for net loss,

cash flows provided by operating activities or other consolidated

statements of operations and cash flows data prepared in accordance

with U.S. GAAP.

The Company mitigates these limitations by

reconciling the non-GAAP financial measures to the most comparable

U.S. GAAP performance measures, all of which should be considered

when evaluating the Company’s performance.

For more information on the non-GAAP financial

measures, please see the table captioned “Unaudited Reconciliations

of GAAP and Non-GAAP Results.”

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars (“US$”) at specified rates

solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to US$ were made at the rate of RMB7.0176

to US$1.00, the exchange rate on September 30, 2024 set forth in

the H.10 statistical release of the Federal Reserve Board. The

Company makes no representation that the RMB or US$ amounts

referred to could be converted into US$ or RMB, as the case may be,

at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continue,” or other similar expressions. Among other

things, outlook and quotations from management in this

announcement, as well as Bilibili’s strategic and operational

plans, contain forward-looking statements. Bilibili may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission, in its interim and

annual reports to shareholders, in announcements, circulars or

other publications made on the website of The Stock Exchange of

Hong Kong Limited (the “Hong Kong Stock Exchange”), in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including but not limited to

statements about Bilibili’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: results of operations, financial condition, and stock

price; Bilibili’s strategies; Bilibili’s future business

development, financial condition and results of operations;

Bilibili’s ability to retain and increase the number of users,

members and advertising customers, provide quality content,

products and services, and expand its product and service

offerings; competition in the online entertainment industry;

Bilibili’s ability to maintain its culture and brand image within

its addressable user communities; Bilibili’s ability to manage its

costs and expenses; PRC governmental policies and regulations

relating to the online entertainment industry, general economic and

business conditions globally and in China and assumptions

underlying or related to any of the foregoing. Further information

regarding these and other risks is included in the Company’s

filings with the Securities and Exchange Commission and the Hong

Kong Stock Exchange. All information provided in this announcement

and in the attachments is as of the date of the announcement, and

the Company undertakes no duty to update such information, except

as required under applicable law.

For investor and media inquiries, please

contact:

In China:

Bilibili Inc.Juliet YangTel: +86-21-2509-9255

Ext. 8523E-mail: ir@bilibili.com

Piacente Financial Communications Helen WuTel:

+86-10-6508-0677E-mail: bilibili@tpg-ir.com

In the United States:

Piacente Financial Communications Brandi

PiacenteTel: +1-212-481-2050E-mail: bilibili@tpg-ir.com

|

BILIBILI INC.Unaudited Condensed

Consolidated Statements of Operations(All amounts

in thousands, except for share and per share data) |

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues: |

|

|

|

|

|

|

|

|

|

|

Value-added services (VAS) |

2,595,036 |

|

|

2,565,888 |

|

|

2,821,269 |

|

|

7,053,001 |

|

|

7,916,066 |

|

|

Advertising |

1,638,232 |

|

|

2,037,491 |

|

|

2,094,427 |

|

|

4,482,876 |

|

|

5,800,502 |

|

|

Mobile games |

991,776 |

|

|

1,007,367 |

|

|

1,822,609 |

|

|

3,014,279 |

|

|

3,812,786 |

|

|

IP derivatives and others |

580,037 |

|

|

516,398 |

|

|

567,315 |

|

|

1,628,735 |

|

|

1,568,010 |

|

|

Total net revenues |

5,805,081 |

|

|

6,127,144 |

|

|

7,305,620 |

|

|

16,178,891 |

|

|

19,097,364 |

|

|

Cost of revenues |

(4,354,664 |

) |

|

(4,293,943 |

) |

|

(4,758,434 |

) |

|

(12,397,008 |

) |

|

(13,111,617 |

) |

|

Gross profit |

1,450,417 |

|

|

1,833,201 |

|

|

2,547,186 |

|

|

3,781,883 |

|

|

5,985,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

(992,303 |

) |

|

(1,035,596 |

) |

|

(1,202,407 |

) |

|

(2,790,686 |

) |

|

(3,165,062 |

) |

|

General and administrative expenses |

(499,132 |

) |

|

(488,039 |

) |

|

(505,386 |

) |

|

(1,610,526 |

) |

|

(1,525,202 |

) |

|

Research and development expenses |

(1,066,155 |

) |

|

(894,701 |

) |

|

(906,072 |

) |

|

(3,140,188 |

) |

|

(2,765,893 |

) |

|

Total operating expenses |

(2,557,590 |

) |

|

(2,418,336 |

) |

|

(2,613,865 |

) |

|

(7,541,400 |

) |

|

(7,456,157 |

) |

|

Loss from operations |

(1,107,173 |

) |

|

(585,135 |

) |

|

(66,679 |

) |

|

(3,759,517 |

) |

|

(1,470,410 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Other (expenses)/income: |

|

|

|

|

|

|

|

|

|

|

Investment loss, net (including impairments) |

(244,961 |

) |

|

(94,684 |

) |

|

(70,957 |

) |

|

(236,640 |

) |

|

(186,890 |

) |

|

Interest income |

117,722 |

|

|

100,344 |

|

|

91,279 |

|

|

416,022 |

|

|

324,830 |

|

|

Interest expense |

(30,064 |

) |

|

(19,809 |

) |

|

(17,824 |

) |

|

(135,746 |

) |

|

(69,207 |

) |

|

Exchange losses |

(23,871 |

) |

|

(15,275 |

) |

|

(5,909 |

) |

|

(40,423 |

) |

|

(79,244 |

) |

|

Debt extinguishment gain/(loss) |

9,771 |

|

|

- |

|

|

- |

|

|

292,213 |

|

|

(20,980 |

) |

|

Others, net |

(40,695 |

) |

|

256 |

|

|

(18,134 |

) |

|

22,633 |

|

|

36,305 |

|

|

Total other (expenses)/income, net |

(212,098 |

) |

|

(29,168 |

) |

|

(21,545 |

) |

|

318,059 |

|

|

4,814 |

|

|

Loss before income tax |

(1,319,271 |

) |

|

(614,303 |

) |

|

(88,224 |

) |

|

(3,441,458 |

) |

|

(1,465,596 |

) |

|

Income tax (expense)/benefit |

(17,975 |

) |

|

6,154 |

|

|

8,419 |

|

|

(73,565 |

) |

|

13,011 |

|

|

Net loss |

(1,337,246 |

) |

|

(608,149 |

) |

|

(79,805 |

) |

|

(3,515,023 |

) |

|

(1,452,585 |

) |

|

Net (profit)/loss attributable to noncontrolling interests |

(14,198 |

) |

|

(551 |

) |

|

290 |

|

|

(10,814 |

) |

|

15,825 |

|

| Net loss attributable

to the Bilibili Inc.'s shareholders |

(1,351,444 |

) |

|

(608,700 |

) |

|

(79,515 |

) |

|

(3,525,837 |

) |

|

(1,436,760 |

) |

| Net loss per share, basic |

(3.26 |

) |

|

(1.46 |

) |

|

(0.19 |

) |

|

(8.54 |

) |

|

(3.45 |

) |

| Net loss per ADS, basic |

(3.26 |

) |

|

(1.46 |

) |

|

(0.19 |

) |

|

(8.54 |

) |

|

(3.45 |

) |

| Net loss per share,

diluted |

(3.26 |

) |

|

(1.46 |

) |

|

(0.19 |

) |

|

(8.54 |

) |

|

(3.45 |

) |

| Net loss per ADS, diluted |

(3.26 |

) |

|

(1.46 |

) |

|

(0.19 |

) |

|

(8.54 |

) |

|

(3.45 |

) |

| Weighted average number of

ordinary shares, basic |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

| Weighted average number of

ADS, basic |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

| Weighted average number of

ordinary shares, diluted |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

| Weighted average number of

ADS, diluted |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of

this press release.

|

BILIBILI INC.Notes to Unaudited Financial

Information(All amounts in thousands, except for

share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based

compensation expenses included in: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

18,808 |

|

18,370 |

|

26,781 |

|

48,710 |

|

58,828 |

|

Sales and marketing expenses |

13,523 |

|

13,361 |

|

16,015 |

|

42,689 |

|

41,936 |

|

General and administrative expenses |

155,511 |

|

139,032 |

|

133,825 |

|

446,724 |

|

430,681 |

|

Research and development expenses |

116,195 |

|

88,716 |

|

120,490 |

|

327,462 |

|

289,731 |

| Total |

304,037 |

|

259,479 |

|

297,111 |

|

865,585 |

|

821,176 |

|

BILIBILI INC.Unaudited Condensed

Consolidated Balance Sheets(All amounts in

thousands, except for share and per share data) |

|

|

|

|

December 31, |

|

September 30, |

|

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

|

|

|

|

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

7,191,821 |

|

7,463,154 |

|

|

Time deposits |

5,194,891 |

|

3,531,414 |

|

|

Restricted cash |

50,000 |

|

50,000 |

|

|

Accounts receivable, net |

1,573,900 |

|

1,516,707 |

|

|

Prepayments and other current assets |

2,063,362 |

|

1,886,186 |

|

|

Short-term investments |

2,653,065 |

|

4,239,534 |

|

|

Total current assets |

18,727,039 |

|

18,686,995 |

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

714,734 |

|

668,022 |

|

|

Production cost, net |

2,066,066 |

|

1,866,219 |

|

|

Intangible assets, net |

3,627,533 |

|

3,238,432 |

|

|

Goodwill |

2,725,130 |

|

2,725,130 |

|

|

Long-term investments, net |

4,366,632 |

|

4,172,991 |

|

|

Other long-term assets |

931,933 |

|

663,511 |

|

|

Total non-current assets |

14,432,028 |

|

13,334,305 |

|

|

Total assets |

33,159,067 |

|

32,021,300 |

|

|

Liabilities |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

4,333,730 |

|

4,923,826 |

|

|

Salary and welfare payables |

1,219,355 |

|

1,445,622 |

|

|

Taxes payable |

345,250 |

|

384,087 |

|

|

Short-term loan and current portion of long-term debt |

7,455,753 |

|

4,297,045 |

|

|

Deferred revenue |

2,954,088 |

|

4,106,212 |

|

|

Accrued liabilities and other payables |

1,795,519 |

|

2,600,074 |

|

|

Total current liabilities |

18,103,695 |

|

17,756,866 |

|

|

Non-current liabilities: |

|

|

|

|

Long-term debt |

646 |

|

724 |

|

|

Other long-term liabilities |

650,459 |

|

540,594 |

|

|

Total non-current liabilities |

651,105 |

|

541,318 |

|

|

Total liabilities |

18,754,800 |

|

18,298,184 |

|

|

|

|

|

|

|

Total Bilibili Inc.’s shareholders’ equity |

14,391,900 |

|

13,726,574 |

|

|

Noncontrolling interests |

12,367 |

|

(3,458 |

) |

|

Total shareholders’ equity |

14,404,267 |

|

13,723,116 |

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

33,159,067 |

|

32,021,300 |

|

|

BILIBILI INC.Unaudited Selected Condensed

Consolidated Cash Flows Data(All amounts in

thousands, except for share and per share data) |

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by/(used in) operating

activities |

277,384 |

|

1,750,540 |

|

2,225,629 |

|

(373,774 |

) |

|

4,613,866 |

|

BILIBILI INC.Unaudited Reconciliations of

GAAP and Non-GAAP Results(All amounts in

thousands, except for share and per share data) |

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

2023 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

(1,107,173 |

) |

|

(585,135 |

) |

|

(66,679 |

) |

|

(3,759,517 |

) |

|

(1,470,410 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses |

304,037 |

|

|

259,479 |

|

|

297,111 |

|

|

865,585 |

|

|

821,176 |

|

| Amortization expense related

to intangible assets acquired through business acquisitions |

47,734 |

|

|

41,776 |

|

|

41,776 |

|

|

144,036 |

|

|

125,328 |

|

|

Adjusted (loss)/profit from operations |

(755,402 |

) |

|

(283,880 |

) |

|

272,208 |

|

|

(2,749,896 |

) |

|

(523,906 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

(1,337,246 |

) |

|

(608,149 |

) |

|

(79,805 |

) |

|

(3,515,023 |

) |

|

(1,452,585 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses |

304,037 |

|

|

259,479 |

|

|

297,111 |

|

|

865,585 |

|

|

821,176 |

|

| Amortization expense related

to intangible assets acquired through business acquisitions |

47,734 |

|

|

41,776 |

|

|

41,776 |

|

|

144,036 |

|

|

125,328 |

|

| Income tax related to

intangible assets acquired through business acquisitions |

(5,563 |

) |

|

(5,407 |

) |

|

(5,406 |

) |

|

(16,813 |

) |

|

(16,220 |

) |

| Loss/(Gain) on fair value

change in investments in publicly traded companies |

137,358 |

|

|

41,311 |

|

|

(17,778 |

) |

|

(43,875 |

) |

|

10,347 |

|

| (Gain)/Loss on repurchase of

convertible senior notes |

(9,771 |

) |

|

- |

|

|

- |

|

|

(292,213 |

) |

|

20,980 |

|

|

Adjusted net (loss)/profit |

(863,451 |

) |

|

(270,990 |

) |

|

235,898 |

|

|

(2,858,303 |

) |

|

(490,974 |

) |

| Net (profit)/loss attributable

to noncontrolling interests |

(14,198 |

) |

|

(551 |

) |

|

290 |

|

|

(10,814 |

) |

|

15,825 |

|

|

Adjusted net (loss)/profit attributable to the Bilibili

Inc.'s shareholders |

(877,649 |

) |

|

(271,541 |

) |

|

236,188 |

|

|

(2,869,117 |

) |

|

(475,149 |

) |

|

Adjusted net (loss)/profit per share, basic |

(2.12 |

) |

|

(0.65 |

) |

|

0.57 |

|

|

(6.95 |

) |

|

(1.14 |

) |

|

Adjusted net (loss)/profit per ADS, basic |

(2.12 |

) |

|

(0.65 |

) |

|

0.57 |

|

|

(6.95 |

) |

|

(1.14 |

) |

|

Adjusted net (loss)/profit per share, diluted |

(2.12 |

) |

|

(0.65 |

) |

|

0.57 |

|

|

(6.95 |

) |

|

(1.14 |

) |

|

Adjusted net (loss)/profit per ADS, diluted |

(2.12 |

) |

|

(0.65 |

) |

|

0.57 |

|

|

(6.95 |

) |

|

(1.14 |

) |

|

Weighted average number of ordinary shares, basic |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

|

Weighted average number of ADS, basic |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

|

Weighted average number of ordinary shares, diluted |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

|

Weighted average number of ADS, diluted |

413,983,020 |

|

|

416,287,273 |

|

|

417,849,446 |

|

|

412,676,893 |

|

|

416,475,386 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

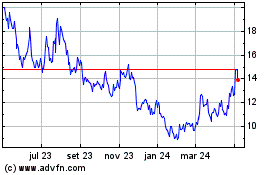

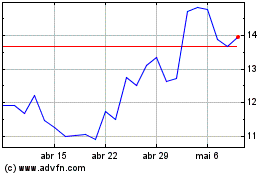

Bilibili (NASDAQ:BILI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Bilibili (NASDAQ:BILI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025