U.S. index futures indicate a positive opening on Monday, driven

by the anticipation of an end to the Federal Reserve’s interest

rate hike cycle.

As of 06:28, Dow Jones futures (DOWI:DJI) rose 19 points, or

0.06%. S&P 500 futures gained 0.17%, and Nasdaq-100 futures

increased by 0.20%. The yield on 10-year Treasury notes stood at

4.595%.

In the commodities market, West Texas Intermediate crude for

December rose 1.66%, to $81.86 a barrel. Brent crude for December

gained 1.53% to near $86.19 a barrel. Iron ore with a 62%

concentration, traded on the Dalian Commodity Exchange, increased

by 0.05%, priced at $127.15 per tonne.

The economic agenda for this Monday will not be busy, with the

only highlight being a speech by Cleveland Fed President Loretta

Mester scheduled for 11:00 AM.

In the Middle East, the Israeli military struck 450 Hamas

targets in Gaza and seized a militant complex. Concurrently, U.S.

Secretary of State Antony Blinken visited the West Bank for

diplomatic meetings. In Asia, financial markets closed higher,

responding to U.S. economic data and comments from the Bank of

Japan’s president regarding deflation. The Hong Kong, Shanghai, and

Tokyo stock indices recorded significant gains. In Europe, German

industrial data exceeded expectations, while other economic

indicators for the region pointed to a slowdown.

US stocks closed higher on Friday, driven by optimism following

the announcement of lower-than-expected debt issuance by the US

Treasury and the Federal Reserve’s decision to maintain stable

interest rates. The Dow Jones increased by 0.66%, the S&P 500

rose by 0.94%, and the Nasdaq advanced by 1.38%. Over the course of

the week, the Nasdaq saw a remarkable surge of 6.6%, the S&P

500 soared by 5.9%, and the Dow Jones recorded a 5.1% increase. The

Treasury has plans to offer $112 billion in bonds, leading to a

decline in long-term interest rates. Federal Reserve President

Jerome Powell expressed caution and uncertainty about the

appropriate adjustments to monetary policy to manage inflation,

which will be a crucial factor for the December meeting.

On the corporate earnings front for Monday, investors will be

closely monitoring reports from Dish Network

(NASDAQ:DISH), BioNTech (NASDAQ:BNTX),

Axsome Therapeutics (NASDAQ:AXSM), Kosmos

Energy (NYSE:KOS), prior to the market opening. After the

market closes, reports from Realty Income

(NYSE:O), NXP Semiconductors (NASDAQ:NXPI),

Diamondback Energy (NASDAQ:FANG),

Coterra (NYSE:CTRA), Tripadvisor

(NASDAQ:TRIP), among others, are eagerly anticipated.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN), Meta

Platforms (NASDAQ:META) – The UK competition regulator has

accepted commitments from Meta and Amazon to promote fair

competition on their retail platforms. Amazon will not use rival

sellers’ market data for unfair advantages, while Meta will refrain

from exploiting advertising customer data to enhance Facebook

Marketplace.

Apple (NASDAQ:AAPL) – Apple has warned that its

revenue in the next quarter will remain virtually flat compared to

the previous year, disappointing investors who were expecting

growth. Overall sales will remain similar, with the iPhone slightly

boosting revenue, while iPad and wearables will experience

declines. The company faces challenges in China due to US tech bans

and local competition.

Alphabet (NASDAQ:GOOGL) – Epic Games Inc. is

challenging Alphabet in an antitrust trial, alleging that the

Google Play Store restricts competition by forcing developers to

install their apps only through the Play Store. Epic is not seeking

financial compensation but rather changes in Google’s practices.

The trial is expected to last several weeks, with a witness list

that includes executives from both companies.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway reported a 40.6% jump in third-quarter operating profits,

totaling $10.761 billion, while amassing a record $157.2 billion in

cash. Warren Buffett invested in Treasury bonds and reduced stock

buybacks.

General Motors (NYSE:GM) – The provisional

agreement between the United Auto Workers and General Motors

includes salary increases of up to 33% for full-time workers,

faster progression opportunities for temporaries, $4 billion in

investments in electric vehicle factories, and improvements in

working conditions. Additionally, General Motors reversed its

decision to lay off 1,245 workers in Brazil after the Labor Court

rejected the company’s request. The union considers this reversal a

“historic victory.”

Tesla (NASDAQ:TSLA) – Tesla plans to produce a

$26,838 car at its Berlin factory, aiming for mass acceptance of

electric vehicles. The production start date has not been

disclosed. Elon Musk aims to make electric vehicles more

affordable. Tesla also announced wage increases for its employees

in Gruenheide, Germany.

Lucid Group (NASDAQ:LCID) – Lucid Group has cut

prices on its luxury sedan lineup, the Air model, due to fierce

competition and a slowdown in electric vehicle demand. High

interest rates have pressured EV demand, leading manufacturers,

including Tesla, to reduce prices. Lucid has reduced prices on

several models, with discounts of up to $10,000. The offer is valid

until November 30.

Polestar (NASDAQ:PSNYW) – Electric vehicle

manufacturer Polestar announced a deal with South Korean company SK

On to supply battery cell modules for its upcoming Polestar 5 EV

model.

Ryanair (NASDAQ:RYAAY) – Ryanair expects to

achieve a record annual profit of €1.85 to €2.05 billion due to

higher summer fares and limited capacity. The company plans to pay

regular dividends for the first time and anticipates strong growth

next year.

Morgan Stanley (NYSE:MS) – According to Michael

Wilson, a strategist at Morgan Stanley, the recent recovery in the

S&P 500 should not be seen as the start of a sustained recovery

but rather as a bear market rally. Concerns about higher interest

rates and weak economic data still persist. Wilson maintains a

bearish view on stocks this year.

UBS (NYSE:UBS) – Bosco Ojeda, former head of

small and mid-cap European stock research at UBS Group AG, is

transitioning to fund management. He has teamed up with Pedro

Yagüez to manage the Columbus European Equities mutual fund in

Madrid, focusing on small and mid-cap companies.

Barclays (NYSE:BCS) – Barclays has revised its

forecast for the Federal Reserve, anticipating a 25 basis point

rate hike in January instead of December. This is based on weak job

data and the Fed’s cautious approach to future projections. The

unemployment rate in October rose to 3.9%, the highest since

January 2022. Barclays economists believe the Fed will keep rates

elevated until September 2024.

KKR and Company (NYSE:KKR), Telecom

Italia (BIT:TIT) – KKR has successfully raised its second

global impact fund, garnering $2.8 billion, more than double its

2020 fund. This fund invests in sustainable initiatives aligned

with the UN Sustainable Development Goals and has already made 18

investments. In other news, Telecom Italia (TIM) approved the sale

of its fixed-line network to KKR for $20 billion. The decision was

contested by Vivendi, TIM’s largest shareholder.

BlackRock (NYSE:BLK) – According to Jean

Boivin, head of the BlackRock Investment Institute, stocks may face

continued pressure due to prospects of higher interest rates and

stagnant economic growth. However, other analysts like Savita

Subramanian of Bank of America (NYSE:BAC) see

upside potential, predicting a 15.5% price return for the S&P

500 over the next 12 months.

Bain Capital (NYSE:BCSF) – Bain Capital is

nearing the acquisition of Guidehouse, valued at $5.3 billion,

according to the Wall Street Journal. An announcement may be made

soon. Guidehouse is a government and business consulting firm that

was acquired by Veritas Capital from PricewaterhouseCoopers’ public

sector business in 2018.

Cinemark Holdings (NYSE:CNK) – Cinemark

reported a net profit of $90.2 million, an increase compared to the

$24.5 million loss from the same period last year. Revenue totaled

$874.8 million, surpassing estimates, driven by increased

admissions and concessions revenue, reflecting a 27.9% rise in

admissions and a 6.9% increase in the average ticket price.

Birkenstock Holding (NYSE:BIRK) – Shares of

Birkenstock Holding rose 1.2% in pre-market trading, reaching

$41.64, after analysts from institutions such as JP Morgan,

Jefferies, Citi, and Stifel initiated coverage of the German

footwear manufacturer with buy recommendations.

Tyson Foods (NYSE:TSN) – Tyson Foods is

conducting a voluntary recall of 30,000 pounds of chicken “Fun

Nuggets” after reports of metal pieces in the product.

Tyson-branded 29-ounce packages are affected. The product was

produced on September 5, 2023. A mild oral injury has been

reported, but no further injuries or illnesses associated with

it.

Unilever (NYSE:UL) – Lindsell Train, one of

Unilever’s major investors, has praised the recent management

changes at the consumer goods company and discussed future steps

with the new CEO, Hein Schumacher. Unilever plans to simplify its

business, focusing on 30 core brands.

Lumen Technologies (NYSE:LUMN) – Lumen

Technologies CEO Kate Johnson purchased 1 million company shares at

an average price of $0.97 per share, totaling $970,000 in spending.

Her acquisition came after a historic drop in Lumen’s stock, which

fell 32.9% to $0.98. Johnson now owns over 5.1 million Lumen

shares. The company has faced challenges and is seeking a

turnaround under her leadership.

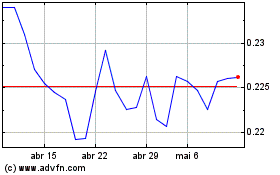

Telecom Italia (BIT:TIT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Telecom Italia (BIT:TIT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024