JPMorgan activates Tokenized Collateral Network (TCN) with historic

transaction between BlackRock and Barclays

JPMorgan Chase (NYSE:JPM) has successfully launched Tokenized

Collateral Network (TCN), its blockchain-based collateral

settlement application, in a groundbreaking transaction involving

BlackRock (NYSE:BLK) and Barclays (NYSE:BCS). TCN

enables near-instant conversion and transfer of tokenized assets,

revolutionizing collateral settlement and signaling a challenge to

traditional systems. The bank plans to expand the TCN to cover

a wider range of assets, increasing market efficiency and

highlighting the growing role of private banks in blockchain

technology.

Jim Cramer expresses pessimism about Bitcoin

Jim Cramer, former hedge fund manager and host of CNBC’s Mad

Money, expressed his skepticism towards Bitcoin (COIN:BTCUSD),

stating “I can’t go out with gold because gold is not good; I can’t

go out with bitcoin because I can’t be in something where Mr.

Bitcoin is about to go down big”. Despite his pessimistic

outlook, the cryptocurrency is still up 68% year to

date. Cramer had already sold his Bitcoin holdings in 2021.

Meanwhile, hedge fund billionaire Paul Tudor Jones has expressed

his support for both Bitcoin and gold due to US debt and

geopolitical concerns.

Ethereum price could reach $8,000 by 2026, says Standard Chartered

Bank

Standard Chartered Bank (LSE:STAN) predicts that the price of

Ethereum (COIN:ETHUSD) could reach $8,000 by the end of 2026,

driven by Ethereum’s dominance in smart contracts, gaming and

tokenization. Geoffrey Kendrick, head of forex and crypto

research at the bank, believes this price is an initial step

towards long-term structural valuation, which ranges from $26,000

to $35,000. Kendrick also predicts that the upcoming Bitcoin

halving in 2024 and regulation in the US will benefit Ethereum,

boosting its price to around $4,000 by the end of 2024.

NASAA supports SEC legal action against Coinbase

The North American Securities Administrators Association (NASAA)

supports the U.S. Securities and Exchange Commission (SEC) in its

legal action against Coinbase (NASDAQ:COIN). NASAA argues that

while cryptocurrencies themselves are not inherently fraudulent,

fraudsters exploit investor fear and economic

circumstances. The association defends the SEC’s consistency

regarding industry regulation and urges the court to reject

Coinbase’s arguments regarding the interpretation of securities

laws.

Bitfinex parent iFinex announces $150 million share buyback in

response to regulatory challenges

iFinex, the parent company of Bitfinex, plans to repurchase

shares worth US$150 million, equivalent to around 9% of the

company’s working capital. This strategy aims to increase

control over private trading and simplify the ownership structure,

in response to recent regulatory challenges. The buyback is

part of a strategy to navigate the ever-changing regulatory

landscape while ensuring operational autonomy.

Digital asset bank Xapo obtains broker license to trade S&P 500

shares in Europe

Gibraltar-based company Xapo has gained a securities broker

license, expanding its offering to include S&P 500 share

trading as well as crypto asset management services. Xapo

focuses on long-term investors and seeks to create diversified

portfolios, combining cryptocurrencies with stocks and savings

accounts. The company also plans to add Ethereum (COIN:ETHUSD)

to its offering, moving beyond its exclusive focus on Bitcoin

(COIN:BTCUSD).

WOO recovers tokens and shares from Three Arrows Capital after

bankruptcy

Cryptocurrency exchange WOO has successfully recovered shares

and tokens acquired from failed hedge fund Three Arrows Capital

(3AC). 3AC was the largest investor in WOO’s Series A funding

round. The deal involved the buyback and burn of 20 million

tokens, eliminating uncertainty in the WOO ecosystem. WOO

co-founder Jack Tan highlighted the focus on rebuilding the

ecosystem and a future of growth. “ The last 18

months have seen a concentration of bad news hit our industry, from

large-scale failures to more zealous regulators. A

complete cleanup of the system has taken place and we look forward

to rebuilding it with our partners and team”, said

Tan. The news came after the arrest of Su Zhu, co-founder of

3AC, in Singapore.

Former CEO of Alameda Research confesses in SBF trial

On the sixth day of the Sam “SBF” Bankman-Fried trial in New

York, former Alameda Research CEO Caroline Ellison confessed to

submitting false numbers to Genesis. She alleged that SBF

instructed her to create “alternative” balance sheets regarding

Alameda’s use of FTX funds, highlighting FTX’s $10 billion in

loans. Ellison expressed concerns about FTX withdrawing

customers and admitted her actions were “dishonest” and

“wrong.” “ I was worried about the withdrawal of

clients from FTX, this exit, people getting hurt […] I didn’t feel

good. If people found out [about Alameda using FTX

funds], they would all try to withdraw from FTX”. In

posts revealed during his trial, Sam Bankman-Fried admitted

considering closing Alameda in 2022 due to concerns about the

relationship between the two companies. He blamed the spread

of FUD (Fear, Uncertainty, Doubt) by FTX’s

competitors. Bankman-Fried planned to maintain Alameda as an

infrastructure investment and development company, but without

active trading.

OKX integrates wallet with Aftermath Finance to access

decentralized DeFi

OKX, a leader in Web3 technology, announced that its wallet is

now integrated with Aftermath Finance, allowing users to access

liquidity pools, farm and decentralized bridge solutions. The

OKX wallet offers access to 70+ blockchains and MPC technology for

enhanced security. Additionally, OKX Wallet smart account

allows payments across multiple blockchains using USDC or USDT.

Immutable and Amazon Web Services collaborate to power blockchain

gaming

Immutable, a blockchain gaming platform, has entered into a

strategic partnership with Amazon Web Services (AWS) to strengthen

the web3 gaming ecosystem. Through this partnership, Immutable

will have access to AWS resources and offer up to $100,000 in AWS

credits to game studios, advancing the blockchain technology

revolution in the gaming industry. Immutable plans to expand

its offerings and partner support in the future with the

Ethereum-compatible Immutable zkEVM.

Io.net turns GPU resources into affordable AI computing power

Io.net, originally a quantitative trading platform, has now

become a decentralized network offering affordable GPU computing

power for AI and machine learning. By aggregating GPU

resources from data centers, cryptocurrency miners, and

decentralized storage providers, Io.net seeks to drastically reduce

costs compared to centralized alternatives. The network

leverages the Solana blockchain and will introduce native tokens to

reward miners and facilitate access to affordable AI computing.

Circle and Coins.ph team up to facilitate remittances in the

Philippines with USDC

Circle (COIN:USDCUSD) announced a strategic partnership with

Coins.ph, a cryptocurrency exchange in the Philippines. The

collaboration aims to raise awareness about USDC payments by making

international money transfers more accessible and faster. The

initiative seeks to improve remittances in the Philippines, one of

the largest global recipients of remittances, especially for the

unbanked population.

Bitstamp plans return to Canadian market after temporary shutdown

Bitstamp, one of the oldest cryptocurrency exchanges, will end

its services in Canada in January 2024, but plans to return in the

future. The decision to exit the Canadian market is temporary

and based on the company’s expansion priorities. Bitstamp will

continue to focus on serving its global user base, depending on

evolving regulatory and market conditions. Currently, the

exchange serves several countries, including the United States,

South Korea and Japan.

UK committee recommends collaboration with NFT marketplaces to

combat copyright infringement

A UK cross-party committee has called on the government to work

with markets for non-fungible tokens (NFTs) to address copyright

infringement. Additionally, the committee expressed concerns

about the release of tokens by UK football clubs, warning of

financial risks to fans. The Financial Conduct Authority (FCA)

recently implemented new rules for crypto companies, requiring

registration and approval of marketing materials, and companies are

expected to comply with the “basic rules” from October

8th. Exchanges including Coinbase, Revolut and Binance have

updated their mobile and web apps to comply with the new

regulations.

Central Bank of Nigeria defends eNaira project after concerns over

financial stability

The Central Bank of Nigeria (CBN) has reacted to recent concerns

about financial stability, stating that its digital currency

project, the eNaira, does not pose a threat. The CBN responded

to allegations in the media by emphasizing its in-depth

understanding of central bank digital currencies (CBDCs) and

highlighting the aim of improving the user experience with

eNaira. The survey also revealed that Nigeria has a highly

cryptocurrency-aware population compared to other global

economies.

India collects $12 million in 1% tax on crypto transactions

India’s Central Board of Direct Taxes (CBDT) has revealed that

it has collected over $12 million in Tax Deducted at Source (TDS)

from crypto transactions this fiscal year. The Indian

government introduced a 1% direct tax on such transactions in July

2021. While the country’s crypto regulations remain uncertain, the

government has been implementing tax measures to curb the

unregulated adoption of cryptocurrencies.

New edition of Monopoly introduces Ethereum cryptocurrency

According to news site Cryptonews, MONOPOLY: World of Women

(WoW) Galaxy Edition, a new edition of Monopoly, will incorporate

cryptographic elements, with Ethereum (COIN:ETHUSD) replacing

traditional money. The game, with custom golden tokens

honoring Web3 communities, will launch on October 17, under license

from Hasbro (NASDAQ:HAS), featuring a decentralized

economy. Yam Karkai, co-founder and creative director of World

of Women, led the creative direction of the project.

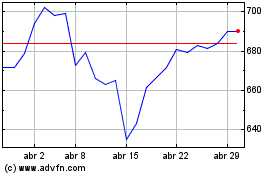

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024