Bitcoin surpasses its maximum price limit and the crypto market

fluctuates

Bitcoin (COIN:BTCUSD) recently exceeded its maximum price limit,

while the total value of the cryptocurrency market remains

supported. Simultaneously, the Internet Computer (COIN:ICPUSD) has

resumed its parabolic upward trend, rising by 33.6% in the last 7

days. Another highlight on Friday was the record-breaking $21.16

billion in Total Value Locked (TVL) on Ethereum’s Layer 2

blockchains (COIN:ETHUSD). Interest in the NuggetRush

cryptocurrency is also high, thanks to its proposal to reshape meme

coins through a play-to-earn (P2E) game. NuggetRush’s pre-sale has

already surpassed $1.5 million, indicating strong investor

interest. Fernando Pereira, an analyst at Bitget, described an

uncertain future in the crypto market, with the possibility of

significant fluctuations depending on the performance of current

support levels. “After failing again to stay above $44k, BTC is

more likely to return to $40k in search of increased demand than to

break the top and surge. The path to $50k will be longer than

expected,” Pereira commented.

Large Bitcoin and Ethereum options expirations also impact the

market

The cryptocurrency market is watching the expiration of nearly

$1 billion in Bitcoin options today, a smaller event compared to

last year’s close. Approximately 21,900 Bitcoin contracts are set

to expire, with a notional value of approximately $955 million,

according to Deribit, with a sell-to-buy ratio of 0.62, indicating

fewer call options compared to put options. Many call options are

concentrated at the $50,000 price, suggesting expectations of a

Bitcoin price increase. Additionally, 255,245 Ethereum options

contracts, totaling $574 million, are also set to expire. Despite

this activity, it is unlikely that these expirations will

significantly influence spot prices, as the market is more focused

on decisions regarding Bitcoin ETFs.

Delays in withdrawing staked ETH on Ethereum with a long queue of

validators

Ethereum (COIN:ETHUSD) validators are facing delays of several

days to withdraw their staked Ether, and former cryptocurrency

lender Celsius may be contributing to this delay. The exit queue

for validators has grown significantly, indicating a wait of up to

5.6 days to release the staked ETH, which currently represents over

$1 billion. Celsius, undergoing restructuring after its collapse in

2022, is identified as one of the main withdrawal requesters, with

32% of the total ETH in the queue. This situation is reminiscent of

the long wait observed in April during the Shapella upgrade, which

introduced the possibility of withdrawing staked ETH.

Celestia’s TIA token challenges the market and attracts interest

with innovative technology

Celestia’s TIA token (COIN:TIAUSD) has recorded a significant

increase of over 30% in recent days, standing out in a generally

stagnant market. The token nearly reached $17, with a record

trading volume of nearly $800 million. At the time of writing, the

token’s price was at $15.52. Investor interest has been driven by

the lucrative staking opportunity with TIA, offering annual yields

between 15% to 17%, well above the US risk-free rate. TIA’s market

capitalization has exceeded $2 billion, indicating significant

growth potential. In addition, staking participants can expect

future airdrops from projects on the Celestia blockchain, further

increasing the token’s appeal.

John Lilic assumes as CEO of the Telos Foundation

The Telos Foundation (COIN:TLOSUSD), responsible for the Layer 1

DPOS Telos blockchain, announced John Lilic, a former member of

Consensys and Polygon, as its new CEO. Lilic, who started at

Bitcoin Center NYC in 2014 and worked at Consensys in 2015 and

Polygon in 2020, is recognized among the top 50 angel investors in

Web3. He will focus on transforming Telos into a Layer 0 network

with ZK technology, attracting global developers and users.

Additionally, Lilic will contribute to sponsorships for ETHCC 2024

and ETH Belgrade 2024 and plans to form an elite external advisory

board in 2024. At the time of writing, Telos’s native token

(COIN:TLOSUSD) was up more than 15%, at $0.229948.

Awaiting SEC decisions: Spot Bitcoin ETFs and the competition of

management fees

The US SEC is close to deciding on the approval of several spot

Bitcoin ETFs, a move eagerly awaited by large financial

institutions. Essential changes to 19b-4 filings, which are crucial

for approval, are expected, addressing aspects such as fund

creation and redemption. The wait is intense for the potential

launch dates of these ETFs, with major names like Grayscale,

Fidelity, and Valkyrie showing signs of progress. This highly

anticipated event has the potential to significantly influence the

cryptocurrency market, with investors closely watching the SEC’s

decisions and their impact on Bitcoin prices. In the race to launch

ETFs, only six of the 13 candidates have revealed their management

fees, making them a crucial focus for potential investors. Fees are

emerging as a key differentiator, as all ETFs will hold the same

asset: Bitcoin (COIN:BTCUSD). Analysts emphasize the importance of

the expense ratio, used to cover operational costs, in the

competitiveness of these products. Invesco and Galaxy innovate by

waiving initial fees, while Fidelity proposes the lowest permanent

fee. The fee from BlackRock (NYSE:BLK), a potential market leader,

is still awaited.

VanEck invests in Bitcoin sustainability by supporting developers

VanEck, a prominent investment manager, has announced an

ambitious plan to support the Bitcoin (COIN:BTCUSD) ecosystem.

VanEck has pledged to allocate 5% of the profits from its future

Bitcoin ETF, pending SEC approval, to Bitcoin Core developers. This

decision, which has already begun with a $10,000 donation to the

Brink organization, reflects VanEck’s long-term commitment to

Bitcoin innovation and decentralization. The initiative is seen as

a proactive step to strengthen the Bitcoin network and contribute

to its evolution and resilience.

Cathie Wood’s ARK Invest reduces its stake in Coinbase in its

innovation ETF

ARK Invest, led by Cathie Wood, sold off another portion of

Coinbase (NASDAQ:COIN) shares from its ARK Innovation ETF

(AMEX:ARKK) last Thursday. This sale follows a previous transaction

of $25 million in Coinbase shares on Wednesday. The investment firm

traded an additional 26,743 shares, valued at approximately $4.16

million at the closing price, on a day when COIN saw a 2.21%

increase to $155.6. The substantial growth of over 130% in Coinbase

shares in the last three months of 2023 resulted in an overweight

position in the ETF, surpassing the desired maximum limit of 10%.

Despite the sale, Coinbase still represents 10.34% of ARKK, with a

stake valued at over $872.5 million.

Arthur Hayes warns of potential crypto collapse in March due to

macroeconomic factors

Arthur Hayes, former CEO of BitMEX and current manager of the

Maelstrom family office, highlighted three macroeconomic variables

that could trigger a crisis in the crypto market in March. These

variables include the Federal Reserve’s Reverse Repo program, the

term funding program for banks, and the interest rate decision in

March. Hayes predicts a decline in market liquidity due to these

factors, potentially resulting in a significant drop in

cryptocurrency prices. He advises caution in crypto trading until

the March decisions are revealed, anticipating a possible market

recovery at the end of the month with expectations of new liquidity

injections.

Solana altcoin investor profits 171x with bold meme coin strategy

A Solana blockchain altcoin trader achieved an extraordinary

return of 171 times on an initial investment of 1.23 SOL in the

meme coin Anita Max Wynn (WYNN). Betting on 25 different crypto

assets with equal amounts of SOL, the trader achieved a success

rate of 56%. The most profitable investment was in WYNN, yielding a

profit of 210 SOL, while the total gain from 14 cryptocurrencies

reached about 277 SOL, equivalent to $28,172. This success

coincides with the ongoing growth of the Solana ecosystem

(COIN:SOLUSD), which recently surpassed $1.3 billion in locked

value.

Record investment in digital asset ETPs with $2 billion in 2023

In 2023, investments in digital asset Exchange Traded Products

(ETPs) reached over $2 billion, marking the year with the

third-highest net inflows since 2017, according to CoinShares data.

With a total of $2.2 billion, inflows more than doubled compared to

2022. Interest increased especially in the last quarter,

anticipating SEC actions to launch bitcoin-based ETFs in the US,

with net inflows of $243 million in the last week of the year.

Marathon Digital Holdings sets record in Bitcoin mining and plans

expansion

Marathon Digital Holdings (NASDAQ:MARA) revealed in its latest

update that it achieved a production milestone, mining 1,853

bitcoins (equivalent to $81.2 million) in the last month, setting a

new record for the company. Compared to the 4,144 BTC mined in

2022, production in 2023 more than tripled, reaching 12,852

bitcoins ($563.4 million). The company also reported an 18%

increase in its average operational hash rate, reaching 22.4 EH/s.

Fred Thiel, Marathon’s CEO, stated that the company aims to expand

further, aiming to reach 50 exahashes in the next 18 to 24 months,

driven by the acquisition of new sites and the rise in Bitcoin

network transaction fees. By the end of 2023, Marathon owned more

than 15,000 bitcoins.

KuCoin Labs invests in DeMR’s innovative MR-DePIN infrastructure

network

KuCoin Labs, the investment arm of the cryptocurrency exchange

KuCoin, announced a strategic investment in DeMR, a “decentralized

mixed reality infrastructure network” (MR-DePIN) based on the

Solana blockchain. This innovative project addresses challenges in

creating 3D maps, using a decentralized network and an AI-based

automated map reconstruction process. This approach allows for

efficient and cost-effective collection and reconstruction of

high-definition global 3D map data, enabling interactive spatial

services for a wide range of mixed reality applications.

Additionally, ownership and revenue from the data are shared among

global contributors, with ongoing earnings based on each

contribution.

Mango Markets faces regulatory challenges after crypto fraud

incident

Mango Markets, a decentralized cryptocurrency exchange, is

facing regulatory scrutiny in the United States following a

significant theft in October 2022. Avi Eisenberg, accused of

stealing more than $100 million from the platform, awaits trial

while Mango Markets deals with the aftermath. With an exit queue of

validators exceeding 16,000, there are concerns about how to

respond to regulatory inquiries. The MangoDAO, the DEX’s regulatory

body, is voting to appoint a representative to handle US regulatory

issues. This situation highlights the risks of operating autonomous

trading infrastructures on blockchains and facing legal scrutiny,

even for decentralized organizations like DAOs.

CertiK security breach triggers social media phishing campaign

CertiK, a renowned blockchain security company, faced an ironic

security incident when its social media profile was hijacked to

promote a phishing campaign. The malicious post, claiming a

vulnerability in the Uniswap router, directed users to a fraudulent

website, potentially compromising their crypto wallets. Despite

CertiK’s swift response, this event underscores the importance of

robust security practices, even for companies specializing in

blockchain security audits.

North Korean hackers drive crypto thefts, obtaining $600 million in

2023

According to TRM Labs, one-third of cryptocurrency thefts in

2023, totaling around $600 million, were executed by hackers linked

to North Korea. This brings the country’s total gains from these

thefts to nearly $3 billion in six years. Despite a 30% reduction

compared to 2022, the thefts highlight the growing North Korean

cyber threat, often associated with funding weapons of mass

destruction programs.

Central Bank of Nigeria authorizes testing of cNGN stablecoin by

Africa Stablecoin consortium

The Central Bank of Nigeria has approved the Africa Stablecoin

Consortium to test the cNGN stablecoin, pegged to the Nigerian

naira, within a controlled regulatory environment. This initiative,

bringing together financial institutions, fintech innovators, and

blockchain experts, aims to enhance the security and compliance of

financial interactions. The cNGN, set to launch on February 27,

2024, aims to make the naira a more dynamic tool for international

financial transactions, streamlining remittances, trade, and global

investments.

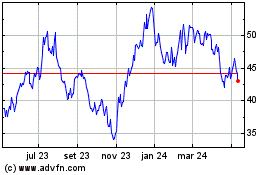

ARK Innovation ETF (AMEX:ARKK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

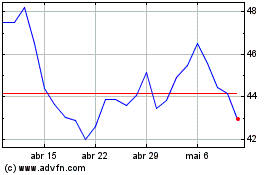

ARK Innovation ETF (AMEX:ARKK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025