Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe &

Green Holdings” or the “Company”), a leading developer,

designer, and fabricator of modular structures, today announced the

execution of a binding Letter of Intent (“LOI”) to acquire 100% of

the outstanding securities of New Asia Holdings Inc. (OTCQB: NAHD)

(“NAHD”). The acquisition includes a diversified energy company

Olenox Corp. (“Olenox”), a wholly owned subsidiary of NAHD. The

acquisition also includes Machfu.com (“Machfu”), a wholly owned

subsidiary of Olenox, specializing in secure connectivity and

automation solutions for industries such as oil & gas,

utilities, and manufacturing.

Olenox’s operations include three vertically

integrated business units: Oil & Gas Production, Energy

Services, and Energy Technologies. Olenox specializes in acquiring

and revitalizing underdeveloped energy assets, leveraging

proprietary technologies and operational expertise to enhance

production efficiency, lower costs, and minimize environmental

impact.

Key achievements of Olenox include expanding

production from 113 barrels of oil equivalent per day (BOE/day) to

a projected 700 BOE/day through increased operational capacity and

innovative technologies. By focusing on distressed and neglected

oil and gas fields in Texas, Oklahoma, and Kansas, Olenox has

created a scalable model that addresses industry inefficiencies

while maintaining a strong commitment to sustainability. Following

the acquisition of NAHD, Safe & Green will continue to maintain

its current operations and fabrication of modular structures. In

addition, the Company plans to leverage its existing facilities,

including its Waldron facility in Durant, Oklahoma, to support its

new operations in the oil and gas industry. Company management

expects that this dual focus will enable the combined entity to

achieve greater efficiencies and benefit from economies of scale

across its business segments. This approach aligns with the

Company’s overarching vision to lead advancements in sustainable

energy, food, water, and shelter as essential pillars for fostering

global resilience.

Olenox’s proprietary plasma pulse and ultrasonic

cleaning tools set it apart from traditional energy players. These

advanced technologies allow for cost-effective recovery of oil and

gas while reducing the environmental footprint, ensuring alignment

with global sustainability trends. Olenox’s Energy Services

division, with its customized service rigs and reclamation

capabilities, enhances the value of its production assets while

generating additional revenue streams through third-party

contracts.

Machfu.com is a trailblazer in the Industrial

IoT sector. Its flagship product, the MachGateway®, and

Edge-to-Enterprise™ software enable seamless integration of legacy

systems with modern IoT platforms. With over 20,000 gateways

deployed globally, Machfu has proven its ability to deliver

real-time data analytics, predictive maintenance, and operational

efficiency to industrial clients.

Machfu’s technology supports cost reduction and

productivity gains by minimizing downtime and optimizing equipment

performance. For example, its Bluetooth IoT gateways connect over

125 sensors per device, enabling scalable, low-cost solutions for

monitoring and control in industrial environments. These

capabilities directly address the growing demand for automation and

digital transformation in energy and other key industries, creating

high-margin recurring revenue opportunities for the combined

entity.

In connection with the transaction, Michael

McLaren, recently appointed CEO of Safe & Green, as well as

founder and CEO of Olenox, will assume the additional role of

Chairman of Safe & Green, succeeding Paul Galvin, who will

remain on Safe & Green’s board of directors. McLaren brings

decades of experience in energy production, sustainability, and

innovation, making him uniquely positioned to lead the company’s

expanded vision.

Newly appointed Chairman and CEO Michael

McLaren

Michael McLaren stated, “We believe that the

combination of Olenox and Machfu with Safe & Green will create

a powerful, diversified entity with robust growth potential in both

the energy and technology sectors. Olenox provides stable and

growing revenues from its oil and gas assets, complemented by the

scalability of Machfu’s recurring IoT revenue streams. We believe

that this synergy will position the combined company to capture

significant market opportunities in renewable energy, digital

transformation, and industrial automation. By maintaining Safe

& Green’s current modular operations, while leveraging

facilities such as our Waldron facility to support oil and gas

activities, we expect to achieve greater operational efficiencies

and economies of scale. For Safe & Green shareholders, this

transaction represents a strategic pivot toward high-growth

markets. Olenox’s proven financial performance, including strong

asset utilization and innovative technologies, enhances the

Company’s equity position and profitability potential. Machfu’s

advanced IoT capabilities further diversify the revenue base,

providing exposure to a rapidly growing global market. I am honored

to lead this next chapter and deeply appreciate Paul Galvin’s

exceptional leadership and dedication. I look forward to working

closely with Paul and the board to realize our shared vision.”

Paul Galvin added, “This transaction marks an

exciting milestone for Safe & Green and its shareholders. The

combination of Olenox and Machfu with Safe & Green creates a

powerful, diversified entity with robust growth potential in both

the energy and technology sectors. We expect that this transaction

will expand the Company’s addressable markets, increase operational

efficiencies, and position the combined entity as a leader in

innovative, sustainable solutions. Importantly, we believe

leveraging existing facilities to support both modular and oil and

gas operations will maximize efficiency and drive economies of

scale. Moreover, Olenox is already profitable and on a strong

growth trajectory. By combining their operations with our own, I am

confident this transaction will drive significant value for

shareholders. Furthermore, we believe this transaction will help

address the Company's Nasdaq listing deficiency by strengthening

our financial position. I am also thrilled to welcome Mike McLaren

as Chairman as we enter this new phase of growth and

innovation.”

About Safe & Green Holdings

Corp.

Safe & Green Holdings Corp., a leading

modular solutions company, operates under core capabilities which

include the development, design, and fabrication of modular

structures, meeting the demand for safe and green solutions across

various industries. The firm supports third-party and in-house

developers, architects, builders, and owners in achieving faster

execution, greener construction, and buildings of higher value. For

more information, visit https://www.safeandgreenholdings.com/ and

follow us at @SGHcorp on Twitter.

No Offer or Solicitation

This communication is for informational purposes

only and is not intended to and shall not constitute an offer to

buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

Safe Harbor Statement

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "predict," "forecast," "project," "plan," "intend" or

similar expressions, or statements regarding intent, belief, or

current expectations, are forward-looking statements. These

forward-looking statements are based upon current estimates and

assumptions and include statements regarding the Company’s letter

of intent to acquire NAHD, including its subsidiary Olenox and

Olenox’s subsidiary Machfu.com, closing of such acquisition, the

Company’s plans to leverage its existing facilities to support the

combined company’s operations in the oil and gas industries,

Olenox’s proprietary plasma pulse and ultrasonic cleaning tools

that allow for cost-effective recovery of oil and gas while

reducing the environmental footprint, and Machfu’s MachGateway® and

Edge-to-Enterprise™ software which enable seamless integration of

legacy systems with modern IoT platforms, and the Company’s ability

to maintain its Nasdaq listing. These forward-looking statements

are subject to various risks and uncertainties, many of which are

difficult to predict that could cause actual results to differ

materially from current expectations and assumptions from those set

forth or implied by any forward-looking statements. Important

factors that could cause actual results to differ materially from

current expectations include, among others, the Company’s ability

to successfully complete the transaction with NAHD, the timing to

consummate the proposed acquisition, the diversion of management

time on transaction-related issues, unexpected costs, charges or

expenses resulting from the acquisition, potential litigation

relating to the acquisition that could be instituted against the

parties to the letter of intent or their respective directors,

managers or officers, including the effects of any outcomes related

thereto, the Company’s ability to successfully leverage its

existing facilities to support its planned new operations for the

combined entity in the oil and gas industries, Olenox’s ability to

successfully leverage its proprietary plasma pulse and ultrasonic

cleaning tools, Olenox’s ability to successfully generate

additional revenue streams through third-party contracts,

Machfu.com’s ability to successfully leverage its advanced IoT

capabilities to diversify and increase its revenue base, the effect

of government regulation, the Company’s ability to maintain

compliance with the NASDAQ listing requirements, and the other

factors discussed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023 and its subsequent filings with

the SEC, including subsequent periodic reports on Forms 10-Q and

8-K. The information in this release is provided only as of the

date of this release, and we undertake no obligation to update any

forward-looking statements contained in this release on account of

new information, future events, or otherwise, except as required by

law.

Investor Relations:

Crescendo Communications, LLC(212)

671-1020sgbx@crescendo-ir.com

- Newly appointed Chairman and CEO Michael McLaren

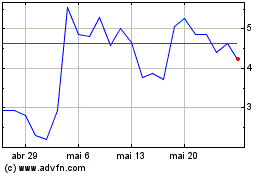

Safe and Green (NASDAQ:SGBX)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Safe and Green (NASDAQ:SGBX)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025