Rapid7, Inc. (Nasdaq: RPD), a leader in extended risk and

threat detection, today announced its financial results for the

fourth quarter and full-year 2024.

“As we reflect on 2024, I’m proud of the

progress we made to position Rapid7 for long-term growth and

success. We achieved $840 million in ARR and delivered over $150

million in free cash flow, while advancing our strategic priorities

to innovate, scale, and empower our customers to consolidate and

secure their operations more effectively. Continued momentum in

Managed Detection and Response and the launch of our Exposure

Command platform have further strengthened our ability to deliver

measurable value for customers,” said Corey Thomas, Chairman and

CEO of Rapid7.

“As we move through 2025, our focus remains on

accelerating growth, deepening customer engagement, and driving

innovation to solidify Rapid7 as the security operations platform

of choice for organizations worldwide.”

Fourth Quarter

2024 Financial Results and Other

Metrics

| |

As of December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| |

(dollars in thousands) |

|

ARR |

$ |

839,819 |

|

|

$ |

805,670 |

|

|

|

4 |

% |

| Number of customers |

|

11,727 |

|

|

|

11,526 |

|

|

|

2 |

% |

| ARR per customer |

$ |

71.6 |

|

|

$ |

69.9 |

|

|

|

2 |

% |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

| |

(in thousands, except per share data) |

|

Product subscriptions revenue |

$ |

206,328 |

|

|

$ |

194,819 |

|

|

|

6 |

% |

|

$ |

808,906 |

|

|

$ |

740,168 |

|

|

|

9 |

% |

| Professional services

revenue |

|

9,933 |

|

|

|

10,449 |

|

|

|

(5 |

%) |

|

|

35,101 |

|

|

|

37,539 |

|

|

|

(6 |

)% |

|

Total revenue |

$ |

216,261 |

|

|

$ |

205,268 |

|

|

|

5 |

% |

|

$ |

844,007 |

|

|

$ |

777,707 |

|

|

|

9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| North America revenue |

$ |

163,014 |

|

|

$ |

158,695 |

|

|

|

3 |

% |

|

$ |

643,405 |

|

|

$ |

607,448 |

|

|

|

6 |

% |

| Rest of world revenue |

|

53,247 |

|

|

|

46,573 |

|

|

|

14 |

% |

|

|

200,602 |

|

|

|

170,259 |

|

|

|

18 |

% |

|

Total revenue |

$ |

216,261 |

|

|

$ |

205,268 |

|

|

|

5 |

% |

|

$ |

844,007 |

|

|

$ |

777,707 |

|

|

|

9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

$ |

150,369 |

|

|

$ |

145,442 |

|

|

|

|

$ |

592,972 |

|

|

$ |

545,661 |

|

|

|

|

GAAP gross margin |

|

70 |

% |

|

|

71 |

% |

|

|

|

|

70 |

% |

|

|

70 |

% |

|

|

| Non-GAAP gross profit |

$ |

157,902 |

|

|

$ |

152,265 |

|

|

|

|

$ |

622,343 |

|

|

$ |

575,052 |

|

|

|

|

Non-GAAP gross margin |

|

73 |

% |

|

|

74 |

% |

|

|

|

|

74 |

% |

|

|

74 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP income (loss) from

operations |

$ |

7,279 |

|

|

$ |

10,000 |

|

|

|

|

$ |

35,035 |

|

|

$ |

(84,288 |

) |

|

|

|

GAAP operating margin |

|

3 |

% |

|

|

5 |

% |

|

|

|

|

4 |

% |

|

|

(11 |

)% |

|

|

| Non-GAAP income from

operations |

$ |

39,995 |

|

|

$ |

41,498 |

|

|

|

|

$ |

163,508 |

|

|

$ |

102,221 |

|

|

|

|

Non-GAAP operating margin |

|

18 |

% |

|

|

20 |

% |

|

|

|

|

19 |

% |

|

|

13 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income (loss) |

$ |

2,172 |

|

|

$ |

19,116 |

|

|

|

|

$ |

25,526 |

|

|

$ |

(152,815 |

) |

|

|

| GAAP net income (loss) per

share, basic |

$ |

0.03 |

|

|

|

0.31 |

|

|

|

|

$ |

0.41 |

|

|

$ |

(2.52 |

) |

|

|

| GAAP net income (loss) per

share, diluted |

$ |

0.03 |

|

|

$ |

0.26 |

|

|

|

|

$ |

0.40 |

|

|

$ |

(2.52 |

) |

|

|

| Non-GAAP net income |

$ |

34,342 |

|

|

$ |

51,691 |

|

|

|

|

$ |

163,138 |

|

|

$ |

107,232 |

|

|

|

| Non-GAAP net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.54 |

|

|

$ |

0.84 |

|

|

|

|

$ |

2.61 |

|

|

$ |

1.76 |

|

|

|

|

Diluted |

$ |

0.48 |

|

|

$ |

0.72 |

|

|

|

|

$ |

2.28 |

|

|

$ |

1.52 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

46,310 |

|

|

$ |

47,819 |

|

|

|

|

$ |

188,450 |

|

|

$ |

126,661 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating

activities |

$ |

63,773 |

|

|

$ |

63,466 |

|

|

|

|

$ |

171,670 |

|

|

$ |

104,278 |

|

|

|

| Free cash flow |

$ |

58,842 |

|

|

$ |

60,254 |

|

|

|

|

$ |

154,083 |

|

|

$ |

84,034 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For additional details on the reconciliation of

non-GAAP measures and certain other business metrics to their

nearest comparable GAAP measures, please refer to the accompanying

financial data tables included in this press release. Certain prior

periods reflect immaterial corrections. See Exhibit 1 for

additional information.

Recent Business Highlights

- In November,

Rapid7 won “Security Vendor of the Year” at the CRN Channel Awards

2024. The award is one of the oldest and most prestigious in the UK

IT channel, and acknowledges Rapid7’s overall contribution to

business development within the channel.

- In November,

Rapid7’s Managed Extended Detection & Response added coverage

for Microsoft security telemetry, integrating organizations'

existing Microsoft telemetry into Rapid7's Command Platform for

broader, faster threat detection and remediation, without

additional infrastructure or complex integration requirements.

- In November,

Rapid7 expanded Exposure Command to add support for Amazon Web

Services (“AWS”) Resource Control Policies, providing additional

visibility, insights, and best practices to guide customers in

addressing complex enterprise Identity and Access Management

challenges across the modern attack surface.

- In December,

Rapid7’s Managed Extended Detection & Response added coverage

for AWS environments, bringing customers deeper cloud detection and

response capabilities by combining cloud native telemetry, AWS

security telemetry, and enhanced detections in the Rapid7 Command

Platform.

- In December,

Rapid7 achieved the In Process Designation from the Federal Risk

and Authorization Management Program (“FedRAMPⓇ”) for its

InsightGovCloud Platform, indicating that Rapid7 is actively

working towards authorization and highlighting Rapid7’s continued

commitment to partnering with federal agencies to invest in

security solutions that enable continuous threat exposure

management and enhance the resilience of their organizations.

- In January,

Rapid7 earned the highest possible score on the Human Rights

Campaign Foundation’s 2025 Corporate Equality Index, the nation’s

foremost report for measuring corporate policies and practices

related to LGBTQ+ workplace equality.

First Quarter and Full-Year

2025 Guidance

Rapid7 anticipates ARR, revenue, non-GAAP income

from operations, non-GAAP net income per share and free cash flow

to be in the following ranges:

| |

First Quarter 2025 |

|

Full-Year 2025 |

| |

(in millions, except per share data) |

| ARR |

|

|

|

|

|

$870 |

|

to |

|

$890 |

|

| Year-over-year growth |

|

|

|

|

|

4% |

|

to |

|

6% |

|

|

Revenue |

|

$207 |

|

to |

|

$209 |

|

|

|

$860 |

|

to |

|

$870 |

|

|

Year-over-year growth |

|

1% |

|

to |

|

2% |

|

|

|

2% |

|

to |

|

3% |

|

| Non-GAAP income from

operations |

|

$23 |

|

to |

|

$25 |

|

|

|

$125 |

|

to |

|

$135 |

|

| Non-GAAP net income per

share |

|

$0.33 |

|

to |

|

$0.36 |

|

|

|

$1.72 |

|

to |

|

$1.85 |

|

| Weighted average shares

outstanding |

|

75.6 |

|

|

|

|

|

|

|

77.3 |

|

|

|

|

|

| Free cash flow |

|

|

|

|

Approximately $135 million |

| |

|

|

|

|

|

The guidance provided above is forward-looking

in nature. Actual results may differ materially. See the cautionary

note regarding “Forward-Looking Statements” below. Guidance for the

first quarter and full-year 2025 does not include any potential

impact of foreign exchange gains or losses. The guidance provided

above is based on a number of assumptions, estimates and

expectations as of the date of this press release and, while

presented with numerical specificity, this guidance is inherently

subject to significant business, economic and competitive

uncertainties and contingencies, many of which are beyond Rapid7's

control and are based upon specific assumptions with respect to

future business decisions or economic conditions, some of which may

change. Rapid7 undertakes no obligation to update guidance after

this date.

Non-GAAP guidance excludes estimates for

stock-based compensation expense, amortization of acquired

intangible assets, amortization of debt issuance costs, and certain

other items such as acquisition-related expenses, impairment of

long-lived assets, restructuring expense, induced conversion

expense, change in the fair value of derivative assets,

litigation-related expenses and discrete tax items. Rapid7 has

provided a reconciliation of each non-GAAP guidance measure to the

most comparable GAAP measures in the financial statement tables

included in this press release. The reconciliation does not reflect

any items that are unknown at this time, including, but not limited

to, non-ordinary course litigation-related expenses, which we are

not able to predict without unreasonable effort due to their

inherent uncertainty.

Conference Call and Webcast

Information

Rapid7 will host a conference call today,

February 12, 2025, to discuss its results at 4:30 p.m. Eastern

Time. The call will be accessible by telephone at 888-330-2384

(domestic) or +1 240-789-2701 (international) with the event code

8484206. The call will also be available live via webcast on

Rapid7's website at https://investors.rapid7.com. A webcast replay

of the conference call will be available at

https://investors.rapid7.com.

About Rapid7

Rapid7 (Nasdaq: RPD) is on a mission to create a

safer digital world by making cybersecurity simpler and more

accessible. We empower security professionals to manage a modern

attack surface through our best-in-class technology, leading-edge

research, and broad, strategic expertise. Rapid7’s comprehensive

security solutions help more than 11,000 global customers unite

cloud risk management and threat detection to reduce attack

surfaces and eliminate threats with speed and precision. For more

information, visit our website, check out our blog, or follow us on

LinkedIn or Twitter.

Non-GAAP Financial Measures and Other

Metrics

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

generally accepted accounting principles in the United States

(“GAAP”), we provide investors with certain non-GAAP financial

measures and other metrics, which we believe are helpful to our

investors. We use these non-GAAP financial measures and other

metrics for financial and operational decision-making purposes and

as a means to evaluate period-to-period comparisons. We also use

certain non-GAAP financial measures as performance measures under

our executive bonus plan. We believe that these non-GAAP financial

measures and other metrics provide useful information about our

operating results, enhance the overall understanding of past

financial performance and future prospects and allow for greater

transparency with respect to metrics used by our management in its

financial and operational decision-making.

While our non-GAAP financial measures are an

important tool for financial and operational decision-making and

for evaluating our own operating results over different periods of

time, you should review the reconciliation of our non-GAAP

financial measures to the comparable GAAP financial measures

included below, and not rely on any single financial measure to

evaluate our business.

Non-GAAP Financial Measures

We disclose the following non-GAAP financial

measures: non-GAAP gross profit, non-GAAP income from operations,

non-GAAP net income, non-GAAP net income per share, adjusted EBITDA

and free cash flow. We also disclose non-GAAP gross margin and

non-GAAP operating margin derived from these financial

measures.

We define non-GAAP gross profit, non-GAAP income

from operations, non-GAAP net income and non-GAAP net income per

share as the respective GAAP balances excluding the effect of

stock-based compensation expense, amortization of acquired

intangible assets, amortization of debt issuance costs and certain

other items such as acquisition-related expenses, impairment of

long-lived assets, change in the fair value of derivative assets,

restructuring expense, induced conversion expense and discrete tax

items. Non-GAAP net income per basic and diluted share is

calculated as non-GAAP net income divided by the weighted average

shares used to compute net income per share, with the number of

weighted average shares decreased, when applicable, to reflect the

anti-dilutive impact of the capped call transactions entered into

in connection with our convertible senior notes.

We believe these non-GAAP financial measures are

useful to investors in assessing our operating performance due to

the following factors:

Stock-based compensation expense. We exclude

stock-based compensation expense because of varying available

valuation methodologies, subjective assumptions and the variety of

equity instruments that can impact our non-cash expense. We believe

that providing non-GAAP financial measures that exclude stock-based

compensation expense allows for more meaningful comparisons between

our operating results from period to period.

Amortization of acquired intangible assets. We

believe that excluding the impact of amortization of acquired

intangible assets allows for more meaningful comparisons between

operating results from period to period as the intangible assets

are valued at the time of acquisition and are amortized over

several years after the acquisition.

Amortization of debt issuance costs. The expense

for the amortization of debt issuance costs related to our

convertible senior notes and our former revolving credit facility

is a non-cash item, and we believe the exclusion of this interest

expense provides a more useful comparison of our operational

performance in different periods.

Induced conversion expense. In conjunction with

the third quarter of 2023 partial repurchase of our 2.25%

convertible senior notes due 2025, we incurred a non-cash induced

conversion expense of $53.9 million. We exclude induced conversion

expense because this amount is not indicative of the performance of

or trends in our business, and neither is comparable to the prior

period nor predictive of future results.

Litigation-related expenses. We exclude

non-ordinary course litigation expense because we do not consider

legal costs and settlement fees incurred in litigation and

litigation-related matters of non-ordinary course lawsuits and

other disputes to be indicative of our core operating performance.

We do not adjust for ordinary course legal expenses, including

legal costs and settlement fees resulting from maintaining and

enforcing our intellectual property portfolio and license

agreements.

Acquisition-related expenses. We exclude

acquisition-related expenses, including accretion expense

associated with contingent consideration, as costs that are

unrelated to the current operations and are neither comparable to

the prior period nor predictive of future results.

Change in fair value of derivative assets. The

expense for the change in fair value of derivative assets related

to our capped calls settlement is a non-cash item and we believe

the exclusion of this other income (expense) provides a more useful

comparison of our operational performance in different periods.

Impairment of long-lived assets. Impairment of

long-lived assets consists of impairment charges allocated to the

carrying amount of certain operating right-of-use assets and the

associated leasehold improvements when the carrying amounts exceed

their respective fair values and we believe the exclusion of the

impairment charges provides a more useful comparison of our

operational performance in different periods.

Restructuring expense. We exclude non-ordinary

course restructuring expenses related to our restructuring plan,

that was completed during fiscal year 2024, because we do not

believe these charges are indicative of our core operating

performance and we believe the exclusion of the restructuring

expenses provides a more useful comparison of our performance in

different periods.

Discrete tax items. We exclude certain discrete

tax items such as income tax expenses or benefits that are not

related to ongoing business operations in the current year and

adjustments to uncertain tax position reserves as these charges are

not indicative of our ongoing operating results, and they are not

considered when we are forecasting our future results.

Anti-dilutive impact of capped call transaction.

Our capped call transactions are intended to offset potential

dilution from the conversion features in our convertible senior

notes. Although we cannot reflect the anti-dilutive impact of the

capped call transactions under GAAP, we do reflect the

anti-dilutive impact of the capped call transactions in non-GAAP

net income (loss) per diluted share, when applicable, to provide

investors with useful information in evaluating our financial

performance on a per share basis.

Adjusted EBITDA. Adjusted EBITDA is a non-GAAP

measure that we define as net income (loss) before (1) interest

income, (2) interest expense, (3) other (income) expense, net, (4)

provision for (benefit from) income taxes, (5) depreciation

expense, (6) amortization of intangible assets, (7) stock-based

compensation expense, (8) acquisition-related expenses, (9)

litigation-related expenses, (10) impairment of long-lived assets

and (11) restructuring expense. We believe that the use of adjusted

EBITDA is useful to investors and other users of our financial

statements in evaluating our operating performance because it

provides them with an additional tool to compare business

performance across companies and across periods.

Free Cash Flow. Free cash flow is a non-GAAP

measure that we define as cash provided by operating activities

less purchases of property and equipment and capitalization of

internal-use software costs. We consider free cash flow to be a

liquidity measure that provides useful information to management

and investors about the amount of cash generated by the business

after necessary capital expenditures.

Our non-GAAP financial measures may not provide

information that is directly comparable to that provided by other

companies in our industry, as other companies in our industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures because the

non-GAAP financial measures are not prepared in accordance with

GAAP, may be different from non-GAAP financial measures used by

other companies and exclude expenses that may have a material

impact upon our reported financial results. Further, stock-based

compensation expense has been and will continue to be for the

foreseeable future a significant recurring expense in our business

and an important part of the compensation provided to our

employees.

Other Metrics

ARR. ARR is defined as the annual value of all

recurring revenue related to contracts in place at the end of the

period. ARR should be viewed independently of revenue and deferred

revenue as ARR is an operating metric and is not intended to be

combined with or replace these items. ARR is not a forecast of

future revenue, which can be impacted by contract start and end

dates and renewal rates, and does not include revenue reported as

professional services revenue in our consolidated statement of

operations.

Number of Customers. We define a customer as any

entity that has an active Rapid7 recurring revenue contract as of

the specified measurement date, excluding InsightOps and Logentries

only customers with a contract value of less than $2,400 per

year.

ARR per Customer. We define ARR per customer as

ARR divided by the number of customers at the end of the

period.

Cautionary Language Concerning

Forward-Looking Statements

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, but

are not limited to, the statements regarding our financial guidance

for the first quarter and full-year 2025, and the assumptions

underlying such guidance. Our use of the words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “will” and

similar expressions are intended to identify forward-looking

statements. The events described in our forward-looking statements

are subject to a number of risks and uncertainties, assumptions and

other factors that could cause actual results and the timing of

certain events to differ materially from future results expressed

or implied by the forward-looking statements. Risks that could

cause or contribute to such differences include, but are not

limited to, growing macroeconomic uncertainty, unstable market and

economic conditions, fluctuations in our quarterly results, our

ability to successfully grow our sales of our cloud-based

solutions, including through the shift to a consolidated platform

sales approach, effectiveness of our restructuring plan that was

completed during fiscal year 2024, failure to meet our publicly

announced guidance or other expectations about our business, our

ability to sustain our revenue growth rate, the ability of our

products and professional services to correctly detect

vulnerabilities, renewal of our customer's subscriptions,

competition in the markets in which we operate, market growth, our

ability to innovate and manage our growth, our sales cycles, our

ability to integrate acquired companies, exposure to greater than

anticipated tax liabilities, and our ability to operate in

compliance with applicable laws as well as other risks and

uncertainties that could affect our business and results described

in our filings with the Securities and Exchange Commission (the

“SEC”), including our most recent Quarterly Report on Form 10-Q

filed with the SEC on November 7, 2024, particularly in the section

entitled "Item 1.A Risk Factors," and in the subsequent reports

that we file with the SEC. Moreover, we operate in a very

competitive and rapidly changing environment. New risks emerge from

time to time. It is not possible for our management to predict all

risks, nor can we assess the impact of all factors on our business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those expressed in

any forward-looking statements we may make. Except as required by

law, we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

such statements. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

Investor contact:

Elizabeth ChwalkSenior Director, Investor

Relationsinvestors@rapid7.com(617) 865-4277

Press contact:

Alice RandallDirector, Global Corporate

Communicationspress@rapid7.com(214) 693-4727

|

RAPID7, INC.Consolidated Balance Sheets

(Unaudited)(in thousands) |

| |

| |

December 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

334,686 |

|

|

$ |

213,629 |

|

|

Short-term investments |

|

187,025 |

|

|

|

169,544 |

|

|

Accounts receivable, net |

|

168,242 |

|

|

|

164,862 |

|

|

Deferred contract acquisition and fulfillment costs, current

portion |

|

52,134 |

|

|

|

45,008 |

|

|

Prepaid expenses and other current assets |

|

44,024 |

|

|

|

41,407 |

|

|

Total current assets |

|

786,111 |

|

|

|

634,450 |

|

|

Long-term investments |

|

37,274 |

|

|

|

56,171 |

|

|

Property and equipment, net |

|

32,245 |

|

|

|

39,642 |

|

|

Operating lease right-of-use assets |

|

48,877 |

|

|

|

54,693 |

|

|

Deferred contract acquisition and fulfillment costs, non-current

portion |

|

73,672 |

|

|

|

76,601 |

|

|

Goodwill |

|

575,268 |

|

|

|

536,351 |

|

|

Intangible assets, net |

|

85,719 |

|

|

|

94,546 |

|

|

Other assets |

|

12,868 |

|

|

|

12,894 |

|

|

Total assets |

$ |

1,652,034 |

|

|

$ |

1,505,348 |

|

| Liabilities and

Stockholders’ Equity (Deficit) |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

18,908 |

|

|

$ |

15,812 |

|

|

Accrued expenses and other current liabilities |

|

88,802 |

|

|

|

85,025 |

|

|

Convertible senior notes, current portion, net |

|

45,895 |

|

|

|

— |

|

|

Operating lease liabilities, current portion |

|

15,493 |

|

|

|

13,452 |

|

|

Deferred revenue, current portion |

|

461,118 |

|

|

|

455,503 |

|

|

Total current liabilities |

|

630,216 |

|

|

|

569,792 |

|

|

Convertible senior notes, non-current portion, net |

|

888,356 |

|

|

|

929,996 |

|

|

Operating lease liabilities, non-current portion |

|

68,430 |

|

|

|

81,130 |

|

|

Deferred revenue, non-current portion |

|

27,078 |

|

|

|

32,577 |

|

|

Other long-term liabilities |

|

20,243 |

|

|

|

10,032 |

|

|

Total liabilities |

|

1,634,323 |

|

|

|

1,623,527 |

|

| Stockholders’ equity

(deficit): |

|

|

|

|

Common stock |

$ |

635 |

|

|

$ |

617 |

|

|

Treasury stock |

|

(4,765 |

) |

|

|

(4,765 |

) |

|

Additional paid-in-capital |

|

1,011,080 |

|

|

|

898,185 |

|

|

Accumulated other comprehensive (loss) income |

|

(1,205 |

) |

|

|

1,344 |

|

|

Accumulated deficit |

|

(988,034 |

) |

|

|

(1,013,560 |

) |

|

Total stockholders’ equity (deficit) |

|

17,711 |

|

|

|

(118,179 |

) |

|

Total liabilities and stockholders’ equity (deficit) |

$ |

1,652,034 |

|

|

$ |

1,505,348 |

|

Note: Certain prior periods reflect immaterial corrections. See

Exhibit 1 for additional information.

|

RAPID7, INC.Consolidated Statements of

Operations (Unaudited)(in thousands, except share and per

share data) |

| |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Product subscriptions |

$ |

206,328 |

|

|

$ |

194,819 |

|

|

$ |

808,906 |

|

|

$ |

740,168 |

|

|

Professional services |

|

9,933 |

|

|

|

10,449 |

|

|

|

35,101 |

|

|

|

37,539 |

|

|

Total revenue |

|

216,261 |

|

|

|

205,268 |

|

|

|

844,007 |

|

|

|

777,707 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Product subscriptions |

|

58,932 |

|

|

|

52,369 |

|

|

|

225,547 |

|

|

|

203,140 |

|

|

Professional services |

|

6,960 |

|

|

|

7,457 |

|

|

|

25,488 |

|

|

|

28,906 |

|

|

Total cost of revenue |

|

65,892 |

|

|

|

59,826 |

|

|

|

251,035 |

|

|

|

232,046 |

|

|

Total gross profit |

|

150,369 |

|

|

|

145,442 |

|

|

|

592,972 |

|

|

|

545,661 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

46,334 |

|

|

|

40,031 |

|

|

|

173,126 |

|

|

|

177,937 |

|

|

Sales and marketing |

|

72,767 |

|

|

|

73,557 |

|

|

|

298,809 |

|

|

|

313,661 |

|

|

General and administrative |

|

23,989 |

|

|

|

19,623 |

|

|

|

86,002 |

|

|

|

85,340 |

|

|

Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,784 |

|

|

Restructuring |

|

— |

|

|

|

2,231 |

|

|

|

— |

|

|

|

22,227 |

|

|

Total operating expenses |

|

143,090 |

|

|

|

135,442 |

|

|

|

557,937 |

|

|

|

629,949 |

|

| Income (loss) from

operations |

|

7,279 |

|

|

|

10,000 |

|

|

|

35,035 |

|

|

|

(84,288 |

) |

| Other income (expense), net: |

|

|

|

|

|

|

|

|

Interest income |

|

5,551 |

|

|

|

4,177 |

|

|

|

21,063 |

|

|

|

10,177 |

|

|

Interest expense |

|

(2,783 |

) |

|

|

(2,695 |

) |

|

|

(10,963 |

) |

|

|

(64,700 |

) |

|

Other (expense) income, net |

|

(4,361 |

) |

|

|

3,571 |

|

|

|

(3,680 |

) |

|

|

(14,522 |

) |

| Income (loss) before income

taxes |

|

5,686 |

|

|

|

15,053 |

|

|

|

41,455 |

|

|

|

(153,333 |

) |

|

Provision for (benefit from) income taxes |

|

3,514 |

|

|

|

(4,063 |

) |

|

|

15,929 |

|

|

|

(518 |

) |

| Net income (loss) |

$ |

2,172 |

|

|

$ |

19,116 |

|

|

$ |

25,526 |

|

|

$ |

(152,815 |

) |

| Net income (loss) per share,

basic |

$ |

0.03 |

|

|

$ |

0.31 |

|

|

$ |

0.41 |

|

|

$ |

(2.52 |

) |

| Net income (loss) per share,

diluted (1) |

$ |

0.03 |

|

|

$ |

0.26 |

|

|

$ |

0.40 |

|

|

$ |

(2.52 |

) |

| Weighted-average common shares

outstanding, basic |

|

63,339,306 |

|

|

|

61,497,797 |

|

|

|

62,607,583 |

|

|

|

60,756,087 |

|

| Weighted-average common shares

outstanding, diluted |

|

63,901,277 |

|

|

|

73,728,912 |

|

|

|

63,183,651 |

|

|

|

60,756,087 |

|

| |

| (1) We use the

if-converted method to compute diluted earnings per share with

respect to our convertible senior notes. There was no add-back of

interest expense or additional dilutive shares related to the

convertible senior notes where the effect was anti-dilutive. On an

if-converted basis, for the three months ended December 31, 2024

and the years ended December 31, 2024 and 2023, the 2025, 2027 and

2029 Notes were anti-dilutive. On an if-converted basis, for the

three months ended December 31, 2023, the 2027 and 2029 Notes were

dilutive and the 2025 Note was anti-dilutive. |

Note: Certain prior periods reflect immaterial corrections. See

Exhibit 1 for additional information.

|

RAPID7, INC.Consolidated Statements of

Cash Flows (Unaudited)(in thousands) |

| |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

2,172 |

|

|

$ |

19,116 |

|

|

$ |

25,526 |

|

|

$ |

(152,815 |

) |

| Adjustments to reconcile net

income (loss) to cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

11,436 |

|

|

|

11,411 |

|

|

|

44,893 |

|

|

|

45,939 |

|

|

Amortization of debt issuance costs |

|

1,122 |

|

|

|

1,077 |

|

|

|

4,447 |

|

|

|

4,138 |

|

|

Stock-based compensation expense |

|

27,412 |

|

|

|

24,177 |

|

|

|

107,961 |

|

|

|

111,636 |

|

|

Deferred income taxes |

|

(1,049 |

) |

|

|

(5,624 |

) |

|

|

791 |

|

|

|

(5,624 |

) |

|

Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,784 |

|

|

Change in fair value of derivative assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,511 |

|

|

Induced conversion expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

53,889 |

|

|

Other |

|

3,031 |

|

|

|

(5,157 |

) |

|

|

(1,503 |

) |

|

|

469 |

|

| Change in operating assets and

liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(27,912 |

) |

|

|

(26,449 |

) |

|

|

(5,480 |

) |

|

|

(14,021 |

) |

|

Deferred contract acquisition and fulfillment costs |

|

(3,703 |

) |

|

|

(9,046 |

) |

|

|

(4,196 |

) |

|

|

(18,534 |

) |

|

Prepaid expenses and other assets |

|

(3,257 |

) |

|

|

(9,558 |

) |

|

|

2,805 |

|

|

|

(4,125 |

) |

|

Accounts payable |

|

13,227 |

|

|

|

6,704 |

|

|

|

2,777 |

|

|

|

5,449 |

|

|

Accrued expenses |

|

7,584 |

|

|

|

20,390 |

|

|

|

(9,829 |

) |

|

|

2,422 |

|

|

Deferred revenue |

|

36,317 |

|

|

|

36,839 |

|

|

|

(795 |

) |

|

|

30,472 |

|

|

Other liabilities |

|

(2,607 |

) |

|

|

(414 |

) |

|

|

4,273 |

|

|

|

(1,312 |

) |

|

Net cash provided by operating activities |

|

63,773 |

|

|

|

63,466 |

|

|

|

171,670 |

|

|

|

104,278 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Business acquisition, net of cash acquired |

|

(103 |

) |

|

|

— |

|

|

|

(37,301 |

) |

|

|

(34,841 |

) |

|

Purchases of property and equipment |

|

(1,183 |

) |

|

|

(367 |

) |

|

|

(3,425 |

) |

|

|

(4,366 |

) |

|

Capitalization of internal-use software costs |

|

(3,748 |

) |

|

|

(2,845 |

) |

|

|

(14,162 |

) |

|

|

(15,878 |

) |

|

Purchases of investments |

|

— |

|

|

|

(82,816 |

) |

|

|

(242,494 |

) |

|

|

(276,829 |

) |

|

Sales/maturities of investments |

|

58,000 |

|

|

|

49,750 |

|

|

|

250,500 |

|

|

|

150,450 |

|

|

Other investments |

|

— |

|

|

|

2,710 |

|

|

|

360 |

|

|

|

2,710 |

|

|

Net cash provided by (used in) investing activities |

|

52,966 |

|

|

|

(33,568 |

) |

|

|

(46,522 |

) |

|

|

(178,754 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible senior notes, net of issuance

costs paid of $7,909 |

|

— |

|

|

|

(709 |

) |

|

|

— |

|

|

|

292,091 |

|

|

Purchase of capped calls related to convertible senior notes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(36,570 |

) |

|

Payments for repurchase of convertible senior notes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(199,998 |

) |

|

Payments related to business acquisitions |

|

(500 |

) |

|

|

— |

|

|

|

(500 |

) |

|

|

(2,250 |

) |

|

Proceeds from capped call settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

17,518 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(847 |

) |

|

|

(1,558 |

) |

|

|

(4,730 |

) |

|

|

(5,570 |

) |

|

Proceeds from employee stock purchase plan |

|

— |

|

|

|

— |

|

|

|

9,246 |

|

|

|

11,323 |

|

|

Proceeds from stock option exercises |

|

130 |

|

|

|

69 |

|

|

|

1,566 |

|

|

|

3,053 |

|

|

Net cash (used in) provided by financing activities |

|

(1,217 |

) |

|

|

(2,198 |

) |

|

|

5,582 |

|

|

|

79,597 |

|

|

Effects of exchange rates on cash, cash equivalents and restricted

cash |

|

(3,529 |

) |

|

|

3,212 |

|

|

|

(2,756 |

) |

|

|

1,202 |

|

|

Net increase in cash, cash equivalents and restricted cash |

|

111,993 |

|

|

|

30,912 |

|

|

|

127,974 |

|

|

|

6,323 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

|

230,108 |

|

|

|

183,215 |

|

|

|

214,127 |

|

|

|

207,804 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

342,101 |

|

|

$ |

214,127 |

|

|

$ |

342,101 |

|

|

$ |

214,127 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

Cash paid for interest on convertible senior notes |

|

518 |

|

|

|

518 |

|

|

|

6,358 |

|

|

|

4,605 |

|

|

Cash paid for income taxes, net of refunds |

|

1,876 |

|

|

|

459 |

|

|

|

8,949 |

|

|

|

1,624 |

|

| Reconciliation of cash,

cash equivalents and restricted cash: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

334,686 |

|

|

|

213,629 |

|

|

|

334,686 |

|

|

|

213,629 |

|

|

Restricted cash included in prepaid expenses and other current

assets and other assets |

|

7,415 |

|

|

|

498 |

|

|

|

7,415 |

|

|

|

498 |

|

| Total cash, cash

equivalents and restricted cash |

$ |

342,101 |

|

|

$ |

214,127 |

|

|

$ |

342,101 |

|

|

$ |

214,127 |

|

Note: Certain prior periods reflect immaterial

corrections. See Exhibit 1 for additional information.

|

RAPID7, INC.GAAP to Non-GAAP

Reconciliation (Unaudited)(in thousands, except share and

per share data) |

| |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP gross

profit |

$ |

150,369 |

|

|

$ |

145,442 |

|

|

$ |

592,972 |

|

|

$ |

545,661 |

|

|

Add: Stock-based compensation expense1 |

|

3,109 |

|

|

|

2,430 |

|

|

|

12,208 |

|

|

|

11,005 |

|

|

Add: Amortization of acquired intangible assets2 |

|

4,424 |

|

|

|

4,393 |

|

|

|

17,163 |

|

|

|

18,386 |

|

| Non-GAAP gross

profit |

$ |

157,902 |

|

|

$ |

152,265 |

|

|

$ |

622,343 |

|

|

$ |

575,052 |

|

|

Non-GAAP gross margin |

|

73.0 |

% |

|

|

74.2 |

% |

|

|

73.7 |

% |

|

|

73.9 |

% |

| |

|

|

|

|

|

|

|

|

GAAP gross profit - Product subscriptions |

$ |

147,396 |

|

|

$ |

142,450 |

|

|

$ |

583,359 |

|

|

$ |

537,028 |

|

|

Add: Stock-based compensation expense |

|

2,576 |

|

|

|

1,932 |

|

|

|

10,376 |

|

|

|

8,439 |

|

|

Add: Amortization of acquired intangible assets |

|

4,424 |

|

|

|

4,393 |

|

|

|

17,163 |

|

|

|

18,386 |

|

|

Non-GAAP gross profit - Product subscriptions |

$ |

154,396 |

|

|

$ |

148,775 |

|

|

$ |

610,898 |

|

|

$ |

563,853 |

|

|

Non-GAAP gross margin - Product subscriptions |

|

74.8 |

% |

|

|

76.4 |

% |

|

|

75.5 |

% |

|

|

76.2 |

% |

| |

|

|

|

|

|

|

|

|

GAAP gross profit - Professional services |

$ |

2,973 |

|

|

$ |

2,992 |

|

|

$ |

9,613 |

|

|

$ |

8,633 |

|

|

Add: Stock-based compensation expense |

|

533 |

|

|

|

498 |

|

|

|

1,832 |

|

|

|

2,566 |

|

|

Non-GAAP gross profit - Professional services |

$ |

3,506 |

|

|

$ |

3,490 |

|

|

$ |

11,445 |

|

|

$ |

11,199 |

|

|

Non-GAAP gross margin - Professional services |

|

35.3 |

% |

|

|

33.4 |

% |

|

|

32.6 |

% |

|

|

29.8 |

% |

| |

|

|

|

|

|

|

|

| GAAP income (loss)

from operations |

$ |

7,279 |

|

|

$ |

10,000 |

|

|

$ |

35,035 |

|

|

$ |

(84,288 |

) |

|

Add: Stock-based compensation expense1 |

|

27,412 |

|

|

|

24,177 |

|

|

|

107,961 |

|

|

|

111,636 |

|

|

Add: Amortization of acquired intangible assets2 |

|

5,121 |

|

|

|

5,090 |

|

|

|

19,951 |

|

|

|

21,499 |

|

|

Add: Acquisition-related expenses3 |

|

183 |

|

|

|

— |

|

|

|

751 |

|

|

|

363 |

|

|

Add: Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,784 |

|

|

Add: Restructuring expense |

|

— |

|

|

|

2,231 |

|

|

|

(190 |

) |

|

|

22,227 |

|

| Non-GAAP income from

operations |

$ |

39,995 |

|

|

$ |

41,498 |

|

|

$ |

163,508 |

|

|

$ |

102,221 |

|

| |

|

|

|

|

|

|

|

| GAAP net income

(loss) |

$ |

2,172 |

|

|

$ |

19,116 |

|

|

$ |

25,526 |

|

|

$ |

(152,815 |

) |

|

Add: Stock-based compensation expense1 |

|

27,412 |

|

|

|

24,177 |

|

|

|

107,961 |

|

|

|

111,636 |

|

|

Add: Amortization of acquired intangible assets2 |

|

5,121 |

|

|

|

5,090 |

|

|

|

19,951 |

|

|

|

21,499 |

|

|

Add: Amortization of debt issuance costs |

|

1,122 |

|

|

|

1,077 |

|

|

|

4,447 |

|

|

|

4,138 |

|

|

Add: Acquisition-related expenses3 |

|

183 |

|

|

|

— |

|

|

|

751 |

|

|

|

363 |

|

|

Add: Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,784 |

|

|

Add: Change in fair value of derivative assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,511 |

|

|

Add: Restructuring expense4 |

|

— |

|

|

|

2,231 |

|

|

|

(190 |

) |

|

|

22,227 |

|

|

Add: Induced conversion expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

53,889 |

|

|

Add: Discrete tax items5 |

|

(1,668 |

) |

|

|

— |

|

|

|

4,692 |

|

|

|

— |

|

| Non-GAAP net

income |

$ |

34,342 |

|

|

$ |

51,691 |

|

|

$ |

163,138 |

|

|

$ |

107,232 |

|

|

Add: Interest expense of convertible senior notes6 |

|

1,571 |

|

|

|

1,571 |

|

|

|

6,285 |

|

|

|

2,667 |

|

| Numerator for non-GAAP

earnings per share, diluted calculation |

$ |

35,913 |

|

|

$ |

53,262 |

|

|

$ |

169,423 |

|

|

$ |

109,899 |

|

| |

|

|

|

|

|

|

|

| Weighted average

shares used in GAAP earnings per share calculation,

basic |

|

63,339,306 |

|

|

|

61,497,797 |

|

|

|

62,607,583 |

|

|

|

60,756,087 |

|

| Dilutive effect of convertible

senior notes6 |

|

11,183,611 |

|

|

|

11,183,611 |

|

|

|

11,183,611 |

|

|

|

10,429,891 |

|

| |

|

|

|

|

|

|

|

| Dilutive effect of employee

equity incentive plans7 |

|

561,971 |

|

|

|

1,047,504 |

|

|

|

576,068 |

|

|

|

916,134 |

|

| Weighted average shares used

in non-GAAP earnings per share calculation, diluted |

|

75,084,888 |

|

|

|

73,728,912 |

|

|

|

74,367,262 |

|

|

|

72,102,112 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP net income

per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.54 |

|

|

$ |

0.84 |

|

|

$ |

2.61 |

|

|

$ |

1.76 |

|

| Diluted |

$ |

0.48 |

|

|

$ |

0.72 |

|

|

$ |

2.28 |

|

|

$ |

1.52 |

|

| |

|

|

|

|

|

|

|

| 1 Includes stock-based

compensation expense as follows: |

|

|

|

|

|

|

|

|

Cost of revenue |

$ |

3,109 |

|

|

$ |

2,430 |

|

|

$ |

12,208 |

|

|

$ |

11,005 |

|

|

Research and development |

|

10,703 |

|

|

|

7,749 |

|

|

|

37,566 |

|

|

|

39,183 |

|

|

Sales and marketing |

|

6,615 |

|

|

|

6,482 |

|

|

|

28,718 |

|

|

|

30,350 |

|

|

General and administrative |

|

6,985 |

|

|

|

7,516 |

|

|

|

29,469 |

|

|

|

31,098 |

|

| |

|

|

|

|

|

|

|

| 2 Includes amortization

of acquired intangible assets as follows: |

|

|

|

|

|

|

|

|

Cost of revenue |

$ |

4,424 |

|

|

$ |

4,393 |

|

|

$ |

17,163 |

|

|

$ |

18,386 |

|

|

Sales and marketing |

|

652 |

|

|

|

652 |

|

|

|

2,608 |

|

|

|

2,608 |

|

|

General and administrative |

|

45 |

|

|

|

45 |

|

|

|

180 |

|

|

|

505 |

|

| |

|

|

|

|

|

|

|

| 3 Includes

acquisition-related expenses as follows: |

|

|

|

|

|

|

|

|

General and administrative |

$ |

183 |

|

|

$ |

— |

|

|

$ |

751 |

|

|

$ |

363 |

|

| |

|

|

|

|

|

|

|

| 4 For the year

ended December 31, 2024, restructuring expense was included within

general and administrative expense in our consolidated statements

of operations. |

| |

|

|

|

|

|

|

|

| 5 Includes

discrete tax items as follows: |

|

Provision for income taxes |

$ |

(1,668 |

) |

|

$ |

— |

|

|

$ |

4,692 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

6 We use the if-converted method to compute diluted earnings

per share with respect to our convertible senior notes. There was

no add-back of interest expense or additional dilutive shares

related to the convertible senior notes where the effect was

anti-dilutive. Adjustments for interest expense, if applicable, on

our convertible senior notes for purposes of calculating non-GAAP

earnings per share are done gross of any tax impact. On an

if-converted basis, for the three months ended December 31, 2024

and 2023, the 2025, 2027 and 2029 Notes were dilutive. On an

if-converted basis, for the year ended December 31, 2024, the 2025,

2027 and 2029 Notes were dilutive. For the year ended December 31,

2023, the 2027 and 2029 Notes were dilutive and the 2025 Notes were

anti-dilutive. |

| |

|

|

|

|

|

|

|

| 7 We use the

treasury method to compute the dilutive effect of employee equity

incentive plan awards. |

| |

|

|

|

|

|

|

|

Note: Certain prior periods reflect immaterial

corrections. See Exhibit 1 for additional information.

|

RAPID7, INC.Reconciliation of Net Income

(Loss) to Adjusted EBITDA (Unaudited)(in thousands) |

| |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP net income (loss) |

$ |

2,172 |

|

|

$ |

19,116 |

|

|

$ |

25,526 |

|

|

$ |

(152,815 |

) |

|

Interest income |

|

(5,551 |

) |

|

|

(4,177 |

) |

|

|

(21,063 |

) |

|

|

(10,177 |

) |

|

Interest expense |

|

2,783 |

|

|

|

2,695 |

|

|

|

10,963 |

|

|

|

64,700 |

|

|

Other (income) expense, net |

|

4,361 |

|

|

|

(3,571 |

) |

|

|

3,680 |

|

|

|

14,522 |

|

|

Provision for (benefit from) income taxes |

|

3,514 |

|

|

|

(4,063 |

) |

|

|

15,929 |

|

|

|

(518 |

) |

|

Depreciation expense |

|

2,658 |

|

|

|

3,118 |

|

|

|

11,059 |

|

|

|

14,047 |

|

|

Amortization of intangible assets |

|

8,778 |

|

|

|

8,293 |

|

|

|

33,834 |

|

|

|

31,892 |

|

|

Stock-based compensation expense |

|

27,412 |

|

|

|

24,177 |

|

|

|

107,961 |

|

|

|

111,636 |

|

|

Acquisition-related expenses |

|

183 |

|

|

|

— |

|

|

|

751 |

|

|

|

363 |

|

|

Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,784 |

|

|

Restructuring expense |

|

— |

|

|

|

2,231 |

|

|

|

(190 |

) |

|

|

22,227 |

|

| Adjusted EBITDA |

$ |

46,310 |

|

|

$ |

47,819 |

|

|

$ |

188,450 |

|

|

$ |

126,661 |

|

Note: Certain prior period reflect immaterial corrections. See

Exhibit 1 for additional information.

|

RAPID7, INC.Reconciliation of Net Cash

Provided by Operating Activities to Free Cash Flow

(Unaudited)(in thousands) |

| |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by operating

activities |

$ |

63,773 |

|

|

$ |

63,466 |

|

|

$ |

171,670 |

|

|

$ |

104,278 |

|

|

Less: Purchases of property and equipment |

|

(1,183 |

) |

|

|

(367 |

) |

|

|

(3,425 |

) |

|

|

(4,366 |

) |

|

Less: Capitalized internal-use software costs |

|

(3,748 |

) |

|

|

(2,845 |

) |

|

|

(14,162 |

) |

|

|

(15,878 |

) |

| Free cash flow |

$ |

58,842 |

|

|

$ |

60,254 |

|

|

$ |

154,083 |

|

|

$ |

84,034 |

|

|

First Quarter and Full-Year 2025

GuidanceGAAP to Non-GAAP

Reconciliation(in millions, except per share data) |

| |

| |

First Quarter 2025 |

|

Full-Year 2025 |

| Reconciliation of GAAP

income from operations to non-GAAP income from

operations: |

|

|

|

|

|

|

|

|

Anticipated GAAP loss from operations |

$ |

(10 |

) |

to |

$ |

(8 |

) |

|

$ |

(13 |

) |

to |

$ |

(3 |

) |

|

Add: Anticipated stock-based compensation expense |

|

28 |

|

to |

|

28 |

|

|

|

118 |

|

to |

|

118 |

|

|

Add: Anticipated amortization of acquired intangible assets |

|

5 |

|

to |

|

5 |

|

|

|

20 |

|

to |

|

20 |

|

| Anticipated non-GAAP income

from operations |

$ |

23 |

|

to |

$ |

25 |

|

|

$ |

125 |

|

to |

$ |

135 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of GAAP

net income to non-GAAP net income: |

|

|

|

|

|

|

|

| Anticipated GAAP net loss |

$ |

(11 |

) |

to |

$ |

(9 |

) |

|

$ |

(15 |

) |

to |

$ |

(5 |

) |

|

Add: Anticipated stock-based compensation expense |

|

28 |

|

to |

|

28 |

|

|

|

118 |

|

to |

|

118 |

|

|

Add: Anticipated amortization of acquired intangible assets |

|

5 |

|

to |

|

5 |

|

|

|

20 |

|

to |

|

20 |

|

|

Add: Anticipated amortization of debt issuance costs |

|

1 |

|

to |

|

1 |

|

|

|

4 |

|

to |

|

4 |

|

| Anticipated non-GAAP net

income |

$ |

23 |

|

to |

$ |

25 |

|

|

$ |

127 |

|

to |

$ |

137 |

|

|

Add: Anticipated interest expense on convertible senior notes |

|

2 |

|

to |

|

2 |

|

|

|

6 |

|

to |

|

6 |

|

| Numerator for non-GAAP

earnings per share calculation |

$ |

25 |

|

to |

$ |

27 |

|

|

$ |

133 |

|

to |

$ |

143 |

|

| |

|

|

|

|

|

|

|

| Anticipated GAAP net loss per

share, diluted |

$ |

(0.15 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.06 |

) |

| Anticipated non-GAAP net

income per share, diluted |

$ |

0.33 |

|

|

$ |

0.36 |

|

|

$ |

1.72 |

|

|

$ |

1.85 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares used

in earnings per share calculation, diluted |

|

75.6 |

|

|

|

77.3 |

|

| |

|

|

|

|

|

|

|

The reconciliation does not reflect any items

that are unknown at this time, including, but not limited to,

non-ordinary course litigation-related expenses, which we are not

able to predict without unreasonable effort due to their inherent

uncertainty. As a result, the estimates shown for Anticipated GAAP

loss from operations, Anticipated GAAP net loss and Anticipated

GAAP net loss per share are expected to change.

| |

Full-Year 2025 |

| Reconciliation of net

cash provided by operating activities to free cash

flow: |

|

|

Anticipated net cash provided by operating activities |

$ |

153 |

|

|

Less: Anticipated purchases of property and equipment |

|

(3 |

) |

|

Less: Anticipated capitalized internal-use software costs |

|

(15 |

) |

| Anticipated free cash flow |

$ |

135 |

|

Exhibit 1 - Immaterial Correction of an

Error

During the fourth quarter of 2024, we identified

an immaterial error related to stock-based compensation expense

associated with certain restricted stock units (“RSUs”) and

performance stock units (“PSUs”) granted during fiscal years 2023

and 2024 that resulted in an understatement of stock-based

compensation expense in fiscal year 2023 and the year-to-date

period ended September 30, 2024. We have concluded that our

previously issued financial statements were not materially

misstated as a result of this error and have corrected the error in

these prior periods. The correction of this error resulted in (i)

an increase in additional paid-in capital and a corresponding

increase to accumulated deficit as of December 31, 2023 of

approximately $3.6 million and (ii) an increase in additional

paid-in capital and a corresponding increase to accumulated deficit

as of September 30, 2024 of approximately $7.2 million. There was

no change to net cash provided by operating activities, net cash

used in investing activities and net cash provided by financing

activities in our consolidated statements of cash flows for the

year ended December 31, 2023 and the year-to-date period ended

September 30, 2024. Additionally, there was no change to our ARR,

revenue, non-GAAP net income (loss) from operations, non-GAAP net

income (loss) or free cash flow.

The following table sets forth the effect of the

immaterial error correction to certain line items of our

consolidated statements of operations for (i) the three months

ended December 31, 2023, (ii) the fiscal year ended December 31,

2023, and (iii) the three months ended March 31, 2024, June 30,

2024 and September 30, 2024, respectively:

| |

Three Months Ended |

|

Year Ended |

|

Three Months Ended |

| |

December 31, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

September 30, 2024 |

| |

Adjustment |

|

Adjustment |

|

Adjustment |

|

Adjustment |

|

Adjustment |

| |

(in thousands, except for per share amounts) |

| Consolidated Statement of

Operations: |

|

|

|

|

|

|

|

|

|

|

Cost of revenue - product subscriptions |

$ |

62 |

|

|

$ |

236 |

|

|

$ |

79 |

|

|

$ |

125 |

|

|

$ |

121 |

|

| Cost of revenue - professional

services |

$ |

16 |

|

|

$ |

69 |

|

|

$ |

12 |

|

|

$ |

19 |

|

|

$ |

19 |

|

| Research and development

expense |

$ |

302 |

|

|

$ |

1,161 |

|

|

$ |

378 |

|

|

$ |

392 |

|

|

$ |

411 |

|

| Sales and marketing expense |

$ |

243 |

|

|

$ |

1,025 |

|

|

$ |

290 |

|

|

$ |

331 |

|

|

$ |

300 |

|

| General and administrative

expense |

$ |

309 |

|

|

$ |

1,064 |

|

|

$ |

93 |

|

|

$ |

790 |

|

|

$ |

293 |

|

| Net income (loss) |

$ |

(932 |

) |

|

$ |

(3,555 |

) |

|

$ |

(852 |

) |

|

$ |

(1,657 |

) |

|

$ |

(1,144 |

) |

| Net income (loss) per share,

basic |

$ |

(0.02 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

| Net income (loss) per share,

diluted |

$ |

(0.01 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

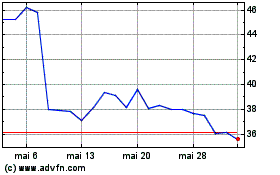

Rapid7 (NASDAQ:RPD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Rapid7 (NASDAQ:RPD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025