Achilles Therapeutics Reports Third Quarter 2024 Financial Results

14 Novembro 2024 - 9:00AM

Achilles Therapeutics plc (NASDAQ: ACHL) today announced its

financial results for the third quarter ended September 30, 2024,

and recent corporate updates.

Corporate Updates

- Following the discontinuation of

its TIL-based cNeT program and closure of the Phase I/IIa CHIRON

and THETIS clinical trials, the Company has engaged BofA Securities

as a financial advisor in the process of exploring strategic

options.

- Achilles Chief Scientific Officer,

Sergio Quezada, presented “Targeting Clonal Neoantigens with

Precision T-Cell Therapies: Key Mechanistic Insights From cNeT

Clinical Trials” in a seminar on October 23, 2024 at the 6th Annual

TIL Therapies Summit.

Financial Highlights

- Cash and cash

equivalents: Cash and cash equivalents were $86.1 million

as of September 30, 2024, as compared to $131.5 million as of

December 31, 2023. Subsequent to September 30, 2024, the Company

received a cash R&D tax credit of $12.8 million.

- Research and development

(R&D) expenses: R&D expenses were $16.4 million

for the third quarter ended September 30, 2024, compared to $14.7

million for the third quarter ended September 30, 2023.

- General and administrative

(G&A) expenses: G&A expenses were $4.0 million for

the third quarter ended September 30, 2024, compared to $4.4

million for the third quarter ended September 30, 2023.

- Net loss: Net loss

for the third quarter ended September 30, 2024 was $19.6 million or

$0.48 per share, compared to $16.7 million or $0.42 per share for

the third quarter ended September 30, 2023.

About Achilles Therapeutics

Achilles is a clinical-stage biopharmaceutical

company that was developing AI-powered precision T cell therapies

targeting clonal neoantigens: protein markers unique to the

individual that are expressed on the surface of every cancer cell.

Achilles uses DNA sequencing data from each patient, together with

its proprietary PELEUSTM bioinformatics platform, to identify

clonal neoantigens specific to that patient, to enable and support

development of product candidates specifically targeting those

clonal neoantigens.

Forward Looking Statements

This press release contains express or implied

forward-looking statements that are based on the Company

management's belief and assumptions and on information currently

available to the Company’s management. Forward-looking statements

in this press release include, but are not limited to, statements

regarding the Company’s clinical trials and the Company’s beliefs

about its goals for the discontinued trials; expectations related

to the Company’s cash runway and operating expenses and capital

expense requirements; the Company’s ability to engage with third

parties who are developing alternative modalities to target clonal

neoantigens for the treatment of cancers and the Company’s review

and evaluation of potential strategic options and their impact on

stockholder value. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, these statements relate to future events or the

Company’s future operational or financial performance, and involve

known and unknown risks, uncertainties and other factors that may

cause the Company’s actual results, performance, or achievements to

be materially different from any future results, performance or

achievements expressed or implied by these forward-looking

statements. The forward-looking statements in this press release

represent the Company’s views as of the date of this press release.

We anticipate that subsequent events and developments will cause

the Company’s views to change. However, while the Company may elect

to update these forward-looking statements at some point in the

future, the Company has no current intention of doing so except to

the extent required by applicable law. You should therefore not

rely on these forward-looking statements as representing the

Company’s views as of any date subsequent to the date of this press

release.

For further information, please contact:

Meru AdvisorsLee M. Sternlstern@meruadvisors.com

| |

| |

|

ACHILLES THERAPEUTICS PLCCondensed

Consolidated Balance Sheets (Unaudited)(in thousands,

except share and per share amounts)(expressed in U.S. Dollars,

unless otherwise stated) |

| |

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

| Cash and cash equivalents |

$ |

86,052 |

|

|

$ |

131,539 |

|

| Prepaid expenses and other

current assets |

|

25,573 |

|

|

|

14,094 |

|

|

Total current assets |

|

111,625 |

|

|

|

145,633 |

|

| Property and equipment,

net |

|

5,827 |

|

|

|

9,171 |

|

| Operating lease right of use

assets |

|

3,407 |

|

|

|

4,372 |

|

| Deferred tax assets |

|

41 |

|

|

|

41 |

|

| Restricted cash |

|

20 |

|

|

|

33 |

|

| Other assets |

|

1,756 |

|

|

|

2,206 |

|

|

Total non-current assets |

|

11,051 |

|

|

|

15,823 |

|

|

Total assets |

$ |

122,676 |

|

|

$ |

161,456 |

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

4,248 |

|

|

$ |

5,629 |

|

| Accrued expenses and other

liabilities |

|

10,602 |

|

|

|

7,828 |

|

| Operating lease liabilities -

current |

|

3,620 |

|

|

|

3,539 |

|

|

Total current liabilities |

|

18,470 |

|

|

|

16,996 |

|

| NON-CURRENT LIABILITIES: |

|

|

|

| Operating lease liabilities -

non-current |

|

- |

|

|

|

1,076 |

|

| Other long-term liability |

|

1,068 |

|

|

|

1,015 |

|

|

Total non-current liabilities |

|

1,068 |

|

|

|

2,091 |

|

|

Total liabilities |

|

19,538 |

|

|

|

19,087 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

| Ordinary shares, £0.001 par

value; 41,100,040 and 41,082,948 shares authorized, issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively |

|

54 |

|

|

|

54 |

|

| Deferred shares, £92,451.85.

par value, one share authorized, issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

128 |

|

|

|

128 |

|

| Additional paid in

capital |

|

419,098 |

|

|

|

415,210 |

|

| Accumulated other

comprehensive income |

|

(7,941 |

) |

|

|

(13,071 |

) |

| Accumulated deficit |

|

(308,201 |

) |

|

|

(259,952 |

) |

|

Total shareholders’ equity |

|

103,138 |

|

|

|

142,369 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

122,676 |

|

|

$ |

161,456 |

|

| |

|

ACHILLES THERAPEUTICS PLCCondensed

Consolidated Statements of

Operations and

Comprehensive Loss (Unaudited)(in

thousands, except share and per share amounts)(expressed in U.S.

Dollars, unless otherwise stated) |

| |

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

| |

Research and development |

$ |

16,396 |

|

|

$ |

14,712 |

|

|

$ |

40,171 |

|

|

$ |

42,354 |

|

| |

General and

administrative |

|

4,021 |

|

|

|

4,384 |

|

|

$ |

12,344 |

|

|

|

13,387 |

|

| |

Total operating expenses |

|

20,417 |

|

|

|

19,096 |

|

|

|

52,515 |

|

|

|

55,741 |

|

| LOSS FROM

OPERATIONS: |

|

(20,417 |

) |

|

|

(19,096 |

) |

|

|

(52,515 |

) |

|

|

(55,741 |

) |

| OTHER INCOME

(EXPENSE), NET: |

|

|

|

|

|

|

|

| |

Other income (expense) |

|

817 |

|

|

|

2,389 |

|

|

|

4,246 |

|

|

|

4,692 |

|

| |

Total other income (expense), net |

|

817 |

|

|

|

2,389 |

|

|

|

4,246 |

|

|

|

4,692 |

|

| Loss before income

taxes |

|

(19,600 |

) |

|

|

(16,707 |

) |

|

|

(48,269 |

) |

|

|

(51,049 |

) |

| |

Benefit for income taxes |

|

5 |

|

|

|

24 |

|

|

|

20 |

|

|

|

14 |

|

| Net

loss |

|

(19,595 |

) |

|

|

(16,683 |

) |

|

|

(48,249 |

) |

|

|

(51,035 |

) |

| Other

comprehensive (loss) income: |

|

|

|

|

|

|

|

| |

Foreign exchange translation

adjustment |

|

6,074 |

|

|

|

(5,289 |

) |

|

|

5,130 |

|

|

|

2,505 |

|

| Comprehensive

loss |

$ |

(13,521 |

) |

|

$ |

(21,972 |

) |

|

$ |

(43,119 |

) |

|

$ |

(48,530 |

) |

| Net loss per share

attributable to ordinary shareholders—basic and diluted |

$ |

(0.48 |

) |

|

$ |

(0.42 |

) |

|

$ |

(1.20 |

) |

|

$ |

(1.28 |

) |

| Weighted average

ordinary shares outstanding—basic and diluted |

|

40,427,199 |

|

|

|

40,066,922 |

|

|

|

40,355,124 |

|

|

|

39,900,910 |

|

| |

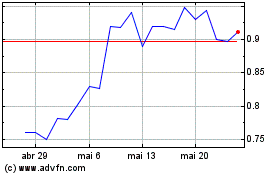

Achilles Therapeutics (NASDAQ:ACHL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Achilles Therapeutics (NASDAQ:ACHL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024