U.S. Stocks Show Significant Move Back To The Upside

14 Fevereiro 2024 - 6:30PM

IH Market News

Stocks showed a strong move back to the upside during trading on

Wednesday, partly offsetting the sell-off seen in the previous

session. The major averages all moved higher on the day, with the

tech-heavy Nasdaq leading the rebound.

After plunging by 1.8 percent Tuesday’s trading, the Nasdaq

(NASDAQI:COMP) surged 203.55 points or 1.3 percent to 15,859.15.

The S&P 500 (SPI:SP500) also jumped 47.45 points or 1.0 percent

to 5,000.62, while the Dow (DOWI:DJI) climbed 151.52 points or 0.4

percent at 38,424.27.

The rebound on Wall Street partly reflected bargain hunting,

with some traders seeing the sharp pullback on Tuesday as a buying

opportunity amid ongoing optimism about the outlook for the

markets.

While yesterday’s hotter-than expected inflation data further

pushed back interest rate cut expectations, signs of continued

strength in the economy is still expected to benefit the markets in

the longer term.

The Federal Reserve is also still likely to begin lower interest

rates sometime in the coming months even if traders have to wait

until June.

Nonetheless, the major averages remained well off their recent

highs ahead of the release of an avalanche of data before the start

of trading on Thursday.

The slew of data due to be released tomorrow includes reports on

weekly jobless claims, retail sales, industrial production and

import and export prices.

Among individual stocks, shares of Lyft (NASDAQ:LYFT)

skyrocketed by 35.1 after the ride-hailing company reported better

than expected fourth quarter results and provided upbeat

guidance.

Investing platform Robinhood (NASDAQ:HOOD) also spiked by 13.0

percent after reporting fourth quarter results that exceeded

analyst estimates on both the top and bottom lines.

On the other hand, shares of Akamai Technologies (NASDAQ:AKAM)

plunged by 8.2 percent after the server network provider reported

better than expected fourth quarter earnings but weaker than

expected revenues.

Sector News

Computer hardware stocks showed a strong move back to the upside

on the day, with the NYSE Arca Computer Hardware Index soaring by

3.4 percent to a record closing high.

Substantial strength also emerged among tobacco stocks, as

reflected by the 3.3 percent spike by the NYSE Arca Tobacco

Index.

Semiconductor, networking and biotechnology stocks also saw

considerable strength, contributing to the rebound by the

tech-heavy Nasdaq.

Most of the other major sectors also rebounded on the day, with

notable strength visible among steel, housing and airline

stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower on Wednesday. Japan’s Nikkei 225 Index

slid by 0.7 percent and South Korea’s Kospi slumped by 1.1 percent,

although Hong Kong’s Hang Seng Index bucked the downtrend and

advanced by 0.8 percent.

Meanwhile, the major European markets have moved to the upside

on the day. While the German DAX Index has risen by 0.4 percent,

the French CAC 40 Index and the U.K.’s FTSE 100 Index are both up

by 0.7 percent.

In the bond market, treasuries regained ground following the

sell-off seen in the previous session. As a result, the yield on

the benchmark ten-year note, which moves opposite of its price,

slid 4.9 basis points to 4.267 percent.

Looking Ahead

The avalanche of U.S. economic reports due to be released

Thursday could lead to early indecision on Wall Street, as the vast

amount of data may provide a mixed view of the economy.

Source: RTTNews.com

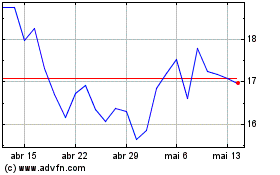

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024