US Index Futures Down, Oil Prices Slide – Market Responds to Powell’s Remarks Ahead of Opening Bell

05 Fevereiro 2024 - 7:51AM

IH Market News

U.S. index futures are down in Monday’s pre-market, reflecting

the impact of Jerome Powell’s statements in a CBS interview on

Sunday. The Fed chairman tempered expectations for immediate

interest rate cuts, signaling a more cautious approach. This

scenario precedes a week full of corporate earnings releases and

comes in a context of geopolitical tensions in the Middle East

following recent U.S. military actions.

At 05:25 AM, Dow Jones futures (DOWI:DJI) fell 88 points, or

0.23%. S&P 500 futures dropped 0.21%, and Nasdaq-100 futures

retreated 0.18%. The yield on 10-year Treasury notes was at

4.089%.

In the commodities market, West Texas Intermediate crude oil for

March fell 0.50% to $71.93 per barrel. Brent crude oil for March

dropped 0.35%, close to $77.06 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, fell 0.63% to $132.43

per metric ton.

Today’s economic agenda in the U.S. starts at 09:45 AM with the

S&P Global report, which will release the revised reading of

the Purchasing Managers’ Index (PMI) for January’s service sector

activity. At 10:00 AM, the Institute for Supply Management will

present the ISM index for January’s service sector activity.

Asian markets ended the session mostly in the red, with the

resilience of the Nikkei, which rose 0.54%, standing out. Despite

signs of expansion in the Chinese service sector, concerns about

China’s economic recovery kept sentiment negative, even with new

stimuli from Beijing, such as the reduction in the bank reserve

requirement ratio.

European markets are making progress, driven by investors’

reaction to recent statements by the President of the U.S. Federal

Reserve and by optimistic financial results presented by major

corporations in the region, indicating renewed optimism in the

European economic landscape.

Friday’s trading session in the U.S. was marked by a notable

rise, driven by favorable results from giants like Meta

Platforms (NASDAQ:META) and Amazon

(NASDAQ:AMZN), as well as a surprisingly positive employment

report. With the Dow and S&P 500 reaching new records, the

market reflected optimism, overcoming mid-week losses. The Dow

Jones rose 0.35% to 38,654.42 points on Friday. The S&P 500

advanced 1.07% to 4,958.61 points, and the Nasdaq increased by

1.74% to 15,628.95 points. The retail sector also stood out,

benefiting from the prospect of increased consumer spending,

contrasting with the decline in gold and oil stocks due to the fall

in the prices of these commodities.

For Monday’s quarterly results, financial reports are scheduled

to be presented before the market opens by

Caterpillar (NYSE:CAT),

McDonald’s (NYSE:MCD), Estée

Lauder (NYSE:EL), Tyson Foods (NYSE:TSN),

Onsemi (NASDAQ:ON), among others.

After the close, numbers from Palantir

Technologies (NYSE:PLTR), NXP

Semiconductors (NASDAQ:NXPI), Chegg

(NYSE:CHGG), Fabrinet (NYSE:FN), Simon

Properties (NYSE:SPG), Symbotic

(NASDAQ:SYM), and more are awaited.

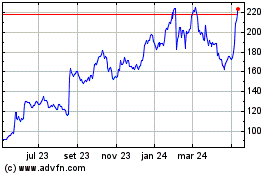

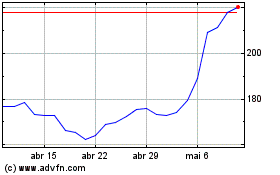

Fabrinet (NYSE:FN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Fabrinet (NYSE:FN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024