Mx2 Mining Inc. (“

Mx2” or the

“

Company”) is pleased to announce the closing of

its previously announced brokered private placement (the

“

Offering”) of common shares of the Company (the

“

Common Shares”) and subscription receipts of the

Company (the “

Subscription Receipts”, and together

with the Common Shares, the “

Offered Securities”).

Under the Offering, the Company issued a total of 3,320,000 Common

Shares and 28,680,000 Subscription Receipts, at an issue price of

C$0.50 per Offered Security, for aggregate gross proceeds of C$16.0

million. Each Subscription Receipt will entitle the holder to

receive one Common Share upon the satisfaction of the Escrow

Release Conditions (as defined below).

As previously announced by Aya Gold & Silver

Inc. on September 12, 2024, the Company has signed a series of

non-binding term sheets in relation to the acquisition of the

Amizmiz Gold Project (“Amizmiz”) in the Kingdom of

Morocco and an option to acquire the Tijirit Gold Project

(“Tijirit”) in the Islamic Republic of Mauritania

(the “Transactions”). Upon completion of the

Transactions, Mx2 will be the 100% owner of the Amizmiz Gold

Project and hold an exclusive option to acquire Aya’s 75% interest

in the Tijirit Gold Project.

The Offering was led by Eight Capital, as lead

agent and sole bookrunner (the “Lead Agent”), on

behalf of a syndicate of agents including Beacon Securities Limited

and Raymond James Ltd. (collectively, the

“Agents”). The net proceeds of the Offering will

be used for exploration and development activities on the Amizmiz

and Tijirit properties, for working capital and for general

corporate purposes.

The gross proceeds of the sale of Subscription

Receipts, net of the reasonable costs and expenses of the Agents

(the “Net Escrowed Funds”), were deposited in

escrow on the closing of the Offering. The Net Escrowed Funds will

be released from escrow to the Company upon the completion or the

satisfaction of all material conditions precedent to the

Transactions, including for certainty the receipt of all required

regulatory approvals, as well as certain other standard conditions

(the “Escrow Release Conditions”).

In the event that the Escrow Release Conditions

are not satisfied on or before the date that is 180 days following

the closing of the Offering, the Net Escrowed Funds together with

accrued interest earned thereon will be returned to the subscribers

of the Subscription Receipts and the Subscription Receipts will be

cancelled. To the extent that the Net Escrowed Funds are

insufficient to refund 100% of the purchase price of the

Subscription Receipts to the subscribers, the Company shall be

responsible for any shortfall. Proceeds from the sale of the Common

Shares will not be subject to any escrow. The Subscription Receipts

and the Common Shares will be subject to an indefinite hold period

pursuant to Canadian securities laws.

The Offered Securities have not been and

will not be registered under the United States Securities Act of

1933, as amended and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirement. This press release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

ABOUT Mx2 MINING

Mx2 Mining is a gold exploration and development

company focused on North Africa. The leadership group at Mx2

includes key personnel responsible for the success of several

African precious metals companies, including Red Back Mining, Aya

Gold & Silver, Orca Gold and Montage Gold. Mx2’s assets will

include the high-grade Amizmiz Gold Project in the Kingdom of

Morocco, containing a Historic Inferred Mineral Resource of 819,769

tonnes grading 12.94 g/t for 342,094 ounces and an option to

acquire a 75% interest in the Tijirit Gold Project in Mauritania.

At Amizmiz, exploration is being conducted for the first time since

2010, with the objective of the program to test for the potential

of multiple mineralized zones that together can provide for a +1Moz

resource grading +10 g/t gold.

CONTACT INFORMATION

Salisha IlyasInvestor

Relationsinvestors@mx2mining.com

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

information” (also referred to herein as “forward-looking

statements”) under the provisions of applicable Canadian securities

legislation regarding the potential future operations and assets of

forward-looking statements can typically be identified by the use

of words such as “plans”, “expects”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”,

“believes” or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will”, “occur” or “be achieved” or the negative

connotation thereof.

Forward-looking statements herein include, but

are not limited to, those in respect of the use of proceeds from

the Offering and certain statements related to the Transactions.

Forward-looking statements are subject to known and unknown risks,

uncertainties and other important factors that may cause the actual

results, level of activity, performance or achievements of Mx2 to

be materially different from those expressed or implied by such

forward-looking statements, including but not limited to: future

global financial conditions being materially worse than current

conditions; uncertainties, costs and risks related to carrying on

business in foreign countries; filing to obtain necessary

additional financing; the costs of complying with environmental

laws and policies; title disputes and defects and other matters

relating to failing to obtain or revocation of permits and

licenses; failure of equipment or processes to operate as

anticipated; lower than expected future prices, market, demand,

supply and/or uses of precious metals; adverse currency

fluctuations; unexpected costs related to and delays in the

integration of acquisitions; accidents; labour disputes; failure to

retain key personnel; delays in obtaining governmental approvals;

and other risks relating to the mining industry.

Forward-looking statements also include, but are

not limited to, factors and assumptions in respect of: the future

price, market, demand, supply and/or uses of precious metals being

as expected. Although Mx2 has attempted to identify important

factors, risks and assumptions that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be others that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such forward-looking statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Forward-looking statements are made as of the date

hereof and, accordingly, are subject to change after such date.

Forward-looking statements are provided for the purpose of

providing information about management's current expectations and

plans. Mx2 does not intend or undertake to update any

forward-looking statements that are included in this press release,

whether as a result of new information, future events or otherwise,

except in accordance with applicable securities laws.

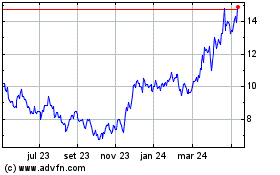

Aya Gold & Silver (TSX:AYA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

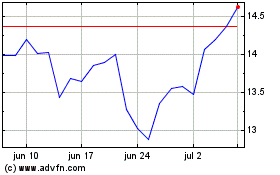

Aya Gold & Silver (TSX:AYA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025