Investments in crypto assets reach new highs

Asset managers such as CoinShares, Bitwise, Grayscale,

ProShares, and 21Shares have reported an influx of $176 million in

crypto assets in the last week, marking a total of $1.76 billion in

10 weeks. This period of inflows is the most significant since the

launch of bitcoin futures-based ETFs in the US in October 2021.

Trading volumes have remained high, with $2.6 billion in the last

week. Bitcoin funds led the inflows, while Ether products also

showed recovery. This growth comes amid rising values of bitcoin

(COIN:BTCUSD) and ether (COIN:ETHUSD), with expectations of future

ETFs in the US.

Bitcoin leads the cryptocurrency market rally

Bitcoin and other cryptocurrencies experienced a significant

increase on Monday, with Bitcoin reaching its highest value in 20

months (COIN:BTCUSD), approximately $41,750. This growth represents

a gain of over 50% since mid-October. The surge is attributed to

hopes of approval for a spot Bitcoin ETF and expectations of

interest rate cuts by the Federal Reserve. Meanwhile, Ether

(COIN:ETHUSD) and other altcoins also recorded gains, with Dogecoin

(COIN:DOGEUSD) and Shiba Inu (COIN:SHIBUSD) showing dynamic

movements.

Societe Generale launches the first digital green bond on the

blockchain

Societe Generale (EU:GLE), one of the largest banks in France,

announced the issuance of its first digital green bond on a public

blockchain, marking an advancement in its crypto services. The

issuance of $10.87 million in unsecured senior bonds was subscribed

by AXA Investment Managers and Generali Investments. Using the

Ethereum blockchain, these green bonds aim to fund environmental

projects. AXA IM invested in the bond through the purchase of

SocGen’s stablecoin EUR CoinVertible.

Zodia Custody and Metaco collaborate to strengthen crypto asset

custody

Zodia Custody, backed by Standard Chartered (LSE:STAN), is

partnering with Metaco, affiliated with Ripple (COIN:XRPUSD), to

enhance crypto asset custody services for institutions. This

partnership offers access to high-level security solutions and risk

management. The collaboration emphasizes connectivity with

fundamental blockchain layers and the creation of a robust

settlement network. The goal is to make Zodia Custody the most

connected custodian in the digital asset ecosystem, focusing on

expanding options for clients and ensuring asset security.

Shopify drives advances in cryptocurrency

Kaz Najatian, VP of Product and COO of Shopify (NYSE:SHOP),

anticipates surprises with the company’s advancements in

cryptocurrency and blockchain. “The cryptographic work we are doing

at Shopify is some of our best work right now. In a few years,

people will be surprised at how quickly we have progressed, but

that’s because of the work being done now,” Najatian wrote in a

post on X. Without specific details, the statement suggests a focus

on integrating these technologies into the platform. Shopify has

already adopted encrypted payment solutions, such as integration

with Solana Pay and Crypto.com Pay. The Canadian-based e-commerce

giant serves over 2 million businesses globally.

Franklin Templeton CEO reveals personal investments in

cryptocurrencies

Jenny Johnson, CEO of Franklin Templeton (TG:GCOR), revealed in

an interview with Fortune that she has personal investments in

cryptocurrencies, including Bitcoin (COIN:BTCUSD), Ether

(COIN:ETHUSD), and governance tokens like Uniswap (COIN:UNIUSD) and

Sushi (COIN:SUSHIUSD). Johnson described these investments as a

small portion of her overall portfolio and expressed skepticism

about non-fungible tokens (NFTs), preferring assets with clear

financial returns. While Franklin Templeton has applied to the SEC

for a Bitcoin ETF, Johnson acknowledges uncertainty regarding

regulatory approval.

Mantle launches a revolutionary liquid staking protocol on Ethereum

The web3 ecosystem led by the DAO Mantle (COIN:MNTLLUSD)

announced its new Mantle Liquid Staking Protocol (LSP), enabling

interactions with the Ethereum proof-of-stake (PoS) network. This

permissionless and custody-free protocol, operating on Ethereum L1,

is the second flagship product after the Mantle L2 Network. With

the Mantle LSP, users stake ETH and receive mETH, a token that

accrues value and rewards. mETH, tradable on various exchanges,

stands out for its deterministic exchange rate calculation. Mantle

prioritizes user experience and security, presenting a simplified

architecture and robust risk management strategies.

Amazon Managed Blockchain and Polygon expand collaboration for Web3

developers

Amazon Managed Blockchain (AMB) now supports Polygon’s

proof-of-stake mainnet and Mumbai testnet, facilitating the

development of Web3 applications. AMB, which provides access to

public and private blockchains, is compatible with the Ethereum

Virtual Machine used in dApps, NFTs, and tokenization. This

integration allows developers to create efficient and

cost-effective Web3 applications on Polygon, benefiting consumer

brands and financial institutions, with a focus on NFTs and digital

assets. The collaboration promotes the development of scalable Web3

applications and gaming applications, with advantages such as

automatic scaling and reduced costs. This partnership between AWS

and Polygon is not unprecedented, as they have had previous

collaborations like the MoonRealm Express Accelerator with Animoca

Brands.

Impressive recovery of Terra and Terra Classic tokens

Tokens associated with the Terra 2.0 and Terra Classic

ecosystems, including Luna Classic (COIN:LUNCUSD), Terra 2.0

(COIN:LUNAUSD), and Terra ClassicUSD (COIN:USTCUSD), have

experienced a significant increase. Driven by various factors, such

as investments from Terraform Labs and a plan to revamp USTC using

Bitcoin, trading volume exceeded $2 billion. Additionally, Binance

implemented a LUNC burning scheme, and the “Six Samurai” proposed a

revitalization plan for Terra Classic. This remarkable recovery

comes after the dramatic collapse of the Terra network in May

2022.

Crypto.com receives EMI license from the UK financial regulator

Crypto.com, one of the leading cryptocurrency platforms, has

obtained authorization as an Electronic Money Institution (EMI)

from the UK’s Financial Conduct Authority. This license, broader

than the registration as a crypto company acquired in August 2022,

allows for the issuance and management of electronic money, as well

as offering various financial services. The company joins other

major players like Coinbase (NASDAQ:COIN) and Gemini, expanding its

range of electronic money products in the UK.

Challenges and concerns regarding the deployment of Digital Pound

in the UK

The UK Treasury Committee has expressed uncertainties about the

benefits of a Retail Central Bank Digital Currency (CBDC) known as

the Digital Pound, pondering whether its advantages outweigh the

risks. The implementation of this currency could pose economic

challenges, including the possibility of bank runs and increased

loan interest rates. Additionally, there are significant concerns

about privacy and data security. Legislators have suggested that

any progress in introducing the Digital Pound should be cautious,

with lower initial deposit limits and a careful approach to

evaluating whether the benefits justify the risks. The project,

which began development in 2020, is currently in the design phase,

and a final decision is not expected before the second half of this

decade.

South Africa evaluates cryptocurrency licenses

The Financial Sector Conduct Authority of South Africa is

reviewing 36 license applications from cryptocurrency companies,

out of the 138 initially proposed. This month, the FSCA will focus

on criteria such as market participation, consumer protection, and

risk management. The process will consider the range of services

offered, regulatory compliance, and cyber and credit risk

management to ensure secure investments. South Africa, observing

local growth in digital assets, seeks a robust regulatory

environment inspired by the European MiCA model.

India registers cryptocurrency service providers under anti-money

laundering rules

Up to 28 cryptocurrency service providers have registered with

the Financial Intelligence Unit (FIU) of India, as announced by the

Minister of State for Finance, Pankaj Chaudhary. This measure

follows the March decision by the Ministry of Finance, requiring

crypto companies to register with the FIU and follow procedures

under the Prevention of Money Laundering Act, including KYC checks.

The regulation also extends to offshore cryptocurrency exchanges

operating in India, with possible actions under the PMLA against

non-compliant platforms. Notably, none of the registered companies

are offshore entities.

China, Japan, and South Korea join forces in technology and trade

At the 10th China-Japan-ROK Foreign Ministers’ Meeting in Busan,

South Korea, China, Japan, and South Korea reaffirmed their

commitment to deepening collaboration in emerging technologies such

as big data, blockchain, and artificial intelligence. With a focus

on regional and global economic recovery, the countries seek to

revitalize negotiations for a trilateral free trade agreement. This

cooperation aims to promote peace, prosperity, and economic

integration in the Asia-Pacific region, aiming for global

leadership in technological innovation. Meanwhile, South Korea

faces challenges with the increasing cryptocurrency-related crimes,

highlighting the need for a collaborative and strategic

approach.

El Salvador’s Bitcoin Treasury returns to profit

El Salvador’s national Bitcoin treasury, according to

NayibTracker.com, has returned to profit. The total investment of

$127 million now shows a gain of $4 million, a profit of 3.17%.

Based on President Nayib Bukele’s promise to buy 1 Bitcoin

(COIN:BTCUSD) per day since November 2022, the website tracks

purchases and earnings.

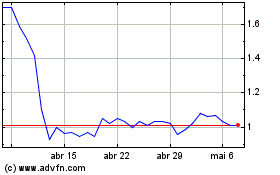

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

SushiToken (COIN:SUSHIUSD)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025