Azimut Exploration Inc. (“Azimut” or the

“Company”) (

TSXV: AZM)

(

OTCQX: AZMTF) is pleased to announce the

commencement of a diamond drilling program that will focus on the

recently discovered high-grade antimony

corridor (the “

Fortin Zone”) on its

wholly-owned Wabamisk Property

(the “Property”) in the Eeyou Istchee James Bay (“James Bay”)

region of Quebec (see Figures 1 to 4).

Azimut is proceeding with a

5,000-metre diamond drilling program to assess the

corridor’s strike and grade continuity. An initial 2,000-metre

phase will be completed before the end of the year. Contingent on

positive results, the remaining 3,000 metres of drilling will be

carried out in early 2025. With approximately $9 million in its

treasury, the Company is fully funded for this drill program.

The discovery of a high-grade antimony system in

Quebec presents a rare opportunity, given the commodity's status as

a critical mineral and the current risk of

a supply shortage (see explanation below).

As previously disclosed (see press release of

October 29, 2024), the 2024 prospecting program has revealed an

antimony-rich system demonstrated by channel

samples (3.92% Sb over 14.0 m) and numerous

high-grade grab samples (up to 24.8%

Sb) collected along a 1.2-kilometre-long strike within the

Fortin Zone. Gold (up to

7.27 g/t Au in grabs) commonly accompanies antimony.

Note that grab samples are selective by nature and unlikely to

represent average grades.

Geoscientific data support a

minimum 3.5-kilometre length for the

antimony-gold exploration corridor. The corridor is

related to an extensive shear zone between a thick metasedimentary

unit to the north (the Auclair Formation) and a mafic volcanic

package to the south (the Natel Formation). It is marked by a

strong antimony footprint in lake sediments, till and soil. The

antimony showings (grades higher than 0.5% Sb) correlate well with

induced polarization (“IP”) chargeability anomalies and an axis of

moderate magnetic intensity. The spatial distribution of the

showings suggests a 30-metre-wide envelope for the mineralized

zone.

A recently completed high-resolution magnetic

heliborne survey (381 line-km covering 1 km by 8 km at

25-metre line spacing) further defines the extent of the target

zone. A string of magnetic anomalies, well correlated with antimony

showings and IP anomalies, highlights the priority targets to be

drilled during the current program (see Figures 5 and 6).

About Antimony

Supply shortage riskAntimony is

listed as a critical mineral by the Canadian and United States

governments and the European Commission. Five countries account for

about 91% of the world's production, estimated to be 83,000 tonnes

in 2023, including China (48.2%) and Tajikistan (25.3%). Antimony

is not currently mined in Canada or the United States. In

August 2024, China imposed restrictions on the export of antimony,

which led to a significant export reduction in October, increasing

the risk of supply disruptions. Prices have risen sharply since the

beginning of the year, reaching an all-time high of approximately

US$34,000 per tonne for antimony metal on the international market

in November. For comparative purposes, copper averaged about

US$9,500 per tonne in November.

Mineral deposit types and

gradesMost antimony deposits occur in clastic siliceous

sedimentary rocks with significant fault and fracture systems.

Stibnite is the most common ore mineral. The main deposit types

correspond to hydrothermal systems with antimony as the primary

commodity or as a byproduct in gold deposits. Quartz-stibnite and

replacement deposits account for most of the current mining

production. These deposits typically form the peripheral parts of

orogenic and intrusion-related gold deposits. Representative

examples include Xikuangshan in China (mining reserves of

11.5 Mt at 3.5% Sb in 1980) and Sarylakh in Russia (resources

of 2.17 Mt at 6% Sb and 6 g/t Au). Canadian examples include Beaver

Brook in Newfoundland and Lake George in New Brunswick. The classic

example of an Archean deposit is the past-producing Consolidated

Murchison mine in South Africa. The above tonnage and grade

references are historical and do not correspond to National

Instrument 43-101 standards. This section's main source of

information is USGS Professional Paper 1802-C (2017).

About the Wabamisk Property

Wabamisk is a wholly-owned project (39.5 km

by 9.2 km) comprising 544 claims covering 287.9 km2. It lies

13 km east of the Clearwater Property (Fury Gold Mines),

42 km northeast of the Whabouchi lithium deposit (Nemaska

Lithium), and 70 km south of the Eleonore gold mine (Newmont).

Major powerlines pass through or close to the property’s eastern

end, and the North Road highway passes 37 km to the south. The

nearest town is Nemaska, a Cree village municipality 55 km to

the southwest.

Geophysics and Drilling Contracts,

Analytical Protocols and Management

Novatem Inc., based in Mont-Saint-Hilaire,

Quebec, carried out the magnetic heliborne survey. Nouchimi / RJLL

Drilling Inc. of Rouyn-Noranda, Quebec, has been contracted to

conduct the drilling program using an NQ core diameter.

Samples are sent to ALS Laboratories in Val-d’Or

(Quebec), where gold is analyzed by fire assay with atomic

absorption and gravimetric finishes for grades above 3.0 g/t Au.

Samples are also analyzed for a 48-element suite using ICP.

Overlimit antimony assays (1%) are reanalyzed using four-acid

digestion and ICP-AES. Azimut applies industry-standard QA/QC

procedures to its drilling programs. All batches sent for analysis

include certified reference materials, blanks and field

duplicates.

The project is under the direction of Alain

Cayer (P.Geo.), Project Manager.

Qualified Person

Dr. Jean-Marc Lulin (P.Geo.), Azimut’s President

and CEO, has prepared this press release and approved the

scientific and technical information disclosed herein, acting as

the Company’s qualified person within the meaning of National

Instrument 43-101.

About Azimut

Azimut is a leading mineral exploration company

with a solid reputation for target generation and partnership

development. The Company holds the largest mineral exploration

portfolio in Quebec, controlling strategic land positions for

copper-gold, nickel and lithium. Its wholly owned flagship project,

the Elmer Gold Project, is at the resource stage

(311,200 oz Indicated; 513,900 oz

Inferred*) and has a strong exploration upside. Azimut is

also advancing the Galinée lithium discovery with

its joint venture partner SOQUEM Inc.

Azimut uses a pioneering approach to big data

analytics (the proprietary AZtechMine™ expert

system) enhanced by extensive exploration know-how. The Company’s

competitive edge is based on systematic regional-scale data

analysis. Azimut maintains rigorous financial discipline and a

strong balance sheet, with 85.6 million shares issued and

outstanding.

Contact and Information

Jean-Marc Lulin, President and

CEOTel.: (450) 646-3015 – Fax: (450) 646-3045

Jonathan Rosset, Vice President Corporate

DevelopmentTel.: (604)

202-7531info@azimut-exploration.com www.azimut-exploration.com

_____________________________________________________________________________________

* “Technical Report and Initial Mineral Resource

Estimate for the Patwon Deposit, Elmer Property, Quebec, Canada”,

prepared by: Martin Perron, P.Eng., Chafana Hamed Sako, P.Geo.,

Vincent Nadeau-Benoit, P.Geo. and Simon Boudreau, P.Eng. of

InnovExplo Inc., dated January 4, 2024.

Cautionary note regarding

forward-looking statements

Cautionary note regarding forward-looking

statements. This press release contains forward-looking statements,

which reflect the Company’s current expectations regarding future

events related to the drilling results from the Wabamisk Property.

To the extent that any statements in this press release contain

information that is not historical, the statements are essentially

forward-looking and are often identified by words such as

“consider”, “anticipate”, “expect”, “estimate”, “intend”,

“project”, “plan”, “potential”, “suggest” and “believe”. The

forward-looking statements involve risks, uncertainties, and other

factors that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements. Many

factors could cause such differences, particularly volatility and

sensitivity to market metal prices, the impact of changes in

foreign currency exchange rates and interest rates, imprecision in

reserve estimates, recoveries of gold and other metals,

environmental risks including increased regulatory burdens,

unexpected geological conditions, adverse mining conditions,

community and non-governmental organization actions, changes in

government regulations and policies, including laws and policies,

global outbreaks of infectious diseases, including COVID-19, and

failure to obtain necessary permits and approvals from government

authorities, as well as other development and operating risks.

Although the Company believes that the assumptions inherent in the

forward-looking statements are reasonable, undue reliance should

not be placed on these statements, which only apply as of the date

of this document. The Company disclaims any intention or obligation

to update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise, other than

as required to do so by applicable securities laws. The reader is

directed to carefully review the detailed risk discussion in our

most recent Annual Report filed on SEDAR+ for a fuller

understanding of the risks and uncertainties that affect the

Company’s business. Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Azimut Exploration (TSXV:AZM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

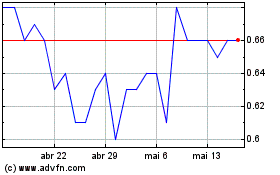

Azimut Exploration (TSXV:AZM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024