Expiration of $3.6 billion in Bitcoin options could influence the

market

Today, around $3.6 billion worth of Bitcoin options contracts

are set to expire on major derivatives exchanges, raising questions

about possible impacts on the cryptocurrency’s value. The majority

of these options reside on Deribit and CME, indicating significant

speculation or hedging strategies against Bitcoin volatility. With

62% of open contracts being call options, there is general

optimism, but the impending expiration could generate selling

pressure, especially if the price of Bitcoin (COIN:BTCUSD) does not

remain above certain critical thresholds, such as the US$ 48

thousand predicted to maximize losses among traders.

BlackRock solidifies crypto market position with massive Bitcoin

accumulation

BlackRock (NYSE:BLK), a global leader in asset management,

consolidated its influence in the crypto market by acquiring

122,600 Bitcoins (COIN:BTCUSD) in just six weeks, representing 0.6%

of the total in circulation. With this strategic move, the company

now has around US$6.31 billion in Bitcoin, positioning itself as

the 11th largest holder of the currency. The buying spree started

modestly but soon gained momentum, reflecting the growing

acceptance of Bitcoin as a legitimate asset class by traditional

investors and signaling a significant vote of confidence in the

cryptocurrency’s future.

Reddit adds Bitcoin and Ether to its asset portfolio

Reddit has joined the select group of companies such as

MicroStrategy (NASDAQ:MSTR) and Tesla (NASDAQ:TSLA) in investing in

Bitcoin (COIN:BTCUSD) and Ether (COIN:ETHUSD), revealing the

strategy in an filing from IPO to SEC. The platform, which seeks to

go public on the New York Stock Exchange under the symbol “RDDT”,

also mentioned the acquisition of Ether and Polygon (COIN:MATICUSD)

for sales of virtual goods. With sales of US$804 million in 2023

and total assets of US$1.6 billion, Reddit is preparing for public

trading in March, seeking to strengthen ownership among its

users.

Block records robust growth in Bitcoin sales and profits

Block (NYSE:SQ), under the leadership of Jack Dorsey, saw a 37%

increase in its bitcoin sales in the fourth quarter of 2023,

reaching $2.52 billion. Benefiting from the rising price of bitcoin

(COIN:BTCUSD), the company reported $207 million in gains from its

bitcoin holdings. With a portfolio of 8,038 bitcoins, the

appreciation contributed significantly to the gross profit of Cash

App and Square, Block subsidiaries, which also showed significant

growth. Furthermore, the company’s net profit saw a notable

turnaround compared to the previous year.

Uniswap proposes reinvigorating governance with incentives

The Uniswap Foundation suggested innovations in the

administration of its decentralized exchange project, seeking to

encourage a more active and considered delegation of votes. The

proposal includes an improvement in the rewards system, benefiting

users who delegate and invest their UNI tokens. The intention is to

promote a more strategic participation in governance, linking

rewards to contributions that favor the growth of the protocol.

Voting for this change will take place in two phases, starting

March 1. Uniswap’s native token (COIN:UNIUSD) was up 55.5% at the

time of writing.

Filecoin Reaches New Annual High Driven by Partnership and AI

Filecoin (COIN:FILUSD) posted a new annual record, with its

token FIL reaching $8.43, driven by a strategic collaboration with

Solana (COIN:SOLUSD) and the growing influence of artificial

intelligence in the sector. Despite a correction to $8.06 at the

time of writing, FIL stands out with an increase of over 37% in the

last week and an impressive 63% growth in the last month. The

partnership promises to improve Solana’s scalability and security

with decentralized Filecoin storage, while the AI trend

contributes to market optimism regarding FIL.

Avalanche faces four-hour block production stoppage

The Avalanche network experienced a significant outage, going

more than four hours without producing new blocks, an incident

attributed to increased signups, as explained by Ava Labs

co-founder Kevin Sekniqi. This outage, which has prevented the

addition of new blocks since Friday morning, has led to a more than

2% drop in the value of Avalanche’s native token (COIN:AVAXUSD).

Meanwhile, the developer community is working to resolve the issue

and return to normality on the network.

Worldcoin reaches new high driven by gains in AI sector

Worldcoin (COIN:WLDUSD) reached an unprecedented peak of

US$8.98, registering a significant increase in its value. Even

after a small pullback to $8.32, the token exhibits remarkable

growth of 138.52% in a week, 271.45% in a month, and 479.17% in 6

months, raising its market capitalization to US$1.11 billion. The

price jump coincides with Worldcoin’s expansion and growing

interest in AI technology, reinforced by significant announcements

in the sector.

Ethereum whale accumulates over $400 million in ETH

In February, an anonymous Ethereum whale, identified by wallet

0x7a95c, acquired a staggering sum of ETH (COIN:ETHUSD) and stETH

(COIN:STETHUSD), totaling $411 million, mostly through Binance.

This massive accumulation includes significant transactions of up

to 34,000 ETH each, evidenced by data from Spotonchain and analysis

from news site CryptoSlate. The whale displays a sophisticated

investment strategy, with recent acquisitions bringing its holdings

to 132,585 ETH in addition to 5,485 STETH, generating an unrealized

profit of $21.13 million. Rumors about the possible connection to

Justin Sun and the approval of an Ethereum ETF by the SEC add to

the speculation surrounding this notable activity.

Buffett says no to Bitcoin, but Berkshire bets on Nubank

Warren Buffett, known for his criticism of Bitcoin

(COIN:BTCUSD), maintains his position, refusing to invest in the

cryptocurrency even with its appreciation. However, its holding,

Berkshire Hathaway (NYSE:BRK.B), diverges by investing US$1 billion

in Nubank (NYSE:NU), a Brazilian digital bank that has stood out in

Latin America for its financial inclusion and its opening to the

crypto market with Nucrypto. This investment underscores a classic

Buffett approach: investing in companies with disruptive models and

sustainable growth potential, even in sectors that he personally

may not endorse.

PancakeSwap expands horizons with affiliate model

PancakeSwap, a decentralized finance (DeFi) platform, will

introduce an affiliate model, allowing developers to launch adapted

versions of the platform on multiple blockchains. According to

developer Chef Mochi, this strategy aims to expand access and

opportunities in DeFi, offering technical support and incentives to

affiliates. CAKE holders will benefit from affiliated DEX tokens

and reduction in CAKE supply through token burning. PancakeSwap,

already present on several blockchains, is seeking community

feedback on this new initiative, and the price of the native token

(COIN:CAKEUST) has risen 8% to $3.12 in the last 24 hours.

Hacker saves millions in attack on Blueberry DeFi protocol

“c0ffeebabe.eth”, an ethical hacker, emerged as a hero by

preventing a significant loss on Blueberry Protocol, a DeFi

platform that supports leveraged lending. In a crisis that could

have seen the evaporation of around $1.3 million worth of Ethereum

(COIN:ETHUSD), the quick action of “c0ffeebabe.eth” ensured the

safety of the threatened funds. The incident, which occurred on

February 23, highlights the vital importance of white hat hackers

in combating exploits in the growing DeFi sector, where recent

attacks have raised concerns about the security of digital

assets.

Co-founder of Sky Mavis and Axie Infinity suffers hack into

personal wallets

Jeffrey Zirlin, one of the creators of Sky Mavis and the popular

game Axie Infinity (COIN:AXSUSD), announced that two of his

personal wallets were hacked, without affecting the Ronin platform.

PeckShield, a blockchain security firm, discovered that a large

amount of Ether (COIN:ETHUSD), valued at approximately $9.7

million, was moved to Tornado Cash from the Ronin Bridge. Zirlin

assured that the incident did not compromise the operations of

Ronin or Sky Mavis, emphasizing the continued security of the

platform.

Lejilex vs. SEC: Crypto industry seeks change

Historically, the relationship between the SEC and the

cryptocurrency industry has varied, ranging from initial neglect to

a more rigorous stance in recent years. Recently, the SEC has taken

a tough approach, regulating through enforcement against major

players like Coinbase and Kraken, leaving many in the industry wary

of operating in the US. In response, the Lejilex platform, backed

by the Crypto Freedom Alliance of Texas, filed a lawsuit

challenging the SEC, arguing that secondary sales of digital assets

are not securities transactions. This case, reflecting an “impact

litigation” strategy, seeks a significant change in the application

of securities laws to the crypto sector.

Kraken criticizes SEC actions as retaliation for his testimony

Cryptocurrency exchange Kraken claims the SEC’s charges are in

retaliation for its call for better regulation of the crypto

industry, expressed in testimony to US Congressional committees.

The exchange emphasizes the need for a more fine-tuned regulatory

approach and accuses the SEC of exceeding its jurisdiction,

especially after alleging that Kraken operated without proper

registrations. Kraken sees this as an attempt to intimidate them

from exercising their freedom of expression and advocating for a

clearer and fairer regulatory environment.

Bitcoin miners challenge US government energy probe

Riot Platforms (NASDAQ:RIOT) and the Texas Blockchain Council

are suing U.S. government agencies, including the Department of

Energy, over an inquiry into the energy consumption of Bitcoin

miners. They claim that data collection is invasive and lacks legal

basis, violating the Bureaucracy Reduction Law and the

Administrative Procedure Law. Miners see the action as a political

effort, unrelated to network stability, and want to protect their

confidential information.

Adam Back refutes Craig Wright claims with Satoshi emails in trial

In the COPA trial against Craig Wright, Adam Back presented

correspondence with Satoshi Nakamoto to dispute Wright’s claims of

being the creator of Bitcoin (COIN:BTCUSD). The emails, which

include discussions of Bitcoin’s precursor Hashcash and references

to other digital currency proposals, were used to argue against

Wright’s copyright claims on the Bitcoin whitepaper. COPA alleges

that such claims harm the development and security of the Bitcoin

ecosystem, making the case of public interest.

FTX advances in the sale of stake in Anthropic

FTX, now in liquidation, has been granted permission to sell its

7.84% stake in Anthropic, an AI startup. After an initial

investment of US$500 million in 2021, the stake is potentially

valued at US$1 billion, reflecting Anthropic’s growth. This move is

part of FTX’s efforts to reimburse its customers, amid the

impending conviction of its founder, Sam Bankman-Fried, for

fraud.

NFT platform innovates with N64 emulator via Bitcoin

Pizza Ninjas, a platform dedicated to NFTs, announced the launch

of a Nintendo 64 console emulator operating on the Bitcoin

blockchain, using the ordinal technique to record data in satoshis.

This innovation allows you to play classic titles without a

physical console, thanks to Google’s Brotli compression, which

significantly reduces file sizes. With this, games like the

renowned Goldeneye 64 can be enrolled on the blockchain efficiently

and economically, preserving the heritage of classic games in the

digital age.

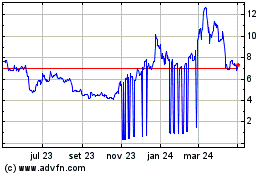

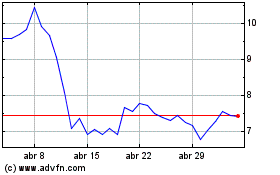

Axie Infinity Shard (COIN:AXSUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Axie Infinity Shard (COIN:AXSUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025