AVAX and NEAR lead weekly gains

In the last week, the tokens AVAX from Avalanche (COIN:AVAXUSD)

and NEAR from Near Protocol (COIN:NEARUSD) registered significant

gains, with AVAX rising almost 60% and NEAR increasing more than

23%. The growth of AVAX can be attributed to its inclusion in the

Project Guardian of the Monetary Authority of Singapore, along with

partners like Onyx from JPMorgan (NYSE:JPM) and Apollo Global

(NYSE:APO). On the other hand, NEAR benefited from several

announcements made at the annual Nearcon conference in Lisbon.

Meanwhile, Bitcoin (COIN:BTCUSD) and Ether (COIN:ETHUSD) lost

value, falling 1.6% and 9.3%, respectively.

Crypto market stabilization after action from the US government

The threat of imminent liquidation in the cryptocurrency market

was averted after the US president, Joe Biden, signed a law to

avoid a government shutdown, according to Markus Thielen from

Matrixport. A shutdown would have interrupted government functions,

affecting approvals of Bitcoin ETFs and could lead to a 10% drop in

the value of bitcoin (COIN:BTCUSD). The approval of the law keeps

the hope of authorizing Bitcoin ETFs. The recent drop in inflation

in the US and the possible reduction of interest rates by the Fed

signal a recovery of risk assets, with expectations of a bullish

bitcoin market until December 2024. Mike Belshe, CEO of BitGo,

considers it “quite likely” that the US SEC will reject Bitcoin ETF

requests. In an interview with Bloomberg, he pointed out that the

rejection could be due to a lack of separation between exchanges

and custody, citing Coinbase (NASDAQ:COIN) as an example. Although

ETF analysts give a 90% chance of approval in January, the SEC has

a history of rejections due to concerns about market manipulation

and customer protection. The price of BTC has risen 45% since

BlackRock’s ETF request in June.

WisdomTree persists with new Bitcoin ETF request to the SEC

WisdomTree, an asset manager, is renewing its efforts to launch

a Bitcoin ETF (COIN:BTCUSD), despite past rejections. According to

James Seyffart, ETF analyst at Bloomberg, the company submitted an

amendment to the SEC, signaling its ongoing intention to launch the

ETF amid growing interest in cryptocurrency products.

Crypto community challenges SEC Gensler’s speech

Gary Gensler, chairman of the SEC, emphasized in a speech the

need for the agency to be an ally of honest businesses. However,

members of the cryptographic community, including the lawyer for

Ripple (COIN:XRPUSD), countered, accusing Gensler of contradiction

and prejudgment in actions against cryptocurrencies. They

criticized the SEC for allegedly favoring a corrupt system and for

becoming internationally irrelevant.

Avara expands presence in Web3 with strategic acquisition

Aave (COIN:AAVEUSD), now renamed Avara, is expanding its web3

portfolio with the acquisition of Los Feliz Engineering, a web3

innovation company from Los Angeles. The acquisition includes

notable products such as the Ethereum Family wallet and the

ConnectKit library. Benji Taylor, founder of the Family, joins the

Avara team as senior vice president. This move reinforces Avara’s

goal of building a robust and innovative web3 ecosystem, as

highlighted by founder Stani Kulechov.

Sushi adds support for native Bitcoin through expansion to

ZetaChain

The DeFi protocol Sushi (COIN:SUSHIUSD) made history by

integrating native Bitcoin (COIN:BTCUSD) into its system through

ZetaChain. This innovation, announced in a blog post, allows users

to trade BTC on 30 different networks without the need to convert

it into an ERC-20 token, as usual on Ethereum (COIN:ETHUSD).

ZetaChain, a layer 1 blockchain platform, offers Omnichain smart

contracts that facilitate safe and efficient transfers across

multiple blockchains. The Sushi-ZetaChain partnership promotes the

concept of DeFi 3.0, providing decentralized native BTC trading in

the DeFi space. With the integration of Sushi’s offerings,

including AMM Sushi v2, v3 AMM, and SushiXSwap, users will be able

to trade native BTC across various networks, exploring

unprecedented liquidity in the Bitcoin network.

PRC-20 tokens drive high gas fees on Polygon

Transactions with PRC-20 tokens on Polygon (COIN:MATICUSD), an

Ethereum (ETH) layer 2 network, raised gas fees to the highest

levels of the year. On November 16, the average gas fee reached a

peak of over 5,000 Gwei, with network users spending about $131,000

or 155,000 MATIC in fees, the highest value since last November.

Sandeep Nailwal, founder of Polygon, called the high fees “crazy”,

despite the good performance of the network, which recorded 6

million transactions in 24 hours. The increase in fees coincided

with the minting of the PRC-20 POLS token, which consumed more than

102 million MATIC in transaction fees. These tokens, similar to the

BRC-20 of Bitcoin Ordinals, allow the creation of NFTs on the

Polygon network. Interestingly, this rise in Polygon fees is

comparable to the increase in fees on the Bitcoin network due to

Ordinals and the similar, albeit less intense, impact on the

Litecoin network (COIN:LTCUSD).

EigenLayer prepares phase 2 to improve scaling and security on

Ethereum

The Ethereum protocol EigenLayer plans to launch the second

phase of its mainnet in 2024, enabling ether delegation to EigenDA

operators. This will strengthen the security of the protocol and

support scaling solutions, such as rollups. EigenLayer aims to use

staked ether for additional security and scaling services.

Patent confrontation in the blockchain domain industry

In a battle over patents, Nick Johnson of the Ethereum Name

Service (ENS) criticizes Unstoppable Domains for patenting

blockchain domain technologies. Accusing it of benefiting from ENS

innovations, he highlights the open-source philosophy of ENS, in

contrast to Unstoppable’s patent approach. He threatens legal

action unless Unstoppable formally commits to not restricting

innovations, while Unstoppable invites ENS to join the Web3 Domain

Alliance.

Ukrainian empowerment in investigation of crypto financial crimes

In Vienna, 14 Ukrainian officers received specialized training

in the investigation of crypto financial crimes, organized by the

UN and OSCE. From November 14 to 17, 2023, they are learning

advanced techniques and practical uses of investigative tools,

focusing on tracking illicit transactions on blockchains. Ralf

Ernst of the OSCE emphasized the importance of the training given

the increasing use of cryptocurrencies in Ukraine: “With the

growing use of virtual assets and cryptocurrencies in Ukraine,

there is an urgent need to strengthen the capacity of law

enforcement and supervisory bodies. This is essential for effective

investigations, increasing Ukraine’s resilience against money

laundering and other financial crimes.”

Jennifer Hicks leaves position at Binance

Jennifer Hicks, former head of counter-terrorism at Binance, has

left the world’s largest cryptocurrency exchange, as indicated on

her LinkedIn profile. Hicks, who previously worked at Chainalysis

and the US Navy, served at Binance for almost two years. Her

departure occurs in a context where the role of cryptocurrencies in

financing terrorism has been intensively debated in the US,

especially after reports on the use of cryptocurrencies by militant

groups.

Strike expands Bitcoin purchase for global users

Strike, a Bitcoin platform, is expanding its service globally,

enabling the purchase of Bitcoin in more than 36 countries.

Announced by founder Jack Mallers, this long-requested feature

makes buying Bitcoin easy and straightforward through the Strike

app. Although there is a 3.9% fee for users outside the US, Strike

plans to reduce this cost. The company is also collaborating with

Bitrefill to enable global purchases using the Lightning

Network.

Mastercard’s skepticism about the viability of CBDCs

Ashok Venkateshwaran of Mastercard (NYSE:MA) expressed doubts to

CNBC about the need for central bank digital currencies (CBDCs),

given customer satisfaction with conventional money. He highlighted

the complexity of adopting CBDCs, which must be as usable as

physical money. About 130 countries are exploring CBDCs, but only

11 have implemented them. Mastercard, through its partnership

program, is engaged in the development of CBDCs, having completed a

pilot in Hong Kong, but Venkateshwaran emphasizes that creating the

necessary infrastructure for CBDCs is a significant challenge.

Bitget Wallet offers innovation and expansion in the Turkish market

Bitget Wallet, formerly BitKeep, stood out at the Devconnect

conference in Istanbul as a leader in Web3 wallets and sponsor of

the UnStable Summit. The exchange plans expansion in the Turkish

market, focusing on Web3 services and local partnerships. The

company also emphasizes its influence in the Web3 ecosystem and

offers non-custodial OTC services, including NFT trading and DeFi

solutions on more than 90 blockchains.

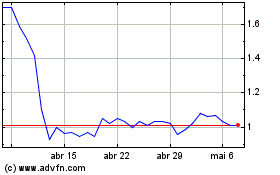

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025