US index futures are falling in Tuesday’s pre-market, with

investors digesting European indicators waiting for American

inflation, which will be released tomorrow and should give clues

about the Federal Reserve’s next steps.

At 7:01 AM, Dow Jones futures (DOWI:DJI) fell 46 points, or

0.13%. S&P 500 futures were down 0.14% and Nasdaq-100

futures were down 0.19%. The yield on the 10-year Treasury

note was at 4.29%.

On Tuesday’s United States economic agenda, investors await the

auction of ten-year Treasuries. Yesterday, the American

government invested US$44 billion in the three-year event, with a

cut rate of 4.66%. At 4:30 pm, API releases the weekly oil

stock report, which is expected to fall by 2 million barrels.

In September, the ZEW investor confidence index in Germany

exceeded expectations, registering a drop of 11.4 points, compared

to the forecast of 15 points. In the euro zone, the indicator

had a smaller drop than expected, of 8.20 points.

In the UK, the unemployment rate for July was 4.30%, as

predicted. This value was higher than in June, indicating an

increase in unemployment amid an economy pressured by

inflation.

Meanwhile, European markets await the interest rate decision by

the European Central Bank (ECB) on Thursday. Despite rising

inflation, the rate is likely to remain at 4.25% per year.

Asian markets had mixed results, reflecting new measures in

China after the financial regulator downplayed the risks of

insurers investing in shares. Country Garden, a leading

private Chinese construction company, has been granted permission

to defer payments on six bonds, sending its shares up more than

10%. This decision comes as investors watch the Chinese

government’s recent interventions in the real estate sector.

In the commodities market, West Texas Intermediate crude oil for

October rose 0.84% to US$88.02 per barrel. Brent oil for

November rose 0.71% to US$91.28 per barrel. Iron ore with a

concentration of 62% rose 1.96% to US$ 117.61.

At Monday’s close, stock markets posted gains as investors

awaited crucial economic information from the Federal

Reserve. The Dow Jones rose 87.13 points or 0.25% to 34,663.72

points. The S&P 500 rose 29.97 points or 0.67% to

4,487.46. The Nasdaq Composite jumped 156.37 points or 1.14%

to 13,917.89.

A recent NY Fed survey indicated that US inflation expectations

remained stable in August, but there was an increase in economic

concerns. This study negatively impacted expectations of

future interest rates. Stocks in Asia also revealed

developments that led to a depreciation of the dollar. The

Chinese Central Bank, PBOC, set a level for the Yuan above market

forecasts. Comments from Kazuo Ueda, president of the Japanese

Central Bank, led to speculation about a possible increase in

interest rates.

On Tuesday’s corporate earnings front, investors are watching

Cognyte’s (NASDAQ:CGNT) report. After the market closes,

results from Edgio (NASDAQ:EGIO), InnovAge (NASDAQ:INNV), Farmer

Bros (NASDAQ:FARM), Mama’s Creations (NASDAQ:MAMA), among others,

will be awaited.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – For the first time,

the launched iPhone will be available immediately, made in

India. Apple intends to make the Indian iPhone 15 available at

global launch. This highlights India’s productive growth and

Apple’s diversification outside of China. The iPhone 15

promises to be the most significant update in three years, with

improvements to the camera system and a 3-nanometer processor in

the Pro models. This innovation aims to boost sales that were

falling.

Qualcomm (NASDAQ:QCOM) – Qualcomm on

Monday announced a deal to supply 5G chips

to Apple (NASDAQ:AAPL) by 2026,

strengthening the existing relationship. This suggests that

Apple won’t be releasing its own modem anytime soon. Qualcomm

and Apple shares rose 4% and 0.5% on Monday, respectively. The

previous agreement between the companies ends this year.

Microsoft (NASDAQ:MSFT) – Microsoft shares

have underperformed tech peers in recent weeks. However, Citi

Research predicts improvement in the coming months due to the

stabilization of the PC market, advancements in Azure and growth in

artificial intelligence. Citi maintained its Buy rating on

Microsoft, citing “a rich catalytic path ahead” through the end of

the year.

Amazon (NASDAQ:AMZN) – Amazon shares

closed at their highest in a year, rising 3.5% on Monday. UBS

analyst Lloyd Walmsley sees potential for growth in the company’s

retail margins. Additionally, the recent partnership with

Shopify (NYSE:SHOP) and changes to the Seller Fulfilled Prime

program are viewed positively. Amazon shares are up 70% so far

this year, outperforming the S&P 500 index.

Amazon (NASDAQ:AMZN), Occidental

Petroleum (NYSE:OXY) – Amazon is financing an

Occidental Petroleum project to capture carbon from the air,

offsetting emissions from its fleet. The company will purchase

250,000 metric tons of carbon removal from Oxy over 10

years. The initiative is part of Amazon’s efforts to achieve

zero carbon emissions by 2040.

Alphabet (NASDAQ:GOOGL) – Alphabet

registered a 0.4% drop in Tuesday’s pre-market as the anticipated

antitrust case begins in Washington, where the Department of

Justice accuses Google of an illegal monopoly in the search market

online. The trial is expected to last until mid-November.

Alibaba (NYSE:BABA) – Alibaba’s new CEO

Eddie Wu emphasized “user first” and “AI guidance” as strategic

focuses in an internal letter. Wu will promote young employees

to maintain a startup mentality. He will also lead Alibaba’s

cloud computing unit, targeting an IPO in 2024. The unit is crucial

to the company’s AI strategy.

Oracle (NYSE:ORCL) – Oracle

projected revenue below Wall Street expectations due to reduced

enterprise cloud spending, resulting in a 9.14% decline in

Tuesday’s premarket. As the company faces competition from

giants like Amazon and Microsoft, growth in AI adoption could boost

its cloud business. First-quarter revenue was $12.45 billion,

slightly below estimates of $12.47 billion. Excluding items,

it earned $1.19 per share, compared to estimates of $1.15.

Overstock.com (NASDAQ:OSTK) – Angela Hsu,

chief marketing officer at Overstock.com, resigned on September

6. President Dave Nielsen will assume his duties while the

company searches for a replacement. Hsu will become a

consultant, and her departure is not due to internal

disagreements.

Casey’s General Stores (NASDAQ:CASY) –

Casey’s General Stores reported first-quarter results that beat

estimates. Net profit was $169.2 million, with same-store

sales growing 5.4%. CEO Darren Rebelez attributed the success

to the company’s new pizzas. The company also plans to acquire

125 stores, including 63 from EG Group.

Avantax Inc (NASDAQ:AVTA) – Cetera

Holdings will acquire Avantax for about $1.2 billion. Avantax

shareholders will receive $26 per share, a 30% premium to the

recent price. Mike Durbin, CEO of Cetera, valued Avantax’s tax

expertise. The acquisition reinforces the trend of

consolidation in the wealth management sector. Cetera will

maintain Avantax as an independent unit and is backed by private

equity firm Genstar Capital Partners.

Magellan Midstream

Parters (NYSE:MMP), Oneok

Inc (NYSE:OKE) – Oneok is expected to buy Magellan

Midstream for US$19 billion after support from consultancies Glass

Lewis and Institutional Shareholder Services (ISS). Voting

will take place on September 21st. Tax concerns for Magellan

holders have arisen, but Magellan defends the benefits of the

transaction.

WestRock (NYSE:WRK) – WestRock rose 6.6%

in Tuesday’s pre-market after signing an acquisition agreement with

Dublin-based Smurfit Kappa, forming a paper and packaging company

valued at around $20 billion. Under the deal, WestRock

shareholders will receive one new share of Smurfit WestRock and $5

in cash, for a total of $43.51 per share. After the merger,

Smurfit Kappa shareholders will own 50.4% of the combined company,

while WestRock will own the remainder. Shares

in Smurfit Kappa (LSE:SKG) in London

fell 9.4%.

Bank of America (NYSE:BAC) – Investment

banking fees fell 30% to 35% in the third quarter compared to the

previous year. However, Bank of America expects to surpass

that average, with fees approaching $1 billion, said CFO Alastair

Borthwick. Analysts believe this could put pressure on the

bank’s profit estimate. In the previous quarter, BofA recorded

fees of US$1.2 billion, increasing the profit of its banking

unit.

Goldman Sachs (NYSE:GS) – The Dutch

financial regulator revealed that Goldman Sachs had a short

position in Philips (NYSE:PHG),

offsetting a previously announced position. This occurred

during a review of Exor NV’s acquisition of 15% of

Philips. There are discussions about the need for new

guidelines for rapid acquisitions in listed companies. In

other news, Ericka Leslie has been named by Goldman Sachs as head

of global banking and markets, leaving just two women in the

executive group. Diversity in executive positions on Wall

Street is still a challenge, with few women in prominent

positions. Leslie will replace Will Bousquette, who will take

on another division.

JPMorgan Chase (NYSE:JPM) – Jamie Dimon,

CEO of JPMorgan Chase, criticized stricter regulatory proposals in

the US, considering them an obstacle to economic growth. At a

conference in New York, Dimon expressed disappointment and called

for transparency from regulators. Furthermore, he expressed

caution regarding the Chinese market and the global economy, citing

future uncertainties and risks.

HSBC Holdings (NYSE:HSBC) – HSBC will

increase mortgage rates in Hong Kong due to rising interest rates,

rising from 3.625% to up to 4.125% from 18 September. This

negatively impacted the shares of local real estate developers.

Nubank (NYSE:NU) – Nubank shares in the US

jumped on Monday after JPMorgan reclassified the company from

“Neutral” to “Overweight”. JPMorgan indicated in a statement

that it sees Nubank expanding its market share in Brazil in the

coming years and considers the current moment as a good entry

opportunity, after a recent share devaluation.

KKR and Company (NYSE:KKR) – USI Insurance

announced that KKR will invest more than $1 billion, becoming the

main shareholder. KKR and USI will acquire USI shares from the

CDPQ fund and other investors. CDPQ and KKR purchased USI in

2017 for $4.3 billion.

Globalfoundries (NASDAQ:GFS) –

Globalfoundries has opened a US$4 billion manufacturing facility in

Singapore, expanding its global production. This facility will

produce 450,000 300mm wafers annually by 2026 and generate 1,000

jobs. This expansion aims to meet the growing demand for

chips, especially with partners such as Qualcomm and Apple.

Ecopetrol (NYSE:EC) – The Colombian

government is considering making the participation of the

state-owned company Ecopetrol mandatory in all offshore wind

projects. The proposal is being consulted with companies

interested in Colombia’s first offshore wind energy

auction. The review aims to reinforce energy self-sufficiency

and move away from dependence on fossil fuels. Ecopetrol’s

involvement would minimize risks in new projects, despite its

participation being potentially minimal. The bidding round is

delayed due to regulatory and leadership changes at the Ministry of

Mines and Energy.

AerCap Holdings

NV (NYSE:AER), General

Electric (NYSE:GE) – The General Electric unit plans

to sell a $2.44 billion stake in AerCap Holdings. The sale

involves 40.7 million shares at US$59 each. The offering

increased from the 32.4 million shares initially announced,

following GE’s earlier sale of 18 million shares.

Jetblue (NASDAQ:JBLU) – JetBlue has agreed

to sell all of Spirit Airlines’ assets at Boston and Newark

airports to Allegiant (NASDAQ:ALGT) to

gain approval for the acquisition

of Spirit (NYSE:SAVE). This deal

faced opposition, with the Department of Justice and other state

prosecutors claiming it would harm consumers.

Boeing (NYSE:BA) – VietJet announced that

it will receive 12 737 MAX jets from Boeing in 2023, part of an

order for 200 planes. Initial delivery will be to its

subsidiary in Thailand. Additionally, VietJet entered into a

$550 million financing agreement with Carlyle Aviation

Partners.

RTX Corp (NYSE:RTX) – Shares of RTX Corp,

parent company of Pratt & Whitney, fell after charging $3

billion and announcing possible groundings of Airbus jets to check

rare faults. After discovering a defect in engine components,

RTX expanded inspections, affecting up to 700 Airbus A320neo

engines between 2023 and 2026. This could ground up to 650 jets in

2024.

United Parcel Service (NYSE:UPS) – UPS

revealed a new five-year contract for 340,000 U.S. workers,

increasing wage and benefit costs by 3.3% annually. The

agreement, valid until July 2028, will have an additional US$500

million impact on costs in 2023.

Tesla (NASDAQ:TSLA) – Tesla and its

suppliers plan to invest US$15 billion in a factory in Mexico,

tripling the initially announced amount. CEO Elon Musk had

revealed plans for a gigafactory in Nuevo León, aiming to expand

Tesla’s global presence.

Charter

Communications (NASDAQ:CHTR), Walt Disney (NYSE:DIS)

– Walt Disney and Charter Communications have agreed to bring

Disney networks, including ESPN, back to Spectrum cable, hours

before NFL “Monday Night Football.” This deal aims to combat

the cord-cutting trend and expand Disney streaming. The

previous dispute deprived 15 million Spectrum subscribers of

sporting events. The new deal offers ad-supported Disney+ to

Spectrum subscribers and maintains essential cable revenue for

Disney.

DraftKings (NASDAQ:DKNG) – DraftKings has

apologized for launching a 9/11-themed sports betting

promotion. The offer involved teams from New York and was

titled “Never Forget”, coinciding with the 22nd anniversary of the

2001 terrorist attacks. Critics considered the act insensitive.

Nike (NYSE:NKE) – Investors are asking

Nike to pay textile workers in Cambodia and Thailand who would have

lost wages due to Covid-19. They want Nike to pay $2.2 million

to more than 4,000 workers. Nike denies the allegations,

saying it has no ties to the factories since 2006. Pressure is

mounting ahead of Nike’s annual shareholder meeting, with a focus

on supply chain scrutiny.

Acelyrin (NASDAQ:SLRN) – Los Angeles

pharmaceutical company Acelyrin fell 55.2% in premarket Tuesday

after announcing that in week 16 of a Phase 2b/3 trial, its drug

candidate for skin treatment did not reach statistical

significance.

AstraZeneca (NASDAQ:AZN) – After a drop in

AstraZeneca shares on Monday and rumors about the departure of CEO

Pascal Soriot, the company responded that it does not comment on

market rumors, reinforcing regulatory obligations to announce

significant impacts on shares. Additionally, AstraZeneca

released data from the FLAURA2 trial that combined the Tagrisso

drug with chemotherapy to treat lung cancer, setting a higher

standard for rival Johnson &

Johnson (NYSE:JNJ). The results indicated a 38%

reduction in the risk of disease progression when adding

chemotherapy.

Moderna (NASDAQ:MRNA) – Moderna revealed

on Monday a partnership with German company Immatics to advance the

development of cancer vaccines. As part of the deal, Moderna

will pay Immatics $120 million up front.

26 Capital Acquisition Corp (NASDAQ:ADER)

– A Delaware judge’s ruling exposed fraud at SPAC 26 Capital

Acquisition Corp. SPAC sponsor Jason Ader and consultant Alex

Eiseman conspired in a secret deal benefiting the SPAC. Casino

owner Universal Entertainment Corp. called off the

merger. Ader and Eiseman deny wrongdoing. SEC has proposed

rules for SPAC sponsors to avoid such conflicts.

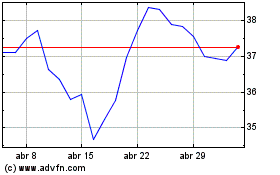

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024