Taseko Mines Limited (TSX: TKO; NYSE American: TGB; LSE: TKO)

("Taseko" or the "Company") reports full year 2024 Adjusted EBITDA*

of $224 million and Earnings from mining operations before

depletion and amortization and non-recurring items* of $244

million. Revenues for 2024 were $608 million from the sale of 108

million pounds of copper and 1.4 million pounds of molybdenum. For

the year, a Net loss of $13 million ($0.05 loss per share) was

recorded and Adjusted net income* was $57 million ($0.19 per

share).

For the fourth quarter, Adjusted EBITDA* was $56

million, Earnings from mining operations before depletion and

amortization and non-recurring items* was $59 million and Cash

flows from operations was $73 million. A Net loss of $21 million

($0.07 loss per share) was recorded and Adjusted net income* was

$10 million ($0.03 per share).

Gibraltar produced 29 million pounds of copper

and 578 thousand pounds of molybdenum in the fourth quarter at

Total operating costs (C1) of $2.42 per pound of copper produced.

Mill throughput averaged 89,600 tons per day, which is the highest

ever achieved for a quarter at Gibraltar.

For the year, copper production was 106 million

pounds, in line with the revised production guidance, and

molybdenum production was 1.4 million pounds. Higher than normal

scheduled downtime in both concentrators and an 18-day labour

strike impacted annual production by approximately 15 million

pounds in 2024. Copper grades in 2024 averaged 0.23% and Total

operating costs (C1) were US$2.66 per pound produced.

Copper production in 2025 is expected to

increase to 120 to 130 million pounds as mill operating time

returns to normal levels and the restart of the SX/EW plant adds

additional capacity. However, production will be weighted to the

back half of the year and the first quarter will be the lowest

production quarter as lower grade ore stockpiles will be used to

supplement mined ore from a new pushback in the Connector pit.

At Florence Copper, construction is advancing on

schedule, including all critical path items, and the overall

project completion was over 60% as of the end of January. A total

of 58 out of the 90 production wells to be drilled during the

construction phase have now been completed. In the SX/EW area,

construction activities are focussed on mechanical, piping and

electrical installations. The erection of the electrowinning

building has commenced, and construction of the tank farm is well

advanced. Work in the pipe corridor continues with lining and pipe

installation nearly complete.

Stuart McDonald, President and CEO of Taseko,

commented, “We had a strong finish to the year at Gibraltar and,

with both concentrators operating well, the mine achieved a new

record for quarterly mill throughput. With stable milling

operations expected in 2025 we expect a significant improvement in

annual production of copper and molybdenum, although we will see

lower head grades in the first part of the year during a new

pushback in the Connector pit. The refurbishment of the SX/EW plant

is progressing on schedule and first cathode production at

Gibraltar is anticipated in the second quarter.”

Mr. McDonald continued, “We remain pleased with

the construction progress at Florence. Four drill rigs are

advancing wellfield drilling which is scheduled for completion in

the second quarter. Our construction workforce is currently at

approximately 360 workers, and will reach peak manpower levels this

quarter. First copper production continues to be targeted before

the end of the year.”

“The Company remains in a solid financial

position with a year end cash balance of $173 million and available

liquidity of approximately $331 million, including our undrawn

credit facility. Recent trends in global markets are benefitting

Gibraltar as copper prices have risen 8% since the start of the

year, and the Canadian dollar has weakened relative to the US

dollar. Gibraltar’s cost structure will also benefit this year from

copper offtake contracts at average TC/RCs of zero, higher

by-product credits from increased molybdenum production, and lower

oil prices. Our copper price protection at a minimum price of

US$4.00 per pound for all of 2025, provides additional downside

protection. We’re very excited about the year ahead as we’re now

less than 12 months from first copper production at Florence

Copper, which is going to dramatically improve our business

outlook,” added Mr. McDonald.

“In the longer term, the Yellowhead project

represents another major growth opportunity for our North American

copper business. We’re advancing project permitting this year and

also publishing a new technical report, with updated costing and

metal prices, and incorporating the new Canadian tax credits

available for copper mine development,” concluded Mr. McDonald.

2024 Annual Review

- Earnings from mining operations

before depletion, amortization and non-recurring items* for the

year was $243.6 million, Adjusted EBITDA* was $224.0 million, and

cash flow from operations was $232.6 million;

- GAAP net loss for the year totalled

$13.4 million ($0.05 loss per share) and Adjusted net income* was

$56.9 million ($0.19 per share);

- Total operating costs (C1)* for the

year were US$2.66 per pound produced and the average realized

copper price was US$4.17 per pound;

- The Gibraltar mine produced 105.6

million pounds of copper and 1.4 million pounds of molybdenum in

2024. Copper head grades were 0.23% and mill recoveries averaged

78.5% for the year;

- Gibraltar sold 108.0 million pounds

of copper for the year (100% basis), resulting in $608.1 million of

revenue to Taseko;

- In January 2024, the Company

commenced construction of the commercial production facility at its

wholly-owned Florence Copper project. Construction activities are

advancing on schedule and the project is approximately 56% complete

at year end. First copper is expected to be produced in the fourth

quarter of 2025;

- In March 2024, Taseko acquired the

remaining 12.5% interest in Gibraltar, increasing its effective

interest in the mine from 87.5% to 100%. An initial payment of $5

million was paid on closing with remaining consideration to be paid

in annual instalments commencing in March 2026, with payments based

on the average LME copper price subject to a cap tied to a

percentage of Gibraltar’s cashflow; and

- In April 2024, the

Company completed an offering of US$500 million aggregate

principal amount of 8.25% Senior Secured Notes due 2030. A portion

of the proceeds was used to redeem the outstanding US$400 million

Senior Secured Notes due 2026 and pay related transaction costs

with the remaining proceeds available for capital expenditures,

working capital, and general corporate purposes.

*Non-GAAP performance measure. See end of news release.

Fourth Quarter Review

- Fourth quarter earnings from mining

operations before depletion, amortization and non-recurring items*

was $59.4 million, Adjusted EBITDA* was $55.6 million, and cash

flow from operations was $73.3 million;

- GAAP net loss for the quarter

totalled $21.2 million ($0.07 loss per share) and Adjusted net

income* was $10.5 million ($0.03 per share);

- Gibraltar produced 28.6 million

pounds of copper for the quarter. Average head grades were 0.22%

and copper recoveries were 78.2% for the quarter;

- Gibraltar sold 27.4 million pounds

of copper in the quarter (100% basis) at an average realized copper

price of US$4.13 per pound;

- Total operating costs (C1)* for the

quarter were US$2.42 per pound produced;

- At Florence, seventeen production

wells were constructed in the quarter, bringing the total completed

wells to 51 out of the 90 planned. Development of the main pipe

corridor from the wellfield to the processing plant are mostly

completed. Electrical, mechanical and piping installations are

underway for the solvent extraction and electrowinning (“SX/EW”)

plant and other site infrastructure;

- In November 2024, the Company

entered into an amendment to its revolving credit facility,

extending the maturity date to November 2027, and increasing the

facility amount to US$110 million from US$80 million. No amounts

are currently drawn against the revolving credit facility;

- In December 2024, the Company

closed a transaction with Osisko Gold Royalties, amending the

Gibraltar silver stream agreement and increasing the attributable

silver percentage from 87.5% to 100% in exchange for an additional

cash payment of US$12.7 million; and

- The Company had a cash balance of

$173 million and approximately $331 million of available liquidity

at December 31, 2024 including its undrawn corporate credit

facility.

*Non-GAAP performance measure. See end of news release.

Highlights

| Operating Data

(Gibraltar - 100% basis) |

Three months endedDecember

31, |

Year endedDecember 31, |

|

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

| Tons mined (millions) |

24.0 |

24.1 |

(0.1 |

) |

88.3 |

88.1 |

0.2 |

|

| Tons milled (millions) |

8.3 |

7.6 |

0.7 |

|

29.3 |

30.0 |

(0.7 |

) |

| Production (million pounds

Cu) |

28.6 |

34.2 |

(5.6 |

) |

105.6 |

122.6 |

(17.0 |

) |

| Sales

(million pounds Cu) |

27.4 |

35.9 |

(8.5 |

) |

108.0 |

120.7 |

(12.7 |

) |

| Financial

Data |

Three months endedDecember

31, |

Year endedDecember 31, |

|

(Cdn$ thousands, except per share amounts) |

2024 |

|

2023 |

Change |

|

2024 |

|

2023 |

Change |

|

| Revenues |

167,799 |

|

153,694 |

14,105 |

|

608,093 |

|

524,972 |

83,121 |

|

| Cash flows from

operations |

73,292 |

|

62,835 |

10,457 |

|

232,615 |

|

151,092 |

81,523 |

|

| Net (loss) income |

(21,207 |

) |

38,076 |

(59,283 |

) |

(13,444 |

) |

82,726 |

(96,170 |

) |

| Per share - basic (“EPS”) |

(0.07 |

) |

0.13 |

(0.20 |

) |

(0.05 |

) |

0.29 |

(0.34 |

) |

| Earnings from mining operations

before depletion, amortization and non-recurring items* |

59,405 |

|

73,106 |

(13,701 |

) |

243,646 |

|

207,354 |

36,292 |

|

| Adjusted EBITDA* |

55,602 |

|

69,107 |

(13,505 |

) |

223,991 |

|

190,079 |

33,912 |

|

| Adjusted net income* |

10,468 |

|

24,061 |

(13,593 |

) |

56,927 |

|

44,431 |

12,496 |

|

| Per share - basic (“Adjusted

EPS”)* |

0.03 |

|

0.08 |

(0.05 |

) |

0.19 |

|

0.15 |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

Effective as of March 25, 2024, the Company

increased its ownership in Gibraltar from 87.5% to 100%. As a

result, the financial results reported in this MD&A include

100% of Gibraltar’s income and expenses for the period March 25,

2024, to December 31, 2024 (87.5% for the period March 16, 2023 to

March 24, 2024, and 75% prior to March 15, 2023).

The Company finalized the accounting for the

acquisition of the remaining 50% interest in Cariboo from Dowa

Metals & Mining Co., Ltd. (“Dowa”) and Furukawa Co., Ltd.

(“Furukawa”) and the related 12.5% interest in Gibraltar in the

fourth quarter of 2024. For more information on the Company’s

acquisition of Cariboo, please refer to the Financial Statements –

Note 3.

*Non-GAAP performance measure. See end of news release.

Review of Operations

Gibraltar mine

|

Operating data (100% basis) |

Q4 2024 |

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

YE 2024 |

YE 2023 |

|

Tons mined (millions) |

|

23.9 |

|

|

23.2 |

|

|

18.4 |

|

|

22.8 |

|

|

24.1 |

|

|

88.3 |

|

|

88.1 |

|

| Tons milled (millions) |

|

8.3 |

|

|

7.6 |

|

|

5.7 |

|

|

7.7 |

|

|

7.6 |

|

|

29.3 |

|

|

30.0 |

|

| Strip ratio |

|

1.9 |

|

|

1.2 |

|

|

1.6 |

|

|

1.7 |

|

|

1.5 |

|

|

1.6 |

|

|

1.3 |

|

| Site operating cost per ton

milled (Cdn$)* |

$12.18 |

|

$14.23 |

|

$13.93 |

|

$11.73 |

|

$9.72 |

|

$12.93 |

|

$12.16 |

|

| Copper

concentrate |

|

|

|

|

|

|

|

|

Head grade (%) |

|

0.22 |

|

|

0.23 |

|

|

0.23 |

|

|

0.24 |

|

|

0.27 |

|

|

0.23 |

|

|

0.25 |

|

|

Copper recovery (%) |

|

78.2 |

|

|

78.9 |

|

|

77.7 |

|

|

79.0 |

|

|

82.2 |

|

|

78.5 |

|

|

82.6 |

|

|

Production (million pounds Cu) |

|

28.6 |

|

|

27.1 |

|

|

20.2 |

|

|

29.7 |

|

|

34.2 |

|

|

105.6 |

|

|

122.6 |

|

|

Sales (million pounds Cu) |

|

27.4 |

|

|

26.3 |

|

|

22.6 |

|

|

31.7 |

|

|

35.9 |

|

|

108.0 |

|

|

120.7 |

|

|

Inventory (million pounds Cu) |

|

4.1 |

|

|

2.9 |

|

|

2.3 |

|

|

4.9 |

|

|

6.9 |

|

|

4.1 |

|

|

6.9 |

|

| Molybdenum

concentrate |

|

|

|

|

|

|

|

|

Production (thousand pounds Mo) |

|

578 |

|

|

421 |

|

|

185 |

|

|

247 |

|

|

369 |

|

|

1,432 |

|

|

1,202 |

|

|

Sales (thousand pounds Mo) |

|

607 |

|

|

348 |

|

|

221 |

|

|

258 |

|

|

364 |

|

|

1,434 |

|

|

1,190 |

|

| Per unit data (US$ per

pound produced)* |

|

|

|

|

|

|

|

|

Site operating costs* |

$2.52 |

|

$2.91 |

|

$2.88 |

|

$2.21 |

|

$1.59 |

|

$2.61 |

|

$2.19 |

|

|

By-product credits* |

|

(0.42 |

) |

|

(0.25 |

) |

|

(0.26 |

) |

|

(0.17 |

) |

|

(0.13 |

) |

|

(0.28 |

) |

|

(0.20 |

) |

|

Site operating costs, net of by-productcredits* |

$2.10 |

|

$2.66 |

|

$2.62 |

|

$2.04 |

|

$1.46 |

|

$2.33 |

|

$1.99 |

|

|

Off-property costs |

|

0.32 |

|

|

0.26 |

|

|

0.37 |

|

|

0.42 |

|

|

0.45 |

|

|

0.33 |

|

|

0.38 |

|

| Total

operating costs (C1)* |

$2.42 |

|

$2.92 |

|

$2.99 |

|

$2.46 |

|

$1.91 |

|

$2.66 |

|

$2.37 |

|

Operations Analysis

Full Year Results

Gibraltar produced 105.6 million pounds of

copper for the year compared to 122.6 million pounds of copper in

2023 with lower mill running time being the primary factor for the

decreased production.

Both concentrators were down for 18 days in June

when the unionized workforce went on strike. The strike overlapped

with planned downtime in Concentrator #1 for its primary crusher

move as well as major maintenance on its SAG, which extended the

downtime to approximately seven weeks. Concentrator #2 was also

down in January 2024 for a planned major component

replacement on its ball mill. The reduced operating hours in

2024 resulted in approximately 15 million fewer copper pounds being

produced compared to normal milling rates at similar grades and

recoveries.

*Non-GAAP performance measure. See end of news release.

Operations Analysis - Continued

A total of 88.3 million tons were mined in the

year consistent with the 88.1 million tons mined in 2023. The strip

ratio increased to 1.6 from 1.3 as mining operations transitioned

into the Connector pit in 2024. The Gibraltar pit, which was the

main source of ore in 2023, had a lower strip ratio. Ore stockpiles

also increased by 5.0 million tons in 2024, comprised primarily of

oxide ore from the upper benches of the Connector pit. The oxide

ore stockpiled will allow the restart of the Gibraltar SX/EW plant

in the second quarter of 2025.

Total site costs* at Gibraltar of $413.9 million

(100% basis) were $16.9 million lower than 2023 due to lower input

costs such as diesel and the impact of the 18-day labour strike in

June 2024 which reduced site operating costs in the second quarter

of 2024.

Transportation costs for the year ended December

31, 2024 increased by $5.4 million over the same prior period, due

to higher costs for rail, ocean freight and port handling costs,

and trucking related costs.

Molybdenum production was 1.4 million pounds in

the year compared to 1.2 million pounds in the prior year.

Molybdenum prices weakened in 2024 with an average molybdenum price

of US$21.30 per pound, a decrease of 12% compared to the 2023

average price of US$24.19 per pound.

Off-property costs per pound produced* were

US$0.33 for the year, which is US$0.05 lower than the prior year

primarily due to a decrease in realized treatment and refining

charges (TC/RC) rates due to the tightening smelter market.

Total operating costs per pound produced (C1)* was US$2.66 for

the year, compared to US$2.37 in the prior year and the increase

was substantially attributed to lower production and less

capitalized stripping costs as shown in the bridge graph below:

https://www.globenewswire.com/NewsRoom/AttachmentNg/223b49e5-9f9a-47ca-b30d-2b225d76603f

Fourth Quarter Results

Gibraltar produced 28.6 million pounds of copper

in the quarter. Copper head grades were 0.22% and copper recoveries

in the fourth quarter were 78%, in line with recent quarters. Mill

throughput was 8.3 million tons, consistently above nameplate

capacity throughout the quarter and benefitting from the softer

characteristics of the ore feed.

A total of 24.0 million tons were mined in the

fourth quarter at an average strip ratio of 1.9 and the majority of

ore and waste mining occurred in the Connector pit.

Total site costs* at Gibraltar of $102.5 million

(100% basis) were lower than the third quarter of 2024, with the

prior quarter including repairs and maintenance costs associated

with a large maintenance project on one of the shovels.

*Non-GAAP performance measure. See end of news release.

Operations Analysis - Continued

Molybdenum production was 578 thousand pounds in

the fourth quarter. The 57% increase in quarter-over-quarter

production is primarily due to higher molybdenum grade in the

Connector pit ore. At an average molybdenum price of US$21.71 per

pound, molybdenum generated a meaningful by-product credit per

pound of copper produced of US$0.42 in the fourth quarter.

Off-property costs per pound produced* were

US$0.32 for the fourth quarter, in line with average costs for the

year.

Gibraltar Outlook

With the major project and related mill

maintenance work completed in 2024, increased mill availability and

higher throughput is expected to be the primary driver of improved

copper production in 2025. Refurbishment of Gibraltar’s SX/EW

plant, which has been idle since 2015, is underway and the plant is

expected to start producing copper cathode in the second quarter.

Total copper production for the year is expected to be in the range

of 120 to 130 million pounds.

Mining activities have transitioned to the

Connector pit, which will be the main source of mill feed going

forward. A new pushback in the Connector pit has been initiated in

early 2025 resulting in a higher strip ratio in the first quarter.

Lower grade ore stockpiles will be utilized to supplement mined ore

during this period, and as a result 2025 copper production will be

weighted to the second half of the year.

Molybdenum production is forecast to increase in

2025 as molybdenum head grades are expected to be notably higher in

the Connector pit ore compared to the Gibraltar pit ore.

The Company has previously entered into offtake

contracts for Gibraltar concentrate production in 2025 and 2026,

which will result in significantly lower treatment and refining

costs (“TC/RCs”). In 2024, TC/RCs accounted for approximately

US$0.09 per pound of off-property costs, and with the new offtake

contracts, the Company expects average TC/RCs to reduce to zero in

2025 and 2026.

The Company benefits from a strengthening of the

US dollar relative to the Canadian dollar as our sales contracts

are priced in US dollars whereas our Gibraltar mine costs are

primarily incurred in Canadian dollars.

The Company also has a prudent hedging program

in place to protect a minimum copper price during the Florence

construction period. Currently, the Company has copper collar

contracts that secure a minimum copper price of US$4.00 per pound

for 108 million pounds of copper for 2025. The copper collar

contracts also have ceiling prices between US$5.00 and US$5.40 per

pound (refer to the section “Hedging Strategy” for details).

Florence Copper

The Company has all the key permits in place for

the commercial production facility at Florence Copper and

construction of the Florence Copper commercial production facility

continues to advance on schedule. Nearly 450,000 project hours have

been worked with no reportable injuries or environmental incidents.

The Company has a fixed-price contract with the general contractor

for construction of the SX/EW plant and associated surface

infrastructure.

A total of 51 production wells out of a total of

90 new wells had been completed as of December 31, 2024. Process

ponds and surface water runoff pond construction are complete, and

development of the main pipe corridor is substantially complete

with the installation of high density polyethylene piping in the

corridor ongoing. Mechanical and piping installations are underway

throughout the SX/EW plant, erection of structural steel for

solvent extraction pipe rack is nearing completion, and the

electrical work has commenced.

Florence Copper - Continued

Florence Copper Quarterly Capital Spend

|

|

Three months ended |

Year ended |

| (US$ in

thousands) |

December 31, 2024 |

December 31, 2024 |

|

Site and PTF operations |

6,007 |

19,512 |

| Commercial facility

construction costs |

57,647 |

154,970 |

| Other

capital costs |

- |

28,943 |

|

Total Florence project expenditures |

63,654 |

203,425 |

Construction costs in the fourth quarter were

US$57.6 million, and US$155.0 million has been incurred for the

year ended December 31, 2024. Other capital costs of US$28.9

million include final payments for delivery of long-lead equipment

that was ordered in 2022, and the construction of an evaporation

pond to provide additional water management flexibility.

Construction of this evaporation pond was completed in the third

quarter of 2024.

The Company has closed several Florence project

level financings to fund initial commercial facility construction

costs. In October the Company received the fourth deposit of US$10

million from the US$50 million copper stream transaction with

Mitsui & Co. (U.S.A.) Inc. (“Mitsui”). The final deposit of

US$10 million was received in January 2025.

Remaining project construction costs are

expected to be funded with the Company’s available liquidity and

cashflow from its 100% ownership interest in Gibraltar. The Company

also has in place an undrawn corporate revolving credit facility

for US$110 million.

The Company has a technical report entitled “NI

43-101 Technical Report Florence Copper Project, Pinal County,

Arizona” dated March 30, 2023 (the “2023 Technical Report”) on

SEDAR+. The 2023 Technical Report was prepared in accordance with

NI 43-101 and incorporated the results of testwork from the

Production Test Facility (“PTF”) as well as updated capital and

operating costs (Q3 2022 basis) for the commercial production

facility.

Project highlights based on the 2023 Technical

Report:

- Net present value of US$930 million

(at $US 3.75 copper price, 8% after-tax discount rate)

- Internal rate of return of 47%

(after-tax)

- Payback period of 2.6 years

- Operating costs (C1) of US$1.11 per

pound of copper

- Annual production capacity of 85

million pounds of LME grade A cathode copper

- 22 year mine life

- Total life of mine production of

1.5 billion pounds of copper

- Remaining initial capital cost of

US$232 million (Q3 2022 basis)

Based on the 2023 Technical report, the

estimated remaining construction costs for the commercial facility

were US$232 million (basis Q3 2022), and management expects that

total costs will be within 10% to 15% of that estimate. Florence

Copper remains on track for first copper production in late

2025.

Long-term Growth Strategy

Taseko’s strategy has been to grow the Company

by acquiring and developing a pipeline of projects focused on

copper in North America. We continue to believe this will generate

long-term returns for shareholders. Our other development projects

are located in British Columbia, Canada.

Yellowhead Copper Project

The Yellowhead Project (“Yellowhead”) is

expected to produce 4.4 billion pounds of copper over a 25-year

mine life at an average C1* cost, net of by-product credit, of

US$1.67 per pound. During the first 5 years of operation,

Yellowhead will produce an average of 200 million pounds of copper

per year at an average C1* cost, net of by-product credit, of

US$1.43 per pound. The Yellowhead project also contains valuable

precious metal by-products with 440,000 ounces of gold and 19

million ounces of silver production over the life of mine.

The economic analysis in the 2020 Technical

Report was prepared using long-term copper price of US$3.10 per

pound, a gold price of US$1,350 per ounce, and silver price of

US$18 per ounce. This report entitled “Technical Report on the

Mineral Reserve Update at the Yellowhead Copper Project, British

Columbia, Canada” was published on January 16, 2020, under the

supervision of Richard Weymark, P. Eng., MBA, Vice President,

Engineering for Taseko and a Qualified Person as defined by NI

43-101. Taseko plans to publish a new technical report in 2025

using updated long-term metal price assumptions, updated project

costing, and incorporating the new Canadian tax credits available

for copper mine development.

The Company is ready to enter the environmental

assessment process and plans to submit an Initial Project

Description to formally commence this process with the regulators

in the second quarter this year. The Company is also focusing

discussions with the regulators on developing a workplan to

streamline the overall permitting process. Taseko opened a

project office in 2024 to support ongoing engagement with local

communities including First Nations.

New Prosperity Gold-Copper Project

In late 2019, the Tŝilhqot’in Nation, as

represented by Tŝilhqot’in National Government, and Taseko Mines

Limited entered into a confidential dialogue, with the involvement

of the Province of British Columbia, seeking a long-term resolution

of the conflict regarding Taseko’s proposed copper-gold mine

previously known as New Prosperity, acknowledging Taseko’s

commercial interests and the Tŝilhqot’in Nation’s opposition to the

project.

This dialogue has been supported by the parties’

agreement, beginning December 2019, to a series of standstill

agreements on certain outstanding litigation and regulatory matters

relating to Taseko’s tenures and the area in the vicinity of Teztan

Biny (Fish Lake).

The dialogue process has made meaningful

progress in recent months and is close to completion. The

Tŝilhqot’in Nation and Taseko acknowledge the constructive nature

of discussions, and the opportunity to conclude a long-term and

mutually acceptable resolution of the conflict that also makes an

important contribution to the goals of reconciliation in

Canada.

Aley Niobium Project

The converter pilot test is ongoing to provide

additional process data to support the design of commercial process

facilities and final product samples to support product marketing

initiatives. The Company has also initiated a scoping study to

investigate the potential production of niobium oxide at Aley to

supply the growing market for niobium-based batteries.

Conference Call and WebcastThe Company will host a

telephone conference call and live webcast on Thursday, February

20, 2025, at 11:00 a.m. Eastern Time (8:00 a.m. Pacific) to discuss

these results. After opening remarks by management, there

will be a question-and-answer session open to analysts and

investors.Participants can join by conference call dial-in or

webcast:Conference Call Dial-In

- Participants can dial in to the conference call; however,

pre-registration is required

- To register, visit https://bit.ly/Q42024_Dialin

- Once registered, an email will be sent, including dial-in

details and a unique access code required to join the live

call

- Please ensure you have registered at least 15 minutes prior to

the conference call start time

Webcast

- A live webcast of the conference call can be accessed at Taseko

Mines | Events

- The webcast will be archived for later playback until March 13,

2025 at Taseko Mines | Events

|

For further information on Taseko, please see

the Company's website at www.tasekomines.com or contact:

Brian Bergot, Vice President, Investor Relations

– 778-373-4554, toll free 1-800-667-2114

Stuart McDonaldPresident & CEO

No regulatory authority has approved or

disapproved of the information in this news release.

Non-GAAP Performance

Measures

This document includes certain non-GAAP

performance measures that do not have a standardized meaning

prescribed by IFRS. These measures may differ from those used by,

and may not be comparable to such measures as reported by, other

issuers. The Company believes that these measures are commonly used

by certain investors, in conjunction with conventional IFRS

measures, to enhance their understanding of the Company’s

performance. These measures have been derived from the Company’s

financial statements and applied on a consistent basis. The

following tables below provide a reconciliation of these non-GAAP

measures to the most directly comparable IFRS Accounting Standards

measure.

Total operating costs and site operating costs,

net of by-product credits

Total costs of sales include all costs absorbed

into inventory, as well as transportation costs and insurance

recoverable. Site operating costs are calculated by removing net

changes in inventory, depletion and amortization, insurance

recoverable, and transportation costs from cost of sales. Site

operating costs, net of by-product credits is calculated by

subtracting by-product credits from the site operating costs. Site

operating costs, net of by-product credits per pound are calculated

by dividing the aggregate of the applicable costs by copper pounds

produced. Total operating costs per pound is the sum of site

operating costs, net of by-product credits and off-property costs

divided by the copper pounds produced. By-product credits are

calculated based on actual sales of molybdenum (net of treatment

costs) and silver during the period divided by the total pounds of

copper produced during the period. These measures are calculated on

a consistent basis for the periods presented.

|

(Cdn$ in thousands, unless otherwise indicated) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q11 |

2024YE1 |

|

Cost of sales |

134,940 |

|

124,833 |

|

108,637 |

|

122,528 |

|

490,938 |

|

|

Less: |

|

|

|

|

|

|

Depletion and amortization |

(24,641 |

) |

(20,466 |

) |

(13,721 |

) |

(15,024 |

) |

(73,852 |

) |

|

Net change in inventories of finished goods |

4,064 |

|

2,938 |

|

(10,462 |

) |

(20,392 |

) |

(23,852 |

) |

|

Net change in inventories of ore stockpiles |

(3,698 |

) |

9,089 |

|

1,758 |

|

2,719 |

|

9,868 |

|

|

Transportation costs |

(10,170 |

) |

(8,682 |

) |

(6,408 |

) |

(10,153 |

) |

(35,413 |

) |

|

Site operating costs |

100,495 |

|

107,712 |

|

79,804 |

|

79,678 |

|

367,689 |

|

|

Less by-product credits: |

|

|

|

|

|

|

Molybdenum, net of treatment costs |

(16,507 |

) |

(8,962 |

) |

(7,071 |

) |

(6,112 |

) |

(38,652 |

) |

|

Silver, excluding amortization of deferred revenue |

(139 |

) |

(241 |

) |

(144 |

) |

(137 |

) |

(661 |

) |

|

Site operating costs, net of by-product credits |

83,849 |

|

98,509 |

|

72,589 |

|

73,429 |

|

328,376 |

|

|

Total copper produced (thousand pounds) |

28,595 |

|

27,101 |

|

20,225 |

|

26,694 |

|

102,615 |

|

|

Total costs per pound produced |

2.94 |

|

3.63 |

|

3.59 |

|

2.75 |

|

3.20 |

|

|

Average exchange rate for the period (CAD/USD) |

1.40 |

|

1.36 |

|

1.37 |

|

1.35 |

|

1.37 |

|

|

Site operating costs, net of by-product credits(US$ per pound) |

2.10 |

|

2.66 |

|

2.62 |

|

2.04 |

|

2.33 |

|

|

Site operating costs, net of by-product credits |

83,849 |

|

98,509 |

|

72,589 |

|

73,429 |

|

328,376 |

|

|

Add off-property costs: |

|

|

|

|

|

|

Treatment and refining costs |

2,435 |

|

816 |

|

3,941 |

|

4,816 |

|

12,008 |

|

|

Transportation costs |

10,170 |

|

8,682 |

|

6,408 |

|

10,153 |

|

35,413 |

|

|

Total operating costs |

96,454 |

|

108,007 |

|

82,938 |

|

88,398 |

|

375,797 |

|

|

Total operating costs (C1) (US$ per pound) |

2.42 |

|

2.92 |

|

2.99 |

|

2.46 |

|

2.66 |

|

1 Q1 2024 includes the impact from the March 25,

2024 acquisition of Cariboo from Dowa and Furukawa, which increased

the Company’s Gibraltar mine ownership from 87.5% to 100%.

Non-GAAP Performance Measures -

Continued

Total operating costs and site operating costs,

net of by-product credits (Continued)

|

(Cdn$ in thousands, unless otherwise indicated) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q11 |

2023YE1 |

|

Cost of sales |

93,914 |

|

94,383 |

|

99,854 |

|

86,407 |

|

374,558 |

|

|

Less: |

|

|

|

|

|

|

Depletion and amortization |

(13,326 |

) |

(15,993 |

) |

(15,594 |

) |

(12,027 |

) |

(56,940 |

) |

|

Net change in inventories of finished goods |

(1,678 |

) |

4,267 |

|

3,356 |

|

(399 |

) |

5,546 |

|

|

Net change in inventories of ore stockpiles |

(3,771 |

) |

12,172 |

|

2,724 |

|

5,561 |

|

16,686 |

|

|

Transportation costs |

(10,294 |

) |

(7,681 |

) |

(6,966 |

) |

(5,104 |

) |

(30,045 |

) |

|

Site operating costs |

64,845 |

|

87,148 |

|

83,374 |

|

74,438 |

|

309,805 |

|

|

Oxide ore stockpile reclassification from capitalized

stripping |

- |

|

- |

|

(3,183 |

) |

3,183 |

|

- |

|

|

Less by-product credits: |

|

|

|

|

|

|

Molybdenum, net of treatment costs |

(5,441 |

) |

(9,900 |

) |

(4,018 |

) |

(9,208 |

) |

(28,567 |

) |

|

Silver, excluding amortization of deferred revenue |

124 |

|

290 |

|

(103 |

) |

(160 |

) |

151 |

|

|

Site operating costs, net of by-product credits |

59,528 |

|

77,538 |

|

76,070 |

|

68,253 |

|

281,389 |

|

|

Total copper produced (thousand pounds) |

29,883 |

|

30,978 |

|

24,640 |

|

19,491 |

|

104,992 |

|

|

Total costs per pound produced |

1.99 |

|

2.50 |

|

3.09 |

|

3.50 |

|

2.68 |

|

|

Average exchange rate for the period (CAD/USD) |

1.36 |

|

1.34 |

|

1.34 |

|

1.35 |

|

1.35 |

|

|

Site operating costs, net of by-product credits(US$ per pound) |

1.46 |

|

1.87 |

|

2.30 |

|

2.59 |

|

1.99 |

|

|

Site operating costs, net of by-product credits |

59,528 |

|

77,538 |

|

76,070 |

|

68,253 |

|

281,389 |

|

|

Add off-property costs: |

|

|

|

|

|

|

Treatment and refining costs |

7,885 |

|

6,123 |

|

4,986 |

|

4,142 |

|

23,136 |

|

|

Transportation costs |

10,294 |

|

7,681 |

|

6,966 |

|

5,104 |

|

30,045 |

|

|

Total operating costs |

77,707 |

|

91,342 |

|

88,022 |

|

77,499 |

|

334,570 |

|

|

Total operating costs (C1) (US$ per pound) |

1.91 |

|

2.20 |

|

2.66 |

|

2.94 |

|

2.37 |

|

1 Q1 2023 includes the impact from the March 15,

2023 acquisition of Cariboo from Sojitz, which increased the

Company’s Gibraltar mine ownership from 75% to 87.5%.

Non-GAAP Performance Measures -

Continued

Total Site Costs

Total site costs are comprised of the site

operating costs charged to cost of sales as well as mining costs

capitalized to property, plant and equipment in the period. This

measure is intended to capture Taseko’s share of the total site

operating costs incurred in the quarter at Gibraltar calculated on

a consistent basis for the periods presented.

|

(Cdn$ in thousands, unless otherwise indicated) –100% basis (except

for Q1 2024) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q11 |

2024YE1 |

|

Site operating costs |

100,495 |

107,712 |

79,804 |

79,678 |

367,689 |

|

Add: |

|

|

|

|

|

|

Capitalized stripping costs |

1,981 |

3,631 |

10,732 |

16,152 |

32,496 |

|

Total site costs – Taseko share |

102,476 |

111,343 |

90,536 |

95,830 |

400,185 |

|

Total site costs – 100% basis |

102,476 |

111,343 |

90,536 |

109,520 |

413,875 |

1 Q1 2024 includes the impact from the March 25,

2024 acquisition of Cariboo from Dowa and Furukawa, which increased

the Company’s Gibraltar mine ownership from 87.5% to 100%.

|

(Cdn$ in thousands, unless otherwise indicated) –87.5% basis

(except for Q1 2023) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q11 |

2023YE1 |

|

Site operating costs |

64,845 |

87,148 |

83,374 |

74,438 |

309,805 |

|

Add: |

|

|

|

|

|

|

Capitalized stripping costs |

31,916 |

2,083 |

8,832 |

12,721 |

55,552 |

|

Total site costs – Taseko share |

96,761 |

89,231 |

92,206 |

87,159 |

365,357 |

|

Total site costs – 100% basis |

110,584 |

101,978 |

105,378 |

112,799 |

430,739 |

1 Q1 2023 includes the impact from the March 15,

2023 acquisition of Cariboo from Sojitz, which increased the

Company’s Gibraltar mine ownership from 75% to 87.5%.

Non-GAAP Performance Measures -

Continued

Adjusted net income (loss) and Adjusted EPS

Adjusted net income (loss) removes the effect of

the following transactions from net income as reported under

IFRS:

- Unrealized foreign currency

gains/losses;

- Unrealized gain/loss on

derivatives;

- Other operating costs;

- Call premium on settlement of

debt;

- Loss on settlement of long-term

debt, net of capitalized interest;

- Bargain purchase gains on Cariboo

acquisition;

- Gain on acquisition of control of

Gibraltar;

- Realized gain on sale of finished

goods inventory;

- Inventory write-ups to net

realizable value that was sold or processed;

- Accretion and fair value adjustment

on Florence royalty obligation; and

- Finance and other non-recurring

costs for Cariboo acquisition.

Management believes these transactions do not

reflect the underlying operating performance of our core mining

business and are not necessarily indicative of future operating

results. Furthermore, unrealized gains/losses on derivative

instruments, changes in the fair value of financial instruments,

and unrealized foreign currency gains/losses are not necessarily

reflective of the underlying operating results for the reporting

periods presented.

Adjusted EPS is the Adjusted net income (loss)

attributable to common shareholders of the Company divided by the

weighted average number of common shares outstanding during the

period.

Non-GAAP Performance Measures -

Continued

Adjusted net income (loss) and Adjusted EPS (Continued)

|

(Cdn$ in thousands, except per share amounts) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q1 |

2024YE |

|

Net (loss) income |

(21,207 |

) |

(180 |

) |

(10,953 |

) |

18,896 |

|

(13,444 |

) |

|

Unrealized foreign exchange loss (gain) |

40,462 |

|

(7,259 |

) |

5,408 |

|

13,688 |

|

52,299 |

|

|

Unrealized (gain) loss on derivatives |

(25,514 |

) |

1,821 |

|

10,033 |

|

3,519 |

|

(10,141 |

) |

|

Other operating costs1 |

4,132 |

|

4,098 |

|

10,435 |

|

- |

|

18,665 |

|

|

Call premium on settlement of debt |

- |

|

- |

|

9,571 |

|

- |

|

9,571 |

|

|

Loss on settlement of long term debt, net ofcapitalized

interest |

- |

|

- |

|

2,904 |

|

- |

|

2,904 |

|

|

Gain on Cariboo acquisition |

- |

|

- |

|

- |

|

(47,426 |

) |

(47,426 |

) |

|

Gain on acquisition of control of Gibraltar2 |

- |

|

- |

|

- |

|

(14,982 |

) |

(14,982 |

) |

|

Realized gain on sale of inventory3 |

- |

|

- |

|

3,768 |

|

13,354 |

|

17,122 |

|

|

Inventory write-ups to net realizable value that wassold or

processed4 |

1,905 |

|

3,266 |

|

4,056 |

|

- |

|

9,227 |

|

|

Accretion and fair value adjustment on Florenceroyalty

obligation |

3,682 |

|

3,703 |

|

2,132 |

|

3,416 |

|

12,933 |

|

|

Accretion and fair value adjustment on considerationpayable to

Cariboo |

4,543 |

|

9,423 |

|

8,399 |

|

1,555 |

|

23,920 |

|

|

Non-recurring other expenses for Cariboo adjustment |

- |

|

- |

|

394 |

|

138 |

|

532 |

|

|

Estimated tax effect of adjustments |

2,465 |

|

(6,644 |

) |

(15,644 |

) |

15,570 |

|

(4,253 |

) |

|

Adjusted net income |

10,468 |

|

8,228 |

|

30,503 |

|

7,728 |

|

56,927 |

|

|

Adjusted EPS |

0.03 |

|

0.03 |

|

0.10 |

|

0.03 |

|

0.19 |

|

1 Other operating costs relates to the in-pit

crusher relocation project and care and maintenance costs due to

the June 2024 labour strike.

2 The $15.0 million gain on acquisition of

control of Gibraltar in Q1 2024 relates to the write-up of finished

copper concentrate inventory for Taseko’s 87.5% share to its fair

value at March 25, 2024.

3 Cost of sales for the year ended December 31,

2024 included $17.1 million in write-ups to net realizable value

for concentrate inventory held at the date of acquisition of

control of Gibraltar (March 25, 2024) that were subsequently sold.

The realized portion of the gains recorded in the first quarter for

GAAP purposes was $13.4 million and for the second quarter were

$3.8 million and have been included in Adjusted net income in the

period they were sold.

4 Write-ups to net realizable value for

inventory held at the date of acquisition of control of Gibraltar

(March 25, 2024) totaled $9.2 million. The inventory write-ups in

the first quarter for GAAP purposes have been included in Adjusted

net income in the period they were sold or processed. Cost of sales

for the year ended December 31, 2024 included $9.2 million in

inventory write-ups that were subsequently sold or processed

between the second and fourth quarter.

Non-GAAP Performance Measures -

Continued

|

(Cdn$ in thousands, except per share amounts) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q1 |

2023YE |

|

Net income |

38,076 |

871 |

9,991 |

33,788 |

82,726 |

|

Unrealized foreign exchange (gain) loss |

(14,541) |

14,582 |

(10,966) |

(950) |

(11,875) |

|

Unrealized loss (gain) on derivatives |

1,636 |

4,518 |

(6,470) |

2,190 |

1,874 |

|

Gain on Cariboo acquisition |

- |

- |

- |

(46,212) |

(46,212) |

|

Finance and other non-recurring costs |

(916) |

1,244 |

1,714 |

- |

2,042 |

|

Estimated tax effect of adjustments |

(194) |

(1,556) |

1,355 |

16,271 |

15,876 |

|

Adjusted net income (loss) |

24,061 |

19,659 |

(4,376) |

5,087 |

44,431 |

|

Adjusted EPS |

0.08 |

0.07 |

(0.02) |

0.02 |

0.15 |

Adjusted EBITDA

Adjusted EBITDA is presented as a supplemental

measure of the Company’s performance and ability to service debt.

Adjusted EBITDA is frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in the industry, many of which present Adjusted EBITDA

when reporting their results. Issuers of “high yield” securities

also present Adjusted EBITDA because investors, analysts and rating

agencies consider it useful in measuring the ability of those

issuers to meet debt service obligations.

Adjusted EBITDA represents net income before

interest, income taxes, and depreciation and also eliminates the

impact of a number of items that are not considered indicative of

ongoing operating performance. Certain items of expense are added

and certain items of income are deducted from net income that are

not likely to recur or are not indicative of the Company’s

underlying operating results for the reporting periods presented or

for future operating performance and consist of:

- Unrealized foreign exchange

gains/losses;

- Unrealized gain/loss on

derivatives;

- Amortization of share-based

compensation expense;

- Other operating costs;

- Call premium on settlement of

debt;

- Loss on settlement of long-term

debt;

- Bargain purchase gains on Cariboo

acquisition;

- Gain on acquisition of control of

Gibraltar;

- Realized gain on sale of finished

goods inventory;

- Inventory write-ups to net

realizable value that was sold or processed; and

- Finance and other non-recurring

costs for Cariboo acquisition.

Non-GAAP Performance Measures -

Continued

Adjusted EBITDA (Continued)

|

(Cdn$ in thousands) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q1 |

2024YE |

|

Net (loss) income |

(21,207 |

) |

(180 |

) |

(10,953 |

) |

18,896 |

|

(13,444 |

) |

|

Add: |

|

|

|

|

|

|

Depletion and amortization |

24,641 |

|

20,466 |

|

13,721 |

|

15,024 |

|

73,852 |

|

|

Finance and accretion expense |

21,473 |

|

25,685 |

|

21,271 |

|

19,849 |

|

88,278 |

|

|

Finance income |

(1,674 |

) |

(1,504 |

) |

(911 |

) |

(1,086 |

) |

(5,175 |

) |

|

Income tax expense (recovery) |

11,707 |

|

(200 |

) |

(3,247 |

) |

23,282 |

|

31,542 |

|

|

Unrealized foreign exchange loss (gain) |

40,462 |

|

(7,259 |

) |

5,408 |

|

13,688 |

|

52,299 |

|

|

Unrealized (gain) loss on derivatives |

(25,514 |

) |

1,821 |

|

10,033 |

|

3,519 |

|

(10,141 |

) |

|

Amortization of share-based compensation(recovery) expense |

(323 |

) |

1,496 |

|

2,585 |

|

5,667 |

|

9,425 |

|

|

Other operating costs |

4,132 |

|

4,098 |

|

10,435 |

|

- |

|

18,665 |

|

|

Call premium on settlement of debt |

- |

|

- |

|

9,571 |

|

- |

|

9,571 |

|

|

Loss on settlement of long-term debt |

- |

|

- |

|

4,646 |

|

- |

|

4,646 |

|

|

Gain on Cariboo acquisition |

- |

|

- |

|

- |

|

(47,426 |

) |

(47,426 |

) |

|

Gain on acquisition of control of Gibraltar1 |

- |

|

- |

|

- |

|

(14,982 |

) |

(14,982 |

) |

|

Realized gain on sale of inventory2 |

- |

|

- |

|

3,768 |

|

13,354 |

|

17,122 |

|

|

Inventory write-ups to net realizable value that wassold or

processed3 |

1,905 |

|

3,266 |

|

4,056 |

|

- |

|

9,227 |

|

|

Non-recurring other expenses for Caribooacquisition |

- |

|

- |

|

394 |

|

138 |

|

532 |

|

|

Adjusted EBITDA |

55,602 |

|

47,689 |

|

70,777 |

|

49,923 |

|

223,991 |

|

1 The $15.0 million gain on acquisition of

control of Gibraltar in Q1 2024 relates to the write-up of finished

copper concentrate inventory for Taseko’s 87.5% share to its fair

value at March 25, 2024.

2 Cost of sales for the year ended December 31,

2024 included $17.1 million in write-ups to net realizable value

for concentrate inventory held at the date of acquisition of

control of Gibraltar (March 25, 2024) that were subsequently sold.

The realized portion of the gains recorded in the first quarter for

GAAP purposes was $13.4 million and for the second quarter were

$3.8 million and have been included in Adjusted net income in the

period they were sold.

3 Write-ups to net realizable value for

inventory held at the date of acquisition of control of Gibraltar

(March 25, 2024) totaled $9.2 million. The inventory write-ups in

the first quarter for GAAP purposes have been included in Adjusted

net income in the period they were sold or processed. Cost of sales

for the year ended December 31, 2024 included $9.2 million in

inventory write-ups that were subsequently between the second and

fourth quarter.

Non-GAAP Performance Measures -

Continued

Adjusted EBITDA (Continued)

|

(Cdn$ in thousands) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q1 |

2023YE |

|

Net income |

38,076 |

|

871 |

|

9,991 |

|

33,788 |

|

82,726 |

|

| Add: |

|

|

|

|

|

| Depletion and

amortization |

13,326 |

|

15,993 |

|

15,594 |

|

12,027 |

|

56,940 |

|

| Finance and accretion

expense |

12,804 |

|

14,285 |

|

13,468 |

|

12,309 |

|

52,866 |

|

| Finance income |

(972 |

) |

(322 |

) |

(757 |

) |

(921 |

) |

(2,972 |

) |

| Income tax expense |

17,205 |

|

12,041 |

|

678 |

|

20,219 |

|

50,143 |

|

| Unrealized foreign exchange

(gain) loss |

(14,541 |

) |

14,582 |

|

(10,966 |

) |

(950 |

) |

(11,875 |

) |

| Unrealized loss (gain) on

derivatives |

1,636 |

|

4,518 |

|

(6,470 |

) |

2,190 |

|

1,874 |

|

| Amortization of share-based

compensation expense |

1,573 |

|

727 |

|

417 |

|

3,609 |

|

6,326 |

|

| Gain on Cariboo

acquisition |

- |

|

- |

|

- |

|

(46,212 |

) |

(46,212 |

) |

|

Non-recurring other expenses for Cariboo acquisition |

- |

|

- |

|

263 |

|

- |

|

263 |

|

|

Adjusted EBITDA |

69,107 |

|

62,695 |

|

22,218 |

|

36,059 |

|

190,079 |

|

Non-GAAP Performance Measures -

Continued

Earnings from mining operations before

depletion, amortization, and non-recurring items

Earnings from mining operations before

depletion, amortization, and non-recurring items is earnings from

mining operations with depletion and amortization, and any items

that are not considered indicative of ongoing operating performance

added back. The Company discloses this measure, which has been

derived from our financial statements and applied on a consistent

basis, to assist in understanding the results of the Company’s

operations and financial position and it is meant to provide

further information about the financial results to investors.

|

(Cdn$ in thousands) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q1 |

2024YE |

|

Earnings from mining operations |

28,727 |

26,686 |

44,948 |

24,419 |

124,780 |

|

Add: |

|

|

|

|

|

|

Depletion and amortization |

24,641 |

20,466 |

13,721 |

15,024 |

73,852 |

|

Realized gain on sale of inventory1 |

- |

- |

3,768 |

13,354 |

17,122 |

|

Inventory write-ups to net realizable value thatwas sold or

processed2 |

1,905 |

3,266 |

4,056 |

- |

9,227 |

|

Other operating costs3 |

4,132 |

4,098 |

10,435 |

- |

18,665 |

|

Earnings from mining operations before depletion,

amortization, and non-recurring items |

59,405 |

54,516 |

76,928 |

52,797 |

243,646 |

1 Cost of sales for the year ended December 31,

2024 included $17.1 million in write-ups to net realizable value

for concentrate inventory held at the date of acquisition of

control of Gibraltar (March 25, 2024) that were subsequently sold.

The realized portion of the gains recorded in the first quarter for

GAAP purposes was $13.4 million and for the second quarter were

$3.8 million and have been included in Adjusted net income in the

period they were sold.

2 Write-ups to net realizable value for

inventory held at the date of acquisition of control of Gibraltar

(March 25, 2024) totaled $9.2 million. The inventory write-ups in

the first quarter for GAAP purposes have been included in Adjusted

net income in the period they were sold or processed. Cost of sales

for the year ended December 31, 2024 included $9.2 million in

inventory write-ups that were subsequently sold or processed in the

second and third quarters.

3 Other operating costs relates to the in-pit

crusher relocation project and care and maintenance costs due to

the June 2024 labour strike.

During the year ended December 31, 2024, the

realized gain on sale of inventory and inventory write-ups to net

realizable value that was sold or processed, relates to inventory

held at the date of acquisition of control of Gibraltar (March 25,

2024) that was written-up from book value to net realizable value

and subsequently sold or processed.

|

(Cdn$ in thousands) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q1 |

2023YE |

|

Earnings from mining operations |

59,780 |

49,452 |

12,070 |

29,112 |

150,414 |

|

Add: |

|

|

|

|

|

|

Depletion and amortization |

13,326 |

15,993 |

15,594 |

12,027 |

56,940 |

|

Earnings from mining operations before

depletionand amortization |

73,106 |

65,445 |

27,664 |

41,139 |

207,354 |

Non-GAAP Performance Measures -

Continued

Site operating costs per ton milled

The Company discloses this measure, which has

been derived from our financial statements and applied on a

consistent basis, to provide assistance in understanding the

Company’s site operations on a tons milled basis.

|

(Cdn$ in thousands, except per ton milled amounts) |

2024Q4 |

2024Q3 |

2024Q2 |

2024Q11 |

2024YE1 |

|

Site operating costs (included in cost

ofsales) – Taseko share |

|

100,495 |

|

107,712 |

|

79,804 |

|

79,678 |

|

367,689 |

|

Site operating costs – 100% basis |

|

100,495 |

|

107,712 |

|

79,804 |

|

90,040 |

|

378,050 |

|

Tons milled (thousands) |

|

8,250 |

|

7,572 |

|

5,728 |

|

7,677 |

|

29,227 |

|

Site operating costs per ton milled |

$12.18 |

$14.23 |

$13.93 |

$11.73 |

$12.93 |

1 Q1 2024 includes the impact from the March 25,

2024 acquisition of Cariboo from Dowa and Furukawa, which increased

the Company’s Gibraltar ownership from 87.5% to 100%.

|

(Cdn$ in thousands, except per ton milled amounts) |

2023Q4 |

2023Q3 |

2023Q2 |

2023Q11 |

2023YE1 |

|

Site operating costs (included in cost

ofsales) – Taseko share |

|

64,845 |

|

87,148 |

|

83,374 |

|

74,438 |

|

309,805 |

|

Site operating costs – 100% basis |

|

74,109 |

|

99,598 |

|

95,285 |

|

95,838 |

|

364,830 |

|

Tons milled (thousands) |

|

7,626 |

|

8,041 |

|

7,234 |

|

7,093 |

|

29,994 |

|

Site operating costs per ton milled |

$9.72 |

$12.39 |

$13.17 |

$13.54 |

$12.16 |

1 Q1 2023 includes the impact from the March 15,

2023 acquisition of Cariboo from Sojitz, which increased the

Company’s Gibraltar mine ownership from 75% to 87.5%.

Technical Information

The technical information contained in this

MD&A related to the Florence Copper Project is based upon the

report entitled: “NI 43-101 Technical Report – Florence Copper

Project, Pinal County, Arizona” issued March 30, 2023 with an

effective date of March 15, 2023 which is available on SEDAR+. The

Florence Copper Project Technical Report was prepared under the

supervision of Richard Tremblay, P.Eng., MBA, Richard Weymark,

P.Eng., MBA, and Robert Rotzinger, P.Eng. Mr. Tremblay is employed

by the Company as Chief Operating Officer, Mr. Weymark is Vice

President Engineering, and Robert Rotzinger is Vice President

Capital Projects. All three are Qualified Persons as defined by NI

43–101.

Caution Regarding Forward-Looking

Information

This document contains “forward-looking

statements” that were based on Taseko’s expectations, estimates and

projections as of the dates as of which those statements were made.

Generally, these forward-looking statements can be identified by

the use of forward-looking terminology such as “outlook”,

“anticipate”, “project”, “target”, “believe”, “estimate”, “expect”,

“intend”, “should” and similar expressions.

Forward-looking statements are subject to known

and unknown risks, uncertainties and other factors that may cause

the Company’s actual results, level of activity, performance or

achievements to be materially different from those expressed or

implied by such forward-looking statements. These included but are

not limited to:

- uncertainties about the effect of

COVID-19 and the response of local, provincial, federal and

international governments to the threat of COVID-19 on our

operations (including our suppliers, customers, supply chain,

employees and contractors) and economic conditions generally and in

particular with respect to the demand for copper and other metals

we produce;

- uncertainties and costs related to

the Company’s exploration and development activities, such as those

associated with continuity of mineralization or determining whether

mineral resources or reserves exist on a property;

- uncertainties related to the

accuracy of our estimates of mineral reserves, mineral resources,

production rates and timing of production, future production and

future cash and total costs of production and milling;

- uncertainties related to

feasibility studies that provide estimates of expected or

anticipated costs, expenditures and economic returns from a mining

project;

- uncertainties related to the

ability to obtain necessary licenses permits for development

projects and project delays due to third party opposition;

- uncertainties related to unexpected

judicial or regulatory proceedings;

- changes in, and the effects of, the

laws, regulations and government policies affecting our exploration

and development activities and mining operations, particularly

laws, regulations and policies;

- changes in general economic

conditions, the financial markets and in the demand and market

price for copper, gold and other minerals and commodities, such as

diesel fuel, steel, concrete, electricity and other forms of

energy, mining equipment, and fluctuations in exchange rates,

particularly with respect to the value of the U.S. dollar and

Canadian dollar, and the continued availability of capital and

financing;

- the effects of forward selling

instruments to protect against fluctuations in copper prices and

exchange rate movements and the risks of counterparty defaults, and

mark to market risk;

- the risk of inadequate insurance or

inability to obtain insurance to cover mining risks;

- the risk of loss of key employees;

the risk of changes in accounting policies and methods we use to

report our financial condition, including uncertainties associated

with critical accounting assumptions and estimates;

- environmental issues and

liabilities associated with mining including processing and stock

piling ore; and

- labour strikes, work stoppages, or

other interruptions to, or difficulties in, the employment of

labour in markets in which we operate mines, or environmental

hazards, industrial accidents or other events or occurrences,

including third party interference that interrupt the production of

minerals in our mines.

For further information on Taseko, investors

should review the Company’s annual Form 40-F filing with the United

States Securities and Exchange Commission www.sec.gov and home

jurisdiction filings that are available at www.sedarplus.com.

Cautionary Statement on Forward-Looking

Information

This discussion includes certain statements that

may be deemed "forward-looking statements". All statements in this

discussion, other than statements of historical facts, that address

future production, reserve potential, exploration drilling,

exploitation activities, and events or developments that the

Company expects are forward-looking statements. Although we believe

the expectations expressed in such forward-looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include market prices, exploitation and

exploration successes, continued availability of capital and

financing and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

All of the forward-looking statements made in this MD&A are

qualified by these cautionary statements. We disclaim any intention

or obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except to the extent required by applicable law. Further

information concerning risks and uncertainties associated with

these forward-looking statements and our business may be found in

our most recent Form 40-F/Annual Information Form on file with the

SEC and Canadian provincial securities regulatory authorities.

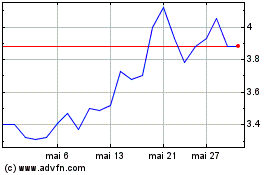

Taseko Mines (TSX:TKO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Taseko Mines (TSX:TKO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025