Amazon Surpasses Analyst Predictions with Stellar Q4 Performance, Stock Rises Over 7%

02 Fevereiro 2024 - 10:47AM

IH Market News

Amazon (NASDAQ:AMZN) showcased an exceptional performance in the

fourth quarter after Thursday’s market close, exceeding analyst

predictions and providing a solid outlook for the current quarter,

leading to a stock rise of more than 7% in Friday morning’s

trading.

Amazon reported earnings of $1.00 per share, which exceeded the

anticipated 80 cents per share forecasted by LSEG (formerly

Refinitiv). The company’s revenue reached $170.0 billion,

surpassing the $166.2 billion that was projected by LSEG.

Additionally, there were other significant aspects of the report

that Wall Street paid close attention to.

Amazon Web Services (AWS) produced a revenue of $24.2 billion,

meeting the expectations set at the same amount according to

StreetAccount. The advertising sector also showed strong

performance, achieving $14.7 billion in revenue, which went beyond

the $14.2 billion that was anticipated by StreetAccount.

Amazon also announced its projections for the first quarter,

with revenue estimates ranging from $138 billion to $143.5 billion,

representing growth of 8% to 13%. These figures surpassed analyst

expectations, which had anticipated revenue of $142.1 billion,

according to Refinitiv.

Amazon’s exceptional fourth-quarter performance positively

surprised Wall Street, indicating that CEO Andy Jassy’s

cost-control efforts are paying off. The company has made

significant staff reductions and cut less promising investments

while continuing to seek ways to optimize spending across various

areas, including its fulfillment business. Additionally, it

announced cuts in services like Prime Video, MGM Studios, and

Twitch, among others.

Amazon’s total revenue grew by 14% in the fourth quarter,

reaching $170 billion, driven by the Christmas shopping season and

the October Prime Day event, both exceeding the company’s

expectations.

Sales from Amazon Web Services (AWS) rose by 13% in the fourth

quarter to $24.2 billion, aligning with Wall Street’s forecasts.

This represents a slight increase from the previous quarter, where

growth was at 12%, but a slowdown compared to the same period last

year, when sales grew by 20%.

Despite AWS’s growth slowdown over the past year due to reduced

cloud spending by businesses, Amazon’s CFO Brian Olsavsky noted

that cost optimizations are easing and new workloads are

increasing. He highlighted the growing interest in AWS’s generative

AI products, such as the “Q” AI chatbot.

In addition to the results, Amazon also announced the testing of

a generative AI shopping assistant named Rufus, available to a

select group of users in the US.

CEO Andy Jassy stated, “This fourth quarter was a

record-breaking holiday shopping season and capped off a strong

year for Amazon in 2023. As we enter 2024, our teams are delivering

results quickly, and we have much to look forward to with

excitement.”

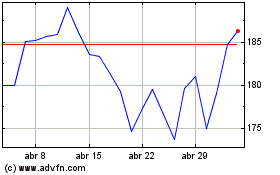

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024