U.S. index futures are down in Monday’s pre-market trading,

reversing some of last week’s gains. This comes amidst growing bets

that the Federal Reserve will keep interest rates unchanged at the

upcoming monetary policy meeting and initiate a decline next year.

Despite efforts by Fed Chairman Jerome Powell to discourage

expectations of rate cuts, stating it’s “premature” to anticipate

monetary easing, the market remains skeptical.

At 04:57 AM, the Dow Jones futures (DOWI:DJI) fell 59 points, or

0.16%. The S&P 500 futures retreated 0.24% and the Nasdaq-100

futures dropped 0.33%. The 10-year Treasury yield was at

4.247%.

In the commodities market, the West Texas Intermediate crude oil

for January fell 0.53%, to $73.68 per barrel. Brent oil for

February dropped 0.52%, near $78.47 per barrel. The iron ore with a

concentration content of 62%, traded on the Dalian exchange, fell

1.14%, to $135.34 per ton.

On this Monday’s economic agenda, investors are watching at

10:00 AM, the factory orders of October by the Department of

Commerce.

The European markets recorded a slight decline, reflecting a

pause in the recent global recovery. Investors are speculating

about possible interest rate cuts by major central banks in

2024.

The Asian stock markets had a mixed performance this Monday.

Shanghai and Tokyo recorded losses, with the Shanghai Stock

Exchange dropping 0.29% and Tokyo’s falling 0.60%, due to pressure

on shares of Japanese developers and exporters. However, the

Seoul’s Kospi index rose 0.40%, boosted by companies related to

batteries and maritime cargo transportation. The Sydney Stock

Exchange in Australia also had a positive performance, rising

0.73%. The Hong Kong Hang Seng Index fell 1.09%.

U.S. stocks rose on Friday, with the Dow and the S&P 500

reaching their best closing levels since the beginning of 2022,

while the Nasdaq recorded its best close in four months. The Dow

rose 0.82%, the S&P 500 advanced 0.59%, and the Nasdaq grew

0.55% in the session. Optimism about interest rates remained after

the Institute for Supply Management reported a continuous

contraction in U.S. manufacturing activity in November.

On Monday’s corporate earnings front, investors will be

attentive to the reports from Saic (NYSE:SAIC),

Fusion Fuel (NASDAQ:HTOO), GitLab

(NASDAQ:GTLB), Joann (NASDAQ:JOAN) and

Culp (NYSE:CULP).

Corporate Highlights of Wall Street for Today

Apple (NASDAQ:AAPL) – Japan’s TDK

Corp will manufacture lithium-ion battery cells for

Apple’s iPhones in India, announced a minister. Apple, seeing India

as a key market for growth, has already started assembling iPhones

in the country. TDK’s new factory in Haryana will create thousands

of jobs, providing cells to Apple’s battery assembler,

Sunwoda Electronics.

Meta Platforms (NASDAQ:META) – The Spanish

Media Association, representing 83 outlets, filed a lawsuit for

$598 million against Meta Platforms, accusing it of unfair

competition in the advertising sector. The association alleges that

Meta uses personal data of Facebook, Instagram, and WhatsApp users

without consent, gaining an unfair advantage in creating

personalized ads. Including major groups such as

Prisa and Vocento, the action

follows previous efforts by Spanish media to challenge technology

giants.

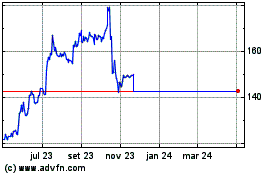

Broadcom (NASDAQ:AVGO), VMware

(NYSE:VMW) – Following the acquisition of cloud computing company

VMware, Broadcom plans to lay off about 1,300 employees in

California, as reported by Bloomberg News. Broadcom, having

completed the acquisition of VMware for $69 billion after receiving

regulatory approval from China, is considering strategies for two

VMware business units, according to a leaked email from CEO Hock

Tan.

Uber Technologies (NYSE:UBER) – Uber

Technologies will be included in the S&P 500 index starting

December 18, along with Jabil Inc (NYSE:JBL) and

Builders FirstSource (NYSE:BLDR), both from the

S&P MidCap 400, as announced by S&P Dow Jones Indices.

Uber’s shares will replace Sealed Air Corp

(NYSE:SEE), Alaska Air Group (NYSE:ALK) and

SolarEdge Technologies (NASDAQ:SEDG) in the

renowned stock market index.

Spotify (NYSE:SPOT) – Spotify announced on

Monday the layoff of 1,500 employees, 17% of its workforce, after

dismissing 600 in January and 200 in June. CEO Daniel Ek cited

increased hiring in 2020 and 2021, despite efficiency. With profits

in the third quarter and a forecast of 601 million listeners, Ek

emphasizes the need to be productive and efficient, opting for

substantial reductions now instead of smaller ones over 2024 and

2025.

Walmart (NYSE:WMT) – Walmart confirmed it

stopped advertising on the social media platform X, formerly known

as Twitter, under the ownership of Elon Musk. Citing the

effectiveness of other platforms to reach its customers, the

decision reflects the growing trend of major brands moving away

from X, which faces challenges in retaining advertisers due to

concerns over antisemitic content and Musk’s public stance.

Alibaba (NYSE:BABA), PDD

Holdings (NASDAQ:PDD) – Alibaba Group Holding’s U.S.

shares fell after a downgrade by Morgan Stanley, due to concerns

over a slow recovery in its main businesses. The 3.2% drop to $72.5

marks the lowest level in a year. Meanwhile, PDD Holdings surpassed

Alibaba, becoming the most valuable Chinese e-commerce company,

with a market capitalization of nearly $196 billion.

McDonald’s (NYSE:MCD) – McDonald’s repurchase

of 28% of its Chinese operations, reaching 48% stake, is a risky

but potentially profitable move, despite geopolitical and economic

challenges. The partnership with CITIC offers political advantages,

standing out in a competitive market.

Wendy’s (NASDAQ:WEN) – Activist hedge fund

Blackwells Capital is planning to challenge Wendy’s Co’s board in

search of improvements in the financial performance of the

fast-food chain. Intending to nominate several directors to the

company’s 12-member board, Blackwells faces Trian Fund Management,

an influential shareholder of Wendy’s. This move arises in a

context of unsatisfactory performance of Wendy’s shares and follows

the line of previous activist actions by Blackwells in other

companies.

MGM Resorts (NYSE:MGM) – The union Unite Here

announced that its members at MGM Grand Detroit, operated by MGM

Resorts, approved a new contract, ending a 47-day strike. The

agreement, covering 1,700 employees, follows a provisional

agreement reached on November 17 for 3,700 workers at three Detroit

casinos. The ratification brings significant wage increases and

other improvements in working conditions, marking the end of the

strikes at all involved casinos.

Mattel (NASDAQ:MAT) – Mattel’s CEO Ynon Kreiz

seeks to transform the toy company into an entertainment empire.

With the success of the Barbie movie and 14 more films in

production, Mattel aims to expand its brands beyond toys, following

the example of Marvel.

VF Corp (NYSE:VFC) – VF Corp announced the

dismissal of about 500 employees as part of a restructuring to

improve operations globally. Facing a challenging retail

environment in the U.S., with consumers reducing spending, the

company responds to pressures from activist investors for cost

cuts. New CEO Bracken Darrell warned about a broad cost reduction

program. The cuts affect all brands and areas of the company, which

had 33,000 employees in April.

Roche (USOTC:RHHBY) – Roche Holding AG agreed

to acquire Carmot Therapeutics for up to $3.1 billion, targeting

experimental drugs for obesity and diabetes, challenging

Novo Nordisk (NYSE:NVO) and expanding its

pipeline. The deal involves an initial payment of $2.7 billion,

with up to $400 million in milestones.

Exxon Mobil (NYSE:XOM) – Exxon Mobil’s CEO

Darren Woods refuted criticisms from the International Energy

Agency, which called large-scale carbon capture an “illusion”. In

an interview with Reuters during COP28, Woods compared the

situation of carbon capture to that of electric vehicles and solar

energy, arguing that no current solution is sufficient to solve the

climate problem. He highlighted the vital role of fossil fuels and

the need for innovation in all areas to combat climate change.

Toyota Motor (NYSE:TM) – Toyota plans to expand

its range of battery electric vehicles in Europe to six models by

2026, expecting them to represent over 20% of new car sales in the

region. The company aims to sell more than 250,000 of these

vehicles annually in Europe, in a market where it faces strong

competition. Elsewhere, Toyota Motor has halted production of older

lines at its joint venture in Tianjin, China, as part of a planned

adjustment, denying reports of suspension due to poor sales. The

company is adapting production to changes in vehicle models and the

aging of certain lines. This move reflects challenges in the

Chinese market, where Toyota faces a slowdown in sales.

General Motors (NYSE:GM) – General Motors

anticipates many of its electric vehicles will be eligible for U.S.

tax credits in 2024, despite new rules restricting the use of

Chinese batteries. The company considers itself well-positioned due

to significant investments in the U.S. and efforts to develop

resilient supply chains, highlighted after the Biden administration

announced new guidelines.

Tesla (NASDAQ:TSLA) – Tesla’s Cybertruck, more

expensive and with less range than promised, divides opinions. Some

are fascinated by its futuristic design, while others, disappointed

with the high price, question its impact on Tesla’s finances and

brand.

Fisker (NYSE:FSR) – Fisker, an electric vehicle

manufacturer, will reduce production this month and manufacture

fewer cars than previously planned to focus on liquidity.

Boeing (NYSE:BA) – Boeing was excluded from the

competition to develop the new “Doomsday Plane” for the U.S. Air

Force, leaving Sierra Nevada Corp as the sole known competitor.

Disputes over contractual terms affected Boeing’s participation in

the project to succeed the E-4B Nightwatch.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is progressing towards a new labor agreement with its

pilots’ union, expecting to conclude in the coming weeks. Southwest

expressed commitment to reaching a fair deal, aiming to reward and

maintain the competitiveness of pilots in the industry. This

progress follows similar agreements reached by other major airlines

with their pilots’ unions this year.

Alaska Air (NYSE:ALK), Hawaiian

Holdings (NASDAQ:HA) – Alaska Air announced the purchase

of Hawaiian Holdings for $1.9 billion, including debts. The offer

of $18 per share reflects a significant premium over Hawaiian’s

market value, impacted by various challenges. The acquisition,

which increases Alaska Air’s presence in lucrative routes to

Hawaii, occurs in a context of antitrust scrutiny in the U.S.

airline sector and may face intense regulatory analysis.

Morgan Stanley (NYSE:MS) – U.S. stocks face a

challenging year-end, following November’s recovery, due to

volatility in bond yields, warned Michael Wilson of Morgan Stanley.

He anticipates turbulence in December before more favorable

seasonal trends and the “January effect” support stocks. Although

the S&P 500 advanced 9% last month, Wilson remains neutral for

2024, predicting the index will end the year around 4,500

points.

Mizuho Financial Group (NYSE:MFG) – The

president of Mizuho Financial Group noted a growing effort among

Japanese companies to improve capital efficiency, responding to the

Tokyo Stock Exchange’s appeal. Starting in January, the exchange

will publish a list of companies adhering to this call, increasing

urgency. So far, only 20% of companies listed in the main section

have disclosed specific measures. The pressure not to be seen as

lagging has led to an increase in share buybacks and other

strategies to improve market value.

UBS (NYSE:UBS) – UBS aims to expand its

operations in the American market, targeting an annual addition of

$150 billion in new net funds. Iqbal Khan, head of the asset

management division, revealed plans for significant investments in

the U.S. over the next three years, as interviewed by NZZ Am

Sonntag.

BNY Mellon (NYSE:BK) – BNY Mellon will raise

its minimum wage to $22.50 per hour in 2023, an increase from the

current $20, marking the third wage increase in three years. The

bank will also improve mental health benefits, covering 12 therapy

sessions annually, up from the current five.

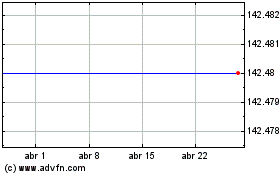

Vmware (NYSE:VMW)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Vmware (NYSE:VMW)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025