Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) and its

strategic partner Ecopetrol S.A. (“Ecopetrol”), are pleased to

announce that they have executed agreements whereby Parex will earn

a 50% working interest (“W.I.”) in four blocks located in the

Putumayo Basin of Colombia (“Putumayo Blocks”) as well as the

Farallones Block in the Llanos Foothills of Colombia (“Farallones

Block”). Additionally, the Company provides an operational update

and reports that it is abandoning the Arantes exploration well at

LLA-122 (50% W.I.). All amounts herein are in United States Dollars

(“USD”) unless otherwise stated.

“The agreements announced today align with

Parex’s strategy and add significant, lower-risk development &

exploitation inventory, while consolidating our position in the

Llanos Foothills trend where world-class exploration potential

exists,” commented Imad Mohsen, President & Chief Executive

Officer.

“The longstanding partnership between Parex and

Ecopetrol is further reinforced by these agreements. I am

particularly excited about the re-development opportunities that

exist in the Putumayo, and Parex’s enhanced exploration position in

the Llanos Foothills, the most prolific trend in Colombia.”

Key Highlights

- Executed

Putumayo business collaboration agreements to establish a new core

area for Parex, where over 350 million barrels of oil have been

recovered to date(1) through primary recovery methods with limited

recent drilling.

- The

Putumayo Blocks offer significant upside potential and the ability

to meaningfully improve recovery factors through the application of

lower-risk infill drilling, re-completions, facility upgrades, and

enhanced oil recovery (“EOR”) implementation.

- Parex’s

independent qualified reserve evaluator, GLJ Ltd. (“GLJ”), has

recognized Company interest proved plus probable reserves (“2P”) of

18 million barrels(2).

- Parex

will assume operatorship in all future drilling and capital

activities; Ecopetrol will retain operatorship of current and

future production.

- Extended

Llanos Foothills position through the addition of a top-ranked

exploration target on the Farallones Block(3).

- November

2024 average production was 44,700 boe/d(4); the Company expects to

achieve its FY 2024 average production guidance of 49,000 to 50,000

boe/d(5).

(1) Source: Ecopetrol S.A.; light & medium crude oil.(2) See

“Putumayo Blocks – Development & Exploitation” for additional

information and “Reserves Advisory.”(3) See “Farallones Block –

Llanos Foothills” for additional information.(4) See “November 2024

Production” for additional information.(5) See November 5, 2024

news release.

Putumayo Blocks – Development &

Exploitation

- Acquired

50% W.I. under business collaboration agreements in the Orito, Area

Sur, Occidente and Nororiente Blocks in the Putumayo Basin of

Colombia via an initial work plan commitment with no up-front

acquisition cost.

- Phase I:

Parex receives 50% of future incremental production through funding

development wells and implementing secondary recovery programs;

expenditure commitment for carry capital by Parex of approximately

$175 million on a gross capital program of roughly $350 million,

with the Company having the flexibility to shift commitment carry

capital to other Parex and Ecopetrol partnerships as required.

- Assets

are expected to receive approximately $20 to $50 million of

budgeted capital expenditures(1) in the FY 2025 Parex program to

begin Phase I development and exploitation activity, with

investment level depending on access timing; the Company currently

expects initial access to be approximately Q2 2025.

- Phase II:

Upon completion of Phase I, or after three years, thereafter Parex

will receive 50% of all base existing production, in addition to

the 50% of incremental production, with an ongoing 3% capital carry

in favour of Ecopetrol; current average production from the base

existing producing wells is approximately 5,800 bbl/d of

oil(2).

- Dated

December 10, 2024, GLJ has recognized Company interest of:

- Proven

reserves (“1P”) of 10 million barrels and future development

capital of approximately $167 million(3).

- Proved

plus probable reserves (“2P”) of 18 million barrels and future

development capital of approximately $171 million(3).

- Provides

low-risk development drilling inventory with gross 2P future

locations of approximately 19(3), in addition to existing producing

wells and re-complete opportunities.

- The

Putumayo Blocks currently produce and are prospective for light

& medium crude oil, with an average API generally above

25°.

- In

addition to development opportunities, the acquired Putumayo Blocks

add near-field exploration prospects in proven plays that

materially enhance Parex’s portfolio.

(1) Non-GAAP financial measure; see “Non-GAAP and Other

Financial Measures Advisory.”(2) Source: National Hydrocarbons

Agency of the Republic of Colombia (“ANH”); light & medium

crude oil.(3) Reserves information contained in the independent

reserves report prepared by GLJ dated December 10, 2024, with an

effective date of September 30, 2024; such report was prepared in

accordance with definitions, standards and procedures contained in

the Canadian Oil and Gas Evaluation Handbook and National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities; the reserves presented in this news release are based

on GLJ’s forecast pricing effective October 1, 2024; all reserves

are light & medium crude oil; see “Reserves Advisory.”

Farallones Block – Llanos Foothills

- Acquired

50% W.I. and operatorship in the Farallones Block in the Llanos

Foothills of Colombia(1), in exchange for drilling the Farallones

exploration well, as well as the further expenditure commitment for

carry capital of approximately $30 million on a gross capital

program of roughly $60 million; commitment carry capital can be

executed until 2029, with the Company having flexibility to shift

commitment carry capital to other Parex and Ecopetrol partnerships

as required.

- Extends

Parex’s Foothills position and includes Farallones, which is an

exploration prospect that offsets Cusiana by approximately 70

kilometres and represents one of the highest-ranking prospects in

Parex’s high-impact, big ‘E’ exploration portfolio.

- In the FY

2025 Parex program, plan to commence initial access work to prepare

for civil works activity and the expected spud of Farallones in

2026.

(1) Subject to government approval.

Operational Update

November 2024 Production

During the month, corporate production was

affected by downtime that resulted in average production of 44,700

boe/d(1). The primary drivers of heightened downtime were

electrical interruptions at Cabrestero, as well as social factors

at LLA-32 and Capachos. While LLA-32 has regained full operational

status, beginning November 28, 2024, ongoing social protests have

caused the Company to temporarily shut in operations at

Capachos.

(1) Light & medium crude oil: ~8,517 bbl/d, heavy crude oil:

~35,499 bbl/d, conventional natural gas: ~4,105 mcf/d; rounded for

presentation purposes.

Current Production

For the period of December 1, 2024, to December

9, 2024, estimated average production was 42,800 boe/d(1), with

lower production primarily due to the aforementioned shut-in at

Capachos. Based on recent constructive dialogue, the Company

expects a near-term resolution that will enable Capachos operations

to resume.

Parex’s production guidance incorporates

contingencies for downtime events. At current production levels,

the Company expects to achieve its FY 2024 average production

guidance of 49,000 to 50,000 boe/d(2).

(1) Light & medium crude oil: ~8,155 bbl/d, heavy crude oil:

~33,990 bbl/d, conventional natural gas: ~3,930 mcf/d; rounded for

presentation purposes.(2) See November 5, 2024 news release.

Arantes Exploration Well at LLA-122(1)

As previously announced(2), Parex had drilled

the well to a depth of roughly 17,750 feet. Since that

announcement, the well was drilled to approximately 18,000 feet;

during operations to set the final liner in place above the zones

of interest, a mechanical issue emerged during the cementing

process. After a thorough evaluation by the Company and its

partner, it was determined that further operations on the well were

technically unfeasible at an acceptable risk tolerance. The well

will be abandoned, with an estimated total cost net to Parex of

approximately $35 million.

The Llanos Foothills of Colombia remain a core

component of Parex’s long-term strategy, and drilling the Arantes

well resulted in improved drilling proficiency and additional

subsurface knowledge that can be utilized for future exploration

wells.

(1) 50% W.I.(2) See November 5, 2024 news release.

About Parex Resources Inc.

Parex is one of the largest independent oil and

gas companies in Colombia, focusing on sustainable conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex shares

trade on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital

Markets & Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations &

Communications AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED

STATES

Non-GAAP and Other Financial Measures

Advisory

This press release uses various “non-GAAP financial measures”,

“non-GAAP ratios”, “supplementary financial measures” and “capital

management measures” (as such terms are defined in NI 52-112),

which are described in further detail below. Such measures are not

standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. Investors are cautioned that non-GAAP financial measures

should not be construed as alternatives to or more meaningful than

the most directly comparable GAAP measures as indicators of Parex's

performance.

These measures facilitate management’s comparisons to the

Company’s historical operating results in assessing its results and

strategic and operational decision-making and may be used by

financial analysts and others in the oil and natural gas industry

to evaluate the Company’s performance. Further, management believes

that such financial measures are useful supplemental information to

analyze operating performance and provide an indication of the

results generated by the Company's principal business

activities.

Set forth below is a description of the non-GAAP financial

measures, non-GAAP ratios, supplementary financial measures and

capital management measures used in this press release.

Non-GAAP Financial Measures

Capital expenditures, is a

non-GAAP financial measure which the Company uses to describe its

capital costs associated with oil and gas expenditures. The measure

considers both property, plant and equipment expenditures and

exploration and evaluation asset expenditures which are items in

the Company’s statement of cash flows for the period and is

calculated as follows:

| |

For the three months ended |

|

For the nine months ended |

| |

Sep. 30, |

|

Sep. 30, |

|

Jun. 30, |

|

Sep. 30, |

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

Property, plant and equipment expenditures |

$ |

68,406 |

|

$ |

93,957 |

|

$ |

49,214 |

|

$ |

158,451 |

|

Exploration and evaluation expenditures |

|

13,961 |

|

|

62,790 |

|

|

48,583 |

|

|

107,134 |

|

Capital expenditures |

$ |

82,367 |

|

$ |

156,747 |

|

$ |

97,797 |

|

$ |

265,585 |

Oil & Gas Matters Advisory

The term "Boe" means a barrel of oil equivalent on the basis of

6 Mcf of natural gas to 1 barrel of oil ("bbl"). Boe’s may be

misleading, particularly if used in isolation. A boe conversation

ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

This press release discloses drilling inventory which is broken

down into three categories: (i) proved locations; and (ii) probable

locations. Proved locations and probable locations are derived from

the GLJ Report and account for drilling locations that have

associated proved and/or probable reserves, as applicable. Of the

19 total drilling locations identified herein, 12 are proved

locations, and 7 are probable locations. The drilling locations on

which Parex will actually drill wells, including the number and

timing thereof is ultimately dependent upon the availability of

funding, regulatory approvals, seasonal restrictions, oil and

natural gas prices, costs, actual drilling results, additional

reservoir information that is obtained and other factors.

Reserves Advisory

Estimates of reserves set forth in this press release from the

GLJ Report have been prepared by GLJ as of December 10, 2024, with

an effective date of September 30, 2024, in accordance with

National Instrument 51-101 – Standards of Disclosure for Oil and

Gas Activities and the Canadian Oil and Gas Evaluations Handbook

and based on GLJ's forecast pricing effective October 1, 2024,

which are available at www.gljpc.com. The recovery and reserve

estimates of crude oil reserves provided in this news release are

estimates only, and there is no guarantee that the estimated

reserves will be recovered. Actual crude oil reserves may

eventually prove to be greater than, or less than, the estimates

provided herein.

It should not be assumed that the estimates of future net

revenues presented herein represent the fair market value of the

reserves. There are numerous uncertainties inherent in estimating

quantities of crude oil, reserves and the future cash flows

attributed to such reserves.

"Proved" reserves are those reserves that can be estimated with

a high degree of certainty to be recoverable. It is likely that the

actual remaining quantities recovered will exceed the estimated

proved reserves.

"Probable" reserves are those additional reserves that are less

certain to be recovered than proved reserves. It is equally likely

that the actual remaining quantities recovered will be greater or

less than the sum of the estimated proved plus probable

reserves.

Advisory on Forward-Looking Statements

Certain information regarding Parex set forth in this document

contains forward-looking statements that involve substantial known

and unknown risks and uncertainties. The use of any of the words

"plan", "expect", “prospective”, "project", "intend", "believe",

"should", "anticipate", "estimate", “forecast”, "guidance",

“budget” or other similar words, or statements that certain events

or conditions "may" or "will" occur are intended to identify

forward-looking statements. Such statements represent Parex's

internal projections, estimates or beliefs concerning, among other

things, future growth, results of operations, production, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, plans for and

results of drilling activity, environmental matters, business

prospects and opportunities. These statements are only predictions

and actual events or results may differ materially. Although the

Company’s management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex's actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this

document include, but are not limited to, statements with respect

to: the expectations and beliefs related to Parex’s partnership

with Ecopetrol and the transactions, farm-ins and other matters

related thereto and the anticipated benefits to be derived

therefrom; the Company’s focus, plans, priorities and strategies;

expectations regarding the opportunities that exist in the Putumayo

and the Llanos Foothills basins; Parex's 2024 average annual

production guidance; the anticipated amount of capital expenditures

required to begin Parex's Phase I development and exploration

activities in the Putumayo basin and the anticipated timing

thereof; the future development capital associated with Parex's 1P

and 2P reserves in the Putumayo basin; the anticipated timing of

when Parex expects to commence initial access work to prepare for

civil works activity; the anticipated timing of when the Farallones

exploration well will spud; and the anticipated total cost net to

Parex associated with abandoning the Arantes exploration well. In

addition, statements relating to "reserves" are by their nature

forward-looking statements, as they involve the implied assessment,

based on certain estimates and assumptions that the reserves

described can be profitably produced in the future. The recovery

and reserve estimates of Parex's reserves provided herein are

estimates only and there is no guarantee that the estimated

reserves will be recovered.

These forward-looking statements are subject to numerous risks

and uncertainties, including but not limited to, the impact of

general economic conditions in Canada and Colombia; prolonged

volatility in commodity prices; industry conditions including

changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

OPEC and other countries as to production levels; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; the

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities; volatility in market prices for oil; fluctuations in

foreign exchange or interest rates; environmental risks; changes in

income tax laws or changes in tax laws and incentive programs

relating to the oil industry; changes to pipeline capacity; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under contracts; the risk that

Brent oil prices may be lower than anticipated; the risk that

Parex's evaluation of its existing portfolio of development and

exploration opportunities may not be consistent with its

expectations; the risk that Parex may not be responsive to changes

in commodity prices; the risk that Parex may not meet its

production guidance for the year ended December 31, 2024; the risk

that Parex’s partnership with Ecopetrol and the transactions,

farm-ins and other matters related thereto may not lead to the

benefits anticipated; the risk that the Putumayo and the Llanos

Foothills basins may not provide Parex with the opportunities

anticipated; the risk that the capital expenditures required to

begin Parex's Phase I development and exploration activities at the

Putumayo basin in 2025 may be greater than anticipated; the risk

that Parex may not commence initial access work to prepare for

civil works activity when anticipated, or at all; the risk that the

Farallones exploration well may not spud when anticipated or at

all; the risk that the abandonment of the Arantes exploration well

may be more costly than anticipated; and other factors, many of

which are beyond the control of the Company.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that

could affect Parex's operations and financial results are included

in reports on file with Canadian securities regulatory authorities

and may be accessed through the SEDAR+ website

(www.sedarplus.ca).

Although the forward-looking statements contained in this

document are based upon assumptions which Management believes to be

reasonable, the Company cannot assure investors that actual results

will be consistent with these forward-looking statements. With

respect to forward-looking statements contained in this document,

Parex has made assumptions regarding, among other things: current

and anticipated commodity prices and royalty regimes; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex's operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex's

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex's evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex's production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex’s partnership with Ecopetrol and

the transactions, farm-ins and other matters related thereto will

lead to the benefits anticipated; and other matters.

Management has included the above summary of assumptions and

risks related to forward-looking information provided in this

document in order to provide shareholders with a more complete

perspective on Parex's current and future operations and such

information may not be appropriate for other purposes. Parex's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do, what benefits Parex will

derive. These forward-looking statements are made as of the date of

this document and Parex disclaims any intent or obligation to

update publicly any forward-looking statements, whether as a result

of new information, future events or results or otherwise, other

than as required by applicable securities laws.This press release

contains information that may be considered a financial outlook

under applicable securities laws about the Company's potential

financial position, including, but not limited to: the anticipated

amount of capital expenditures required to begin Parex's Phase I

development and exploration activities in the Putumayo basin and

the anticipated timing thereof; the future development capital

associated with Parex's 1P and 2P reserves in the Putumayo basin;

and the anticipated total cost net to Parex associated with the

abandonment of the Arantes exploration well, all of which are

subject to numerous assumptions, risk factors, limitations and

qualifications, including those set forth in the above paragraphs.

The actual results of operations of the Company and the resulting

financial results will vary from the amounts set forth in this

press release and such variations may be material. This information

has been provided for illustration only and with respect to future

periods are based on budgets and forecasts that are speculative and

are subject to a variety of contingencies and may not be

appropriate for other purposes. Accordingly, these estimates are

not to be relied upon as indicative of future results. Except as

required by applicable securities laws, the Company undertakes no

obligation to update such financial outlook. The financial outlook

contained in this press release was made as of the date of this

press release and was provided for the purpose of providing further

information about the Company's potential future business

operations. Readers are cautioned that the financial outlook

contained in this press release is not conclusive and is subject to

change.

The following abbreviations used in this press release have the

meanings set forth below:

| API

gravity |

American

Petroleum Institute gravity |

| bbl |

one barrel |

| bbls |

barrels |

| bbl/d |

barrels per day |

| boe |

barrels of oil equivalent of natural gas; one barrel of oil or

natural gas liquids for six thousand cubic feet of natural gas |

| boe/d |

barrels of oil equivalent of natural gas per day |

| mcf |

thousand cubic feet |

| mcf/d |

thousand cubic feet per day |

| W.I. |

working interest |

| |

|

PDF

Available: http://ml.globenewswire.com/Resource/Download/4e414bc7-7105-4c74-afdb-c4b74c8bd1df

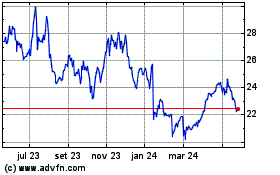

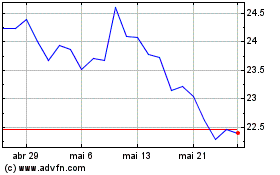

Parex Resources (TSX:PXT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Parex Resources (TSX:PXT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025