Binance reactivates cryptocurrency purchases with Mastercard

Binance, the largest cryptocurrency exchange by volume, has

announced the reactivation of Mastercard (NYSE:MA) for

cryptocurrency purchases. According to a statement on the X

platform, the functionality has been restored with a single

purchase limit of up to 5,000 euros, about $5,440, and $20,000 for

transactions in U.S. dollars. This return is part of a larger

effort by Binance to meet stringent compliance standards,

reinforcing trust among users and regulators. The company also

plans to expand regulated payment options to further facilitate

user transactions.

Robinhood acquires Bitstamp for $200 million to expand crypto

operations

Robinhood Markets (NASDAQ:HOOD) has finalized the acquisition of

Bitstamp, one of the world’s oldest cryptocurrency exchanges, for

$200 million. This acquisition, expected to be completed in the

first half of 2025, aims to expand Robinhood’s Bitcoin and

cryptocurrency business, increasing its global reach and its

ability to serve institutional and retail customers. Bitstamp,

known for its resilience and reliability, will complement the

services already offered by Robinhood, which sees in cryptography

the potential to reorganize the financial system.

Bitdeer acquires Desiweminer in a $140 million transaction

Bitcoin miner Bitdeer (NASDAQ:BTDR) has purchased ASIC chip

designer Desiweminer in an all-stock deal valued at $140 million.

The transaction, announced on June 3, involves 20 million Class A

ordinary shares of BTDR. The Desiweminer team will join Bitdeer’s

ASIC design team in Singapore, with combined products ready for

immediate launch. This move comes after a $150 million investment

from Tether in Bitdeer. In response to the announcement, BTDR

shares rose about 6.3%, to $7.45, in Thursday’s trading.

Core Scientific rejects acquisition offer from Coreweave

Core Scientific (NASDAQ:CORZ), a prominent cryptocurrency miner,

has declined an acquisition proposal from Coreweave valued at $5.75

per share. The board stated that the offer undervalues the company,

considering its recent deals and growth projections. This

announcement comes after Core Scientific overcame a bankruptcy

petition and demonstrated a robust financial recovery in the first

quarter of 2024.

Ark’s Cathie Wood withdraws from Ether ETF due to intense fee war

Cathie Wood of Ark Investment has abandoned the launch of an

Ethereum ETF in the U.S., citing the competitive fee war as a

decisive factor. At the Consensus conference, Wood revealed that

Ark’s spot Bitcoin ETF, with a fee of 0.21%, was not profitable.

With Grayscale setting higher fees and losing market leadership,

the industry faces a race to offer low fees. Analysts view Ark’s

exit as a response to reduced margins and potentially lower demand

for Ether ETFs compared to Bitcoin ETFs.

Bitcoin ETFs record record inflows of $1.4 billion in two days

On June 5, Bitcoin ETFs recorded inflows of $488.1 million,

marking 17 consecutive days of inflows, a new record. In the past

two days, inflows totaled an impressive $1.4 billion. The Fidelity

ETF (AMEX:FBTC) led with $220.6 million, followed by the BlackRock

ETF (NASDAQ:IBIT) with $155.4 million. The ARK ETFs (AMEX:ARKB) and

the Bitwise ETF (AMEX:BITB) registered $71.4 million and $18.5

million, respectively. The Grayscale ETF (AMEX:GBTC) recorded

inflows of $14.6 million, but still faces a total net outflow of

$17.9 billion.

Bitcoin volatility increases with futures expiration and high

projections for 2024

Bitcoin (COIN:BTCUSD) is fluctuating around $71,000 this

Thursday, hitting an intraday high of $71,650.56 and trading at

$70,956 at the time of writing. Among the top 10 cryptocurrencies,

all are experiencing slight declines, except Ether (COIN:ETHUSD),

which is up over 1%, and Toncoin (COIN:TONCOINUSD), which is up

over 3%. The price of ETH is $3,831, while Toncoin is valued at

$7.43.

However, with $2.2 billion in futures options expiring on June

7, Bitcoin could fall below the psychological mark of $70,000. Of

these, $1.22 billion are Bitcoin futures options, indicating a

“maximum pain point” of $69,500. This expiration may increase

Bitcoin’s price volatility, creating a scenario of uncertainty.

Parallelly, Fernando Pereira, analyst at Bitget, highlighted

with optimism the positive correlation between the performance of

the S&P 500 and the price of Bitcoin. He predicts that “a 2.5%

to 5% rise in the S&P 500 in the coming days could drive BTC up

about 12%, reaching $80,000”. Additionally, Geoffrey Kendrick, head

of forex and digital assets research at Standard Chartered, also

shares an optimistic view, predicting that Bitcoin could reach

$100,000 before the U.S. presidential elections. Kendrick suggests

that, should Trump win, the price could reach $150,000 by the end

of the year, attributing this outlook to the political climate,

recent regulatory decisions, and potential favorable economic

data.

Franklin Templeton plans crypto fund for institutional investors

Franklin Templeton, a $1.6 trillion asset manager, is

considering launching a private cryptocurrency fund, according to

The Information. The fund, aimed at institutions, will focus on

assets beyond bitcoin and ether, with the possibility of passing on

staking rewards. The manager has previously taken initiatives in

the digital asset sector, including a bitcoin ETF and a tokenized

government bond fund.

Tim Draper recommends Bitcoin for treasury diversification after

SVB collapse

Venture capitalist Tim Draper suggests that companies diversify

their treasuries by including Bitcoin (COIN:BTCUSD) as protection

against banking risks. This recommendation follows the collapse of

Silicon Valley Bank (SVB) in March 2023, which severely impacted

several startups, including cryptocurrency clients. Draper proposes

that companies split their capitals between large banks, smaller

banks, and Bitcoin to avoid similar challenges in the future. This

method offers a safety net, allowing operations to continue even in

financial crises.

High short positions in MicroStrategy signal potential volatility

Analyses of net short positions released by Fintel reveal that

MicroStrategy (NASDAQ:MSTR) faces high exposure to short selling,

representing 23.14% of its market capitalization, indicating strong

bearish sentiment. In contrast, Coinbase (NASDAQ:COIN) and Marathon

Digital (NASDAQ:MARA) show lower exposure, with 1.77% and 1.68%,

respectively. These positions may reflect hedging strategies,

especially in contexts where companies maintain long positions in

Bitcoin (COIN:BTCUSD), as is the case with Kerrisdale Capital.

Coinbase integrates network alerts in encrypted wallet with Notifi

The mobile wallet of Coinbase Global (NASDAQ:COIN) now offers

automated alerts about network activities through the Notifi

messaging service. The launch, in partnership with GMX, allows

users on Arbitrum and Avalanche to receive notifications about

imminent liquidations and governance changes. The integration uses

the XMTP protocol, enabling secure communications between wallet

users. This new functionality aims to enhance the user experience

by providing relevant and timely information directly in the

wallet.

SushiSwap expands to Bitcoin’s Rootstock sidechain

The decentralized exchange SushiSwap (COIN:SUSHIUSD) now

operates on Bitcoin’s Rootstock sidechain, seeking to integrate

DeFi features into the BTC ecosystem. Rootstock, launched in 2018,

is one of the first Ethereum Virtual Machine (EVM)-compatible

sidechains dedicated to Bitcoin. Its goal is to combine the

security of Bitcoin with the flexibility of Ethereum’s smart

contracts. SushiSwap’s migration follows the trend of expanding

DeFi on Bitcoin, initiated by the Ordinals protocol and other

projects seeking to incorporate typical features of networks like

Ethereum and BNB Chain into Bitcoin.

B2BinPay launches TRX staking and expands blockchain support

B2BinPay, a leader in blockchain payment solutions, has

introduced staking of Tron (COIN:TRXUSD) and expanded its

blockchain support in the latest update. Now, in addition to

Polygon (COIN:MATICUSD) and Avalanche (COIN:AVAXUSD), the platform

includes Optimism (COIN:OPUSD), Arbitrum (COIN:ARBUSD), and Base.

The highlight of the version is TRX Staking with an annual yield of

3-5%, allowing users to save on transaction fees by converting

staking into bandwidth and energy. These additions reinforce the

versatility of B2BinPay, offering more options and efficiency to

its customers.

Avalanche and Blockaid join forces to enhance security in

blockchain wallets

Avalanche (COIN:AVAXUSD) has announced a partnership with

Blockaid to integrate security features into its Core wallet. The

initiative aims to combat phishing scams and other attacks, using

Blockaid’s threat database to simulate and verify transactions

before execution. This measure intends to provide an extra layer of

security for Avalanche network users. Despite criticisms about the

false positives generated by the system, Blockaid emphasizes that

this is a small price to pay to effectively block fraudulent

transactions, promoting greater security in the decentralized

finance ecosystem.

Web3 developer loses $40,000 after exposing keys on GitHub

Brian Guan, co-founder of Unlonely, lost $40,000 after

accidentally making public a GitHub repository containing his

secret keys. The incident, disclosed in a post on X on June 5,

highlights the security risks in managing digital assets. The

cryptocurrency community reacted mixedly, with some offering

support, while others criticized his previous views on using

ChatGPT for programming. The event raises questions about security

practices and developers’ responsibility to effectively protect

their digital assets.

Taiko innovates with decentralized sequencing on Ethereum Layer 2

Taiko, an Ethereum Layer 2 project, has launched its mainnet

with permissionless sequencing and proof, becoming the first rollup

to offer such functionality. This allows anyone to participate in

block sequencing and validation, promoting greater decentralization

compared to other rollups that use centralized sequencers. Taiko’s

co-founder and CEO, Daniel Wang, highlighted the commitment to

decentralization and the security inherited from Ethereum’s base

layer. With this, Taiko aims to enhance Ethereum’s scalability and

efficiency, reducing central dependencies and increasing community

participation.

The Sandbox announces $20 million funding for metaverse expansion

The Sandbox (COIN:SANDUSD), a subsidiary of Animoca Brands, has

raised $20 million to expand its creative economy in the metaverse.

Led by Kingsway Capital and with participation from investors such

as LG Tech Ventures, the funds will be used to enhance tools like

Game Maker and VoxEdit, and to introduce advanced social

interactions. The company is also developing a mobile version,

scheduled for 2025, reinforcing its commitment to making the

metaverse accessible and inclusive to a global audience.

Roger Ver released on bail in Spain awaiting extradition

Bitcoin investor Roger Ver has been released on bail of $163,000

by a Spanish court while awaiting possible extradition to the U.S.

Accused of fraud and tax evasion, Ver must remain in Spain and

appear in court every two days.

JPMorgan evaluates regulatory trend against crypto and CBDC in the

U.S.

According to a report by JPMorgan (NYSE:JPM), cryptocurrency

regulations in the U.S. are taking a restrictive direction,

especially against the launch of a central bank digital currency

(CBDC) and the adoption of cryptocurrencies by local banks. The

report highlights that non-compliant stablecoins, such as tether

(COIN:USDTUSD), are also under increasing scrutiny. The Payment

Stablecoins Clarity Act, which favors regulated stablecoins, has a

better chance of approval before the presidential elections. Other

initiatives, including the FIT21 Act and regulations that make it

difficult for banks to custody crypto assets, face significant

challenges to be implemented.

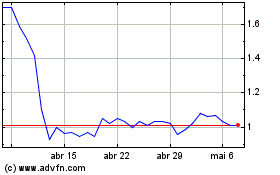

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024