ALX Oncology Reports Fourth Quarter and Full Year 2024 Financial Results and Provides Corporate Update

06 Março 2025 - 6:01PM

ALX Oncology Holdings Inc., (“ALX Oncology” or “the Company”)

(Nasdaq: ALXO), a clinical-stage biotechnology company advancing

therapies that boost the immune system to treat cancer and extend

patients’ lives, today reported financial results for the fourth

quarter and full year ended December 31, 2024, and provided a

corporate update.

“In 2024, we delivered strong progress and

continued momentum for our clinical development program evaluating

evorpacept as a potential first- and best-in-class CD47 blocker

with the ability to deepen and enhance responses to a variety of

important, available therapies across a wide range of cancer

types,” said Jason Lettmann, Chief Executive Officer of ALX

Oncology. “With multiple important clinical trial readouts,

significant momentum for our ongoing clinical studies and key

additions to our leadership team, we have positioned ALX Oncology

for near- and long-term success. Yesterday during our R&D Day

webcast, we shared updates on how we are prioritizing operations

and capital to support our new and ongoing clinical programs that

are expected to extend our cash runway into the fourth quarter of

2026, including taking the difficult decision to streamline our

organization aligned to these priorities.”

Fourth Quarter 2024 Highlights and Recent

Developments

- At the 2025 American Society of Clinical Oncology (ASCO)

Gastrointestinal Cancers Symposium in January 2025, reported

updated results from the multi-center, international ASPEN-06 Phase

2 clinical trial (NCT05002127) evaluating evorpacept in combination

with HERCEPTIN® (trastuzumab), CYRAMZA® (ramucirumab) and

paclitaxel (Evo-TRP) against trastuzumab, CYRAMZA (ramucirumab) and

paclitaxel (TRP) for the treatment of patients with HER2-positive

gastric/gastroesophageal junction (GEJ) cancer, where all patients

had received an anti-HER2 agent in prior lines of therapy.

- Data highlighted evorpacept as the first CD47-blocker to show

substantial tumor response and a well-tolerated safety profile in a

prospective randomized trial.

- Greatest benefit observed among patients with confirmed

HER2-positive cancer, as demonstrated by either fresh biopsy or

ctDNA HER2-expression, with a confirmed objective response rate

(cORR) of 48.9% and median duration of response (mDOR) of 15.7

months vs. 24.5% ORR and mDOR of 9.1 months in the control group,

and a progression-free survival Hazard Ratio of 0.64.

- Evo-TRP was generally well tolerated, with the incidence of

adverse events in the evorpacept population consistent with those

in TRP control.

- At the San Antonio Breast Cancer Symposium (SABCS) 2024,

presented new data from the Phase 1b/2 clinical trial demonstrating

evorpacept in combination with zanidatamab generates promising

antitumor activity in metastatic breast cancer (mBC).

- Patients who were HER2-positive by central assessment (n=9)

showed the greatest anti-tumor activity with a cORR of 55.6% and a

median progression-free survival (mPFS) of 7.4 months.

- Combination therapy was well tolerated with a manageable safety

profile consistent with prior experience with each investigational

agent.

- Announced strategic prioritization and resource optimization

efforts, including approximately 30% workforce reduction primarily

in preclinical research, expected to extend cash runway into Q4

2026.

- Announced key additions to our leadership team and Board of

Directors throughout 2024 and early 2025.

- Allison Dillon, Ph.D., an experienced drug development,

commercial strategy and business development leader, as Chief

Business Officer.

- Alan Sandler, M.D., a distinguished leader with more than 30

years of experience in oncology and drug development, as Chief

Medical Officer.

- Harish Shantharam, CFA, a proven biotech industry executive

with over two decades of senior leadership experience in finance,

commercial and corporate operations, as Chief Financial

Officer.

- Barbara Klencke, M.D., a seasoned clinical leader in oncology

drug development with more than 20 years of industry experience,

appointed to ALX Oncology’s Board of Directors.

- Chris H. Takimoto, M.D., Ph.D., FACP, a distinguished

researcher and drug developer with a proven track record in

oncology with 17 years of industry experience, appointed to ALX

Oncology’s Board of Directors.

- Announced that Jaume Pons, Ph.D., Founder, President and Chief

Scientific Officer, will be departing from his current position and

transitioning to the role of Senior Scientific Advisor in Q2

2025.

Upcoming Clinical Milestones

- Head and Neck Squamous Cell Carcinoma: Topline results from

Phase 2 ASPEN-03 randomized clinical trial of evorpacept with

KEYTRUDA® (pembrolizumab) anticipated in Q2 2025

- Head and Neck Squamous Cell Carcinoma: Topline results from

Phase 2 ASPEN-04 randomized clinical trial of evorpacept with

KEYTRUDA and chemotherapy anticipated in Q2 2025

- Urothelial Cancer: Updated results from Phase 1 ASPEN-07

clinical trial of evorpacept in combination with PADCEV®

(enfortumab vedotin) anticipated in Q2 2025

- Gastric/GEJ Cancer: Regulatory guidance on the gastric cancer

registrational path to be provided in Q2 2025

- Breast Cancer: Topline results from Phase 1b I-SPY clinical

trial of evorpacept with ENHERTU® (fam-trastuzumab deruxtecan-nxki)

anticipated in 2H 2025

- Breast Cancer: Patient dosing anticipated to initiate for

ASPEN-BREAST Phase 2 clinical trial in mid-year 2025

- Colorectal Cancer (CRC): Patient dosing anticipated to initiate

for ASPEN-CRC Phase 1b clinical trial in mid-year 2025

- New ADC Clinical Candidate: Novel EGFR-directed ADC, ALX2004,

planned IND submission in March 2025

2024 Full Year and Fourth Quarter Financial

Results:

- Cash, Cash Equivalents and Investments: Cash,

cash equivalents and investments as of December 31, 2024, were

$131.3 million. The Company believes its cash, cash equivalents and

investments are sufficient to fund planned operations into Q4 of

2026. Potential impact of near-term catalysts related to

ASPEN-03/04 HNSCC read out and FDA interaction on ASPEN-06 (for

e.g., gastric cancer accelerated approval and/or Phase 3

initiation) are excluded from cash runway guidance.

- Research and Development (“R&D”) Expenses:

R&D expenses consist primarily of preclinical, clinical and

development costs related to the development of the Company’s

current lead product candidate, evorpacept, and R&D

personnel-related expenses including stock-based compensation.

R&D expenses for the three months ended December 31, 2024 were

$23.5 million compared to $41.8 million for the prior-year period

or a decrease of $18.3 million. This decrease was primarily

attributable to a decrease of $17.3 million in clinical and

development costs primarily due to less manufacturing of clinical

trial materials to support active clinical trials for our lead

product candidate, evorpacept, and a decrease in stock-based

compensation expense slightly offset by increased preclinical costs

for development of new targets and increased personnel and related

costs. R&D expenses for the year ended December 31, 2024 were

$116.4 million, compared to $141.8 million for the prior-year

period.

- General and Administrative (“G&A”)

Expenses: G&A expenses consist primarily of

administrative personnel-related expenses, including stock-based

compensation and other costs such as legal and other professional

fees, patent filing and maintenance fees, and insurance. G&A

expenses for the three months ended December 31, 2024 were $7.1

million compared to $6.2 million for the prior year period or an

increase of $0.8 million. This increase was primarily attributable

to an increase in personnel and related costs. G&A expenses for

the year ended December 31, 2024 were $26.1 million compared to

$28.5 million for the prior-year period.

- Net loss: GAAP net loss was ($29.2) million

for the three months ended December 31, 2024, or ($0.55) per basic

and diluted share, as compared to a GAAP net loss of ($45.5)

million for the three months ended December 31, 2023, or ($0.93)

per basic and diluted share. The lower net loss is primarily

attributed to lower R&D expenses. GAAP net loss was ($134.9)

million for the year ended December 31, 2024, or ($2.58) per basic

and diluted share, as compared to a GAAP net loss of ($160.8)

million for the year ended December 31, 2023, or ($3.74) per basic

and diluted share. Non-GAAP net loss was ($23.2) million for the

three months ended December 31, 2024, as compared to a non-GAAP net

loss of ($38.7) million for the three months ended December 31,

2023. Non-GAAP net loss was ($107.5) million for the year ended

December 31, 2024, as compared to a non-GAAP net loss of ($134.3)

million for the year ended December 31, 2023. A reconciliation of

GAAP to non-GAAP financial results can be found at the end of this

news release.

About ALX Oncology

ALX Oncology (Nasdaq: ALXO) is a clinical-stage

biotechnology company advancing therapies that boost the immune

system to treat cancer and extend patients’ lives. ALX Oncology’s

lead therapeutic candidate, evorpacept, has demonstrated potential

to serve as a cornerstone therapy upon which the future of

immuno-oncology can be built. Evorpacept is currently being

evaluated across multiple ongoing clinical trials in a wide range

of cancer indications. More information is available at

www.alxoncology.com and on LinkedIn @ALX Oncology.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements that involve substantial risks and uncertainties.

Forward-looking statements include statements regarding future

results of operations and financial position, business strategy,

product candidates, planned preclinical studies and clinical

trials, results of clinical trials, research and development costs,

regulatory approvals, timing and likelihood of success, plans and

objectives of management for future operations, as well as

statements regarding industry trends. Such forward-looking

statements are based on ALX Oncology’s beliefs and assumptions and

on information currently available to it on the date of this press

release. Forward-looking statements may involve known and unknown

risks, uncertainties and other factors that may cause ALX

Oncology’s actual results, performance or achievements to be

materially different from those expressed or implied by the

forward-looking statements. These and other risks are described

more fully in ALX Oncology’s filings with the Securities and

Exchange Commission (“SEC”), including ALX Oncology’s Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and other

documents ALX Oncology files with the SEC from time to time. Except

to the extent required by law, ALX Oncology undertakes no

obligation to update such statements to reflect events that occur

or circumstances that exist after the date on which they were

made.

| |

|

|

|

|

|

| ALX ONCOLOGY

HOLDINGS INC.Consolidated Statements of

Operations(unaudited)(in thousands, except share and per

share amounts) |

| |

|

|

|

|

|

| |

Three Months

Ended |

|

|

Year

Ended |

|

| |

December 31, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

23,532 |

|

|

$ |

41,784 |

|

|

$ |

116,373 |

|

|

$ |

141,795 |

|

|

General and administrative |

|

7,081 |

|

|

|

6,239 |

|

|

|

26,094 |

|

|

|

28,483 |

|

|

Total operating expenses |

|

30,613 |

|

|

|

48,023 |

|

|

|

142,467 |

|

|

|

170,278 |

|

| Loss from operations |

|

(30,613 |

) |

|

|

(48,023 |

) |

|

|

(142,467 |

) |

|

|

(170,278 |

) |

|

Interest income |

|

1,878 |

|

|

|

2,995 |

|

|

|

9,366 |

|

|

|

10,649 |

|

|

Interest expense |

|

(427 |

) |

|

|

(415 |

) |

|

|

(1,729 |

) |

|

|

(1,565 |

) |

|

Other (expense) income, net |

|

(1 |

) |

|

|

(29 |

) |

|

|

(20 |

) |

|

|

389 |

|

| Net loss |

$ |

(29,163 |

) |

|

$ |

(45,472 |

) |

|

$ |

(134,850 |

) |

|

$ |

(160,805 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.55 |

) |

|

$ |

(0.93 |

) |

|

$ |

(2.58 |

) |

|

$ |

(3.74 |

) |

| Weighted-average shares of common

stock used to compute net loss per shares, basic and

diluted |

|

52,802,409 |

|

|

|

48,995,998 |

|

|

|

52,174,904 |

|

|

|

42,987,767 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Consolidated

Balance Sheet Data(unaudited)(in thousands) |

| |

|

|

|

|

|

| |

December 31, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

Cash, cash equivalents and investments |

$ |

131,281 |

|

|

$ |

218,147 |

|

| Total assets |

$ |

147,775 |

|

|

$ |

242,553 |

|

| Total liabilities |

$ |

34,157 |

|

|

$ |

52,841 |

|

| Accumulated deficit |

$ |

(621,122 |

) |

|

$ |

(486,272 |

) |

| Total stockholders’ equity |

$ |

113,618 |

|

|

$ |

189,712 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| GAAP to

Non-GAAP Reconciliation (unaudited) (in thousands) |

| |

|

|

|

|

|

| |

Three Months

Ended |

|

|

Year

Ended |

|

| |

December 31, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

GAAP net loss, as reported |

$ |

(29,163 |

) |

|

$ |

(45,472 |

) |

|

$ |

(134,850 |

) |

|

$ |

(160,805 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

5,858 |

|

|

|

6,721 |

|

|

|

27,093 |

|

|

|

26,273 |

|

|

Accretion of term loan discount and issuance costs |

|

69 |

|

|

|

64 |

|

|

|

265 |

|

|

|

250 |

|

|

Total adjustments |

|

5,927 |

|

|

|

6,785 |

|

|

|

27,358 |

|

|

|

26,523 |

|

| Non-GAAP net loss |

$ |

(23,236 |

) |

|

$ |

(38,687 |

) |

|

$ |

(107,492 |

) |

|

$ |

(134,282 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Non-GAAP Financial

Measures

We supplement our consolidated financial statements

presented on a GAAP basis by providing additional measures which

may be considered “non-GAAP” financial measures under applicable

SEC rules. We believe that the disclosure of these non-GAAP

financial measures provides our investors with additional

information that reflects the amounts and financial basis upon

which our management assesses and operates our business. These

non-GAAP financial measures are not in accordance with generally

accepted accounting principles and should not be viewed in

isolation or as a substitute for reported, or GAAP, net loss, and

are not a substitute for, or superior to, measures of financial

performance performed in conformity with GAAP.

“Non-GAAP net loss” is not based on any

standardized methodology prescribed by GAAP and represents GAAP net

loss adjusted to exclude stock-based compensation expense and

accretion of term loan discount and issuance costs. Non-GAAP

financial measures used by ALX Oncology may be calculated

differently from, and therefore may not be comparable to, non-GAAP

measures used by other companies.

Investor Relations Contact: Elhan

Webb, CFA, IR Consultantewebb@alxoncology.com

Media Contact:Audra Friis, Sam

Brown, Inc.audrafriis@sambrown.com(917) 519-9577

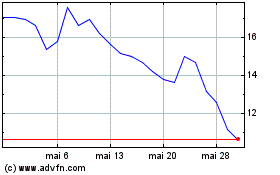

ALX Oncology (NASDAQ:ALXO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

ALX Oncology (NASDAQ:ALXO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025