US Index Futures are down in pre-market trading on Thursday,

reflecting the statement from the monetary authority one day after

the Federal Reserve kept the interest rate in the United States

unchanged.

At 7:04 AM, Dow Jones futures (DOWI:DJI) fell 163 points, or

0.47%. S&P 500 futures were down 0.65% and Nasdaq-100

futures were down 0.88%. The yield on the 10-year Treasury

note was at 4.441%.

In the commodities market, West Texas Intermediate crude oil for

November fell 0.95% to $88.81 per barrel. Brent oil for

November fell 0.94% to US$92.65 per barrel. Iron ore with a

concentration of 62% fell 1.90%, quoted at US$ 116.86 per ton.

On Thursday’s economic agenda in the United States, investors

are awaiting, at 8:30 AM, the weekly unemployment insurance data,

which is forecasted to show 225,000 new claims, an increase

compared to the previous week when 220,000 were recorded.

At the same time, the balance of the current account for June,

forecasted to have a deficit of $221 billion, and the Philadelphia

Fed manufacturing index, consensus being a drop of 0.70% in

September, will also be released. At 10 AM, it will be the turn of

August’s used home sales data.

Attention is also turned to the new economic forecasts revealed

in the “Dot-Plot.” The GDP forecast for 2023 was adjusted to 2.1%,

from 1.0%, and the economic expansion forecast for 2024 increased

to 1.5%, from 1.1%.

In Europe, investors were closely watching the imminent decision

of the Bank of England (BoE) on interest rates. The Bank of England

halted a series of 14 interest rate increases, maintaining the rate

at 5.25% after data showed inflation below expectations. Investors

were already anticipating the pause due to lower inflation growth

in August. The decision came in a context of challenges to balance

inflation and economic growth. A speech by Christine Lagarde,

President of the European Central Bank (ECB), and consumer

confidence data from the eurozone are also awaited.

In Asia, markets closed lower, impacted by the resolution of the

Federal Open Market Committee (FOMC). China’s pledge to implement

more stimulus measures to bolster the economy and promote advanced

industrial sectors failed to boost market morale. These measures

are considered positive as they have the potential to revitalize

the real estate and financial sectors, pillars of the local

economy.

On Wednesday, global markets were performing positively ahead of

the FOMC verdict, however, US stocks reversed sharply lower after

the release of the Fed’s projections. These pointed out that most

members anticipate a further increase interest rate later this

year. Even so, the FOMC decided, at the current meeting, to

keep the Federal Funds interest rate unchanged, at between 5.25 and

5.50%. Future interest rates started considering the

possibility of an increase in the long-term interest rate.

Prior to the decision, markets were responding positively to

inflation in the United Kingdom, which rose much less than

expected, at 0.3% (versus an expectation of 0.7%), strengthening

the view that we may also be reaching the end of the interest rate

hike cycle in the country. Dow Jones ended the day down 76.85

points or 0.22%, to 34,440.88 points. S&P 500 fell 41.75 points

or 0.94% to a nearly one-month closing low of 4,402.20. Nasdaq led

the decline, falling 209.06 points or 1.53% to 13,469.13, its

lowest closing level in nearly a month.

On the corporate earnings front Thursday, investors will be

watching reports from Darden Restaurants (NYSE:DRI), FactSet

(NYSE:FDS), Valneva (NASDAQ:VALN), Scholastic (NASDAQ:SCHL) and

Flux Power (NASDAQ:FLUX).

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple’s main

Taiwanese suppliers faced a decline in sales in August, with a

12.3% drop in revenue, reflecting weak consumer demand in

electronics. However, growth in demand for AI hardware has

boosted companies like Quanta Computer Inc. The new generation

iPhone could potentially revive Apple’s sales later in the

year.

Amazon (NASDAQ:AMZN) – Amazon revealed new

devices and improvements to Alexa, its voice assistant,

incorporating generative artificial intelligence to compete with

other chatbots such as Google Bard. Alexa will speak more

naturally and have new functions. Additionally, Italy’s Safilo

and Amazon have launched Carrera “smart” glasses with Alexa

technology in the United States. They offer six hours of

continuous use and direct sound to the ears, minimizing external

hearing. In other news, Amazon reversed its decision to impose

a 2% fee on merchants who don’t use its shipping services, after

announcing the fee in August. The company stated that this

revocation is intended to maintain participation in the program,

and the decision was made after careful consideration and feedback

from merchants.

Alphabet (NASDAQ:GOOGL), Broadcom (NASDAQ:AVGO)

– Google may abandon Broadcom as an AI chip supplier in 2027,

designing its own chips, following disputes over pricing. That

sent Broadcom shares down 4.9% in premarket trading

Thursday. Google has stepped up investments in AI following

the success of OpenAI’s ChatGPT.

Nvidia (NASDAQ:NVDA) – During a five-day

visit to India, Nvidia CEO Jensen Huang explored business

opportunities in AI, envisioning India as a vital market due to

trade restrictions with China. India, rich in data and talent,

and boasting a growing digital economy, is investing aggressively

in AI infrastructure and electronics production. Nvidia,

already with a significant presence in the country, sees

significant potential in its emerging technology market.

Qualcomm (NASDAQ:QCOM) – Qualcomm has

announced its entry into the Wi-Fi router market,

with UK-based Charter

Communications (NASDAQ:CHTR)

and EE (NYSE:EE) as its first

customers. The new routers will utilize the

Wi-Fi 7 standard, allowing for faster data flow and traffic

prioritization for certain services where legal. The company

also acquired OptiCore Technologies, which focuses on optical

networks.

CrowdStrike (NASDAQ:CRWD) – CrowdStrike

Holdings saw pre-market trading rise after revealing at Fal.Con

that it has raised its subscription gross margin target model to

82%-85% of revenue, an increase of 400 basis points over the

previous objective, and also expanded its operating margin target

to 28% to 32%, an increase of 900 basis points. The company

has set a deadline of three to five years to achieve these

objectives.

Klaviyo (NYSE:KVYO), Instacart (NASDAQ:CART), Arm

Holdings (NASDAQ:ARM) – On Wednesday, Klaviyo shares

closed below their first-day peak, raising uncertainty about future

listings. The poor performances of Arm Holdings and Instacart

and unfavorable market conditions, marked by high interest rates

and market declines, reinforce doubts about the expected resurgence

of IPOs. Klaviyo is down 3.6% in pre-market trading on

Thursday to $31.58 after it opened for trading on Wednesday at

$36.75, a 23% increase from the initial offering price of $30, and

closed at $32.76, an increase of 9.2%.

3D

Stratasys (NASDAQ:SSYS), Desktop

Metal (NYSE:DM) – Consultancy Institutional

Shareholder Services (ISS) recommended that Stratasys shareholders

reject plans to acquire Desktop Metal, suggesting that an offer

from 3D Systems would be more advantageous. ISS argues that it

is unclear whether Desktop Metal’s proposal creates value for

Stratasys shareholders, especially with recent declines in the

share prices of the companies involved. Voting will be on

September 28th.

Vinfast (NASDAQ:VFS) – VinFast, a

Vietnamese electric vehicle producer, plans to ship its first cars

to Europe this year after regulatory approval, at a time when

tariffs could be imposed by the European Union on Chinese

competitors. Around 3,000 VF8 crossovers are planned to be

shipped to France, Germany and the Netherlands in the fourth

quarter of this year. This expansion represents a significant

increase compared to previous targets and comes as EU research

could create a market gap. If successful, Europe will become

VinFast’s main overseas market this year.

Nio (NYSE:NIO) – Chinese electric vehicle

maker NIO has launched an Android smartphone, aiming to improve its

drivers’ experience and regain investor trust. The device,

costing around $900, will begin shipping on September

28th. NIO does not aim to compete with other phone brands, but

to integrate more technology into its vehicles.

Ford

Motor (NYSE:F), Stellantis (NYSE:STLA), General

Motors (NYSE:GM) – Detroit automakers and the United

Auto Workers have not made significant progress in negotiations,

facing possible strikes. The demands include 40% pay increases

and a 32-hour work week. GM, Ford and Stellantis face

disruptions, with little progress in sight, and a complete shutdown

could affect US GDP growth. Ford Motor workers in Canada will

vote Saturday on a three-year interim agreement, after a

last-minute compromise that avoided strikes. General Motors

shut down its Fairfax, Kansas, facility, affecting three plants and

resulting in extensive layoffs. Stellantis is also facing

disruptions, temporarily laying off employees.

Stellantis (NYSE:STLA) – UK affiliates of

Volkswagen (EU:VWA) and Stellantis are calling for

regulatory clarity, following rumors that the UK may delay its ban

on petrol and diesel cars from 2030. Both companies emphasize the

need for a framework clear legislation and binding targets for

infrastructure.

FedEx (NYSE:FDX) – FedEx reported a

surprising quarterly profit, to $4.55 per share – 82 cents more

than Wall Street expected, according to LSEG data. Shares are

up 4.9% in premarket trading after cutting costs and gaining

customers from UPS and Yellow. The company, optimizing

operations and mitigating expenses, is positive for the holiday

season, a period when volumes typically double, and plans to

repurchase US$1.5 billion in shares this fiscal year.

Exxon Mobil (NYSE:XOM) – Exxon Mobil

forecasts its fuel and chemical profits will reach $16 billion by

2027, an increase of $4 billion, as demand grows. The company,

differing from the International Energy Agency, predicts that

demand for gasoline will only peak at the end of this

decade. Exxon has integrated its refining and chemicals

businesses to maximize profits while adapting to market

demands.

General Electric (NYSE:GE) – General

Electric and Safran SA have requested sales records from AOG

Technics, which is involved in a fake components scandal. The

case reached a court in London after several airlines found

suspicious parts on their planes. The parts with suspicious

documentation would be present in CFM56 engines, used in Airbus and

Boeing planes.

Textron Aviation (NYSE:TXT) – On

Wednesday, Textron Aviation and NetJets entered into an agreement,

giving Berkshire Hathaway‘s (NYSE:BRK.B)

NetJets the option to purchase up to 1,500 Cessna Citation jets

over the next 15 years. Potentially valued at US$30 billion,

this agreement could begin to take effect in 2025, with deliveries

of the Citation Ascend, currently under development.

Walt Disney (NYSE:DIS) – Disney CEO Bob

Iger promised to “calm the noise” amid cultural tensions and

announced plans to double investments in parks and

cruises. The company, central to cultural and legislative

controversies, faces streaming challenges and adjustments to its

sports brand, ESPN. Iger emphasized the company’s commitment

to positive entertainment, moving away from controversial

agendas.

General Mills (NYSE:GIS) – General Mills

surpassed first-quarter sales and profit forecasts, benefiting from

high prices. Despite falling demand, price increases in

cereals, snacks and pet products have boosted revenues and

margins. The company kept annual forecasts stable.

Unilever (NYSE:UL) – Unilever, looking to

streamline its business and facing inflation, revived plans to sell

non-core brands including Q-Tips and Impulse, hiring Morgan Stanley

and Evercore Inc. Elida Beauty, generating $760 million in 2022 ,

includes brands such as Caress and St. Ives. The sale process,

after an abandoned effort, aims to attract private equity firms in

a possible multibillion-dollar deal.

Starbucks (NASDAQ:SBUX) – Starbucks

announced a 7.5% increase in its quarterly dividend, from 53 cents

to 57 cents, marking the 13th consecutive

increase. Shareholders of record on November 10th will receive

the dividend on November 24th.

Coty (NYSE:COTY) – Coty adjusted its

annual sales forecast due to high demand and prices. The

CoverGirl owner has seen an increase in demand for prestige

fragrances and cosmetics despite inflation challenges. The

company now expects sales growth of 8% to 10% for 2024, above

previous forecasts.

KB Home (NYSE:KBH) – KB Home reported

positive results and increased revenue forecast, reporting stable

demand despite rising mortgage rates. The company anticipated

annual revenues of approximately $6.31 billion, surpassing previous

estimates. Jeffrey Mezger, the CEO, expressed confidence in

the company’s ability to navigate changing market conditions.

DR Horton (NYSE:DHI) – DR Horton has

appointed Paul J. Romanowski as President and CEO, effective

October 1. He had been appointed co-chief operating officer of

the homebuilding company in October 2021. In the CEO role,

Romanowski will succeed David V. Auld, who will be reassigned as

executive vice chairman of the board. Auld has served as

president and CEO since October 2014.

UBS (NYSE:UBS) – UBS has laid off about

70% of staff at Credit Suisse’s Hong Kong bond research unit,

keeping fewer than 10 researchers focused on Hong Kong and China

stocks, amid post-acquisition integration from Credit

Suisse. The merger aims to optimize resources and

operations.

Goldman Sachs (NYSE:GS) – Economists at

Goldman Sachs predict the Federal Reserve will begin cutting

interest rates in the fourth quarter of next year, pushing back

their previous forecast for the second quarter.

Bank of America (NYSE:BAC) – Bank of

America will raise the hourly minimum wage to $23 in October, with

plans to reach $25 per hour by 2025, the company

announced. This will result in an annual salary of nearly

$48,000 for full-time employees.

JPMorgan Chase (NYSE:JPM) – Washington

asked JPMorgan for patience before ceasing agricultural payments to

Moscow after Russia abandoned a grain export deal. The bank

processed payments with U.S. guarantees, but after Russia abandoned

the deal, cooperation ceased in August.

Deutsche Bank AG

(NYSE:DB) – Deutsche Bank AG expects trading revenue to fall for

the third consecutive quarter as the fixed income unit normalizes,

CFO James von Moltke said. While investment banking faces

declining revenues, the bank sees growth in advisory and

underwriting. The bank’s corporate and private areas now drive

growth, benefiting from high interest rates, and the bank will

continue to focus more on these areas, limiting new capital to

investment banking.

Block (NYSE:SQ) – Block’s Square announced

a partnership with Jane Technologies to enter the Canadian cannabis

market. It will initially focus on Ontario, allowing

dispensaries to test their point-of-sale offerings. The goal

is to make legal cannabis products as accessible as illicit

ones.

US Steel

Corp (NYSE:X), Cleveland-Cliffs

Inc (NYSE:CLF) – US Steel and Cleveland-Cliffs

dispute the terms of a confidentiality agreement relating to a

sales process. Cliffs refused a six-month shutdown proposed by

US Steel, keeping options open for potential

challenges. Meanwhile, US Steel accepted offers from other

interested parties. Cliffs, aiming for transparency, opened

its books and demonstrated financial commitment to make its offer

happen. Neither company, however, commented on the

impasse.

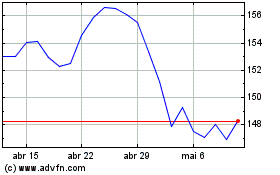

Darden Restaurants (NYSE:DRI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

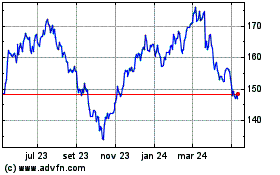

Darden Restaurants (NYSE:DRI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024