SINTX Technologies Announces $5 Million Private Placement Priced At-the-Market under Nasdaq Rules

26 Fevereiro 2025 - 10:00AM

SINTX Technologies, Inc., (“SINTX” or the “Company”) (Nasdaq:

SINT), a leader in advanced ceramics for medical applications,

today announced that it has, pursuant to a securities purchase

agreement with institutional and accredited investors dated

February 20, 2025, issued and sold 1,449,287 shares of common stock

(or pre-funded warrants in lieu therof) at a purchase price of

$3.45 per share (or pre-funded warrant in lieu thereof) in a

private placement priced at-the-market under Nasdaq rules. In

addition, the Company issued to the investors in the offering

unregistered warrants (the “warrants”) to purchase up to an

aggregate of 1,449,287 shares of common stock. The warrants are

exercisable immediately at an exercise price of $3.32 per share and

will expire five and one-half years from the date of issuance. The

offering closed on February 25, 2025.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The aggregate gross proceeds to the Company from

the private placement were approximately $5 million before

deducting placement agent fees and other offering expenses payable

by the Company. The Company intends to use the net proceeds from

the offering for working capital purposes.

The shares of common stock, pre-funded warrants

and warrants described above were offered in a private placement

under Section 4(a)(2) of the Securities Act of 1933, as amended

(the “Act”) and Regulation D promulgated thereunder and, along with

the shares of common stock underlying the pre-funded warrants and

warrants, have not been registered under the Act or applicable

state securities laws. Accordingly, the shares of common stock, the

pre-funded warrants, the warrants and the shares of common stock

underlying the pre-funded warrants and warrants may not be offered

or sold in the United States absent registration with the

Securities and Exchange Commission (“SEC”) or an applicable

exemption from such registration requirements. The securities were

offered only to accredited investors. Pursuant to a registration

rights agreement, the Company has agreed to file one or more

registration statements with the SEC covering the resale of the

shares of common stock and the shares issuable upon exercise of the

pre-funded warrants and warrants.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About SINTX Technologies,

Inc.

Located in Salt Lake City, Utah, SINTX

Technologies is an advanced ceramics company that develops and

commercializes materials, components, and technologies for medical

and technical applications. SINTX is a global leader in the

research, development, and manufacturing of silicon nitride, and

its products have been implanted in humans since 2008. Over the

past several years, SINTX has utilized strategic acquisitions and

alliances to enter into new markets.

For more information on SINTX Technologies or

its materials platform, visit www.sintx.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 that are subject to a number of risks and

uncertainties. Forward-looking statements can be identified by

words such as: "anticipate," "believe," "project," "estimate,"

"expect," "strategy,” "future," "likely," "may," "should," "will"

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding the anticipated use of proceeds from offering.

Readers are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date on

which they are made and reflect management’s current estimates,

projections, expectations and beliefs. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict and many of which are outside of our control.

Our actual results and financial condition may differ materially

from those indicated in the forward-looking statements. Important

factors that could cause our actual results and financial condition

to differ materially from those indicated in the forward-looking

statements include, among others, difficulties in commercializing

ceramic technologies and development of new product opportunities.

A discussion of other risks and uncertainties that could cause our

actual results and financial condition to differ materially from

those indicated in the forward-looking statements can be found in

SINTX’s Risk Factors disclosure in its Annual Report on Form 10-K,

filed with the SEC on March 27, 2024, and in SINTX’s other filings

with the SEC. SINTX undertakes no obligation to publicly revise or

update the forward-looking statements to reflect events or

circumstances that arise after the date of this report, except as

required by law.

Business and Media Inquiries for

SINTX: SINTX Technologies 801.839.3502 IR@sintx.com

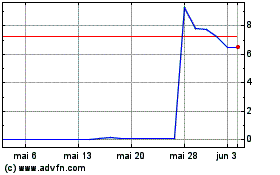

SiNtx Technologies (NASDAQ:SINT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

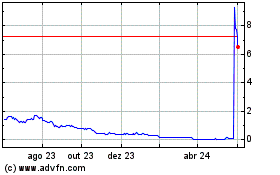

SiNtx Technologies (NASDAQ:SINT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025