U.S. Futures Dip as PCE Data Looms; Modest Gains for WTI and Brent Crude in April Contracts

29 Fevereiro 2024 - 8:13AM

IH Market News

U.S. index futures are down in pre-market trading as investors

await the release of January’s Personal Consumption Expenditures

(PCE) deflator, a key indicator for the Federal Reserve (Fed).

Anxiety mounts following surprises in CPI and PPI indices, while

the Fed maintains a cautious stance on interest rate cuts.

At 05:40, Dow Jones futures (DOWI:DJI) fell 124 points, or

0.32%. S&P 500 futures declined 0.28%, and Nasdaq-100 futures

fell 0.25%. The yield on 10-year Treasury bonds was at 4.311%.

In the commodities market, West Texas Intermediate crude oil for

April rose 0.13% to $78.64 a barrel. Brent crude oil for April rose

0.02%, close to $83.70 a barrel. Iron ore traded on the Dalian

exchange fell 0.17% to $123.98 per metric ton.

Asian markets closed without a unified direction on Thursday.

While some showed caution ahead of upcoming U.S. inflation data,

Chinese markets advanced with new initiatives from Beijing. Japan’s

Nikkei was slightly in the red for the second consecutive day,

while Hong Kong’s Hang Seng and South Korea’s Kospi also recorded

declines of -0.15% and -0.37%, respectively. On the other hand,

China’s Shanghai SE saw a significant increase of +1.94%, while

Australia’s ASX 200 closed up +0.50%.

European markets are operating in positive territory as

investors closely follow inflation reports in both the U.S. and

Europe. Today, inflation data for February from Germany, Spain, and

France is expected to be released, capturing market participants’

attention.

On the U.S. economic agenda for Thursday, highlights include the

release of the PCE index at 08:30, reflecting January’s spending

and personal income, and last week’s unemployment insurance claims

at the same time, both by the Department of Commerce. In addition,

January’s pending home sales will be presented at 10:00 AM.

On Wednesday, U.S. markets showed a partial recovery after a

negative start but closed lower. The Dow Jones slightly decreased,

while the S&P 500 and Nasdaq also retreated, reflecting

investors’ caution ahead of the inflation data release. The initial

volatility was driven by profit-taking and the anticipation of

significant economic indicators, highlighting the market’s

sensitivity to changes in economic outlook and monetary

policies.

For quarterly earnings, financial reports are scheduled to be

presented before the market opens from Celsius

(NASDAQ:CELH), Canadian Natural Resources

(NYSE:CNQ), Melco (NASDAQ:MLCO), Best

Buy (NYSE:BBY), Cronos Group

(NASDAQ:CRON), Polestar (NASDAQ:PSNY),

Birkenstock (NYSE:BIRK), AbInBev

(NYSE:BUD), Bath & Body Works (NYSE:BBWI),

Brinks (NYSE:BCO), among others.

After the market closes, investors await results from

Zcaler (NASDAQ:ZS), SoundHound

AI (NASDAQ:SOUN), Fisker

(NYSE:FSR), Dell Technologies (NYSE:DELL),

AutoDesk (NASDAQ:ADSK), Veeva

(NYSE:VEEV), Hewlett Packard Enterprise

(NYSE:HPE), NetApp (NASDAQ:NTAP), and more.

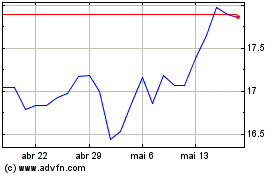

Hewlett Packard Enterprise (NYSE:HPE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Hewlett Packard Enterprise (NYSE:HPE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024