3 Issues To Watch Out For This Week: Jackson Hole, Nvidia, China

21 Agosto 2023 - 9:45AM

IH Market News

This week’s attention turns to the annual meeting of the Federal

Reserve and other major central banks in Jackson Hole, Wyoming.

Investors will scrutinize Fed Chair Jerome Powell’s speech on the

25th for clues about the rate outlook.

And although the second quarter earnings season is virtually

over, we anticipate Nvidia’s quarterly earnings announcement on the

23rd. Investors’ focus will be on countermeasures against the real

estate industry crisis and local government debt, as revealed by

the debt problem of China’s Hengda Group (Evergrande), as well as

the world’s second-largest economy’s downturn.

Key issues in the market to watch out for this week include:

Jackson Hole Meeting

The key variable that will influence the market trend this week

is the Fed’s Summer Recreation Conference from the 24th to 26th. In

particular, on the 25th, Chairman Powell’s speech is scheduled at

10:05 am Eastern Time.

Considering that the two main drivers of this year’s rise in the

New York stock market were the AI boom and expectations for the

end of the Fed’s interest rate hike, what Powell says in his speech

on the 25th regarding additional interest rate hikes could

determine the future market trend.

Minutes from the Federal Open Market Committee (FOMC) meeting

for July released on the 16th of last week indicate that most

policymakers are still concerned about the risk of rising

inflation, indicating that further rate hikes cannot be ruled

out.

Investors will focus on whether the Fed believes more policy

tightening is needed to keep inflation down or whether enough

progress has been made to keep interest rates in check. And it will

also look for clues as to whether the Fed is weighing the

possibility of cutting rates in 2024.

Investors in contracts tied to the Fed’s benchmark rate have

added to their bets that they won’t raise it any further, and 99 of

110 economists polled by Reuters last week see the risk of a US

recession diminishing.

Nvidia Earnings

Everyone is paying attention to the quarterly results of Nvidia

(NASDAQ:NVDA), which will be released after the New York market

closes on the 23rd. The announcement of the first quarter results

in May was a huge boon that caused a sensation in the market.

Although sales in the first quarter fell 13% to $7.19 billion

from a year ago, net profit soared 26% over the same period to $2

billion, or $1.09 per share. It far exceeded market expectations

for earnings of $0.92 per share on sales of $6.52 billion.

Thanks to the prospect that performance will soar with AI wings,

Nvidia broke through a market cap of $1 trillion for the first time

as a semiconductor company on May 31, a week later.

Nvidia predicted that sales in the second quarter would reach

$11 billion, and that there could be an error of around 2%. That

beats analysts’ expectations of $7.15 billion.

In addition, results are expected from Australian mining

companies BHP Billiton and Zoom Video (NASDAQ:ZM) on the 21st ,

Lowe’s (NYSE:LOW) on the 22nd , Snowflake (NYSE:SNOW) on the 23rd,

and INTUIT (NASDAQ:INTU) on the 24th.

China Economy

China cut its one-year benchmark lending rate on Monday as

authorities seek to ramp up efforts to stimulate credit demand, but

surprised markets by keeping the five-year rate unchanged amid

broader concerns about a rapidly weakening currency.

The recovery in the world’s second-largest economy has lost

steam due to a worsening property slump, weak consumer spending and

tumbling credit growth, adding to the case for authorities to

release more policy stimulus.

However, downward pressure on the yuan means Beijing has limited

room for deeper monetary easing, analysts say, as a further

widening of China’s yield differentials with other major economies

could trigger yuan selloffs and capital flight.

The one-year loan prime rate (LPR) was lowered by 10 basis

points to 3.45% from 3.55% previously, while the five-year LPR was

left at 4.20%.

In a Reuters poll of 35 market watchers, all participants

predicted cuts to both rates. The 10 bp cut in the one-year rate

was smaller than the 15 bp cut expected by most poll

respondents.

China cut several key and unexpected interest rates last week,

but analysts say the move so far has been too little, too late, and

much stronger action is needed to stem the economic downturn.

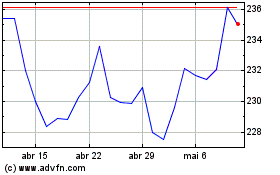

Lowes Companies (NYSE:LOW)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Lowes Companies (NYSE:LOW)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024