First Quantum Minerals Ltd. (“First Quantum” or the “Company”)

(TSX: FM) announces that it has successfully completed the pricing

of its offering (the “Offering”) of $1,000 million aggregate

principal amount of 8.000% senior notes due 2033 (the “Notes”). The

original offering amount of the Notes of $750 million has been

increased to $1,000 million. The issue price of the Notes is

100.000%.

Interest on the Notes will accrue from the issue

date at a rate of 8.000% per annum and will be payable

semi-annually. Settlement is expected to take place on or about

March 5, 2025, subject to customary conditions precedent for

similar transactions. The Notes will be senior unsecured

obligations of the Company and will be guaranteed by certain of the

Company's subsidiaries.

The Company intends to apply the gross proceeds

from the sale of the Notes, together with cash on balance sheet, to

repay a $250 million portion of its revolving credit facility, to

fund the partial tender offer for its existing 6.875% senior notes

due 2027 and to pay transaction fees, costs and expenses.

For further information, visit our website at

www.first-quantum.com or contact:

Bonita To, Director, Investor Relations (416) 361-6400

Toll-free: 1 (888) 688-6577E-Mail: info@fqml.com

IMPORTANT DISCLAIMER

The information in this announcement does not

constitute a notice of redemption or the solicitation to purchase

any securities of the Company, or an offer of securities for sale

in the United States or any other jurisdiction. Securities may not

be offered or sold in the United States unless they are registered

or are exempt from the registration of the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”). The Notes will not be

registered under the U.S. Securities Act, or the securities laws of

any state of the U.S. or other jurisdictions and the Notes will not

be offered or sold within the U.S. or to, or for the account or

benefit of, U.S. Persons (as defined in Regulation S of the U.S.

Securities Act), except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

U.S. Securities Act and the applicable laws of other jurisdictions.

The Company does not intend to conduct a public offering in the

United States or any other jurisdiction. It may be unlawful to

distribute this announcement in certain jurisdictions.

The information in this announcement does not

constitute an offer, or a solicitation of an offer, of securities

for sale in the United States, Canada, the EEA, the UK,

Switzerland, Panama, Hong Kong, Japan, Singapore, or any other

jurisdiction in which such an offer, solicitation or sale is not

permitted.

In member states of the EEA, this announcement

and any offer of the securities referred to herein in any Member

State of the European Economic Area (“EEA”) will be made pursuant

to an exemption under the Prospectus Regulation from the

requirement to publish a prospectus for offers of the securities

referred to herein. Accordingly, any person making or intending to

make an offer in a Member State of Notes which are the subject of

the offering contemplated may only do so in circumstances in which

no obligation arises for the company or any of the initial

purchasers to publish a prospectus pursuant to Article 3 of the

Prospectus Regulation, in each case, in relation to such offer.

Neither the company nor the initial purchasers have authorized, nor

do they authorize, the making of any offer of Notes in

circumstances in which an obligation arises for the company or the

initial purchasers to publish a prospectus for such offer. The

expression “Prospectus Regulation” means Regulation (EU)

2017/1129.

The securities are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the EEA. For

these purposes, a retail investor means a person who is one (or

more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, “MiFID II”) or (ii) a

customer within the meaning of Directive 2016/97/EU (as amended),

where that customer would not qualify as a professional client as

defined in point (10) of Article 4(1) of MiFID II. Consequently, no

key information document required by Regulation (EU) No 1286/2014

(as amended, the “PRIIPs Regulation”) for offering or selling the

securities or otherwise making them available to retail investors

in the EEA has been prepared and therefore offering or selling the

securities or otherwise making them available to any retail

investor in the EEA may be unlawful under the PRIIPS

Regulation.

The securities are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the United

Kingdom (“UK”). For these purposes, a retail investor means a

person who is one (or more) of: (i) a retail client, as defined in

point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of domestic law by virtue of the European Union (Withdrawal)

Act 2018 (“EUWA”); or (ii) a customer within the meaning of the

provisions of the FSMA and any rules or regulations made under the

FSMA to implement Directive (EU) 2016/97, where that customer would

not qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law by virtue of the EUWA. Consequently no key information

document required by Regulation (EU) No 1286/2014 as it forms part

of domestic law by virtue of the EUWA (as amended, the “UK PRIIPs

Regulation”) for offering or selling the Notes or otherwise making

them available to retail investors in the UK has been prepared and

therefore offering or selling the Notes or otherwise making them

available to any retail investor in the UK may be unlawful under

the UK PRIIPs Regulation.

In the UK, this announcement and any offer of

the securities referred to herein in the UK will be made pursuant

to an exemption under the Prospectus Regulation from the

requirement to publish a prospectus for offers of the securities

referred to herein. Accordingly, any person making or intending to

make an offer in the UK of Notes which are the subject of the

offering contemplated may only do so in circumstances in which no

obligation arises for the company or any of the initial purchasers

to publish a prospectus pursuant to Article 3 of the UK Prospectus

Regulation, in each case, in relation to such offer. Neither the

company nor the initial purchasers have authorized, nor do they

authorize, the making of any offer of Notes in circumstances in

which an obligation arises for the company or the initial

purchasers to publish a prospectus for such offer. The expression

“UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it

forms part of domestic law by virtue of the EUWA.

Neither the content of the company’s website nor

any website accessible by hyperlinks on the company’s website is

incorporated in, or forms part of, this announcement. The

distribution of this announcement into certain jurisdictions may be

restricted by law. Persons into whose possession this announcement

comes should inform themselves about and observe any such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction. This announcement is an advertisement and is not a

prospectus for the purposes of the Prospectus Regulation or the UK

Prospectus Regulation.

This communication is only directed at (i)

persons having professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended,

(the “Order”), or (ii) high net worth entities falling within

Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it

would otherwise be lawful to distribute to or direct at, all such

persons together being referred to as “relevant persons”. The Notes

are only available to, and any invitation, offer or agreement to

subscribe, purchase or otherwise acquire such securities will be

engaged in only with relevant persons. Any person who is not a

relevant person should not act or rely on this communication or any

of its contents.

This announcement is not, and under no

circumstances is to be construed as, a prospectus, an advertisement

or a public offering of the securities referred to herein in

Canada. No securities commission or similar regulatory authority in

Canada has reviewed or in any way passed upon this announcement or

the merits of the securities referred to herein, and any

representation to the contrary is an offence.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

Certain information contained in this news

release constitutes "forward-looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995 and

“forward-looking information” under applicable Canadian securities

legislation. The forward-looking statements and forward-looking

information in this news release include, among other things, the

timing of the closing of the Offering and the expected uses of

proceeds of the Offering. Often, but not always, forward-looking

statements or information can be identified by the use of words

such as “plans”, “expects” or “does not expect”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates” or “does not anticipate” or “believes” or variations

of such words and phrases or statements that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be

taken, occur or be achieved. With respect to forward-looking

statements and information contained herein, the Company has made

numerous assumptions including, among other things, assumptions

about the ability to price the Notes on terms that are acceptable

to the Company, the timing of the closing of the Offering and the

ability to achieve the Company’s goals. Forward-looking statements

and information by their nature are based on assumptions and

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements or information. These factors include,

but are not limited to, events generally impacting global economic,

financial, political and social stability.

See the Company’s Annual Information Form and

other documents filed with the securities regulators or similar

authorities in Canada (accessible under the Company’s profile on

SEDAR+ at www.sedarplus.ca) for additional information on risks,

uncertainties and other factors relating to the forward-looking

statements and information. Although the Company has attempted to

identify factors that would cause actual actions, events or results

to differ materially from those disclosed in the forward-looking

statements or information, there may be other factors that cause

actual results, performances, achievements or events not to be

anticipated, estimated or intended. Also, many of these factors are

beyond First Quantum’s control. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to reissue or update

forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. All forward-looking statements and information

contained herein are expressly qualified by this cautionary

statement.

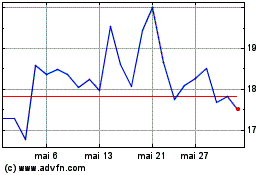

First Quantum Minerals (TSX:FM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

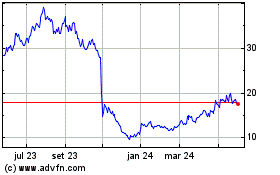

First Quantum Minerals (TSX:FM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025