Marker Therapeutics Reports Third Quarter 2024 Financial Results and Provides Business Updates

14 Novembro 2024 - 6:30PM

Marker Therapeutics, Inc. (Nasdaq: MRKR), a clinical-stage

immuno-oncology company focusing on developing next-generation T

cell-based immunotherapies for the treatment of hematological

malignancies and solid tumors, today reported corporate updates and

financial results for the third quarter ended September 30, 2024.

“As we approach the end of 2024, we continue to

build momentum across our clinical and corporate programs,” said

Juan Vera, M.D., President and Chief Executive Officer of Marker

Therapeutics. “During the third quarter, we made significant

progress in our ongoing Phase 1 APOLLO study investigating MT‑601

in patients with lymphoma who have relapsed after anti-CD19

chimeric antigen receptor (CAR)-T cell therapy or where CAR-T cells

are not an option. Enrollment is ongoing and we expect to be able

to report preliminary safety and efficacy data by the end of this

year. We, along with our study investigators, have been encouraged

by the promising activity shown in this platform and look forward

to continuing assessments from the trial.”

“We also recently strengthened our financial

position with the receipt of two, $2 million Small Business

Innovation Research (SBIR) grants from the National Institutes of

Health (NIH). The non-dilutive funding will be used to

support further development of MT-601 in patients with

non-Hodgkin’s lymphoma who have relapsed following anti-CD19 CAR-T

cell therapy, as well as assist in funding the clinical

investigation of MT‑601 in pancreatic cancer. We continue to make

meaningful progress and remain focused on execution as we move our

programs through the clinical trials,” added Dr. Vera.

PROGRAM UPDATES & EXPECTED

MILESTONES

MT-601 (Lymphoma)

- Marker’s lead program is investigating MT-601 in the nationwide

multicenter Phase 1 APOLLO study (clinicaltrials.gov identifier:

NCT05798897) in patients with lymphoma who have relapsed after

anti-CD19 CAR-T cell therapy or where CAR-T cells are not an

option.

- The Company previously reported that one of the Principal

Investigators presented preliminary safety and efficacy with

sustained objective responses observed in three study participants

treated at City of Hope National Medical Center (Press Release,

April 8, 2024). Treatment was well tolerated among all study

participants with no observation of severe adverse effects such as

immune effector cell associated neurotoxicity syndrome

(ICANS).

- All study participants continue to be observed for long-term

treatment effects and durability of response.

- The Company is enrolling additional study participants in the

Phase 1 APOLLO trial and expects to provide an update on safety and

durability during the fourth quarter of 2024.

- Marker Therapeutics was awarded a $2 million grant from NIH

Small Business Innovation Research Program (SBIR) to support the

clinical investigation of MT-601 in patients with lymphoma who have

relapsed following anti-CD19 CAR-T cell therapy (Press Release,

August 12, 2024).

MT-601 (Pancreatic)

- The Company was awarded a $2 million grant from NIH Small

Business Innovation Research (SBIR) Program to support the clinical

investigation of MT-601 in patients with metastatic pancreatic

cancer.

- The Company expects to start the clinical program of MT-601 in

patients with metastatic pancreatic cancer in 2025.

MT-401-OTS (Acute Myeloid Leukemia or

Myelodysplastic Syndrome)

- The Company previously secured non-dilutive funding to support

the clinical investigation of MT‑401‑OTS in patients with Acute

Myeloid Leukemia (AML) or Myelodysplastic Syndrome (MDS) and

anticipates clinical program initiation during the first half of

2025.

THIRD QUARTER 2024 FINANCIAL

HIGHLIGHTS

Cash Position and Guidance: At

September 30, 2024, Marker had cash and cash equivalents of $9

million. The Company believes that its existing cash and cash

equivalents will fund its operating expenses into October 2025.

This estimate is subject to the Company’s ability to effectively

manage its costs and utilize drawdowns of available grant

funds.

R&D Expenses: Research and

development expenses were $3.5 million for the quarter ended

September 30, 2024, compared to $2.0 million for the quarter ended

September 30, 2023 as a result of our increased clinical trial

activity in the quarter.

G&A Expenses: General and

administrative expenses were $0.9 million for the quarter ended

September 30, 2024, compared to $1.4 million for the quarter ended

September 30, 2023 reflecting the savings from the reorganization

that was completed in late 2023.

Net Loss: Marker reported a net

loss from continuing operations of $2.3 million for the quarter

ended September 30, 2024, compared to $3.0 million for the quarter

ended September 30, 2023.

About multiTAA-specific T

cells

The multi-tumor associated antigen

(multiTAA)-specific T cell platform is a novel, non-genetically

modified cell therapy approach that selectively expands

tumor-specific T cells from a patient's/donor’s blood capable of

recognizing a broad range of tumor antigens. Unlike other T cell

therapies, multiTAA-specific T cells allow the recognition of

hundreds of different epitopes within up to six tumor-specific

antigens, thereby reducing the possibility of tumor escape. Since

multiTAA-specific T cells are not genetically engineered, Marker

believes that its product candidates will be easier and less

expensive to manufacture, with an improved safety profile, compared

to current engineered T cell approaches, and may provide patients

with meaningful clinical benefits.

About Marker Therapeutics,

Inc.

Marker Therapeutics, Inc. is a Houston, TX-based

clinical-stage immuno-oncology company specializing in the

development of next-generation T cell-based immunotherapies for the

treatment of hematological malignancies and solid tumors. Clinical

trials that enrolled more than 200 patients across various

hematological and solid tumor indications showed that the Company’s

autologous and allogeneic multiTAA-specific T cell products were

well tolerated and demonstrated durable clinical responses.

Marker’s goal is to introduce novel T cell therapies to the market

and improve patient outcomes. To achieve these objectives, the

Company prioritizes the preservation of financial resources and

focuses on operational excellence. Marker’s unique T cell platform

is strengthened by non-dilutive funding from U.S. state and federal

agencies supporting cancer research.

To receive future press releases via email, please visit:

https://www.markertherapeutics.com/email-alerts.

Forward-Looking Statements

This release contains forward-looking statements

for purposes of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Statements in this news

release concerning the Company’s expectations, plans, business

outlook or future performance, and any other statements concerning

assumptions made or expectations as to any future events,

conditions, performance or other matters, are “forward-looking

statements.” Forward-looking statements include statements

regarding our intentions, beliefs, projections, outlook, analyses

or current expectations concerning, among other things: our

research, development and regulatory activities and expectations

relating to our non-engineered multi-tumor antigen specific T cell

therapies; the effectiveness of these programs or the possible

range of application and potential curative effects and safety in

the treatment of diseases; and the timing, conduct and

success of our clinical trials of our product candidates, including

MT-601 for the treatment of patients with lymphoma. Forward-looking

statements are by their nature subject to risks, uncertainties and

other factors which could cause actual results to differ materially

from those stated in such statements. Such risks, uncertainties and

factors include, but are not limited to the risks set forth in the

Company’s most recent Form 10-K, 10-Q and other SEC filings which

are available through EDGAR at WWW.SEC.GOV. The Company assumes no

obligation to update its forward-looking statements whether as a

result of new information, future events or otherwise, after the

date of this press release except as may be required by law.

|

|

|

Marker Therapeutics, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

| |

2024 |

|

2023 |

| ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

8,999,664 |

|

|

$ |

15,111,450 |

|

|

Prepaid expenses and deposits |

|

1,166,274 |

|

|

|

988,126 |

|

|

Other receivables |

|

744,410 |

|

|

|

1,027,815 |

|

|

Total current assets |

|

10,910,348 |

|

|

|

17,127,391 |

|

| Total

assets |

$ |

10,910,348 |

|

|

$ |

17,127,391 |

|

| |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

2,557,335 |

|

|

$ |

1,745,193 |

|

|

Related party payable |

|

903,438 |

|

|

|

1,329,655 |

|

|

Total current liabilities |

|

3,460,773 |

|

|

|

3,074,848 |

|

| Total liabilities |

|

3,460,773 |

|

|

|

3,074,848 |

|

| |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value, 5 million shares authorized, 0

shares issued and outstanding at September 30, 2024 and December

31, 2023, respectively |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 30 million shares authorized, 8.9

million shares issued and outstanding as of September 30, 2024 and

December 31, 2023 (see Note 9) |

|

8,923 |

|

|

|

8,891 |

|

|

Additional paid-in capital |

|

450,620,206 |

|

|

|

450,329,515 |

|

|

Accumulated deficit |

|

(443,179,554 |

) |

|

|

(436,285,863 |

) |

| Total stockholders’

equity |

|

7,449,575 |

|

|

|

14,052,543 |

|

| Total liabilities and

stockholders’ equity |

$ |

10,910,348 |

|

|

$ |

17,127,391 |

|

|

Marker Therapeutics, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(Unaudited) |

| |

|

|

|

| |

For the Three Months Ended |

|

For the Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues |

|

Grant income |

$ |

1,926,020 |

|

|

$ |

257,606 |

|

|

$ |

4,339,317 |

|

|

$ |

2,254,601 |

|

| Total revenues |

|

1,926,020 |

|

|

|

257,606 |

|

|

|

4,339,317 |

|

|

|

2,254,601 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

3,471,216 |

|

|

|

2,044,980 |

|

|

|

8,381,661 |

|

|

|

7,799,472 |

|

|

General and administrative |

|

854,677 |

|

|

|

1,412,672 |

|

|

|

3,214,611 |

|

|

|

6,098,716 |

|

| |

| Total operating expenses |

|

4,325,893 |

|

|

|

3,457,652 |

|

|

|

11,596,272 |

|

|

|

13,898,188 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(2,399,873 |

) |

|

|

(3,200,046 |

) |

|

|

(7,256,955 |

) |

|

|

(11,643,587 |

) |

| Other income

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

91,681 |

|

|

|

218,085 |

|

|

|

363,264 |

|

|

|

337,819 |

|

|

|

|

Loss from continuing operations |

|

(2,308,192 |

) |

|

|

(2,981,961 |

) |

|

|

(6,893,691 |

) |

|

|

(11,305,768 |

) |

| Discontinued

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,922,406 |

) |

|

Gain on disposal of discontinued operations before income

taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,794,426 |

|

| Income from discontinued

operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,872,020 |

|

| |

| Net (loss)

income |

$ |

(2,308,192 |

) |

|

$ |

(2,981,961 |

) |

|

$ |

(6,893,691 |

) |

|

$ |

(5,433,748 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations, basic and diluted |

$ |

(0.26 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.77 |

) |

|

$ |

(1.29 |

) |

|

Income from discontinued operations, basic |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.67 |

|

|

Income from discontinued operations, diluted |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.66 |

|

|

Net loss per share |

$ |

(0.26 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.77 |

) |

|

$ |

(0.62 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

8,923,170 |

|

|

|

8,825,881 |

|

|

|

8,914,487 |

|

|

|

8,782,340 |

|

|

Diluted |

|

8,923,170 |

|

|

|

8,825,881 |

|

|

|

8,914,487 |

|

|

|

8,834,512 |

|

|

Marker Therapeutics, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(Unaudited) |

| |

|

|

|

|

|

| |

For the Nine Months Ended |

| |

September 30, |

| |

2024 |

|

2023 |

| Cash Flows from

Operating Activities: |

|

|

|

|

|

|

Net loss |

$ |

(6,893,691 |

) |

|

$ |

(5,433,748 |

) |

|

Less: gain from discontinued operations, net of tax |

|

— |

|

|

|

5,872,020 |

|

|

Net loss from continuing operations |

|

(6,893,691 |

) |

|

|

(11,305,768 |

) |

|

Reconciliation of net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Stock-based compensation |

|

195,320 |

|

|

|

714,899 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid expenses and deposits |

|

(178,148 |

) |

|

|

(80,116 |

) |

|

Other receivables |

|

283,405 |

|

|

|

2,318,691 |

|

|

Related party payable |

|

(426,217 |

) |

|

|

367,915 |

|

|

Accounts payable and accrued expenses |

|

812,142 |

|

|

|

(159,567 |

) |

|

Deferred revenue |

|

— |

|

|

|

107,530 |

|

|

Net cash used in operating activities - continuing operations |

|

(6,207,189 |

) |

|

|

(8,036,416 |

) |

|

Net cash used in operating activities - discontinued

operations |

|

— |

|

|

|

(6,035,961 |

) |

|

Net cash used in operating activities |

|

(6,207,189 |

) |

|

|

(14,072,377 |

) |

| Cash Flows from

Investing Activities: |

|

|

|

|

|

|

Net cash provided by investing activities - discontinued

operations |

|

— |

|

|

|

18,664,122 |

|

|

Net cash provided by investing activities |

|

— |

|

|

|

18,664,122 |

|

| Cash Flows from

Financing Activities: |

|

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

36,902 |

|

|

|

1,014,640 |

|

|

Proceeds from stock options exercise |

|

58,501 |

|

|

|

85,342 |

|

|

Net cash provided by financing activities |

|

95,403 |

|

|

|

1,099,982 |

|

| Net (decrease) increase in

cash and cash equivalents |

|

(6,111,786 |

) |

|

|

5,691,727 |

|

| Cash and cash equivalents at

beginning of the period |

|

15,111,450 |

|

|

|

11,782,172 |

|

| Cash and cash

equivalents at end of the period |

$ |

8,999,664 |

|

|

$ |

17,473,899 |

|

| |

ContactsInvestorsTIBEREND

STRATEGIC ADVISORS, INC.Jonathan

Nugent205-566-3026jnugent@tiberend.com

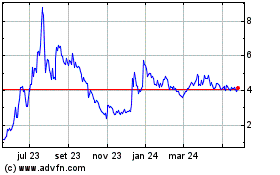

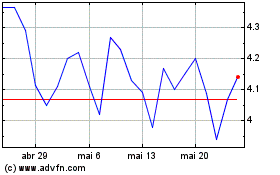

Marker Therapeutics (NASDAQ:MRKR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Marker Therapeutics (NASDAQ:MRKR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024