Keep An Eye Out: Pre-Market Movers And Recommendations

08 Setembro 2023 - 11:08AM

IH Market News

- Adobe (NASDAQ:ADBE): Barclays maintains its equalweight rating

with a target price raised from $540 to $620.

- Docusign (NASDAQ:DOCU): Morgan Stanley maintains its

underweight recommendation with a target price increase from $49 to

$51.

- Edwards Life (NYSE:EW): Piper Sandler & Co maintains a

neutral recommendation on the stock with a reduced target price of

$83.

- Fedex Corp (NYSE:FDX): Morgan Stanley maintains its

equalwt/in-line rating with a target price increase from $186 to

$200.

- Johnson & Johnson (NYSE:JNJ): Barclays maintains its

equalweight rating with a reduced target price of $158.

- Lucid Group (NASDAQ:LCID): RBC Capital maintains its sector

perform rating on the stock with a target price of $6.

- Nucor Corp (NYSE:NUE): JP Morgan downgrades to underweight

from neutral. PT up 0.7% to $151.

- Paypal Holdings (NASDAQ:PYPL): Jefferies maintains a hold

recommendation on the stock with a reduced target price of

$65.

- Roblox Corp (NYSE:RBLX): CITIC Securities Co Ltd upgrades

to add from hold. PT reduced from $57 to $37.

- Steel Dynamics (NASDAQ:STLD): JP Morgan downgrades to

underweight from neutral. PT up 1.1% to $95.

- T-mobile (NASDAQ:TMUS): DZ Bank AG Research maintains its buy

recommendation with a raised target price from $170 to $175.

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

The mood on Wall Street appears somber, partly due to weakening

economic data in China and Europe, as well as indications of

persistent inflation in the United States. Surprisingly, the U.S.

services sector outperformed expectations in August, contradicting

the notion of a cooling U.S. economy and inflation, thus bolstering

the case for an extended period of higher interest rate hikes.

Additionally, lower-than-expected jobless claims added to the

concern, suggesting a tightly competitive job market. Even Apple, a

cornerstone of the NYSE, is encountering difficulties.

In the previous day, market indices experienced significant

fluctuations. In short, markets with a substantial presence of

defensive stocks performed relatively well, while those heavily

invested in technology and cyclical stocks faced some setbacks. For

instance, the Swiss SMI, led by its three major defensive stocks –

Nestlé, Roche, and Novartis – gained 0.6%, while Apple struggled,

dragging the Nasdaq down by 0.7%.

The challenges faced by Apple, the creator of the iPhone, are

particularly untimely for the tech sector, which is already

grappling with concerns about its ability to maintain high

valuation multiples. Today, it was reported that restrictions on

the use of iPhones by government employees in China have expanded

to local governments, as reported by the Nikkei. Apple’s stock has

declined by 6.4% over two trading sessions, resulting in a nearly

$200 billion reduction in market capitalization, equivalent to

erasing a company like Netflix from the market. Given that Apple

and its peers, including Nvidia, Microsoft, Amazon, and Meta, have

contributed to roughly 60% of Nasdaq’s gains this year, any setback

affecting this group has a magnified impact on the tech index. In

contrast, the Dow Jones saw a marginal increase yesterday, thanks

to its substantial healthcare stock holdings.

To sum up the concerns for September, inflation and high

interest rates top the list, followed by the state of the Chinese

economy and geopolitical tensions causing distortions in various

markets, including energy and agricultural commodities. On the

positive side, there is optimism surrounding corporate earnings

strength, the resilience of the U.S. economy, and promising

developments in artificial intelligence.

The energy market could experience renewed tensions, given

apparent breakdowns in negotiations between Chevron’s Australian

LNG division and its employees. Social unrest in the sector is

affecting gas supplies to Europe, consequently impacting prices.

Meanwhile, the offshore yuan in China has reached its lowest point

against the U.S. dollar in its 13-year history. Observers suggest

that Beijing may be comfortable with this depreciation as it

bolsters the export competitiveness of a nation eager to revitalize

its economic momentum.

In premarket trading, all three major Wall Street indices were

relatively stable.

Key economic highlights for the day include U.S. wholesale

inventories.

Currency exchange rates stand at USD 0.9341 and GBP 0.8007,

while the price of gold hovers around USD 1924 per ounce. North Sea

Brent oil is priced at USD 90.62 per barrel, and U.S. light crude

WTI is at USD 87.05. The yield on 10-year U.S. government debt has

eased to 4.22%, and Bitcoin remains around USD 26,000.

In corporate news:

- Tesla: Passenger car sales in China rebounded with year-on-year

growth in August, driven by price reductions and subsidies. Tesla,

in particular, nearly doubled its market share in August compared

to July, according to data from the China Passenger Car

Association.

- Nvidia and Reliance announced a partnership to develop

artificial intelligence (AI) language models and generative

applications for millions of users within the Indian telecom

group.

- Gamestop experienced a 2.9% decline in pre-market trading

following reports that its chairman, billionaire Ryan Cohen, is

being investigated by the U.S. Securities and Exchange Commission

(SEC) over the surprise purchase and sale of shares in Bled Bath

& Rebond.

- Smith & Wesson Brands saw a 12.08% increase in pre-market

trading after reporting higher quarterly earnings that exceeded

analyst expectations.

- DocuSign shares gained 2.7% in premarket trading following the

company’s better-than-expected quarterly results and an upward

revision of its full-year sales forecast.

Friday’s Wall Street Highlights: Apple, Goldman Sachs, Morgan

Stanley, DocuSign, and more

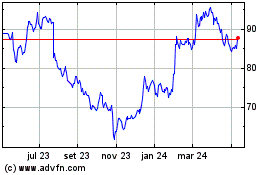

Edwards Lifesciences (NYSE:EW)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

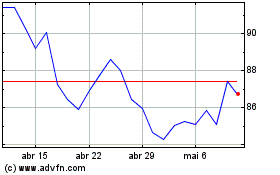

Edwards Lifesciences (NYSE:EW)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024