Defiance ETFs today launched NVOX, the world's first single-stock

leveraged ETF for the pharmaceutical stock Novo Nordisk (NYSE:

NVO). As the weight loss market continues to expand and Novo

Nordisk is a key provider in that space, NVOX offers retail

investors 2X daily long leveraged exposure to the change in the

daily share price of Novo Nordisk without the need for a margin

account. This provides a unique tool for tactical traders. NVOX

does not invest directly in Novo Nordisk and has a higher degree of

risk due to tracking a single stock.

Novo Nordisk is a leading global healthcare company, founded in

1923 and headquartered in Denmark, seeking to drive change to

defeat serious chronic diseases, built upon their heritage in

diabetes. The company does so by pioneering scientific

breakthroughs, expanding access to their medicines, and

working to prevent and ultimately cure disease. Novo Nordisk

employs about 69,000 people in 80 countries and markets its

products in around 170 countries.

"For investors who want to gain enhanced exposure to the share

price movement of Novo Nordisk stock, NVOX is a great choice,” said

Sylvia Jablonski, CEO of Defiance ETFs. “As people worldwide are

losing weight using products like Ozempic and Wegovy, their maker

Novo Nordisk represents a multi-trillion-dollar opportunity, and we

are excited to provide investors with a groundbreaking trading tool

to participate in this transformative sector."

About Defiance ETFs

Founded in 2018, Defiance stands as a leading ETF issuer

dedicated to income and thematic investing. Defiance also pioneers

leveraged ETFs designed for traders seeking tactical

opportunities.

Our suite of first-mover leveraged & thematic ETFs empowers

investors to express targeted views on disruptive innovations,

including artificial intelligence, machine learning, and quantum

computing, while our actively managed options ETFs are designed to

seek current income.

Important Disclosures

The fund attempts to provide daily investment results

that correspond to two times (200%) the share price performance of

an underlying exchange-traded fund (an “Underlying

Security”). The Fund is not intended to be used by, and are

not appropriate for, investors who do not intend to actively

monitor and manage their portfolios. The Fund is very different

from most mutual funds and exchange-traded funds.

The Fund’s investment adviser will not attempt to

position a Fund’s portfolio to ensure that the Fund does not gain

or lose more than a maximum percentage of its net asset value on a

given trading day. As a consequence, if an Underlying Security’s

share price referenced by a Fund decreases by more than 50% on a

given trading day, the corresponding Fund’s investors could lose

all of their money.

NVOX Disclosure: Defiance ETFs LLC is the ETF sponsor. The

Fund’s investment adviser is Tidal Investments, LLC (“Tidal” or the

“Adviser”).

The Fund’s investment objectives, risks, charges, and expenses

must be considered carefully before investing.

The prospectus and summary prospectus contain this and

other important information about the investment company. Please

read the prospectus and / or summary prospectus carefully before

investing. Hard copies can be requested by calling

833.333.9383.

Investing involves risk. Principal loss is possible. As

an ETF, the funds may trade at a premium or discount to NAV. Shares

of any ETF are bought and sold at market price (not NAV) and are

not individually redeemed from the Fund. A portfolio concentrated

in a single industry or country, may be subject to a higher degree

of risk.

There is no guarantee that the Fund’s investment strategy will

be properly implemented, and an investor may lose some or all of

its investment.

Total return represents changes to the NAV and accounts for

distributions from the fund.

Median 30 Day Spread is a calculation of

Fund’s median bid-ask spread, expressed as a percentage rounded to

the nearest hundredth, computed by: identifying the Fund’s national

best bid and national best offer as of the end of each 10 second

interval during each trading day of the last 30 calendar days;

dividing the difference between each such bid and offer by the

midpoint of the national best bid and national best offer; and

identifying the median of those values.

Underlying Security Risk. The underlying

security is subject to many risks that can negatively impact the

Fund.

Indirect Investment in NVO Nordisk Risk. NVO Nordisk is not

affiliated with the Trust, the Fund, or the Adviser, or their

respective affiliates and is not involved with this offering in any

way and has no obligation to consider your Shares in taking any

corporate actions that might affect the value of Shares.

NVO Trading Risk. The trading price of the Underlying Security

may exhibit volatility and significant fluctuations due to various

factors inherent in the semiconductor industry. This sector is

susceptible to price and volume fluctuations, which may not always

correlate with the companies’ operational performance. Short

sellers may exert influence on trading dynamics, potentially

impacting supply and demand dynamics and contributing to market

price volatility.

NVO Performance Risk. NVO may fail to meet its publicly

announced guidelines or other expectations about its business,

which could cause the price of NVO to decline. NVO provides

guidance regarding its expected financial and business performance,

such as projections regarding sales and production, as well as

anticipated future revenues, gross margins, profitability and cash

flows.

Pharmaceutical Industry Risks. Pharmaceutical research and

development are very costly and highly uncertain; NVO may not

succeed in developing, licensing, or acquiring commercially

successful products sufficient in number or value to replace

revenues of products that have lost or will lose intellectual

property protection or are displaced by competing products or

therapies. NVO and NVO’s products face intense competition from

multinational pharmaceutical companies, biotechnology companies,

and lower-cost generic and biosimilar manufacturers, and such

competition could have a material adverse effect on NVO’s

business.

Fixed Income Securities Risk. When the

Fund invests in fixed income securities, the value of your

investment in the Fund will fluctuate with changes in interest

rates. Typically, a rise in interest rates causes a decline in the

value of fixed income securities owned by the Fund.

Leverage Risk. Leverage may increase the

risk of loss and cause fluctuations in the market value of the

Fund’s portfolio to have disproportionately large effects or cause

the NAV of the Fund generally to decline faster than it would

otherwise.

Derivatives Risk. Derivatives may be more

sensitive to changes in market conditions and may amplify

risks.

Foreign and Emerging Markets

Risks. Investments in foreign securities may involve

risks such as social and political instability, market illiquidity,

exchange-rate fluctuations, a high level of volatility and limited

regulation. Investing in emerging markets involves different and

greater risks, as these countries are substantially smaller, less

liquid and more volatile than securities markets in more developed

markets.

Effects of Compounding and Market Volatility

Risk. The Fund has a daily leveraged investment objective

and the Fund’s performance for periods greater than a trading day

will be the result of each day’s returns compounded over the

period, which is very likely to differ from the Fund performance,

before fees and expenses.

Single Issuer Risk. Issuer-specific

attributes may cause an investment in the Fund to be more volatile

than a traditional pooled investment which diversifies risk or the

market generally. The value of the Fund, which focuses on an

individual security, may be more volatile than a traditional pooled

investment or the market as a whole and may perform differently

from the value of a traditional pooled investment or the market as

a whole.

Swap Agreements. The use of swap

transactions is a highly specialized activity, which involves

investment techniques and risks different from those associated

with ordinary portfolio securities transactions. These risks may

prevent the Fund from achieving its leveraged investment objective,

even if the Underlying Security later reverses all or a portion of

its movement.

Counterparty Risk. The Fund is subject to

counterparty risk by virtue of its investments in derivatives which

exposes the Fund to the risk that the counterparty will not fulfill

its obligation to the Fund.

Non-Diversification Risk. Because the Fund

is “non-diversified,” it may invest a greater percentage of its

assets in the securities of a single issuer or a smaller number of

issuers than if it was a diversified fund. As a result, a decline

in the value of an investment in a single issuer or a smaller

number of issuers could cause the Fund’s overall value to decline

to a greater degree than if the Fund held a more diversified

portfolio.

New Fund Risk. As of the date of this

prospectus, the Fund has no operating history and currently has

fewer assets than larger funds. Like other new funds, large inflows

and outflows may impact the Fund’s market exposure for limited

periods of time.

Diversification does not ensure a profit nor protect against

loss in a declining market.

Brokerage Commissions may be charged on trades.

NVOX is distributed by Foreside Fund Services, LLC.

Media Contacts:

Frank Taylor/Sarah Lazarus

defiance@dlpr.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/023469e4-ef3a-4346-aa78-369588be7e25

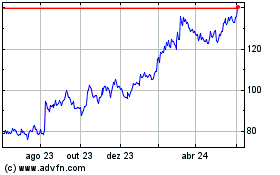

Novo Nordisk (NYSE:NVO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

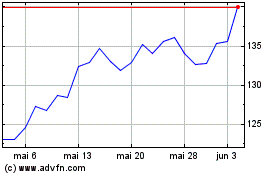

Novo Nordisk (NYSE:NVO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025