Sienna Senior Living Inc. (“

Sienna” or the

“

Company”) (TSX:SIA) announced today the launch of

a $125 million equity offering, on a bought deal basis.

Sienna has entered into an agreement with a

syndicate of underwriters (the “Underwriters”) led

by TD Securities Inc., as sole bookrunner, under which the

Underwriters have agreed to buy, on a bought deal

basis, 7,920,000 common shares of the Company (the

“Common Shares”) at a price of $15.80 per

Common Share (the “Offering Price”) for total

gross proceeds of approximately $125 million (the

“Offering”). The Company has also granted the

Underwriters an over-allotment option to purchase up to an

additional 1,188,000 Common Shares at the Offering Price,

exercisable in whole or in part, for a period of 30 days following

closing of the Offering (the “Over-Allotment

Option”). If the Over-Allotment Option is exercised in

full, the gross proceeds to the Company will be approximately $144

million.

Sienna intends to use the net proceeds of the

Offering, together with any net proceeds from the Over-Allotment

Option, (i) to fund the Company’s previously announced acquisitions

of Wildpine Residence, a 165-suite retirement residence in the

Ottawa suburb of Stittsville, and Cawthra Gardens, a 192-bed Class

A long-term care home in Mississauga, Ontario (collectively, the

“Acquisitions”); and (ii) for general corporate

purposes, which include financing strategic growth initiatives such

as future acquisition opportunities.

Wildpine Residence is a 165-suite retirement

residence in Stittsville, Ontario, offering modern independent

living and assisted living options with stabilized occupancy. The

Company has agreed to acquire Wildpine Residence for a purchase

price of approximately $48.0 million. The Company expects to

partially fund the acquisition through the assumption of

approximately $25.0 million of Canada Mortgage and Housing

Corporation insured debt, with the remainder funded through the net

proceeds of the Offering. Sienna is acquiring this property at a

capitalization rate of 6.25%. Cawthra Gardens is a 192-bed Class A

long-term care home in Mississauga, Ontario. Built in 2003, the

home offers modern amenities for residents to enjoy, as well as the

option for private and semi-private suites. The Company has agreed

to acquire Cawthra Gardens for a purchase price of approximately

$32.6 million. Cawthra Gardens is expected to be funded through the

net proceeds of the Offering. Sienna is acquiring this property at

a capitalization rate of 6.75%. The Acquisitions will be completed

at a significant discount to replacement cost and are expected to

be immediately accretive to Sienna’s AFFO per share.

The remaining net proceeds of the Offering,

together with any net proceeds from the Over-Allotment Option, will

also provide Sienna with enhanced balance sheet flexibility as it

continues to evaluate attractive acquisition opportunities in its

target markets that fit strategically with its stated growth

objectives. Sienna remains committed to its prudent capital

allocation approach of investing in strategic growth projects that

are accretive to AFFO per share. Sienna currently has a meaningful

acquisition pipeline with multiple properties currently in various

stages of negotiation under non-binding letters of intent.

Completion of the Acquisitions are subject to

customary closing conditions for transactions of this nature,

including the receipt of all necessary regulatory approvals,

including approvals from the Ontario Retirement Homes Regulatory

Authority and the Ontario Ministry of Long-Term Care. Future

acquisition opportunities, including Sienna's acquisition pipeline,

are subject to ongoing review and change.

The Common Shares will be issued pursuant to a

prospectus supplement that will be filed by no later than February

24, 2025 (the “Prospectus Supplement”) with the securities

regulatory authorities in all provinces and territories of Canada

under the Company's short form base shelf prospectus dated November

29, 2024 (the “Base Shelf Prospectus”). The Offering is expected to

close on or about February 27, 2025, subject to customary

regulatory approvals, including the approval of the Toronto Stock

Exchange.

The securities offered have not and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of

such Act. This news release shall not constitute an offer to sell

or the solicitation of an offer to buy the securities in any

jurisdiction.

Delivery of the Base Shelf Prospectus, the

Prospectus Supplement and any amendments to the documents will be

provided in accordance with securities legislation relating to

procedures for providing access to a base shelf prospectus, a shelf

prospectus supplement and any amendment. The Base Shelf Prospectus

is, and the Prospectus Supplement will be (within two business days

of the date hereof), accessible on SEDAR+ at www.sedarplus.com. An

electronic or paper copy of the Prospectus Supplement, the

corresponding Base Shelf Prospectus and any amendment to the

documents may be obtained without charge, from TD Securities Inc.

at 1625 Tech Avenue, Mississauga, Ontario, L4W 5P5 Attention:

Symcor, NPM, or by telephone at (289) 360-2009 or by email at

sdcconfirms@td.com by providing the contact with an email address

or address, as applicable. The Base Shelf Prospectus and Prospectus

Supplement contain important, detailed information about the

Company and the proposed Offering. Prospective investors should

read the Base Shelf Prospectus and the Prospectus Supplement (when

filed) in their entirety before making an investment decision.

ABOUT SIENNA SENIOR LIVING

Sienna Senior Living Inc. (TSX:SIA) offers a

full range of senior living options, including independent living,

assisted living and memory care under its Aspira retirement brand,

long-term care, and specialized programs and services. Sienna’s

approximately 13,500 employees are passionate about cultivating

happiness in daily life. For more information, please visit

www.siennaliving.ca.

FORWARD-LOOKING STATEMENTS

Certain of the statements contained in this news

release are forward-looking statements and are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future. Readers are

cautioned that such statements may not be appropriate for other

purposes. These statements generally use forward-looking words,

such as “anticipate”, “continue”, “could”, “expect”, “may”, “will”,

“estimate”, “believe”, “goals” or other similar words.

Forward-looking statements in this press release include, but are

not limited to, the expected closing date of the Offering and the

intended use of net proceeds from the Offering together with any

net proceeds from the Over-Allotment Option, the successful closing

of the Acquisitions, the expected benefits of the Acquisitions to

Sienna, including that the Acquisitions are expected to be

accretive to the Company’s AFFO, the financing of the Acquisitions

through the assumption of existing debt and potential future

acquisitions, including from Sienna’s existing pipeline, and are

subject to, and expressly qualified by, the cautionary disclaimers

that are set out in Sienna’s regulatory filings.

These forward-looking statements are subject to

significant known and unknown risks and uncertainties that may

cause actual results or events to differ materially from those

expressed or implied by such statements and, accordingly, should

not be read as guarantees of future performance or results and will

not necessarily be accurate indications of whether or not such

results will be achieved. The forward-looking statements in this

news release are based on information currently available and what

management currently believes are reasonable assumptions. The

Company does not undertake any obligation to publicly update or

revise any forward-looking statements except as may be required by

applicable law.

NON-GAAP MEASURES

Certain terms used in this news release, such as

AFFO per share, are not measures defined under IFRS@ Accounting

Standards as issued by the International Accounting Standards Board

(“IFRS Accounting Standards”) and do not have standardized meanings

prescribed by IFRS Accounting Standards. AFFO should not be

construed as an alternative to “net income” or “cash flow from

operating activities” determined in accordance with IFRS Accounting

Standards as indicators of the Company’s performance. The Company’s

method of calculating AFFO may differ from other issuers’ methods

and accordingly, these measures may not be comparable to measures

used by other issuers. The Company believes AFFO is a relevant

measure of its ability to earn cash and pay dividends on its Common

Shares. The definitions of these non-GAAP measures and an example

of the reconciliation of AFFO to the most directly comparable IFRS

measure are provided on page 51 of the Company’s management’s

discussion and analysis for the year ended December 31, 2024, which

is available on SEDAR+ (www.sedarplus.ca).

FOR FURTHER INFORMATION, PLEASE

CONTACT:

David HungChief Financial Officer & Executive Vice

President, Investments(905) 489-0258david.hung@siennaliving.ca

Nancy WebbExecutive Vice President, Corporate Affairs and

Marketing(905) 489-0788nancy.webb@siennaliving.ca

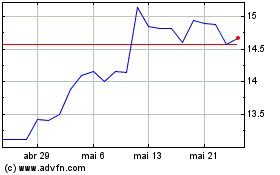

Sienna Senior Living (TSX:SIA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Sienna Senior Living (TSX:SIA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025