H&E Equipment Services, Inc. d/b/a H&E Rentals (NASDAQ:

HEES) (“H&E”) today announced that it has determined that a

definitive offer from Herc Holdings Inc. (NYSE: HRI) ("Herc") to

acquire all of the outstanding shares of H&E common stock for a

combination of cash and Herc common stock constitutes a “Superior

Proposal,” as defined in the existing merger agreement (the “United

Rentals Merger Agreement”) with United Rentals, Inc. (NYSE: URI)

(“United Rentals”). The Herc definitive offer, which expires at

12:01 p.m. Eastern Time on February 24, 2025, includes a fully

negotiated merger agreement and the related financing commitments.

The Herc definitive offer provides for

consideration of (i) $78.75 in cash, without interest, less any

applicable withholding of taxes, and (ii) a fixed exchange ratio of

0.1287 shares of Herc common stock, without interest, per share of

H&E common stock. The combination of cash and stock is equal to

approximately $104.59 per share of H&E common stock, based upon

Herc’s closing price on February 14, 2025, of $200.74 per

share.

In accordance with the United Rentals Merger

Agreement, H&E notified United Rentals of the H&E board of

directors’ determination that the definitive offer from Herc

constituted a Superior Proposal, following which United Rentals

notified H&E in writing that it does not intend to submit a

revised proposal and has waived the four business day match period

under the United Rentals Merger Agreement, which will permit

H&E to terminate its existing merger agreement and enter into a

merger agreement with Herc.

H&E is not permitted to enter into a merger

agreement with Herc until H&E satisfies certain other

requirements under the United Rentals Merger Agreement, which are

currently anticipated to be satisfied on or about February 19,

2025.

Under the United Rentals Merger Agreement,

H&E is required to pay a $63,523,892 termination fee to United

Rentals if H&E terminates the United Rentals Merger Agreement

in order to enter into an agreement with Herc. Herc has agreed to

pay the termination fee to United Rentals on behalf of H&E in

such event. H&E would be required to repay Herc for the United

Rentals termination fee under certain circumstances in connection

with a termination of the merger agreement with Herc. At this time,

H&E’s board of directors has neither changed its recommendation

with respect to the pending transaction with United Rentals nor

terminated the United Rentals Merger Agreement. There can be no

assurances that a transaction with Herc will result from Herc’s

definitive offer, or that any other transaction will be

consummated.

H&E today also announced the expiration of

the 35-day “go-shop” period as of 11:59 p.m. Eastern Time on

February 17, 2025, in accordance with the terms of the United

Rentals Merger Agreement.

About H&E

Founded in 1961, H&E is one of the largest

rental equipment companies in the nation. The Company’s fleet is

comprised of aerial work platforms, earthmoving, material handling,

and other general and specialty lines. H&E serves a diverse set

of end markets in many high-growth geographies and has branches

throughout the Pacific Northwest, West Coast, Intermountain,

Southwest, Gulf Coast, Southeast, Midwest and Mid-Atlantic

regions.

Additional Information and Where to Find

it

This press release is for information purposes

only and not intended to be a recommendation to buy, sell or hold

securities and does not constitute an offer for the sale of, or the

solicitation of an offer to buy securities in any jurisdiction,

including the United States. Any such offer will only be made by

means of a prospectus or offering memorandum, and in compliance

with applicable securities laws. These forward-looking statements

speak only as of the date hereof. H&E Equipment Services

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws. On January 28, 2025, United Rentals and its

acquisition subsidiary, UR Merger Sub VII Corporation

(“Purchaser”), filed a Tender Offer Statement on Schedule TO with

the SEC and on January 28, 2025, H&E Equipment Services filed a

Solicitation/Recommendation Statement on Schedule 14D-9 with the

SEC, in each case with respect to the tender offer. The tender

offer materials (including an offer to purchase, a related letter

of transmittal and other offer documents) and the

solicitation/recommendation statement, as they may be amended from

time to time, contain important information that should be read

carefully when they become available and considered before any

decision is made with respect to the tender offer. Those materials

and all other documents filed by, or caused to be filed by, United

Rentals and H&E Equipment Services with the SEC will be

available at no charge on the SEC’s website at www.sec.gov. The

tender offer materials and related materials also may be obtained

for free (when available) under the “Financials—SEC Filings”

section of United Rentals’ investor website at

https://investors.unitedrentals.com/, and the

Solicitation/Recommendation Statement and such other documents also

may be obtained for free (when available) from H&E Equipment

Services under the “Financial Information—SEC Filings” section of

H&E Equipment Services’ investor website at

https://investor.he-equipment.com/.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995, known as the PSLRA. Forward-looking

statements involve significant risks and uncertainties that may

cause actual results to differ materially from such forward-looking

statements. These statements are based on current plans, estimates

and projections, and, therefore, investors should not place undue

reliance on them. No forward-looking statement, including any such

statement concerning the completion and anticipated benefits of the

proposed transaction, can be guaranteed, and actual results may

differ materially from those projected. Forward-looking statements

are not historical facts, but rather are based on current

expectations, estimates, assumptions and projections about the

business and future financial results of the equipment rental

industries, and other legal, regulatory and economic developments.

H&E Equipment Services uses words such as “anticipates,”

“believes,” “plans,” “expects,” “projects,” “future,” “intends,”

“may,” “will,” “should,” “could,” “estimates,” “predicts,”

“targets,” “potential,” “continue,” “guidance” and similar

expressions to identify these forward-looking statements that are

intended to be covered by the safe harbor provisions of the PSLRA.

Actual results could differ materially from the results

contemplated by these forward-looking statements due to a number of

factors, including, but not limited to, those described in the SEC

reports filed by United Rentals and H&E Equipment Services, as

well as the possibility that (1) United Rentals and H&E

Equipment Services may be unable to obtain regulatory approvals

required for the proposed transaction or may be required to accept

conditions that could reduce the anticipated benefits of the

acquisition as a condition to obtaining regulatory approvals;

(2) the length of time necessary to consummate the proposed

transaction may be longer than anticipated; (3) H&E Equipment

Services’ business may suffer as a result of uncertainty

surrounding the proposed transaction, or any adverse effects on

H&E Equipment Services’ ability to maintain relationships with

customers, employees and suppliers; (4) the occurrence of any

event, change or other circumstances that could give rise to the

termination of the merger agreement, the failure of the closing

conditions included in the merger agreement to be satisfied, or any

other failure to consummate the proposed transaction; (5) any

negative effects of the announcement of the proposed transaction or

the financing thereof on the market price of H&E Equipment

Services common stock or other securities; and (6) the industry may

be subject to future risks that are described in the “Risk Factors”

section of the Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q and other documents filed from time to time with the SEC

by United Rentals and H&E Equipment Services. H&E Equipment

Services gives no assurance that it will achieve its expectations

and does not assume any responsibility for the accuracy and

completeness of the forward-looking statements. The foregoing list

of factors is not exhaustive. Investors should carefully consider

the foregoing factors and the other risks and uncertainties that

affect the businesses of United Rentals and H&E Equipment

Services described in the “Risk Factors” section of the Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and other

documents filed from time to time with the SEC by United Rentals

and H&E Equipment Services. These forward-looking statements

speak only as of the date hereof. H&E Equipment Services

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws.

Contact:

H&E Equipment Services,

Inc.

Leslie S. MageeChief Financial

Officer225-298-5261lmagee@he-equipment.com

Jeffrey L. ChastainVice President of Investor

Relations225-952-2308jchastain@he-equipment.com

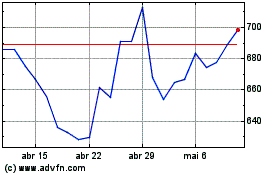

United Rentals (NYSE:URI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

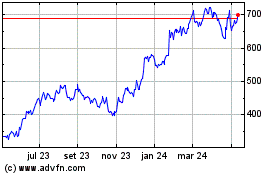

United Rentals (NYSE:URI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025