Iveco Group 2024 Full Year and Fourth Quarter Results

07 Fevereiro 2025 - 3:30AM

The following is an extract from the “Iveco

Group 2024 Full Year and Fourth Quarter Results (*). The complete

press release can be accessed by visiting the media section of the

Iveco Group corporate website:

https://www.ivecogroup.com/media/corporate_press_releases or

consulting the accompanying PDF:

The Board of Directors approves FY 2024

preliminary results, which mark another year of solid performance,

and recommends an annual cash dividend of €0.33 per common

share

The Board is considering separating the

Defence business during 2025through a

spin-off

Consolidated revenues amounted

to €15,289 million compared to €15,978 million in

2023. Net revenues of Industrial

Activities were

€14,948 million compared to

€15,640 million in 2023, with positive price realisation partially

offsetting lower volumes in Truck and Powertrain.

Adjusted EBIT was

€982 million (€11 million

increase compared to 2023) with a

6.4% margin (up

30 bps compared to 2023). Adjusted EBIT of Industrial

Activities was

€851 million

(€849 million in 2023), with positive price realisation more

than offsetting lower volumes. Adjusted EBIT margin of

Industrial Activities was 5.7% (up 30 bps

compared to 2023), with margin improvements in Bus, Defence and

Powertrain.

Adjusted net income was

€569 million (up €181 million compared to

2023) after excluding from the €394 million reported net income,

primarily the loss of €145 million from the transfer of the

Fire Fighting business, €96 million in engine campaign costs, and a

€94 million tax benefit due to the recognition of deferred tax

assets in the German jurisdiction. Adjusted diluted

earnings per share was €2.09, up €0.74

compared to 2023.

Net financial expenses amounted

to €211 million (€443 million in 2023), an

improvement of €232 million compared to 2023 mainly due to a more

contained cost of hedge impact in Argentina, resulting from the

implemented hedging strategy, and an improvement in the Argentinian

hyperinflation accounting impact.

Reported income tax expense was €69 million,

with an adjusted Effective Tax Rate (adjusted ETR)

of 26% in 2024. The adjusted ETR reflects the

different tax rates applied in the jurisdictions where the Group

operates and some other discrete items.

Free cash flow of Industrial

Activities was positive at

€402 million (€450 million

in 2023) as a result of an optimised management of production

levels to adapt to a lower industry demand, and an effective

hedging strategy to reduce the Argentinian foreign exchange

exposure.

Available liquidity was

€5,474 million as of 31st December 2024, up

€726 million from 31st December 2023, including

€1,900 million of undrawn committed facilities.

(*) 2024 financial data shown refers to

Continuing Operations only, unless otherwise stated. Continuing

Operations exclude the Fire Fighting business which, following the

signing of a definitive agreement for the transfer of its

ownership, has been classified as Discontinued Operations; the

transfer was completed on 3rd January 2025. 2023

comparative figures have been recast consistently.

- 20250207_PR_IVG_FY&Q4_2024

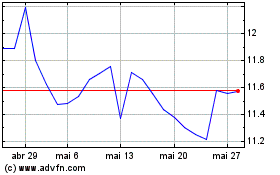

Iveco Group NV (BIT:IVG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Iveco Group NV (BIT:IVG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025