Extendicare Inc. (“Extendicare” or the “Company”) (TSX: EXE.TO)

announced today that it has entered into an agreement with Revera

Inc. (“Revera”) and certain of its affiliates to acquire nine Class

C long-term care (“LTC”) homes (the “Acquired Homes”) located in

Ontario and Manitoba and one parcel of vacant land located in

Ontario (the “Transaction”).

Closing of the Transaction is subject to

customary closing conditions, including receipt of regulatory

approvals from the Ontario Ministry of Long-Term Care, Ontario

Retirement Home Regulatory Authority, and Manitoba Health and

Winnipeg Regional Health Authority, and is not conditional on

financing or due diligence. The Transaction is anticipated to close

in mid-2025.

The aggregate cash consideration for the

Transaction is approximately $60.3 million, subject to customary

and other adjustments. The purchase price is expected to be funded

from cash on hand and existing senior secured credit

facilities.

Relatedly, Extendicare has been advised by

Revera that Revera has entered into a sale agreement with a third

party pursuant to which that third party will acquire 21 of

Revera’s Class C LTC homes located in Ontario that are currently

managed by Extendicare (the “Third-Party Sale”), subject to

regulatory approval. Upon closing of the two transactions,

Extendicare’s existing management agreements with Revera in respect

of the 30 homes, as well as related redevelopment arrangement

agreements, will terminate in accordance with their terms.

“This transaction adds approximately 1,100 beds

to our redevelopment pipeline, giving us control of the

redevelopment process for these homes,” said Dr. Michael Guerriere,

President and CEO of Extendicare. “Although we have generally

avoided purchasing Class C homes, this was a unique opportunity as

net operating income from the acquired homes more than offsets the

reduction in management fees, and the opportunity to sell seven

operational retirement homes once LTC redevelopment is complete

makes it likely we will recover most of the purchase price.”

Transaction Overview

The Acquired Homes encompass 1,396 beds in nine

homes, seven of which consist of a mix of 361 funded LTC beds and

574 private pay retirement beds. The LTC beds in these seven homes

are all C beds which we intend to redevelop and replace with six

new LTC homes comprising a proposed 361 replacement beds and 727

new beds. Also included in the 1,396 beds is the 250 bed Class C

Carlingview Manor home in Ottawa, which is in the process of being

redeveloped into a new LTC home that is owned by our joint venture

with Axium. We are committed to ensuring that the residents, their

families and staff at these homes are unaffected by this change in

ownership as Extendicare will continue to operate the homes in the

same manner as it currently does under current management

agreements. There are not expected to be any job losses as a result

of the Transaction.

The homes to be acquired in the Transaction are

set out in the table below.

|

Name |

Address |

LTC Beds(1) |

Retirement beds |

|

Blenheim Community Village |

Blenheim, ON |

57 |

30 |

|

Brierwood Gardens |

Brantford, ON |

67 |

71 |

|

Riverbend Place |

Cambridge, ON |

39 |

92 |

|

Summit Place |

Owen Sound, ON |

99 |

77 |

|

Telfer Place |

Paris, ON |

35 |

180 |

|

Village on the Ridge |

Ridgetown, ON |

30 |

65 |

|

Trillium Court |

Kincardine, ON |

34 |

59 |

|

Carlingview Manor(2) |

Ottawa, ON |

250 |

- |

|

Poseidon |

Winnipeg, MB |

211 |

- |

|

Total Beds |

|

822 |

574 |

(1) LTC Beds excludes 133 third

and fourth ward-style beds that have been taken out of service per

regulatory requirements that are eligible to be reinstated upon

redevelopment.(2) Carlingview Manor is in the

process of being redeveloped into a new 320-bed LTC home that is

owned by the Axium JV.

In accordance with the management agreements to be terminated on

completion of the Third-Party Sale, Revera is required to repay

Extendicare a portion of the consideration paid to Revera in

respect of the management agreements. Assuming completion of the

Third-Party Sale at the end of the second quarter of 2025,

Extendicare expects the repayment to be approximately $1.5

million.

The Transaction would add approximately $124.0

million and $13.0 million in annualized revenue and net operating

income(1) (“NOI”), respectively, to the Company’s LTC segment,

based on the actual revenue and NOI generated from the Acquired

Homes, adjusted for one-time items, for the nine-month period ended

September 30, 2024. Also, the loss of management fees as a result

of the Transaction and the Third-Party Sale would reduce the

Company’s managed services segment annualized revenue and NOI by

approximately $14.7 million and $6.2 million, respectively, based

on actual revenue and NOI, adjusted for one-time impacts, for the

nine months ended September 30, 2024. On a combined basis, the

annualized net effect of the Transaction and Third-Party Sale,

would be an increase in the Company’s consolidated revenue and NOI

of approximately $109.3 million and $6.8 million, respectively.

On the same basis, the annualized impact on

adjusted funds from operations (“AFFO”)(1), assuming the

Transaction is funded from cash on hand, would add approximately

$1.4 million (or AFFO/basic share of $0.02)

On a combined pro forma basis, giving effect to

the Transaction and the Third-Party Sale, the Company’s LTC segment

would own and operate 61 LTC homes with capacity for 8,509

residents, inclusive of these 574 private pay retirement beds

across 7 mixed use homes, and our Extendicare Assist division

within the managed services segment would provide management

contract services to 40 LTC homes with capacity for 5,943

residents.

Advisors

Torys LLP is acting as legal advisor to

Extendicare in connection with the Transaction. Stormont Partners

is acting as financial advisor to Revera and Goodmans LLP is acting

as legal advisor to Revera in connection with the Transaction.

About Extendicare

Extendicare is a leading provider of care and

services for seniors across Canada, operating under the

Extendicare, ParaMed, Extendicare Assist, and SGP Purchasing

Partner Network brands. We are committed to delivering quality care

to meet the needs of a growing seniors’ population, inspired by our

mission to provide people with the care they need, wherever they

call home. We operate a network of 122 long-term care homes (52

owned, 70 under management contracts), deliver approximately 10.7

million hours of home health care services annually, and provide

group purchasing services to third parties representing

approximately 143,500 beds across Canada. Extendicare proudly

employs approximately 22,000 qualified, highly trained and

dedicated team members who are passionate about providing

high-quality care and services to help people live better.

Non-GAAP Measures

Certain measures used in this press release,

such as net operating income and adjusted funds from operations,

are not measures recognized under GAAP and do not have standardized

meanings prescribed by GAAP. These measures may differ from similar

computations as reported by other issuers and, accordingly, may not

be comparable to similarly titled measures as reported by such

issuers. These measures are not intended to replace earnings (loss)

from continuing operations or net earnings (loss), or other

measures of financial performance and liquidity reported in

accordance with GAAP. Such items are presented in this document

because management believes that they are relevant measures of

Extendicare’s operating performance and the impact of the

Transaction and Third-Party Sale thereon.

Detailed descriptions of these measures can be

found in Extendicare’s Q3 2024 Management’s Discussion &

Analysis (“MD&A”) (refer to “Non-GAAP Measures”), which is

available on SEDAR+ at www.sedarplus.ca and on Extendicare’s

website at www.extendicare.com.

Forward-looking Statements

This press release contains forward-looking

statements concerning anticipated future events, results,

circumstances, economic performance or expectations with respect to

Extendicare and its subsidiaries, including, without limitation,

statements regarding the Transaction, the Third-Party Sale, their

impact on the Company, and the potential redevelopment and

subsequent sale of the Acquired Homes. Forward-looking statements

can often be identified by the expressions “anticipate”, “believe”,

“estimate”, “expect”, “intend”, “objective”, “plan”, “project”,

“will”, “may”, “should” or other similar expressions or the

negative thereof. These forward-looking statements reflect

Extendicare’s current expectations regarding future results,

performance or achievements and are based upon information

currently available to it and on assumptions that Extendicare

believes are reasonable. These statements are not guarantees of

future performance and involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements of Extendicare to differ materially

from those expressed or implied in the statements. For further

information on the risks, uncertainties and assumptions that could

cause Extendicare’s actual results to differ from current

expectations, refer to “Risks and Uncertainties” and “Forward

Looking-Statements” in Extendicare’s Q3 2024 MD&A and latest

Annual Information Form filed by Extendicare with the securities

regulatory authorities, available at www.sedarplus.ca and on

Extendicare’s website at www.extendicare.com. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

Extendicare’s forward-looking statements. Except as required by

applicable securities laws, Extendicare assumes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

For further information, please

contact:

Investor Inquiries:

David BaconSenior Vice President and Chief

Financial OfficerEmail: david.bacon@extendicare.comPhone: (905)

470-5587

Endnotes:

(1) See the “Non-GAAP Measures” section of this

press release and Extendicare’s Q3 2024 MD&A, which includes

the reconciliation of such non-GAAP measure to the most directly

comparable GAAP measure.

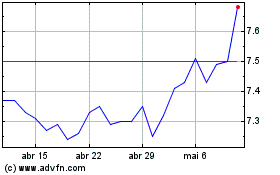

Extendicare (TSX:EXE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

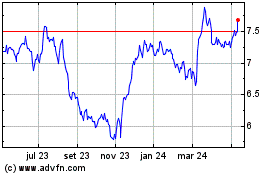

Extendicare (TSX:EXE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024