Crypto: Bitcoin Futures Achieve Record Highs, WLD Skyrockets by Over 200% This Week, and More

19 Fevereiro 2024 - 11:50AM

IH Market News

Records in Bitcoin futures indicate market growth

Open interest in Bitcoin futures on centralized platforms

reached an annual peak, surpassing previous marks from November

2021. According to CoinGlass, the value of open Bitcoin futures

contracts reached $22.9 billion, reflecting an increase of over 30%

since the beginning of 2024. This growth accompanies the

appreciation of Bitcoin (COIN:BTCUSD), which rose to $52,300, while

Ether futures (COIN:ETHUSD) also saw a significant increase,

reaching a total value of $10.5 billion, representing a 50% growth

since the beginning of 2024. Meanwhile, the market value of Ether

increased to $2,900, showing a growth of over 27% throughout the

year, signaling vigorous commercial interest in

cryptocurrencies.

Alameda Research values its stake in WLD after records

The value of Alameda Research’s stake in the Worldcoin

(COIN:WLDUSD) token increased to over $50 million in just one day,

reaching a new peak of $186 million with the token’s appreciation.

This increase represents 33% of the company’s portfolio. While

Alameda and FTX liquidated over $700 million in digital assets over

several months, the fate of their holdings in WLD remains

uncertain. WLD saw a weekly jump of 205% in its value, driven by

increased adoption of the World App and association with OpenAI’s

Sam Altman.

Massive flows into Bitcoin ETFs according to BitMEX analysis

BitMEX revealed a significant increase in investments in Bitcoin

ETFs, with an impressive inflow of $331 million on February 16

alone, culminating in a weekly accumulation of $2.273 billion.

Since January 11, the total accumulated reached $4.926 billion,

highlighting a period of strong interest. BlackRock (NASDAQ:IBIT)

led the inflows, while GBTC (AMEX:GBTC) saw considerable outflows.

In total, global ETPs now hold about 947,000 BTC, reinforcing the

growing adoption of Bitcoin (COIN:BTCUSD) in the investment

sector.

Airdrop hunting annoys developers on GitHub

Developers are facing a wave of spam in GitHub repositories from

token airdrop hunters seeking to qualify for future distributions.

Recent projects have altered distribution criteria, rewarding

contributions on GitHub, which has intensified the phenomenon. The

situation pressures already overloaded teams and raises questions

about the distinction between genuine contributions and

manipulation attempts, despite some proposed measures to mitigate

spam.

FixedFloat suffers attack and loses $26 million in crypto

Cryptocurrency exchange FixedFloat confirmed a cyber attack over

the weekend, resulting in significant losses of digital assets. The

team acknowledged the incident but did not detail the exact amount

lost while working to strengthen security and conduct a thorough

investigation. The site was temporarily disabled for maintenance.

On-chain analysis indicates that approximately $26 million in

Ethereum (COIN:ETHUSD) and Bitcoin (COIN:BTCUSD) were expropriated,

with some of the funds being laundered through techniques like

CoinJoin to conceal origins.

ARK Invest unloads Coinbase shares after analyst updates

ARK Invest, led by Cathie Wood and a major investor in Coinbase

(NASDAQ:COIN), liquidated nearly 500,000 shares of the

cryptocurrency exchange, totaling around $90 million. Sales were

distributed among three ARK ETFs, following a wave of positive

analyst revisions due to Coinbase’s encouraging fourth-quarter

results. Despite market optimism, JPMorgan (NYSE:JPM) expressed

caution, highlighting uncertainties in Coinbase’s earnings.

Coinbase Commerce ends support for Bitcoin and UTXO

Coinbase’s (NASDAQ:COIN) payment platform, Coinbase Commerce,

has discontinued support for Bitcoin and other UTXO-based

cryptocurrencies, as announced by executive Lauren Dowling. UTXO

represents the amount of unspent cryptocurrency available to be

used in new transactions, ensuring each coin is unique and avoids

double spending on the blockchain network. The decision, motivated

by technical challenges in updating the payment protocol to support

these coins, still allows Bitcoin payments via Coinbase accounts.

The company also plans to integrate the Lightning Network to

improve commercial transactions, despite community criticisms about

limiting Bitcoin (COIN:BTCUSD) adoption.

Ethiopia-China partnership for Bitcoin mining driven by

hydroelectricity

Ethiopia has partnered with Chinese companies to develop a

Bitcoin mining infrastructure centered around the Grand Ethiopian

Renaissance Dam, seeking to capitalize on hydroelectric power. This

$250 million project, despite facing diplomatic and regulatory

challenges, promises to turn the country into an attractive

destination for Chinese miners, boosting energy generation and

potentially encouraging similar investments in other regions.

Virginia allocates modest funds to Blockchain Commission

Virginia’s General Government Subcommittee recommended an annual

allocation of $17,192 for the Blockchain and Cryptocurrency

Commission for 2025 and 2026, as revealed in its Sunday report.

This amount is slightly less than that allocated to the Artificial

Intelligence Commission and higher than the Autism Advisory

Council. The newly established commission by the Department of

State will focus on studying and recommending policies on

blockchain and digital assets, with the budget covering operational

costs and meetings.

Japan expands investment horizons to include crypto assets

The Japanese government, aiming to strengthen its economy and

technological innovation, has given the green light to a bill

allowing investment funds and venture capital companies in the

country to invest in cryptocurrencies. This decision, endorsed by

the Ministry of Economy, Trade, and Industry, aligns with Japan’s

proactive stance on regulating stablecoins and fostering the Web3

ecosystem, while maintaining rigorous safeguards for users. The

revised law now advances to debate in The Diet, Japan’s parliament,

signaling a potential boost to Web3 startups through crypto

investments.

AltLayer raises $14.4 million for expansion with leadership from

Polychain and Hack VC

AltLayer, a rollups platform, raised $14.4 million in a round

led by Polychain Capital and Hack VC, with support from several

other investment firms. The funding, completed in September 2023,

aims to strengthen AltLayer’s team and infrastructure. Following

the launch of its native token and a reward for active users, the

company seeks to innovate in rollups and network security, with

project governance being driven by ALT token holders.

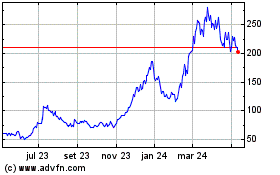

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

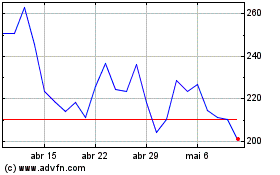

Coinbase Global (NASDAQ:COIN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024