Entrée Resources Ltd. (TSX:ETG; OTCQB:ERLFF – the

“

Company” or “

Entrée”) is pleased

to announce a non-brokered private placement of up to an aggregate

2,577,700 units of the Company (the “Units”) to two placees at a

price of C$2.21 per Unit for gross proceeds of up to C$5,696,717

(the “

Private Placement”).

Each Unit will consist of one common share and

one-half of one non-transferable common share purchase warrant

(each whole warrant, a “Warrant”). Each Warrant

entitles the holder to purchase one additional common share of the

Company at a price of C$3.00 per share for a period of two years

following the date of issuance. No finder’s fees will be payable in

connection with the Private Placement.

The net proceeds from the Private Placement are

expected to be used for general corporate purposes, including

implementation of the partial final award made by the three-member

international arbitration Tribunal appointed in connection with the

Company’s binding arbitration proceedings against its joint venture

partner Oyu Tolgoi LLC (“OTLLC”) and Turquoise

Hill Resources Ltd. (see the Company’s News Release dated December

19, 2024 titled “Entrée Resources Wins Arbitration Decision”) and

to support ongoing commercial discussions with Oyu Tolgoi project

stakeholders.

Stephen Scott, the Company’s President & CEO

commented, “The Company has made enormous strides forward in the

past year and is closing in on achieving its stated business

objectives. Raising this money now enables Entrée to finish

the current work and move on to the next chapter with momentum and

a strong balance sheet”.

Closing of the Private Placement is anticipated

to occur in the first quarter of 2025 and is subject to receipt of

all necessary regulatory approvals including acceptance by the

Toronto Stock Exchange. The securities issued in connection with

the Private Placement will be subject to a hold period of four

months plus one day from the date of issuance, in accordance with

applicable securities laws.

Subject to receipt of all necessary regulatory

approvals, Horizon Copper Corp. (“Horizon”),

through its wholly owned subsidiary, 1363013 B.C. Ltd., an insider

of the Company, will acquire up to 625,202 Units under the Private

Placement to maintain its current proportionate interest in the

Company. Participation by Horizon in the Private Placement would

constitute a “related party transaction” as defined under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

However, such participation would be exempt from the formal

valuation and minority shareholder approval requirements of MI

61-101 based on the fact that neither the fair market value of the

Units subscribed for by Horizon, nor the consideration paid by

Horizon for the Units, would exceed 25% of the Company’s market

capitalization.

The securities being offered pursuant to the

Private Placement have not been, and will not be registered under

the United States Securities Act of 1933, as amended, or state

securities laws and may not be offered or sold within the United

States absent U.S. federal and state registration or an applicable

exemption from the U.S. registration requirements. This news

release does not constitute an offer to sell or a solicitation of

an offer to buy any of the securities in the United States.

ABOUT ENTRÉE RESOURCES LTD.

Entrée Resources Ltd. is a Canadian mining company with a unique

carried joint venture interest on a significant portion of one of

the world’s largest copper-gold projects – the Oyu Tolgoi project

in Mongolia. Entrée has a 20% or 30% carried participating interest

in the Entrée/Oyu Tolgoi joint venture, depending on the depth of

mineralization. Horizon Copper Corp. and Rio Tinto are major

shareholders of Entrée, beneficially holding approximately 24% and

16% of the shares of the Company, respectively. More information

about Entrée can be found at www.EntreeResourcesLtd.com.

FURTHER INFORMATION David Jan

Investor Relations Entrée Resources Ltd. Tel: 604-687-4777 | Toll

Free: 1-866-368-7330 E-mail: djan@EntreeResourcesLtd.com

This News Release contains forward-looking

information within the meaning of applicable Canadian securities

laws with respect to corporate strategies and plans; requirements

for additional capital; the proposed Private Placement; anticipated

closing of the proposed Private Placement; the ability of the

Company to obtain the required regulatory approvals; Horizon’s

participation in the Private Placement; anticipated use of

proceeds; and implementation of the partial final arbitration

award, commercial discussions, and the ability of the Company to

meet its business objectives.

In certain cases, forward-looking information

can be identified by words such as "plans", "expects" or "does not

expect", "is expected", "budgeted", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate" or

"believes" or variations of such words and phrases or statements

that certain actions, events or results "may", "could", "would",

"might", "will be taken", "occur" or "be achieved". While the

Company has based this forward-looking information on its

expectations about future events as at the date that such

information was prepared, the information is not a guarantee of

Entrée’s future performance and is based on numerous assumptions

regarding present and future business strategies; the correct

interpretation of agreements, laws and regulations; the

commencement and conclusion of arbitration proceedings, including

the potential benefits, timing and outcome of arbitration

proceedings; the potential benefits, timing and outcome of

discussions with the Government of Mongolia, Erdenes Oyu Tolgoi

LLC, OTLLC, and Rio Tinto; the future ownership of the Shivee

Tolgoi and Javhlant mining licenses; that the Company will continue

to have timely access to detailed technical, financial, and

operational information about the Entrée/Oyu Tolgoi joint venture

property, the Oyu Tolgoi project, and government relations to

enable the Company to properly assess, act on, and disclose

material risks and opportunities as they arise; local and global

economic conditions and the environment in which Entrée will

operate in the future, including commodity prices, projected

grades, projected dilution, anticipated capital and operating

costs, including inflationary pressures thereon resulting in cost

escalation, and anticipated future production and cash flows; the

anticipated location of certain infrastructure and sequence of

mining within and across panel boundaries; the construction and

continued development of the Oyu Tolgoi underground mine; the

status of Entrée’s relationship and interaction with the Government

of Mongolia, Erdenes Oyu Tolgoi LLC, OTLLC, and Rio Tinto; and the

Company’s ability to operate sustainably, its community relations,

and its social license to operate.

With respect to the construction and continued

development of the Oyu Tolgoi underground mine, important risks,

uncertainties and factors which could cause actual results to

differ materially from future results expressed or implied by such

forward-looking information include, amongst others, the current

economic climate and the significant volatility, uncertainty and

disruption arising in connection with the Ukraine conflict; the

nature of the ongoing relationship and interaction between OTLLC,

Rio Tinto, Erdenes Oyu Tolgoi LLC and the Government of Mongolia

with respect to the continued operation and development of Oyu

Tolgoi; the continuation of undercutting in accordance with the

mine plans and designs in the 2023 Oyu Tolgoi Feasibility Study;

applicable taxes and royalty rates; the future ownership of the

Shivee Tolgoi and Javhlant mining licenses; the amount of any

future funding gap to complete the Oyu Tolgoi project and the

availability and amount of potential sources of additional funding;

the timing and cost of the construction and expansion of mining and

processing facilities; inflationary pressures on prices for

critical supplies for Oyu Tolgoi resulting in cost escalation; the

ability of OTLLC or the Government of Mongolia to deliver a

domestic power source for Oyu Tolgoi (or the availability of

financing for OTLLC or the Government of Mongolia to construct such

a source) within the required contractual timeframe; sources of

interim power; OTLLC’s ability to operate sustainably, its

community relations, and its social license to operate in Mongolia;

the impact of changes in, changes in interpretation to or changes

in enforcement of, laws, regulations and government practises in

Mongolia; delays, and the costs which would result from delays, in

the development of the underground mine; the anticipated location

of certain infrastructure and sequence of mining within and across

panel boundaries; projected commodity prices and their market

demand; and production estimates and the anticipated yearly

production of copper, gold and silver at the Oyu Tolgoi underground

mine.

Other risks, uncertainties and factors which

could cause actual results, performance or achievements of Entrée

to differ materially from future results, performance or

achievements expressed or implied by forward-looking information

include, amongst others, unanticipated costs, expenses or

liabilities; discrepancies between actual and estimated production,

mineral reserves and resources and metallurgical recoveries;

development plans for processing resources; matters relating to

proposed exploration or expansion; mining operational and

development risks, including geotechnical risks and ground

conditions; regulatory restrictions (including environmental

regulatory restrictions and liability); risks related to

international operations, including legal and political risk in

Mongolia; risks related to the potential impact of global or

national health concerns; risks associated with changes in the

attitudes of governments to foreign investment; risks associated

with the conduct of joint ventures, including the ability to access

detailed technical, financial and operational information; risks

related to the Company’s significant shareholders, and whether they

will exercise their rights or act in a manner that is consistent

with the best interests of the Company and its other shareholders;

inability to upgrade Inferred mineral resources to Indicated or

Measured mineral resources; inability to convert mineral resources

to mineral reserves; conclusions of economic evaluations;

fluctuations in commodity prices and demand; changing foreign

exchange rates; the speculative nature of mineral exploration; the

global economic climate; dilution; share price volatility;

activities, actions or assessments by Rio Tinto or OTLLC and by

government stakeholders or authorities including Erdenes Oyu Tolgoi

LLC and the Government of Mongolia; the availability of funding on

reasonable terms; the impact of changes in interpretation to or

changes in enforcement of laws, regulations and government

practices, including laws, regulations and government practices

with respect to mining, foreign investment, strategic deposits,

royalties and taxation; the terms and timing of obtaining necessary

environmental and other government approvals, consents and permits;

the availability and cost of necessary items such as water, skilled

labour, transportation and appropriate smelting and refining

arrangements; unanticipated reclamation expenses; changes to

assumptions as to the availability of electrical power, and the

power rates used in operating cost estimates and financial

analyses; changes to assumptions as to salvage values; ability to

maintain the social license to operate; accidents, labour disputes

and other risks of the mining industry; global climate change;

global conflicts; natural disasters; the impacts of civil unrest;

the impacts of the Ukraine conflict; breaches of the Company’s

policies, standards and procedures, laws or regulations; trade

tensions between the world’s major economies; increasing societal

and investor expectations, in particular with regard to

environmental, social and governance considerations; the impacts of

technological advancements; title disputes; limitations on

insurance coverage; competition; loss of key employees; cyber

security incidents; misjudgements in the course of preparing

forward-looking information; and those factors discussed in the

Company’s most recently filed MD&A and in the Company’s Annual

Information Form for the financial year ended December 31, 2023,

dated March 8, 2024 filed with the Canadian Securities

Administrators and available at www.sedarplus.ca. Although the

Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in forward-looking information, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information. The Company is

under no obligation to update or alter any forward-looking

information except as required under applicable securities

laws.

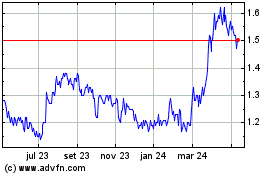

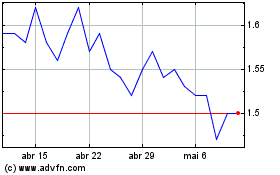

Entree Resources (TSX:ETG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Entree Resources (TSX:ETG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025