ARK Invest sees Bitcoin at $2.3 million with asset diversification

and market updates

ARK Invest predicts that Bitcoin could reach $2.3 million with a

reallocation of 19.4% of global assets. The report highlights

Bitcoin (COIN:BTCUSD) as an attractive investment, with an

annualized return history of 44% over the past seven years,

outperforming other assets. ARK Invest’s strategy of including

Bitcoin in portfolios to maximize risk-adjusted returns reflects a

long-term view despite market volatility. Adoption by institutional

investors and its position as a safe asset in times of uncertainty

are key factors. The 11 approved Bitcoin ETF applicants represent

approximately 3.3% of the total Bitcoin supply, indicating growing

institutional accumulation.

On Friday, the price of Bitcoin, which had recovered to the

$43,000 level, slightly dipped below this level in the last 24

hours, and speculation about a reduction in interest rates in the

US may impact the market. “Nearly 60% of players believe that

US interest rates may fall in May after the Federal Reserve

Chairman’s speech this week. The market is liking this hypothesis,

which is keeping BTC above $40,000 and causing exchanges to break

historical highs,” commented Fernando Pereira, an analyst at

Bitget. Additionally, nearly $1 billion in Bitcoin options are set

to expire today, with a significant expiration of 230,000 Ethereum

(COIN:ETHSD) contracts also on the horizon.

Valkyrie announces BitGo as new custodian for Bitcoin ETF

Valkyrie (NASDAQ:BRRR), a pioneer in Bitcoin ETFs in the US, has

chosen BitGo as the second custodian for its fund, emphasizing

diversifying the security of its digital assets. This

collaboration, marked as a milestone by BitGo’s Mike Belshe,

suggests a growing trend among ETFs to strengthen investment

protection. The industry closely watches this development,

anticipating similar moves from other funds in response to

Valkyrie’s innovative risk management.

BlackRock and ProShares ETFs surpass GBTC in trading volume

BlackRock’s (NASDAQ:IBIT) and ProShares’ (AMEX:BITO) ETFs

surpassed Grayscale’s (AMEX:GBTC) ETF in trading volume on

Thursday, with IBIT reaching $306 million and BITO reaching $298

million, compared to GBTC’s $291 million. This milestone, observed

for the first time, highlights a shift in the Bitcoin market, with

daily ETF volumes falling below $1 billion. Investors transitioning

from GBTC to new ETFs reflect diversification and evolving

preferences in crypto asset investments.

Hong Kong’s VSFG moves towards Ethereum ETF

Hong Kong’s Venture Smart Financial Holdings (VSFG) is close to

applying for a Bitcoin ETF and anticipates an Ethereum ETF in the

second quarter, pending regulatory approval. VSFG’s President,

Lawrence Chu, emphasizes careful preparation for regulatory

submission and potential fee competition among asset managers in

the city, where the cryptocurrency ETF market is gaining

traction.

Chainlink reaches a 22-month peak and outperforms major cryptos

Chainlink (COIN:LINKUSD) achieved a notable 22-month peak, with

LINK surpassing $18.5 on Friday, outperforming Bitcoin

(COIN:BTCUSD) and Ether (COIN:ETHUSD) with a 35.14% jump in one

week. This breakthrough ends a three-month stagnation, highlighting

Chainlink’s vital role in connecting blockchains with external

data. Growing interest in LINK futures contracts and the potential

for real asset tokenization reinforce optimism around LINK.

Solana DEX surpasses Ethereum after JUP airdrop

The Jupiter token airdrop on Solana generated significant

enthusiasm, causing Solana’s DEXs to outperform those on Ethereum

in trading volume, with $1.14 billion in 24 hours. This event

underscores Solana’s growth in DeFi, especially after the $700

million JUP airdrop to nearly one million wallets, stimulating

record activity on the network. Despite the recent advantage,

Solana still trails Ethereum in weekly volume, with the network’s

stability evident even amid heavy traffic.

Meta Platforms boosts the market with profits and impacts AI tokens

After reporting positive earnings and announcing a $50 billion

share buyback, Meta’s (NASDAQ:META) shares surged on Friday,

leading to an increase in artificial intelligence tokens. With CEO

Mark Zuckerberg highlighting advances in AI and the metaverse, the

company, which also announced its first dividend, saw a cascading

effect benefiting AI tokens like Render (COIN:RNDRUSD) and Fetch.ai

(COIN:FETUSD), with increases of 0.87% and 3.92% in the last 24

hours, respectively.

Victoria VR drives the metaverse on Apple’s Vision Pro

Victoria VR, an innovator in cryptography and VR, announced the

launch of its metaverse app for Apple’s Vision Pro (NASDAQ:AAPL),

promising advanced graphics and immersive gameplay. Available in

the second quarter, the app promises a rich digital experience,

leveraging the capabilities of Vision Pro and the strength of Web3.

Apple’s pioneering VR with Vision Pro faces competition from Meta

Quest. Victoria’s metaverse is powered by the VR token, which has

appreciated by 60%, encouraging active participation and rewarding

users with a share of in-game sales revenue.

Polygon Labs streamlines team to reinforce efficiency

Polygon Labs (COIN:MATICUSD) reduced its team by 19%, cutting 60

positions, according to CEO Marc Boiron’s announcement on Thursday.

The restructuring aims to accelerate progress and strategically

align teams within the web3 ecosystem while maintaining a sharp

focus on the company’s mission. This strategic decision, driven by

efficiency rather than financial reasons, follows the separation of

Polygon Ventures, now P2 Ventures, and the future independence of

the Polygon ID team.

Avantis launches on the Base network with innovative perpetual

swaps strategy

Avantis debuted on the Base mainnet, bringing an innovative

solution to the challenges of crypto futures markets, focusing on

the retail audience. As a pioneer in Layer 2 backed by Coinbase

(NASDAQ:COIN), Avantis aims to introduce DeFi users to high-risk

trading with leverage of up to 75x. After a two-month test with $5

billion in trading, the protocol proposes a unique method, offering

discounts to traders taking opposite positions, mitigating risks,

and encouraging diversified participation.

Binance freezes $4.2 million in XRP after exploit

Binance blocked $4.2 million in XRP (COIN:XRPUSD) following a

$120 million exploit, following an alert from XRP Ledger

developers. Binance CEO Richard Teng pledged to assist Ripple in

investigations to recover the funds, monitoring transfers to the

exchange. The breach, which affected Ripple co-founder Chris

Larsen’s personal wallet, resulted in the diversion of 213 million

XRP, some of which was laundered through various exchanges.

OPNX announces closure of operations in February

Open Exchange (OPNX), the successor to Coinflex, will cease its

operations in February 2024. The platform instructed users to

settle positions by February 7th and withdraw funds by February

14th, promising an organized closure. Linked to the founders of

Three Arrows Capital, OPNX expressed gratitude to its community for

its support.

El Salvador maintains commitment to Bitcoin under Bukele

El Salvador will continue to adopt Bitcoin (COIN:BTCUSD) as a

legal currency if President Nayib Bukele is reelected, according to

Vice President Felix Ulloa. The decision reinforces the country’s

pioneering position in Bitcoin integration, inspired by the recent

approval of Bitcoin ETFs in the United States. Bukele, known for

his innovative policies, also plans to advance the proposal for

Bitcoin City, powered by volcanic geothermal energy.

Hut 8 and Ionic Digital partner for Bitcoin mining

Hut 8 (NASDAQ:HUT) has entered into a four-year agreement with

Ionic Digital, newly emerged from Celsius’s bankruptcy, to provide

managed Bitcoin mining services. The partnership involves the

expansion and operation of facilities in Texas and New York, with

Hut 8 managing 127,000 miners and a 300 MW infrastructure. This

agreement promises to strengthen Hut 8’s position in the industry,

generate significant revenue, and include an equity stake in

Ionic.

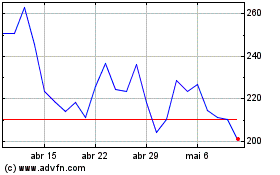

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024