ARMOUR Residential REIT, Inc. (NYSE: ARR and ARR PRC) (“ARMOUR” or

the “Company”) today announced the Company's unaudited Q4 results

and December 31, 2024 financial position.

ARMOUR's Q4

2024 Results

- GAAP net loss related to common

stockholders of $(49.4) million or $(0.83) per common share.

- Net interest income of $12.7

million.

- Distributable Earnings available to

common stockholders of $46.5 million, which represents $0.78 per

common share (see explanation of this non-GAAP measure on page

5).

- Average interest income on interest

earning assets of 4.81% and interest cost on average interest

bearing liabilities of 5.01%.

- Economic interest income was 4.77%

less economic interest expense of 3.24% for an economic net

interest spread of 1.53% (see explanation of this non-GAAP measure

on page 7).

- Raised $136.2 million of capital by

issuing 7,205,653 shares of common stock through an at the market

offering program.

- Paid common stock dividends of

$0.24 per share per month, or $0.72 per share for Q4.

ARMOUR's December 31,

2024 Financial Position

- Book value per common share of

$19.07, compared to $20.76 at September 30, 2024.

- Total economic return, which is

change in book value for the period plus common dividends paid for

the quarter, was (4.67)% for Q4 2024 and (2.62)% for 2024.

- Liquidity, including cash and

unencumbered agency and U.S. government securities, of $608.0

million.

- Agency mortgage-backed securities

("MBS") portfolio totaled $12.4 billion.

- Repurchase agreements, net totaled

$10.7 billion; 45.7% were with ARMOUR affiliate BUCKLER Securities

LLC.

- Debt to equity ratio of 7.87:1

(based on repurchase agreements divided by total stockholders’

equity). Implied leverage, including forward settling sales and

unsettled purchases was 7.95:1.

- Interest Rate swap contracts

totaled $7.2 billion of notional amount.

Company Update

At the close of business on February 10,

2025:

- Common stock outstanding of

76,414,932 shares.

- 7.00% Cumulative Redeemable

Preferred C Stock ("Series C Preferred Stock") with liquidation

preference totaling approximately $171.6 million.

- Liquidity, including cash and

unencumbered securities, exceeded $802 million. MBS principal and

interest receivable due in February 2025 totaled

$139.2 million.

- Securities portfolio included

approximately $14.7 billion of Agency MBS (including TBA

Securities).

- Through February 4, 2025 raised

$259.0 million of capital by issuing 14,002,466 shares of

common stock and $0.4 million of capital by issuing 17,364 shares

of Series C Preferred Stock through at the market offering

programs.

- Debt to equity ratio (based on

repurchase agreements divided by total stockholders' equity) was

6.59 to 1; Implied leverage, including TBA Agency Securities and

forward settling securities was 7.94 to 1.

Book value per common share consisted

of:

| |

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

(in millions except per share) |

|

Common stock, at par value – 62,412,116 and 48,798,954 shares

outstanding, respectively |

|

$ |

0.1 |

|

|

$ |

0.1 |

|

| Additional paid-in

capital |

|

|

4,585.7 |

|

|

|

4,318.2 |

|

| Cumulative distributions to

stockholders |

|

|

(2,383.5 |

) |

|

|

(2,220.6 |

) |

| Accumulated net loss |

|

|

(840.9 |

) |

|

|

(826.5 |

) |

| Total Stockholders'

Equity |

|

$ |

1,361.4 |

|

|

$ |

1,271.2 |

|

|

Less: liquidation preference – 7.00% Cumulative Redeemable

Preferred C Stock - 6,846,978 shares outstanding |

|

|

(171.2 |

) |

|

|

(171.2 |

) |

| Equity Attributable to Common

Stockholders |

|

$ |

1,190.2 |

|

|

$ |

1,100.0 |

|

|

Book value per common share |

|

$ |

19.07 |

|

|

$ |

22.54 |

|

The major drivers of the change in the

Company's financial position

were:

| |

|

Q4 2024 |

|

Q3 2024 |

| |

|

(in millions) |

|

Total Stockholders' Equity – Beginning |

|

$ |

1,316.9 |

|

|

$ |

1,161.3 |

|

| Income

(Loss) |

|

|

|

|

|

Investment in securities: |

|

|

|

|

|

Gain (Loss) on MBS |

|

$ |

(404.1 |

) |

|

$ |

306.1 |

|

|

Gain (Loss) on U.S. Treasury Securities |

|

|

29.2 |

|

|

|

(21.7 |

) |

|

Gain (Loss) on TBA Securities |

|

|

(1.6 |

) |

|

|

39.1 |

|

|

Gain (Loss) on interest rate swaps |

|

|

287.3 |

|

|

|

(232.6 |

) |

|

Gain (Loss) on futures contracts |

|

|

41.6 |

|

|

|

(16.4 |

) |

|

Net Interest Income |

|

|

12.7 |

|

|

|

1.8 |

|

|

Total Expenses after fees waived(1) |

|

|

(11.5 |

) |

|

|

(10.4 |

) |

| Net Income

(Loss) |

|

$ |

(46.4 |

) |

|

$ |

65.9 |

|

| Preferred stock dividends |

|

|

(3.0 |

) |

|

|

(3.0 |

) |

| Common stock dividends |

|

|

(42.9 |

) |

|

|

(37.5 |

) |

| Capital

Activities |

|

|

|

|

|

Issuance of common stock |

|

|

136.8 |

|

|

|

130.2 |

|

| Total Stockholders'

Equity – Ending |

|

$ |

1,361.4 |

|

|

$ |

1,316.9 |

|

|

(1) The Company’s external manager waived a portion of its

contractual management fee at the rate of $1.65 million per quarter

for each of Q4 2024 and Q3 2024. |

| Condensed Balance

Sheet (unaudited) |

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

(in millions) |

| Assets |

|

|

|

|

|

Cash |

|

$ |

68.0 |

|

|

$ |

221.9 |

|

|

Cash collateral posted to counterparties |

|

|

78.2 |

|

|

|

37.0 |

|

|

Agency Securities, at fair value |

|

|

12,439.4 |

|

|

|

11,159.8 |

|

|

Derivatives, at fair value |

|

|

908.1 |

|

|

|

877.4 |

|

|

Accrued interest receivable |

|

|

52.8 |

|

|

|

47.1 |

|

|

Prepaid and other |

|

|

1.4 |

|

|

|

1.2 |

|

| Total

Assets |

|

$ |

13,547.9 |

|

|

$ |

12,344.4 |

|

| |

|

|

|

|

|

Liabilities |

|

|

|

|

|

Repurchase agreements, net |

|

$ |

10,713.8 |

|

|

$ |

9,648.0 |

|

|

Obligations to return securities received as collateral, at fair

value |

|

|

493.4 |

|

|

|

350.3 |

|

|

Cash collateral posted by counterparties |

|

|

833.9 |

|

|

|

860.1 |

|

|

Payable for unsettled purchases |

|

|

103.5 |

|

|

|

171.5 |

|

|

Derivatives, at fair value |

|

|

1.3 |

|

|

|

5.0 |

|

|

Accrued interest payable – repurchase agreements |

|

|

32.1 |

|

|

|

26.5 |

|

|

Accrued interest payable – U.S. Treasury Securities sold

short |

|

|

3.8 |

|

|

|

5.0 |

|

|

Accounts payable and other accrued expenses |

|

|

4.7 |

|

|

|

6.8 |

|

| Total

Liabilities |

|

$ |

12,186.5 |

|

|

$ |

11,073.2 |

|

| |

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

| 7.00% Cumulative Redeemable

Preferred C Stock ($0.001 par value per share, $25.00 per share

liquidation preference) |

|

$ |

— |

|

|

$ |

— |

|

| Common stock ($0.001 par value

per share) |

|

|

0.1 |

|

|

|

0.1 |

|

| Additional paid-in

capital |

|

|

4,585.7 |

|

|

|

4,318.2 |

|

| Cumulative distributions to

stockholders |

|

|

(2,383.5 |

) |

|

|

(2,220.6 |

) |

| Accumulated net loss |

|

|

(840.9 |

) |

|

|

(826.5 |

) |

| Total Stockholders’

Equity |

|

|

1,361.4 |

|

|

|

1,271.2 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

13,547.9 |

|

|

$ |

12,344.4 |

|

Distributable Earnings

Distributable Earnings is a non-GAAP measure

defined as net interest income plus TBA Drop Income adjusted for

the net coupon effect of interest rate swaps and futures contracts

minus net operating expenses. Distributable Earnings is based on

the historical cost basis of our Agency Securities, interest rate

swaps and futures contracts. Distributable Earnings differs,

potentially significantly, from net interest income and from net

income (loss) (which includes realized gains and losses and market

value adjustments).

For a portion of its Agency Securities the

Company may enter into TBA forward contracts for the purchase or

sale of Agency Securities at a predetermined price, face amount,

issuer, coupon and stated maturity on an agreed-upon future date,

but the particular Agency Securities to be delivered are not

identified until shortly before the TBA settlement date. The

Company accounts for TBA Agency Securities as derivative

instruments if it is reasonably possible that it will not take or

make physical delivery of the Agency Securities upon settlement of

the contract. The Company may choose, prior to settlement, to move

the settlement of these securities out to a later date by entering

into an offsetting short or long position (referred to as a “pair

off”), net settling the paired off positions for cash, and

simultaneously purchasing or selling a similar TBA Agency Security

for a later settlement date. This transaction is commonly referred

to as a “dollar roll.” The Company accounts for TBA dollar roll

transactions as a series of derivative transactions.

Forward settling TBA contracts typically trade

at a discount, or “Drop,” to the regular settled TBA contract to

reflect the expected interest income on the underlying deliverable

Agency Securities, net of an implied financing cost, which would

have been earned by the buyer if the contract settled on the next

regular settlement date. When the Company enters into TBA contracts

to buy Agency Securities for forward settlement, it earns this “TBA

Drop Income,” because the TBA contract is essentially equivalent to

a leveraged investment in the underlying Agency Securities. The

amount of TBA Drop Income is calculated as the difference between

the spot price of similar TBA contracts for regular settlement and

the forward settlement price on the trade date. The Company

generally accounts for TBA contracts as derivatives and TBA Drop

Income is included as part of the periodic changes in fair value of

the TBA contracts that the Company recognizes currently in the

Other Income (Loss) section of its Consolidated Statement of

Operations.

Regulation G

Reconciliations

Distributable Earnings and Distributable

Earnings per common share

The Company believes that Distributable Earnings

and Distributable Earnings per common share may be useful to

investors because our Board of Directors may consider Distributable

Earnings and Distributable Earnings per common share as part of its

deliberations when determining the level of dividends on our common

stock. Distributable Earnings and Distributable Earnings per common

share tend to be more stable over time and this practice is

designed to increase the stability of our common stock dividend

from month to month. However, because Distributable Earnings is an

incomplete measure of the Company’s financial performance and

involves significant differences from net interest income and net

income (loss) computed in accordance with GAAP, Distributable

Earnings should be considered as supplementary to, and not as a

substitute for, the Company’s net interest income and net income

(loss) computed in accordance with GAAP as a measure of certain

aspects of the Company’s financial performance.

The elements of ARMOUR’s Distributable Earnings

and Distributable Earnings per common share and a reconciliation of

those amounts to the Company’s Net Interest Income, Net Income

(Loss) and Net Income (Loss) per common share appear below:

| |

|

Q4 2024 |

|

Q3 2024 |

| |

|

($ in millions except, share and per share) |

|

Net Interest Income |

|

$ |

12.7 |

|

|

$ |

1.8 |

|

|

TBA Drop and interest margin loss |

|

|

— |

|

|

|

(0.6 |

) |

|

Net interest income on interest rate swaps |

|

|

47.3 |

|

|

|

63.4 |

|

|

Net interest income on futures contracts |

|

|

1.0 |

|

|

|

0.8 |

|

|

Total Expenses after fees waived |

|

|

(11.5 |

) |

|

|

(10.4 |

) |

| Distributable

Earnings |

|

$ |

49.5 |

|

|

$ |

55.0 |

|

|

Dividends on Preferred Stock |

|

|

(3.0 |

) |

|

|

(3.0 |

) |

| Distributable Earnings

available to common stockholders |

|

$ |

46.5 |

|

|

$ |

52.0 |

|

| Distributable Earnings

per common share |

|

$ |

0.78 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

| Net Income

(Loss) |

|

$ |

(46.4 |

) |

|

$ |

65.9 |

|

| Items Excluded from

Distributable Earnings: |

|

|

|

|

|

(Gain) Loss on MBS |

|

|

404.1 |

|

|

|

(306.1 |

) |

|

(Gain) Loss on U.S. Treasury Securities |

|

|

(29.2 |

) |

|

|

21.7 |

|

|

(Gain) Loss on TBA Securities, less TBA Drop Income (loss) |

|

|

1.6 |

|

|

|

(39.7 |

) |

|

(Gain) Loss on futures contracts |

|

|

(40.6 |

) |

|

|

17.2 |

|

|

(Gain) Loss on interest rate swaps |

|

|

(240.0 |

) |

|

|

296.0 |

|

| Total items excluded |

|

$ |

95.9 |

|

|

$ |

(10.9 |

) |

| Distributable

Earnings |

|

$ |

49.5 |

|

|

$ |

55.0 |

|

|

Dividends on Preferred Stock |

|

|

(3.0 |

) |

|

|

(3.0 |

) |

| Distributable Earnings

available to common stockholders |

|

$ |

46.5 |

|

|

$ |

52.0 |

|

| Distributable Earnings

per common share |

|

$ |

0.78 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

| Net Income

(Loss) |

|

$ |

(46.4 |

) |

|

$ |

65.9 |

|

|

Dividends on Preferred Stock |

|

|

(3.0 |

) |

|

|

(3.0 |

) |

| Net Income (Loss)

available (related) to common stockholders |

|

$ |

(49.4 |

) |

|

$ |

62.9 |

|

| Net Income (Loss) per

common share |

|

$ |

(0.83 |

) |

|

$ |

1.21 |

|

| Weighted average common shares

outstanding |

|

|

59,370,975 |

|

|

|

51,832,743 |

|

Economic Interest Income, Economic Interest

Expense, Economic Net Interest Income/Net Interest Spread and

Economic Net Yield on Interest Earning Assets

The Company believes that these non GAAP

measures, which include the effects of TBA drop income and net

interest income (expense) on interest rate swaps and futures

contracts, may be useful to investors because they reflect items

that we consider in the management of the Company’s investment

portfolio and related funding. The Company believes that the

inclusion in economic net interest income of interest rate swaps

and futures contracts, which are recognized under GAAP in gain/loss

on derivative instruments, is meaningful as interest rate swaps are

the primary instrument the Company uses to economically hedge

against fluctuations in the Company’s borrowing costs and their

inclusion is more indicative of the Company’s total cost of funds

than interest expense alone. It does not include all interest

earning assets and interest bearing liabilities, such as cash

collateral posted by counterparties. Accordingly, it is not a

substitute for net interest income or net income (loss) determined

in accordance with GAAP and should be considered as supplementary

to such GAAP measures as a measure of certain aspects of the

Company’s financial performance.

| |

|

Q4 2024 |

| |

|

(in millions) |

|

|

| |

|

Income (Expense) |

|

Average Balance |

|

Average Rate |

| Interest Bearing

Assets: |

|

|

|

|

|

|

|

Agency Securities, Net of Amortization |

|

$ |

152.0 |

|

|

$ |

12,600.7 |

|

|

4.83 |

% |

|

Cash Equivalents & Treasury Securities |

|

|

0.5 |

|

|

|

74.5 |

|

|

2.54 |

% |

|

Total Interest Income/Average Interest Earning Assets |

|

|

152.5 |

|

|

|

12,675.2 |

|

|

4.81 |

% |

|

TBA drop income (loss)/Implied Average TBA Securities |

|

|

0.1 |

|

|

|

116.7 |

|

|

0.32 |

% |

| Economic interest income |

|

$ |

152.6 |

|

|

$ |

12,791.9 |

|

|

4.77 |

% |

| |

|

|

|

|

|

|

| Interest Bearing

Liabilities: |

|

|

|

|

|

|

|

Repurchase Agreements |

|

$ |

(134.3 |

) |

|

$ |

10,662.4 |

|

|

(5.04 |

)% |

|

Treasury Securities Sold Short |

|

|

(5.5 |

) |

|

|

501.4 |

|

|

(4.39 |

)% |

|

Total Interest Expense/Average Interest Bearing Liabilities |

|

|

(139.8 |

) |

|

|

11,163.8 |

|

|

(5.01 |

)% |

|

Implied Average TBA Funding Positions |

|

|

— |

|

|

|

113.5 |

|

|

— |

% |

|

Net interest income (expense) on interest rate swaps |

|

|

47.3 |

|

|

|

— |

|

|

1.70 |

% |

|

Net interest income (expense) on futures contracts |

|

|

1.0 |

|

|

|

— |

|

|

0.04 |

% |

| Economic interest expense |

|

$ |

(91.5 |

) |

|

$ |

11,277.3 |

|

|

(3.24 |

)% |

| Economic net interest

income/net interest spread |

|

$ |

61.1 |

|

|

|

|

1.53 |

% |

| Economic net yield on interest

earning assets |

|

|

|

|

|

1.91 |

% |

| |

|

Q3 2024 |

| |

|

(in millions) |

|

|

| |

|

Income (Expense) |

|

Average Balance |

|

Average Rate |

| Interest Bearing

Assets: |

|

|

|

|

|

|

|

Agency Securities, Net of Amortization |

|

$ |

125.7 |

|

|

$ |

10,310.5 |

|

|

4.87 |

% |

|

Cash Equivalents & Treasury Securities |

|

|

1.4 |

|

|

|

77.3 |

|

|

7.28 |

% |

|

Total Interest Income/Average Interest Earning Assets |

|

|

127.1 |

|

|

|

10,387.8 |

|

|

4.89 |

% |

|

TBA drop income (loss)/Implied Average TBA Securities |

|

|

(0.7 |

) |

|

|

986.7 |

|

|

(0.30 |

)% |

| Economic interest income |

|

$ |

126.4 |

|

|

$ |

11,374.5 |

|

|

4.44 |

% |

| |

|

|

|

|

|

|

| Interest Bearing

Liabilities: |

|

|

|

|

|

|

|

Repurchase Agreements |

|

$ |

(119.6 |

) |

|

$ |

8,572.7 |

|

|

(5.58 |

)% |

|

Treasury Securities Sold Short |

|

|

(5.6 |

) |

|

|

517.1 |

|

|

(4.33 |

)% |

|

Total Interest Expense/Average Interest Bearing Liabilities |

|

|

(125.2 |

) |

|

|

9,089.8 |

|

|

(5.51 |

)% |

|

Implied Average TBA Funding Positions |

|

|

— |

|

|

|

894.6 |

|

|

— |

% |

|

Net interest income (expense) on interest rate swaps |

|

|

63.4 |

|

|

|

— |

|

|

2.79 |

% |

|

Net interest income (expense) on futures contracts |

|

|

0.8 |

|

|

|

— |

|

|

0.03 |

% |

| Economic interest expense |

|

$ |

(61.0 |

) |

|

$ |

9,984.4 |

|

|

(2.44 |

)% |

| Economic net interest

income/net interest spread |

|

|

65.3 |

|

|

|

|

2.00 |

% |

| Economic net yield on interest

earning assets |

|

|

|

|

|

2.30 |

% |

Dividends

ARMOUR paid monthly cash dividends of $0.24 per

share of the Company’s common stock each month in Q4 2024. On

January 30, 2025, a cash dividend of $0.24 per outstanding

common share was paid to holders of record on January 15,

2025. We have also declared a cash dividend of $0.24 per

outstanding common share payable February 27, 2025 and

March 27, 2025 to holders of record on February 14, 2025

and March 17, 2025, respectively. ARMOUR’s Board of Directors

will determine future common dividend rates based on an evaluation

of the Company’s results, financial position, real estate

investment trust (“REIT”) tax requirements, and overall market

conditions as the quarter progresses. In order to maintain ARMOUR’s

tax status as a REIT, the Company is required to timely distribute

substantially all of its ordinary REIT taxable income for the tax

year.

ARMOUR paid monthly cash dividends of $0.14583

per share of the Company’s Series C Preferred Stock for each month

in Q4 2024. On January 27, 2025, a cash dividend of $0.14583

per outstanding share of Series C Preferred Stock was paid to

holders of record on January 15, 2025. We have also declared

cash dividends of $0.14583 per outstanding share of Series C

Preferred Stock payable February 27, 2025 to holders of record

on February 15, 2025 and payable March 27, 2025 to

holders of record on March 15, 2025.

The Company's Series C Preferred Stock dividends

for 2024 will be treated 100.00% as fully taxable ordinary income.

Common stock dividends for 2024 will be treated 85.18% as taxable

ordinary income and 14.82% as non-taxable return of capital.

Conference Call

As previously announced, the Company will

provide an online, real-time webcast of its conference call with

equity analysts covering Q4 2024 operating results on Thursday,

February 13, 2025, at 9:00 a.m. (Eastern Time). The live

broadcast will be available online and can be accessed at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=JUgGiqtR.

To monitor the live webcast, please visit the website at least 15

minutes prior to the start of the call to register, download, and

install any necessary audio software. An online replay of the event

will be available on the Company’s website at

www.armourreit.com and continue for one year.

ARMOUR Residential REIT, Inc.

ARMOUR invests primarily in fixed rate

residential, adjustable rate and hybrid adjustable rate residential

mortgage-backed securities issued or guaranteed by U.S.

Government-sponsored enterprises or guaranteed by the Government

National Mortgage Association. ARMOUR is externally managed and

advised by ARMOUR Capital Management LP, an investment advisor

registered with the Securities and Exchange Commission (“SEC”).

Safe Harbor

This press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Actual results may differ from expectations, estimates and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results. Additional information

concerning these and other risk factors are contained in the

Company’s most recent filings with the SEC. All subsequent written

and oral forward-looking statements concerning the Company are

expressly qualified in their entirety by the cautionary statements

above. The Company cautions readers not to place undue reliance

upon any forward-looking statements, which speak only as of the

date made. The Company does not undertake or accept any obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based, except as required by

law.

Investors, security holders and other interested

persons may find ARMOUR's most recent Company Update and additional

information regarding the Company at the SEC’s internet site at

www.sec.gov, or the Company website at www.armourreit.com or

by directing requests to: ARMOUR Residential REIT, Inc., 3001 Ocean

Drive, Suite 201, Vero Beach, Florida 32963, Attention: Investor

Relations.

CONTACT:

investor@armourreit.com

Gordon HarperChief Financial OfficerARMOUR

Residential REIT, Inc. (772) 617-4340

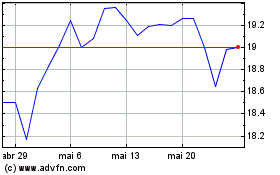

ARMOUR Residential REIT (NYSE:ARR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ARMOUR Residential REIT (NYSE:ARR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025