Currency Exchange International, Corp.

(“Currency Exchange”

or the “Company”) (TSX:CXI) (OTCBB:CURN) today announced

acceptance by the Toronto Stock Exchange (the

"

TSX") of Currency Exchange’s Notice of Intention

to make a normal course issuer bid (the "

NCIB")

and Automatic Securities Purchase Plan (“

ASPP”) to

purchase for cancellation a maximum amount of 316,646 common shares

of the Company (“

Shares”), representing 5% of the

Company’s issued and outstanding common shares as at November 18,

2024.

As of November 18, 2024, Currency Exchange had

6,332,931 common shares issued and outstanding.

Purchases under the NCIB may commence on

December 2, 2024 and will terminate on December 1, 2025 or at such

earlier date in the event that the maximum number of Shares sought

in the NCIB has been repurchased. Currency Exchange reserves the

right to terminate the NCIB earlier if it feels that it is

appropriate to do so.

All Shares will be purchased on the open market

through the facilities of the TSX as well as on alternative

Canadian trading platforms, at prevailing market rates and any

Shares purchased by Currency Exchange will be cancelled. The actual

number of Shares that may be purchased and the timing of any such

purchases will be determined by Currency Exchange. Any purchases

made by Currency Exchange pursuant to the NCIB will be made in

accordance with the rules and policies of the TSX.

Under the policies of the TSX, Currency Exchange

will have the right to repurchase under its NCIB, during any one

trading day, a maximum of 1,000 Shares. In addition, Currency

Exchange will be allowed to make a block purchase (as such term if

defined in the TSX Company Manual) once per week of Shares not

directly or indirectly owned by the insiders of Currency Exchange,

in accordance with TSX policies. Currency Exchange will fund the

purchases through available cash.

CXI’s Group CEO, Randolph Pinna and the Board of

Directors believe the underlying value of Currency Exchange may not

be reflected in the market price of its common shares from time to

time and that, at appropriate times, repurchasing its shares

through the NCIB may represent a good use of Currency Exchange’s

financial resources, as such action can protect and enhance

shareholder value when opportunities or volatility arise.

Therefore, the Board of Directors has determined that the NCIB is

in the best interest of Currency Exchange and its shareholders.

The Company obtained TSX approval for a previous

notice of intention to conduct a normal course issuer bid to

purchase up to 322,169 common shares for the period between

December 1, 2023 to November 30, 2024 (the “Previous

Bid”). Under the Previous Bid, the Company repurchased

149,070 common shares at a volume weighted average price of C$25.30

through the facilities of the TSX as well as on alternative

Canadian trading systems at prevailing market rates.

The ASPP will allow for the purchase of Shares

under the NCIB at times when the Company would ordinarily not be

permitted to purchase Shares due to regulatory restrictions or

self-imposed blackout periods.

Pursuant to the ASPP, prior to entering into a

blackout period, the Company may, but is not required to, instruct

its broker to make purchases under the NCIB in accordance with the

terms of the ASPP. Such purchases will be determined by the broker

in its sole discretion based on parameters established by the

Company prior to the blackout period in accordance with the rules

of the TSX, applicable securities laws and the terms of the ASPP.

The ASPP has been pre-cleared by the TSX and will be implemented

effective December 2, 2024. All repurchases made under the ASPP

will be included in computing the number of Shares purchased under

the NCIB.

Outside of the pre-determined blackout periods,

Shares may be repurchased under the NCIB based on the discretion of

Currency Exchange’s management, in compliance with TSX rules and

applicable securities laws.

About Currency Exchange International,

Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface, www.cxifx.com

(“CXIFX”), its related APIs with core banking

platforms, and through personal relationship managers. Consumers

are served through Group-owned retail branches, agent retail

branches, and its e-commerce platform, order.ceifx.com.

The Group’s wholly-owned Canadian subsidiary

OnlineFX, Exchange Bank of Canada, based in

Toronto, Canada, provides foreign exchange and international

payment services in Canada and select international foreign

jurisdictions. Customers are served through the use of its

proprietary software, www.ebcfx.com (“EBCFX”),

related APIs to core banking platforms, and personal relationship

managers.

Contact Information

For further information please contact: Bill

MitoulasInvestor Relations(416) 479-9547Email:

bill.mitoulas@cxifx.comWebsite: www.cxifx.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, demand and market

outlook for wholesale and retail foreign currency exchange products

and services, future growth, the timing and scale of future

business plans, results of operations, performance, and business

prospects and opportunities. Forward-looking statements are

identified by the use of terms and phrases such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “preliminary”, “project”, “will”, “would”, and similar

terms and phrases, including references to assumptions.

Forward‐looking information in this release

includes, but is not limited to, statements with respect to: the

timing of purchases under the NCIB and ASPP, the Company’s belief

that the NCIB is advantageous to shareholders and that underlying

value of the Company may not be reflected in the market price of

its common shares and whether the Company will make any purchases

of Shares under the NCIB. Forward-looking information is based on

the opinions and estimates of management at the date such

information is provided, and on information available to management

at such time. Forward-looking information involves significant

risks, uncertainties and assumptions that could cause the Company’s

actual results, performance, or achievements to differ materially

from the results discussed or implied in such forward-looking

information. Actual results may differ materially from results

indicated in forward-looking information due to a number of factors

including, without limitation, the competitive nature of the

foreign exchange industry, the impact of infectious diseases or the

evolving situation in Ukraine on factors relevant to the Company’s

business, currency exchange risks, the need for the Company to

manage its planned growth, the effects of product development and

the need for continued technological change, protection of the

Company’s proprietary rights, the effect of government regulation

and compliance on the Company and the industry in which it

operates, network security risks, the ability of the Company to

maintain properly working systems, theft and risk of physical harm

to personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital as well as the factors identified throughout

this press release and in the section entitled “Financial Risk

Factors” of the Company’s Management’s Discussion and Analysis for

the three and nine-months ended July 31, 2024. The forward-looking

information contained in this press release represents management’s

expectations as of the date hereof (or as of the date such

information is otherwise stated to be presented) and is subject to

change after such date. The Company disclaims any intention or

obligation to update or revise any forward-looking information

whether as a result of new information, future events or otherwise,

except as required under applicable securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

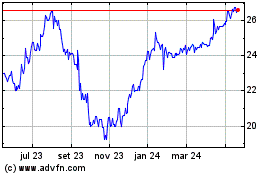

Currency Exchange (TSX:CXI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

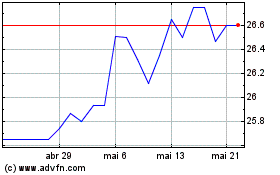

Currency Exchange (TSX:CXI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025