CDPQ to sell 2,500,000 common shares of Intact Financial

18 Fevereiro 2025 - 6:25PM

CDPQ today announced its intention to sell 2,500,000 common shares

of Intact Financial Corporation (TSX: IFC), representing

approximately 1.4% of the issued and outstanding common shares of

Intact as of February 18, 2025.

The common shares are being sold at a gross

price of $278.60 per share, which has been underwritten by CIBC

Capital Markets and National Bank Financial. CDPQ expects to

receive gross cash proceeds of approximately $696,500,000 from the

offering.

This transaction is part of CDPQ’s regular

portfolio rebalancing. Once the transaction is complete, CDPQ will

own approximately 6.6% of Intact’s issued and outstanding common

shares, remaining its largest shareholder and Intact continuing as

one of CDPQ’s largest holdings in the public markets.

“CDPQ has been a major shareholder of Intact for

over fifteen years, during which time our investment in the company

has generated significant returns for our depositors,” said Vincent

Delisle, Executive Vice-President and Head of Liquid Markets at

CDPQ. “This transaction allows us to monetize a portion of these

returns while retaining significant ownership in the company, based

on our confidence in Intact’s growth prospects, including through

several strategic operations based and managed in Québec.”

“CDPQ continues to be a valued partner in

Intact’s evolution as a leading global P&C insurer. This

transaction enables a significant gain on a portion of one of their

largest investments while remaining able to support our growth

ambitions,” said Ken Anderson, Executive Vice President and CFO,

Intact Financial Corporation. “We have delivered an annualized

total shareholder return of 15% over the last 10 years, and we

remain well positioned to sustain our track record of

outperformance, given the strength of our platforms, our talented

team and our clear strategic roadmap.”

ABOUT CDPQAt CDPQ, we invest

constructively to generate sustainable returns over the long term.

As a global investment group managing funds for public pension and

insurance plans, we work alongside our partners to build

enterprises that drive performance and progress. We are active in

the major financial markets, private equity, infrastructure, real

estate and private debt. As at June 30, 2024, CDPQ’s net assets

totalled CAD 452 billion. For more information, visit

cdpq.com, consult our LinkedIn or Instagram pages, or follow us on

X.

CDPQ is a registered trademark owned by Caisse

de dépôt et placement du Québec and licensed for use by its

subsidiaries.

ABOUT INTACT FINANCIAL

CORPORATION Intact Financial Corporation (TSX: IFC) is the

largest provider of Property and Casualty (P&C) insurance in

Canada, a leading Specialty lines insurer with international

expertise and a leader in Commercial lines in the UK and Ireland.

The business has grown organically and through acquisitions to

almost $24 billion of total annual operating direct premiums

written (DPW).

In Canada, Intact distributes insurance under

the Intact Insurance brand through agencies and a wide network of

brokers, including its wholly owned subsidiary BrokerLink. Intact

also distributes directly to consumers through the belairdirect

brand and affinity partnerships. Additionally, Intact provides

exclusive and tailored offerings to high-net-worth customers

through Intact Prestige. In the US, Intact Insurance Specialty

Solutions provides a range of Specialty insurance products and

services through independent agencies, regional and national

brokers, wholesalers and managing general agencies. Across the UK,

Ireland, and Europe, Intact provides Personal, Commercial and/or

Specialty insurance solutions through the RSA, 123.ie, NIG and

FarmWeb brands.

For more information CDPQ Media

Relations Team+ 1 514 847-5493medias@cdpq.com

Caroline AudetManager, Media Relations and

Public Affairs, Intact Financial416 227-7905 / 514

985-7165media@intact.net

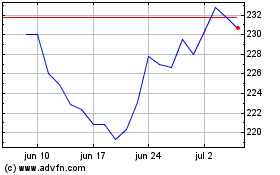

Intact Financial (TSX:IFC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Intact Financial (TSX:IFC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025