US index futures are mixed in Wednesday’s pre-market, influenced

by the quarterly results of Microsoft and Alphabet, which set the

stage for other major technology companies yet to report their

results this week.

At 06:51 AM, Dow Jones futures (DOWI:DJI) rose by 39 points, or

0.12%. S&P 500 futures fell by 0.35%, and Nasdaq-100 futures

dropped by 0.58%. The yield on 10-year Treasury bonds stood at

4.863%.

In the commodities market, West Texas Intermediate crude oil for

December declined by 0.24% to $83.54 per barrel. Brent crude oil

for December fell by 0.12% to nearly $87.97 per barrel. Iron ore

with a 62% concentration, traded on the Dalian exchange, rose by

3.32% to $119.20, marking the second consecutive session gain after

three declines.

On Wednesday’s economic calendar, investors are awaiting new

home sales data for September, to be released by the Department of

Commerce at 10:00 AM. At 10:30 AM, inventory data for the week

ending October 20th will be published. Jerome Powell is scheduled

to speak at an event in Washington at 16:45 PM. In the political

arena, the race for the U.S. House Speaker position remains

undecided.

Asian stock markets had mixed results. Shanghai Composite and

Japan’s Nikkei rose, while Hong Kong’s Hang Seng gained. South

Korea’s Kospi and Australia’s ASX 200 fell due to

higher-than-expected inflation in Australia. Troubled Chinese

developer Country Garden defaulted on a dollar bond, reflecting

China’s real estate crisis. Bank of Japan is monitoring bond yields

before its policy meeting.

In Europe, most markets declined, except the UK’s FTSE 100,

which saw a slight increase. Stoxx 600 fell, with mining stocks

rising and retail stocks dropping. Deutsche Bank’s 7% share

increase couldn’t boost the index, as Kering, Reckitt Benckiser,

Worldline, and Peer Nexi all faced declines.

US Stock markets closed higher on Tuesday’s session, recovering

from previous declines, fueled by optimism about the financial

results of tech giants, with Alphabet (NASDAQ:GOOGL) and Microsoft

(NASDAQ:MSFT) reporting after the closing bell. The Dow Jones rose

204.97 points or 0.62% to 33,141.38 points. The S&P 500 gained

30.63 points or 0.73% to 4,247.68 points. The Nasdaq advanced

121.55 points or 0.93% to 13,139.87 points.

Before Tuesday’s session began, major companies, including

Coca-Cola (NYSE:KO), General Motors (NYSE:GM), and Verizon

(NYSE:VZ), announced better-than-expected results, boosting

investor sentiment. Additionally, international efforts to resolve

the impasse between Israel and Hamas influenced a drop in oil

prices to less than $90 per barrel. It’s worth mentioning the PMI

indicators released in both Europe and the U.S. In Europe, the data

was discouraging for both the services and industrial sectors,

while in the U.S., the statistics exceeded expectations.

On Wednesday’s corporate earnings front, investors will be

watching for reports from Boeing (NYSE:BA), ThermoFisher

(NYSE:TMO), T-Mobile (NASDAQ:TMUS), Hilton (NYSE:HLT), Roper

Technologies (NASDAQ:ROP) before the market opens. After the

closing bell, results from Meta Platforms (NASDAQ:META), IBM

(NYSE:IBM), Servicenow (NYSE:NOW), Align Technology (NASDAQ:ALGN),

Baker Hughes (NASDAQ:BKR), and several other companies are also

expected.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) plans to launch a sovereign cloud in Europe, storing data on

servers in the European Union with exclusive control by AWS

employees residing in the EU. This complies with EU privacy and

security regulations, with AWS debuting in Germany and offering

services to European customers.

Apple (NASDAQ:AAPL) – Apple will support a

right-to-repair bill in the US, allowing independent repair shops

and consumers to access parts and tools to fix iPhones and

computers, reducing costs and promoting sustainability. Apple has

also supported similar legislation in California. Apple also plans

to redesign its TV app as part of a tvOS software update scheduled

for December. The revamp will include discontinuing dedicated apps

for renting and purchasing movies and shows and adopting a user

interface similar to Netflix (NASDAQ:NFLX).

Additionally, Apple announced a special event called “Scary Fast”

on October 30, possibly unveiling new Mac devices with a faster M3

chip.

Nvidia (NASDAQ:NVDA) – US restrictions on

Nvidia’s AI chip exports to China took effect on Monday, ahead of

the deadline. Nvidia does not foresee an immediate impact on

profits, while other companies like AMD

(NASDAQ:AMD) and Intel (NASDAQ:INTC) are also

assessing the impact.

Qualcomm (NASDAQ:QCOM) – Qualcomm unveiled its

Snapdragon Elite X chip for Microsoft (NASDAQ:MSFT) Windows

laptops, emphasizing its superior AI performance compared to Apple

chips. Qualcomm plans to make it available next year. This

development follows Microsoft’s push for AI features in

Windows.

VMware (NYSE:VMW) – VMware’s stock had unusual

movements on Tuesday, falling and then rising above

Broadcom’s (NASDAQ:AVGO) cash offer value.

Investors speculate about the extension of the stock election

period, driven by concerns about potential regulatory approval

delays in China.

ASML (NASDAQ:ASML) – Dutch lawmakers questioned

the Minister of Commerce about the legality of new US rules for

exporting ASML chip manufacturing machines to China. While they do

not oppose the US rules, they call for a more coordinated European

approach. The US rules aim to restrict exports of machines

containing US-made parts to curb Chinese technological

advancement.

Foxconn (USOTC:FXCOF) – Terry Gou, the founder

of Foxconn and a Taiwanese billionaire, had ambitions of becoming

the country’s president, but his candidacy is declining, and he

faces a tax investigation in China, possibly due to his decision to

run as an independent, which could benefit Taiwan’s separatist

candidate. Despite his wealth and connections, Gou has seen his

political popularity decline in polls.

Corning (NYSE:GLW) – Corning projected

fourth-quarter core sales below market expectations, citing a

potential impact from the strike at Detroit Three automakers. The

company provides automotive components and faces a slowdown in

demand for fiber optic cables. Its specialty materials business,

including Gorilla Glass for smartphones, was a positive exception,

boosted by the launch of the iPhone 15.

General Motors (NYSE:GM) – California ordered

on Tuesday that General Motors’ Cruise unit remove its autonomous

cars from state roads, citing public risk and misrepresentation of

safety. Cruise has suspended operations and is reviewing previous

incidents. GM withdrew its profit forecast for 2023 due to the

United Auto Workers (UAW) strike, which has shut down three highly

profitable factories in Arlington, Texas. The strike increases

weekly costs by $400 million. Negotiations continue, with the UAW

seeking additional gains.

Honda Motor (NYSE:HMC) – Honda Motor is ending

its partnership with General Motors to develop affordable electric

vehicles due to financial challenges. CEO Toshihiro Mibe stated

that the project has been canceled, and both companies will seek

solutions separately. The partnership aimed to compete with

Tesla (NASDAQ:TSLA) in producing affordable

EVs.

Stellantis (NYSE:STLA) – Stellantis plans a

joint venture with the French company Orano to recycle electric

vehicle batteries and scrap from its gigafactories in Europe and

North America. The agreement will provide access to essential

materials for electrification. Production will commence in the

first half of 2026.

Nikola (NASDAQ:NKLA) – Nikola’s shares closed

higher on Tuesday due to the possibility of receiving an infusion

of money after an arbitrator ordered former CEO Trevor Milton to

pay $165 million to the company for securities fraud conviction in

2022. This adds approximately $80 million to Nikola’s market

capitalization, which ended the second quarter with over $225

million in cash.

Carnival Corp (NYSE:CCL) – Carnival Corp’s

Australian unit was ordered to pay the medical expenses of a woman

who contracted Covid-19, following a judge’s decision that the

company misled passengers about safety risks in a landmark

class-action lawsuit. The judge concluded that Carnival Australia

should have canceled the March 2020 return voyage from Sydney to

New Zealand. The lead plaintiff received compensation for medical

expenses, but other parties are expected to seek greater

damages.

JetBlue Airways (NASDAQ:JBLU) – JetBlue has

asked the US Department of Transportation to ban KLM from Air

France at JFK Airport, New York, if planned restrictions at

Amsterdam’s Schiphol Airport occur, citing violations of the US-EU

Air Transport Agreement. KLM has warned of potential

retaliation.

BlackRock (NYSE:BLK) – BlackRock’s proposed

bitcoin ETF has been added to a DTCC clearinghouse eligibility

file, sparking speculation about its success and driving

Bitcoin (COIN:BTCUSD) to its highest level in 18

months. However, DTCC clarified that listing does not indicate

regulatory approval, and the SEC has not commented. Approval could

attract more investment into the crypto sector.

Goldman Sachs (NYSE:GS) – David Kamo has been

appointed by Goldman Sachs as global head of financial sponsor

mergers and acquisitions, leading efforts to work with private

equity firms and alternative asset managers in buying and selling

companies in their portfolios. He will also continue to lead

cross-market mergers and acquisitions for the bank.

KKR & Co (NYSE:KKR) – KKR & Co. is in

advanced negotiations to invest approximately $400 million in OMS

Group Sdn, a Malaysian submarine cable company. This investment

could accelerate OMS’ expansion plans, although deal details are

still under discussion.

S&P Global Ratings (NYSE:SPGI) – S&P

Global Ratings downgraded Israel’s sovereign debt outlook to

negative, citing risks associated with the Israel-Hamas conflict

and predicting a 5% economic contraction in the fourth quarter due

to security disturbances and reduced business activity.

Petrobras (NYSE:PBR) – Petrobras confirmed that

the capital reserve to be created will not be used for capital

investments but exclusively for dividend payments, calming market

concerns and positively impacting the company’s shares. The

decision on extra dividends will be made later.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland Co exceeded profit estimates in the third

quarter due to strong ethanol and sweetener margins, along with

robust Brazilian agricultural exports. The company raised its

profit projections for the year and anticipated a return to profit

growth in the Nutrition unit in 2024.

SunPower (NASDAQ:SPWR) – SunPower fell 9.4% in

pre-market trading after the solar panel manufacturer announced it

would review its financial statements for 2022 and the first two

quarters of 2023. The company identified an overvaluation of

approximately $16 million to $20 million in consigned component

stock at third-party locations.

Eli Lilly (NYSE:LLY) – Most people want to lose

weight and make money, regardless of global uncertainties. Eli

Lilly’s shares are seen as an opportunity to capitalize on the

Mounjaro drug for obesity. Although there are risks, the thesis is

solid, even amid market turbulence.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson’s shares approached their lowest level in 52 weeks on

Tuesday, even after recent positive quarterly results, reflecting

general concerns about the pharmaceutical and medical device

industry due to political uncertainties, including new Medicare

drug pricing policies and the impact of obesity drugs on device

sales.

Earnings

Alphabet (NASDAQ:GOOGL) – Alphabet’s shares

were down 6.5% in Wednesday’s pre-market, despite surpassing

analysts’ expectations for third-quarter results and earnings.

Revenue showed accelerated growth of 11% compared to the previous

quarter, marking the first time in four quarters that revenue

reached a double-digit growth rate. However, Google Cloud revenue

came in at $8.41 billion, significantly below the consensus

estimate of $8.64 billion, as reported by StreetAccount.

Microsoft (NASDAQ:MSFT) – Microsoft’s shares

are up 3.7% in Wednesday’s pre-market after reporting first-quarter

financial results that exceeded expert expectations. Microsoft

reported earnings per share of $2.99 with revenue of $56.52

billion. This contrasts with analysts’ predictions of earnings per

share of $2.65 and revenue of $54.50 billion, according to LSEG.

Microsoft’s increased profit was driven by lower-than-expected

operating expenses and outstanding performance in its Azure cloud

computing segment.

Snap Inc (NYSE:SNAP) – The parent company of

Snapchat saw a 0.4% increase in pre-market trading after releasing

third-quarter results. Snap reported earnings of 2 cents per share

and revenue of $1.19 billion, surpassing analysts’ estimates polled

by LSEG, which projected a loss of 4 cents per share with revenue

of $1.11 billion. CEO Evan Spiegel highlighted a return to sales

growth during the quarter. The stock initially rose by up to 20% in

after-hours trading but then retreated as investors reacted to news

that some advertisers had reduced their spending due to the start

of the conflict between Israel and Hamas.

Stride (NYSE:LRN) – The technology-focused

education company experienced a 12.3% increase in pre-market

trading after reporting fiscal first-quarter financial results that

exceeded expectations. Stride announced earnings of 11 cents per

share, surprising analysts who had anticipated a loss of 37 cents

per share, according to FactSet. Additionally, revenue also

exceeded projections, reaching $480.2 million, while analysts

estimated $425.2 million. Strong enrollment performance in the

General Education and Professional Learning sectors drove revenue

growth.

Texas Instruments (NASDAQ:TXN) – Shares of the

semiconductor design and manufacturing company fell 4.5% in

pre-market trading after reporting mixed earnings results. The

company announced earnings per share of $1.85, which exceeded

analysts’ expectations of $1.82, according to LSEG. However,

revenue slightly missed estimates, totaling $4.53 billion compared

to analysts’ consensus of $4.58 billion.

Visa (NYSE:V) – The global payment company’s

shares fell 0.7% in Wednesday’s pre-market, even after reporting a

decline in profits and revenues for the last fiscal quarter. Visa

chose to increase its dividends by around 16% and also approved a

$25 billion stock buyback.

Teladoc Health (NYSE:TDOC) – In the third

quarter, Teladoc Health reported an increase in revenue, driven by

higher access rates, while net losses decreased compared to the

previous year. Revenue increased by 8% to $660 million from $611

million a year earlier. Analysts expected $664 million. Teladoc

reported a loss of $57.1 million, or 35 cents per share, compared

to a loss of $73.48 million, or 45 cents per share, a year ago.

Analysts expected a loss of 37 cents per share. The company

announced plans for an operational review to improve

efficiency.

CoStar Group (NASDAQ:CSGP) – The commercial

real estate company released profit and revenue projections for the

fourth quarter that did not meet analysts’ expectations. In the

third quarter, CoStar’s revenue reached $625 million, which fell

short of the consensus estimates of $625 million, according to

FactSet. Meanwhile, adjusted earnings per share were 30 cents, in

line with estimates.

Deutsche Bank (NYSE:DB) – Deutsche Bank pledged

more share buybacks and potentially higher capital returns to

shareholders, boosting its shares after reporting third-quarter

earnings 8% better than expected. The bank also highlighted growth

momentum and cost discipline but faces uncertainties in its

investment banking business and regulatory issues in the retail

sector.

Meta Platforms (NASDAQ:META) – Meta Platforms

CEO Mark Zuckerberg has been focusing on artificial intelligence

and cost reduction instead of investments in the metaverse.

Advertising remains the primary revenue source, driving

third-quarter sales estimates to $33.5 billion, with earnings of

$3.61 per share. Meta is seeking efficiency and expects increased

capital spending in 2024. Restrictive expenses could turn the “Year

of Efficiency” into years of efficiency, but questions about

AI-related costs and monetization are expected in the earnings

conference call.

Advanced Micro Devices (NASDAQ:AMD)

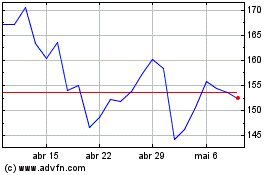

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

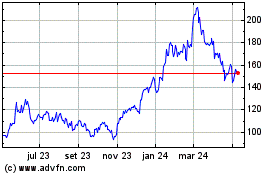

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024