MoonPay and Mastercard team up to boost Web3 integrations and

marketing

Digital asset payment platform MoonPay has announced a

partnership with payments giant Mastercard (NYSE:MA) with the aim

of promoting web3 integrations, strengthening connections and

boosting marketing strategies. The partnership aims to explore

how web3 tools can improve experiential marketing and expand

customer loyalty and engagement. MoonPay will also integrate

Mastercard tools into its services to ensure reliable and regulated

transactions in the crypto markets.“ Joining forces will

create new opportunities to showcase the potential of blockchain in

establishing unique connections and meaningful moments, while

expanding reach overall of our industry ”, described Ivan

Soto-Wright, CEO and co-founder of MoonPay.

JPMorgan’s JPM Coin reaches $1 billion in daily transactions and

considers retail expansion

JPMorgan’s (NYSE:JPM) JPM Coin, a blockchain-based

cryptocurrency for institutional clients, has achieved significant

adoption with daily transaction volume reaching $1 billion, as

reported by Bloomberg on October 26. The bank’s Global Head of

Payments, Takis Georgakopoulos, announced plans to extend its use

to retail customers, highlighting the potential for

growth. While successful, JPM Coin’s volume still represents a

fraction of the bank’s daily transactions, which total $10

trillion. In other news, JPMorgan warned that the US

Securities and Exchange Commission (SEC), by denying approvals for

spot Bitcoin ETFs, could face legal action from

applicants. Although unlikely, such a rejection is possible

and could lead to a new legal battle. JPMorgan predicts that

multiple spot Bitcoin ETF approvals could come soon.

Deutsche Bank and Standard Chartered test communication system for

blockchain transactions

Deutsche Bank (NYSE:DB) and Standard Chartered’s (LSE:STAN) SC

Ventures are conducting trials of a system that aims to enable

communication between blockchain-based transactions, stablecoins

and central bank digital currencies (CBDCs). This system,

similar to the SWIFT messaging layer in traditional banking

infrastructure, is being tested with use cases such as transferring

and exchanging USDC stablecoins on the Universal Digital Payments

Network (UDPN). UDPN is a permissioned blockchain network that

includes validator nodes from banks and financial institutions,

enabling transactions across different networks, from public

stablecoin blockchains to CBDCs.

CyberConnect powered by Binance Labs investment

CyberConnect, a Web3-based social media platform, saw its value

soar more than 30% shortly after the investment announcement from

Binance Labs, the cryptocurrency exchange’s venture capital

division. CyberConnect’s native token (COIN:CYBERUSD) rose to

$6.35 in response to the announcement. The investment

highlights growing interest in the Web3 space, which seeks to

transform traditional social networks with privacy and

decentralization. At the time of writing, the CYBER token was

down -6.5% at $5.90.

PEPE price doubles in a week, reaching market capitalization of

US$500 million

Pepe (COIN:PEPEUSD), a frog-themed memecoin, saw its price

double in a week, reaching a market cap of $500 million, before

dipping slightly. A major factor in this resurgence was the

burning of tokens worth $5.5 million, alleviating concerns about

sales by rogue developers. Other memecoins such as Dogecoin

(COIN:DOGEUSD) and Shiba Inu (COIN:SHIBUSD) also saw notable

rallies, boosting positive sentiment in the market amid rising

hopes of Bitcoin ETF approval in the US.

Token sale of Memeland (MEME) tokens reaches $10 million in record

time

Web3 company Memeland’s token sale raised a whopping $10 million

in just 42 minutes after its launch on Thursday. Previously,

community members had to participate in various activities to get

on a waiting list, but now tokens are marketed as “100% memes, with

no utility, script, promises or financial return.” Although

already sold out, the sale continues until Friday for users on the

waiting list. Memeland, created by the team behind 9GAG,

offers NFTs and apps that combine metaverses, games and NFTs.

SBI Group predicts XRP price increase after market developments

Japanese financial giant SBI Group anticipates a slight increase

in the value of Ripple’s XRP (COIN:XRPUSD) due to recent market

developments. SBI VC Trade projected that the price of XRP

will rise to $0.62, up from the current $0.56. The report also

highlights developments in the legal case between Ripple and the US

SEC, predicting greater acceptance of XRP by individual investors

in the future. However, SBI warns about risks associated with

market volatility and geopolitical issues.

Grayscale Bitcoin Trust (GBTC) shares outperform Bitcoin and

S&P 500 with 220% gain

Investors who purchased shares of Grayscale Bitcoin Trust

(USOTC:GBTC) at the beginning of the year were rewarded with a 220%

increase in share value to $26.79. By comparison, Bitcoin

(COIN:BTCUSD) rose 100% to $35,000, Nvidia (NASDAQ:NVDA) rose 198%,

and the S&P 500 rose 9%. The optimism comes with hopes

that the US SEC will approve the conversion of GBTC into a Bitcoin

exchange-traded fund (ETF). GBTC’s discount to its net asset

value (NAV) has also narrowed to 13% from the previous 46%, as

traders adopt strategies to profit from the narrowing discount.

Bitmain launches new air-cooled Antminer T21 Bitcoin miner

Bitmain, a leading global manufacturer of application-specific

integrated circuits (ASIC) for Bitcoin, has unveiled the Antminer

T21, a new air-cooled Bitcoin miner. The device supports

temperatures of up to 45 degrees Celsius and is designed to mine

cryptocurrencies based on the SHA256 algorithm, such as Bitcoin

(COIN:BTCUSD), Bitcoin Cash (COIN:BCHUSD) and Bitcoin SV

(COIN:BSVUSD). With a hash rate of 190 terahashes per second

and energy efficiency of 19 joules per terahash, the Antminer T21

is expected to be available for purchase from January 2024.

SEC Chairman’s speech reveals $5 billion surveillance

SEC Chairman Gary Gensler highlighted the agency’s $5 billion

worth of enforcement actions in judgments and orders during the

2023 Securities Enforcement Forum. Gensler, however, sparked

controversy in the crypto community by reaffirming his stance

strict on cryptocurrency regulation, stating that most crypto

assets fall under securities and should be regulated as

such. He also compared the current crypto ecosystem to the

financial landscape of the 1920s, highlighting the need for

stricter regulations.

Sam Bankman-Fried prepares to testify in criminal fraud trial

Businessman Sam Bankman-Fried is scheduled to testify in his

criminal fraud trial after the prosecution phase

concludes. Two defense witnesses will be interviewed before

Bankman-Fried takes the stand for at least four hours. The

decision to testify involves risks, as he will face rigorous

questioning from prosecutors, who accuse him of misusing client and

investor funds totaling more than $8 billion. Former

colleagues also testified for the prosecution, alleging that he

oversaw Alameda Research’s misappropriation of funds.

Euroclear and World Bank launch native digital bond on the

Luxembourg Stock Exchange

Euroclear, a Belgian bank, and the World Bank issued digital

bonds worth 100 million euros on the Luxembourg Stock

Exchange. Digitally Native Notes (DNN) were distributed and

settled via blockchain, with Citigroup (NYSE:C) acting as the

issuance and payment agent and TD Securities as the

dealer. R3’s Corda technology was used for the issuance,

seeking to establish a scalable structure that combines

digitalization with accessibility and liquidity. This

advancement could transform debt capital markets and strengthen

digitalization in post-trade services.

UK strengthens powers to confiscate cryptocurrency assets in

criminal cases

The UK government has passed a law expanding authorities’ powers

to seize cryptocurrency assets associated with criminal activity,

including money laundering, fraud and ransomware attacks. The

new legislation allows government agencies such as police to seize

cryptocurrency assets during investigations, even without the need

to arrest an individual for a crime.

Circle, BitoGroup and Taiwan FamilyMart transform loyalty points

into cryptocurrencies

Stablecoin issuer Circle (COIN:USDCUSD), in partnership

with BitoGroup and Taiwan FamilyMart, is introducing an innovative

“Points-to-Crypto” service. BitoGroup is Taiwan’s leading

crypto service provider, and Taiwan FamilyMart is the country’s

second-largest convenience store chain. Customers can now

convert their FamilyMart loyalty points, called FamiPoints, into

digital currencies like USDC. This democratizes access to

crypto, preserving the value of loyalty points and eliminating

transaction fees. This collaboration expands the utility of

loyalty points and promotes entry into the digital economy in

Taiwan by leveraging the country’s dense network of convenience

stores. Circle seeks to expand its presence in the APAC

region, promoting strategic alliances like this.

High-ranking public officials in South Korea have declared their

cryptocurrency holdings to ensure transparency

To promote transparency and avoid conflicts of interest,

Gyeonggi Province, South Korea, announced that civil servants at

level 4 or higher must declare their cryptocurrency holdings

daily. Of the 228 affected employees, 23 reported their

participation. The review of professional responsibilities and

important decisions confirmed that there was no conflict between

his official duties and cryptographic assets. Officials

involved in crypto regulations cannot trade based on official

information and must report their virtual assets.

Anboto Labs raises $3M, launches non-custodial cryptocurrency

trading platform

Hong Kong-based Anboto Labs has raised $3 million in funding and

introduced an institutional-grade non-custodial trading

platform. The investment was raised from investors such as

Kronos Ventures, Cherry Crypto, Mechanism Capital, XBTO and

Matrixport. The platform, which has already undergone an

18-month closed beta with $4 billion in trading volume, offers

execution algorithms, multi-factor authentication and enhanced

security. The company plans to expand its capabilities to

democratize access to cryptocurrency execution tools.

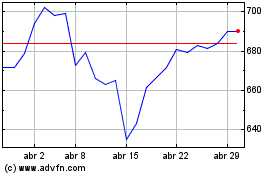

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024