Today, all eyes are focused on the U.S. Federal Reserve’s

monetary policy decision later in the day. U.S. rate futures have

priced in a 99.7% chance for the Fed to keep its federal funds rate

range unchanged at 5.25-5.50%. In addition, market participants

will be closely observing Fed Chair Jerome Powell’s post-decision

press conference for clues about the central bank’s path forward

with rates.

“The Fed will keep the option of future rate hikes firmly on the

table until the labor market cools considerably and inflationary

pressures ease. Chairman Powell will also argue that the lagged

effects of past hikes have not fully impacted the economy and that

patience is prudent,” said Erik Weisman, chief economist and

portfolio manager at MFS Investment Management.

Also, investors will likely focus on the U.S. ISM Manufacturing

PMI, which came in at 49.0 in September. Economists foresee the new

figure to be 49.0.

U.S. ADP Nonfarm Employment Change data will be reported today.

Economists foresee this figure to stand at 150K in October,

compared to 89K in September.

U.S. JOLTs Job Openings data will come in today. Economists

expect September’s figure to be 9.250M, compared to August’s value

of 9.610M.

U.S. S&P Global Manufacturing PMI will also be in focus

today. Economists foresee this figure to stand at 50.0 in October,

compared to the previous number of 49.8.

U.S. Crude Oil Inventories data will be reported today as well.

Economists estimate this figure to be +1.261M, compared to last

week’s value of +1.371M.

In the bond markets, United States 10-year rates are at 4.908%,

up +0.64%.

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

Pre-Market U.S. Stock Movers

Paycom Software (NYSE:PAYC) tumbled over -36%

in pre-market trading after the payment software company reported

weaker-than-expected Q3 revenue and provided soft Q4 revenue and

adjusted EBITDA guidance.

Yum China Holdings (NYSE:YUMC) plunged more

than -12% in pre-market trading after the restaurant operator

posted downbeat Q3 results.

Advanced Micro Devices (NASDAQ:AMD) fell over

-2% in pre-market trading after the semiconductor company issued

weak Q4 guidance due in part to gaming weakness.

Caesars Entertainment Corporation (NASDAQ:CZR)

rose more than +4% in pre-market trading after reporting

better-than-expected Q3 results.

First Solar (NASDAQ:FSLR) climbed over +4% in

pre-market trading after the company posted stronger-than-expected

Q3 earnings and raised the lower end of its full-year earnings

guidance.

Ford Motor Company (NYSE:F) gained more than

+2%, and General Motors Company (GM) rose over +1% in pre-market

trading after Barclays upgraded the stocks to Overweight from Equal

Weight.

Boeing (NYSE:BA) rose more than +1% in

pre-market trading after Goldman Sachs upgraded the stock to

Conviction Buy from Buy.

Don’t Trade Without Seeing

The Orderbook

Today’s U.S. Earnings Spotlight: Wednesday – November

1st

Qualcomm (QCOM), Mondelez (MDLZ), CVS Health Corp (CVS), Airbnb

(ABNB), Humana (HUM), MercadoLibre (MELI), McKesson (MCK), PayPal

Holdings Inc (PYPL), Aflac (AFL), Estee Lauder (EL), MetLife (MET),

Apollo Global Management A (APO), AIG (AIG), Trane Technologies

(TT), Williams (WMB), Energy Transfer (ET), Kraft Heinz (KHC), TE

Connectivity (TEL), Yum! Brands (YUM), Electronic Arts (EA), DuPont

De Nemours (DD), Allstate (ALL), IDEXX Labs (IDXX), Prudential

Financial (PRU), IQVIA Holdings (IQV), Verisk (VRSK), DoorDash

(DASH), CDW Corp (CDW), Coca-Cola European (CCEP), Nutrien (NTR),

Martin Marietta Materials (MLM), Ingersoll Rand (IR), American

Water Works (AWK), Entergy (ETR), DTE Energy (DTE), Garmin (GRMN),

PTC (PTC), Marathon Oil (MRO), Tyler Technologies (TYL), CF

Industries (CF), Biomarin Pharma (BMRN), Albemarle (ALB), Clorox

(CLX), Texas Pacific (TPL), Builders FirstSource (BLDR), Super

Micro Computer (SMCI), Trimble (TRMB), Renaissancere (RNR), Host

Hotels Resorts (HST), EXACT Sciences (EXAS), Gfl Environmental

(GFL), NiSource (NI), United Therapeutics (UTHR), Western Midstream

Partners (WES), Ceridian HCM (CDAY), CH Robinson (CHRW), Boston

Properties (BXP), American Financial (AFG), Zillow C (Z), Zillow

Group Inc (ZG), Procore Technologies (PCOR), Confluent (CFLT),

Qorvo Inc (QRVO), Roku (ROKU), Clean Harbors (CLH), SCI (SCI),

Regal Beloit (RRX), Murphy USA Inc (MUSA), Etsy Inc (ETSY),

Curtiss-Wright (CW), Royal Gold (RGLD), Chord Energy (CHRD), BWX

Tech (BWXT), Exelixis (EXEL), Avis (CAR), Selective (SIGI), Siteone

Landscape Supply (SITE), Sarepta (SRPT), Parsons (PSN),

MicroStrategy (MSTR), Axalta Coating Systems (AXTA), Watts Water

Technologies (WTS), Norwegian Cruise Line (NCLH), Apellis Pharma

(APLS), Bausch + Lomb (BLCO), Wingstop Inc (WING), Informatica

(INFA), DT Midstream (DTM), Generac (GNRC), ELF Beauty (ELF),

Timken (TKR), Wayfair Inc (W), Axis Capital (AXS), Tenable (TENB),

Magnolia Oil (MGY), Remitly Global (RELY), National Fuel Gas (NFG),

Frontier Communications Parent (FYBR), Enact Holdings (ACT), MKS

Instruments (MKSI), Clearwater Analytics Holdings (CWAN), Casella

(CWST), Bright Horizons (BFAM), Avnet (AVT), Sunoco LP (SUN),

Axcelis (ACLS), DXC Technology (DXC), Cerevel Therapeutics Holdings

(CERE), Quidel (QDEL), Radian (RDN), Summit Materials Inc (SUM),

Northern Oil&Gas (NOG), Dun And Bradstreet (DNB), Rayonier

(RYN), Janus Henderson (JHG), Alight (ALIT), Lincoln National

(LNC), California Resources (CRC), National Storage Affiliates

Trust (NSA), Joby Aviation (JOBY), Sotera Health (SHC), Inari Med

(NARI), Arcosa (ACA), Glaukos Corp (GKOS), Marriot Vacations

Worldwide (VAC), Black Hills (BKH), Corcept (CORT), Rapid7 Inc

(RPD), SSR Mining (SSRM), Broadstone Net (BNL), Digitalbridge Group

(DBRG), Extreme (EXTR), FormFactor (FORM), LivaNova PLC (LIVN),

Callon Petroleum (CPE), Aurora Innovation (AUR), Warrior Met Coal

(HCC), Park Hotels & Resorts (PK), Scotts Miracle-Gro (SMG),

Avista (AVA), Vermilion Energy (VET), Spirit Aerosystems (SPR),

Jfrog (FROG), Werner (WERN), Frontdoor (FTDR), NMI Holdings (NMIH),

Sitime Corp (SITM), Resideo Tech (REZI).

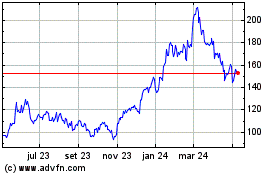

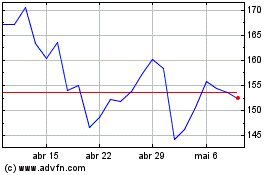

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Advanced Micro Devices (NASDAQ:AMD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024