Adams Diversified Equity Fund Announces 2024 Performance

16 Janeiro 2025 - 7:17PM

Adams Diversified Equity Fund, Inc. (NYSE: ADX) announces the

Fund’s investment returns for 2024. The total return on the Fund’s

net asset value for 2024 was 23.6%, with dividends and capital

gains reinvested. The comparable figures for the S&P 500 Index

and Morningstar U.S. Large Blend Category were 25.0% and 22.7%,

respectively. The total return on the Fund’s market price for the

period was 28.1%.

The Fund paid $2.50 per share in income dividends and realized

capital gain distributions to shareholders in 2024, producing an

annual distribution rate of 10.9% on net asset value.

“In a year of increased volatility related to the presidential

election, we were pleased to outperform our peers in 2024 and

distribute 10.9% of NAV to shareholders, significantly more than

our new commitment adopted mid-year to annually distribute 8% of

NAV,” said Jim Haynie, CEO of Adams Funds.

The 2024 Annual Report is expected to be released on or about

February 19, 2025.

|

|

|

ANNUALIZED ONE, THREE, FIVE, AND TEN-YEAR COMPARATIVE

RETURNS (12/31/24) |

|

|

|

|

1 Year |

3 Year |

5 Year |

10 Year |

| Adams

Diversified Equity Fund (NAV) |

23.6 |

% |

9.2 |

% |

15.0 |

% |

13.7 |

% |

| Adams Diversified Equity Fund (market price) |

28.1 |

% |

10.5 |

% |

15.3 |

% |

14.1 |

% |

| Morningstar U.S. Large Blend Category |

22.7 |

% |

7.8 |

% |

13.3 |

% |

11.8 |

% |

| S&P 500 |

25.0 |

% |

8.9 |

% |

14.5 |

% |

13.1 |

% |

| |

|

|

|

|

|

|

|

|

|

NET ASSET VALUE ANNOUNCED |

The Fund’s net asset value at the end of 2024, compared with the

year earlier, was:

|

|

12/31/24 |

12/31/23 |

| Net

assets |

$ |

2,662,523,552 |

$ |

2,550,393,350 |

| Shares outstanding |

117,585,976 |

124,051,639 |

| Net asset value per share |

$ |

22.64 |

$ |

20.56 |

| |

|

|

|

TEN LARGEST EQUITY PORTFOLIO HOLDINGS

(12/31/24) |

|

|

|

|

% of Net Assets |

| Apple

Inc. |

8.0 |

% |

| Microsoft Corporation. |

7.1 |

% |

| NVIDIA Corporation |

6.9 |

% |

| Amazon.com, Inc. |

4.8 |

% |

| Alphabet Inc. Class A |

3.9 |

% |

| Meta Platforms, Inc. Class A |

2.8 |

% |

| Broadcom Inc. |

2.5 |

% |

| Adams Natural Resources Fund, Inc.* |

1.9 |

% |

| JP Morgan Chase & Co. |

1.9 |

% |

| Tesla, Inc. |

1.8 |

% |

| Total |

41.6 |

% |

| * Non-controlled affiliated closed-end fund. |

|

|

| |

|

|

|

SECTOR WEIGHTINGS (12/31/24) |

|

|

|

|

% of Net Assets |

| Information

Technology |

32.4 |

% |

| Financials |

13.4 |

% |

| Consumer Discretionary |

11.4 |

% |

| Health Care |

9.9 |

% |

| Communication Services |

9.3 |

% |

| Industrials |

7.8 |

% |

| Consumer Staples |

5.7 |

% |

| Energy |

3.5 |

% |

| Utilities |

2.2 |

% |

| Real Estate |

2.0 |

% |

| Materials |

1.7 |

% |

| |

|

|

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 90 years across many

market cycles. The Funds are committed to paying a minimum annual

distribution rate of 8% of NAV paid evenly each quarter throughout

the year, providing reliability for long-term shareholders. A

portion of any distribution may be treated as paid from sources

other than net income, including but not limited to short-term

capital gain, long-term capital gain, and return of capital. The

final determination of the source of all distributions for tax

reporting purposes in a calendar year, including the percentage of

qualified dividend income, will be made after year-end. Shares can

be purchased through our transfer agent or through a broker. For

more information about Adams Funds, please

visit: adamsfunds.com.

For further information please

contact: adamsfunds.com/about/contact │800.638.2479

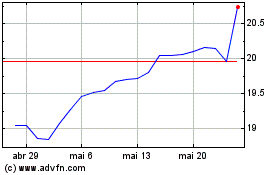

Adams Diversified Equity (NYSE:ADX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Adams Diversified Equity (NYSE:ADX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025