The Bank of Japan maintained its extremely accommodative

monetary policy stance, hitting the yen, while U.S. stocks are set

for hefty weekly drops in the wake of the Federal Reserve’s hawkish

tilt. Microsoft (NASDAQ:MSFT) could soon receive U.K. approval for

its Activision purchase, while an expansion of the UAW draws

nearer.

Don’t Trade Without Seeing

The Orderbook

Adobe (NASDAQ:ADBE): Phillip Securities

downgrades to reduce from accumulate with a price target raised

from $402 to $441.

Brookfield (NYSE:BAM): Wells Fargo maintains

its overweight recommendation and reduces the target price from $37

to $34.

Charter Communications (NASDAQ:CHTR): Wells

Fargo upgrades to overweight from equalweight with a price target

raised from $450 to $550.

Constellation (NYSE:STZ): Goldman Sachs

maintains its buy recommendation and raises the target price from

$275 to $305.

Darden Restaurant (NYSE:DRI): BMO Capital

Markets maintains its market perform recommendation with a price

target reduced from $160 to $155.

Deere (NYSE:DE): Canaccord Genuity downgrades

to hold from buy with a price target reduced from $530 to $400.

Delta Air Lines (NYSE:DAL): BNP Paribas Exane

maintains its outperform rating and reduces the target price from

$65 to $57.

Exxon Mobil (NYSE:XOM): Morgan Stanley

maintains its overweight/attractive recommendation and raises the

target price from $124 to $131.

Fedex (NYSE:FDX): Morningstar downgrades to

hold from sell with a price target raised from $222 to $231.

Intercontinental (NYSE:ICE): Goldman Sachs

maintains a neutral rating on the stock with a target price of

$125.

Kkr (NYSE:KKR): Barclays maintains its

overweight recommendation and raises the target price from $73 to

$82.

Nike (NYSE:NKE): Telsey Advisory Group

maintains its outperform rating and reduces the target price from

$135 to $128.

Raymond James (NYSE:RJF): Citi maintains its

neutral recommendation with a price target reduced from $120 to

$115.

Southwest Air (NYSE:LUV): BNP Paribas Exane

maintains its neutral recommendation with a price target reduced

from $34 to $31.

Splunk (NASDAQ:SPLK): Morningstar downgrades to

hold from buy with a price target raised from $125 to $144.

United Airlines (NASDAQ:UAL): BNP Paribas Exane

maintains its outperform rating and reduces the target price from

$88 to $82.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

1. BOJ maintains ultra-dovish stance, yen falls

The Bank of Japan maintained its short-term benchmark interest

at negative levels earlier Friday, and said that it will continue

with its current pace of asset purchases and yield curve control to

stimulate the economy.

In a statement announcing the decision, the BOJ repeated a

pledge to maintain ultra-loose monetary policy “as long as

necessary to maintain the (2% inflation) target in a stable

manner.”

While this had been widely expected, it followed recent comments

from Governor Kazuo Ueda indicating that the central bank was

considering a move away from this negative rate regime, following

increases in wages and inflation.

Data released earlier Friday showed that the consumer price

index came in above the BOJ’s 2% target for a 17th consecutive

month, while a core reading that excludes fresh food and fuel

prices hit an over 40-year high.

Japanese 10-year bond yields slid nearly 2% after the BOJ

announcement, while the Japanese yen fell 0.5% against the U.S.

dollar, trading close to a 10-month low at ¥148.30.

This yen weakness prompted Japan’s Finance Minister Shunichi

Suzuki to say he would not rule out any options, given the

importance of trade on the Japanese economy.

“We are closely watching currencies with a high sense of

urgency,” Suzuki said.

Japanese authorities intervened in the currency markets last

September and October, buying the Japanese currency at levels

around ¥145 and ¥150.

2. U.K. likely to approve Microsoft/Activision

acquisition

Microsoft’s potential acquisition of Activision Blizzard

(NASDAQ:ATVI) received a boost Friday, after Britain’s antitrust

regulator said the restructured proposal, submitted in August,

“opens the door to the deal being cleared.”

The $69 billion acquisition was blocked in April by Britain’s

competition regulator, which was concerned Microsoft would dominate

the growing cloud gaming market with the purchase.

The U.S. tech giant has since tried to allay these concerns,

proposing the divestment of cloud rights for existing Activision

games, including the popular “Call of Duty”, as well as new games

over the next 15 years, to French game

publisher Ubisoft Entertainment (EPA:UBIP).

The Ubisoft divestment “substantially addresses previous

concerns,” the U.K.’s Competition and Markets Authority said in a

statement.

3. Auto strike could be expanded

The strike affecting the Detroit Three automakers could be

expanded later Friday unless new labor agreements can be agreed

before the UAW union’s 12:00 ET (16:00 GMT) deadline.

The autoworker’s union last week launched simultaneous strikes

at one assembly plant each of General Motors (NYSE:GM), Ford

(NYSE:F) and Chrysler parent Stellantis (NYSE:STLA) in Missouri,

Michigan and Ohio, which produce the Ford Bronco, Jeep Wrangler and

Chevrolet Colorado, alongside other popular models.

UAW President Shawn Fain is due to speak two hours before the

deadline, outlining the plants that will join the strike if a deal

hasn’t been reached.

Analysts expect any wider strike will include plants that build

highly profitable pickup trucks such as Ford’s F-150, GM’s Chevy

Silverado and Stellantis’ Ram.

4. Oil rebounds after Russian export ban

Oil prices rose Friday on growing expectations of tighter

supplies, but were on course for their first weekly loss in four

weeks after the Fed’s warning on higher U.S. interest rates raised

concerns of a hit to demand at the world’s largest consumer.

The news that Russia has banned exports of gasoline and diesel

with immediate effect to stabilise the domestic fuel market has

given the crude market a boost, as it forces Russia’s fuel buyers

to shop elsewhere.

This added to an already tight supply situation as the

Organization of the Petroleum Exporting Countries and allies

maintained previously announced production cuts.

The U.S. crude futures traded 0.7% higher at $90.28 a

barrel, while the Brent contract climbed 0.5% to

$93.78.

Still, the benchmarks are on course to register small losses

this week, potentially ending a run of three positive weeks which

had pushed prices to 10-month highs earlier in

September.

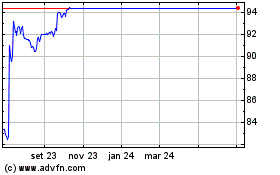

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Activision Blizzard (NASDAQ:ATVI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024