Lyft’s Competitive Pricing Strategy Raises Concerns Over Profitability; Lyft’s Shares Tumbled Nearly 8%

09 Agosto 2023 - 8:46AM

IH Market News

Lyft’s recent decision to prioritize competitive pricing as a

strategy to gain market share has resulted in a nearly 8% decline

in its share value. Market participants are expressing concerns

regarding the company’s road to profitability amid these pricing

changes.

Both Lyft and Uber, its principal competitor, are navigating the

post-pandemic recovery phase, and the recovery strategies adopted

by each are markedly different. While Uber has returned to

pre-pandemic rider volumes in North America by leveraging higher

prices and its diversified business model—including freight

brokerage and food delivery services—Lyft’s approach centers on

cost-competitiveness.

Recently, Lyft (NASDAQ:LYFT) announced its operating profit

forecast to be between $75 million to $85 million for the upcoming

quarter. Uber, in contrast, has already reported a quarterly

operating profit. BTIG analyst Jake Fuller remarked on Lyft’s

strategy, noting, “While Lyft appears to be regaining ground with a

more competitive offering, the profit outlook in the out-years

remains murky.”

One significant decision taken by Lyft is its plan to eliminate

prime-time or surge pricing, which, according to the company, is

strongly disliked by its riders. In line with this strategy, surge

prices were reported to have decreased by 35% in the second quarter

compared to the previous quarter. This decision, combined with

Lyft’s pricing strategy, which marked the average per-mile fare at

10% lower than last year, did contribute to an 8% quarterly

increase in active riders on the platform.

Lyft’s stock valuation, as reflected by its forward

price-to-earnings multiple, stands at 29.66. In comparison, Uber,

which Uber CEO Dara Khosrowshahi acknowledged faces stiff

competition from Lyft, has a multiple of 55.27.

In essence, while Lyft’s aggressive pricing strategy appears to

be driving growth in its active user base, the broader question

remains—will this approach lead to sustainable profitability in the

longer term?

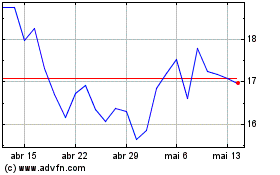

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024