Adobe (NASDAQ:ADBE) – Adobe‘s

shares fell approximately 11.65% in pre-market trading following a

robust first fiscal report. Adobe reported an

adjusted earnings per share of $4.48 on revenue of $5.18 billion,

compared to LSEG consensus estimates of earnings of $4.38 per share

and revenue of $5.14 billion. Net income was $620 million.

Adobe projected earnings and revenue below analyst

estimates for the current quarter and announced a $25 billion share

repurchase.

Cardlytics (NASDAQ:CDLX) – The advertising

platform surged 38% in pre-market trading after the company

reported becoming positive in adjusted earnings before interest,

taxes, depreciation, and amortization for the full year for the

first time since 2019. In the first quarter, the company reported

earnings per share of $0.14 on revenue of $89.2 million, while

estimates were for a loss of $-0.33 per share on revenue of $84.7

million.

Apple (NASDAQ:AAPL) – According to Bloomberg,

Apple acquired the Canadian AI startup DarwinAI

before its planned launch. The acquisition aims to bolster

Apple‘s AI efforts, aligning with its previous

research on language models. Financial terms were not disclosed.

Apple‘s shares rose 0.72% in pre-market trading,

despite a 10% decline this year.

Nvidia (NASDAQ:NVDA) –

Nvidia‘s shares are currently below recent highs,

but a potential new hardware announcement could reignite growth.

Nvidia is expected to reveal more about its B100

chip at the GTC conference, while rumors suggest the existence of a

B200 chip.

Smartsheet (NYSE:SMAR) – The enterprise

software provider registered an 11.2% drop in pre-market trading

due to disappointing revenue outlook for Wall Street.

Smartsheet estimated revenues between $257 million

and $259 million for the current quarter, and between $1.113

billion and $1.118 billion for the year. However, analysts surveyed

by FactSet project revenues of $262.3 million for the quarter and

$1.14 billion for the year.

Cisco Systems (NASDAQ:CSCO) – Cisco

Systems received EU antitrust approval for its $28 billion

acquisition of Splunk (NASDAQ:SPLK),

unconditionally, after regulators found no competition issues. This

is Cisco‘s largest deal, aimed at bolstering its

software business and offsetting the post-pandemic slowdown.

PagerDuty (NYSE:PD) –

PagerDuty reported a net loss of $28.8 million for

the fourth fiscal quarter, with adjusted earnings of 17 cents per

share on revenue of $111.1 million. Analysts surveyed by FactSet

had expected an average adjusted net profit of 15 cents per share

on revenue of $110.7 million. The company provided

weaker-than-expected sales outlooks for the current quarter and the

full year. Shares fell -7.6% in pre-market trading.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC‘s rapid rise is raising concerns among its

staunchest supporters. The stock’s relative strength index reached

overbought levels, while analysts question the sustainability of

AI-driven growth. Nonetheless, TSMC remains

optimistic, though geopolitical concerns persist.

Vodafone (NASDAQ:VOD) – Swisscom announced on

Friday the purchase of Vodafone Italia for $8.7 billion, merging it

with its subsidiary Fastweb. The deal will create Italy’s

second-largest fixed broadband operator. Vodafone

will return 4 billion euros to shareholders and reduce dividends.

The transaction is expected to be completed in the first quarter of

2025.

McDonald’s (NYSE:MCD) –

McDonald’s Japan, along with units in Australia

and Hong Kong, faces system disruptions. In Japan, stores stopped

accepting orders at mobile kiosks. McDonald’s

Australia and Hong Kong are also dealing with technical issues. The

company is working to restore operations soon.

Restaurant Brands International (NYSE:QSR) –

Restaurant Brands International, parent company of

Burger King, named Sami Siddiqui as its new CFO, succeeding Matt

Dunnigan. Jeff Klein becomes president of Popeyes in the US and

Canada, while Thiago Santelmo will lead international businesses.

The changes aim to boost the company’s long-term goals amid global

challenges.

Ulta Beauty (NASDAQ:ULTA) – In the fourth

quarter, Ulta reported earnings per share of $8.08

on revenues of $3.6 billion, beating analyst forecasts. The

cosmetics retailer projected yearly earnings at the lower end of

Wall Street predictions, forecasting annual earnings between $26

and $27 per share, below the $27 expectation of analysts surveyed

by LSEG.

Macy’s (NYSE:M) – Arkhouse Management revealed

ongoing negotiations with Macy’s after expressing

dissatisfaction with a previous offer. The company and Brigade

Capital raised their offer to $24 per share, awaiting

Macy’s response to confirm or potentially increase

the offer.

Alibaba (NYSE:BABA) – AliExpress is under

investigation by the European Commission for the spread of illegal

content, being the third platform to be examined after TikTok. As a

large online platform under the EU’s Digital Services Act, it is

required to take more effective measures against illegal

materials.

Zumiez (NASDAQ:ZUMZ) – After presenting a

disappointing outlook for the current quarter, the specialty

retailer saw a 4.75% drop in pre-market trading.

Zumiez predicted a loss per share between $1.09

and $1.19, contrasting with analysts’ forecast of just 34 cents per

share surveyed by FactSet. The company also set quarterly revenue

between $167 million and $172 million, below the $186.3 million

estimate by analysts.

Altria Group (NYSE:MO) – Altria

Group expanded its share repurchase program by $2.4

billion and revised its annual profit forecast, after selling part

of its stake in Anheuser-Busch InBev (NYSE:BUD). The company plans

to invest the proceeds in transitioning to tobacco alternatives and

paying off debt.

Citigroup (NYSE:C) – Citigroup

is investigating harassment allegations against a senior US banker,

Edward Ruff, from New York, who is on leave. Incidents of abusive

behavior are under scrutiny as Citi changes its organizational

culture.

Bank of America (NYSE:BAC) – Bank of

America implemented leadership changes in its capital

markets business, establishing a Capital Markets Advisory group.

Gregg Nabhan and Mike Browne will lead the advisory unit, aiming to

improve offerings amid a volatile environment.

JPMorgan Chase (NYSE:JPM) –

JPMorgan was fined $348.2 million by US banking

regulators for deficiencies in its trading activities monitoring

program from 2014 to 2023. The bank agreed to review and enhance

its trading surveillance procedures as required by regulators.

New York Community Bancorp (NYSE:NYCB) –

NYCB disclosed the sale of loans to boost earnings

and is integrating the defunct Signature Bank into its financial

reports. Analysts expressed concerns about recovery, predicting

that trading will remain limited until a concrete recovery plan is

established.

Blackstone (NYSE:BX) – Real estate prices have

fallen, creating an opportunity for investors, according to Jon

Gray, President of Blackstone, who noted the need

for capital and buying opportunities. Blackstone

is active in financing and sees growth potential as the market

stabilizes.

Amazon (NASDAQ:AMZN) –

Amazon‘s autonomous vehicle unit Zoox seeks to

outpace Alphabet’s Waymo by expanding vehicle tests in California

and Nevada, including broader areas, higher speeds, and night

driving. The vehicles, lacking internal manual controls, resemble

toasters on wheels. Zoox also operates adapted autonomous Toyota

Highlanders in various cities. The company aims to replace human

drivers with fully autonomous vehicles, though no timeline has been

set. Amazon acquired Zoox in 2020, sparking

speculation about its potential use for delivery, but Zoox has yet

to announce plans beyond robo-taxis.

Honda Motor (NYSE:HMC) –

Nissan and Honda are considering

a strategic partnership to collaborate on key components for

electric vehicles (EVs) and AI in automotive software platforms.

This potential cooperation aims to face increasing competition from

rivals.

General Motors (NYSE:GM) – General

Motors‘ Mexican unit and union agreed on a 9.2% wage

increase, along with improvements in the savings fund and food

vouchers.

Fisker (NYSE:FSR) – Fisker

denied speculation about potential bankruptcy, stating it routinely

works with consultants and is committed to securing a deal with

another automaker. Its shares plummeted Thursday following reports

of financial troubles, but the company asserts it remains focused

on raising capital and establishing strategic partnerships.

United Airlines (NASDAQ:UAL) – United

Airlines is close to acquiring more than three dozen

Airbus A321neo jets from aircraft lessors, seeking alternatives to

the uncertified Boeing MAX 10.

Royal Caribbean (NYSE:RCL) – Royal

Caribbean suspended cruise visits to Labadee, Haiti, for

seven days due to escalating gang violence in the country. The

company’s president, Michael Bayley, stated the suspension would

continue as necessary, with prior notice given to affected

guests.

Hilton (NYSE:HLT) – Hilton

announced the acquisition of Graduate Hotels from Adventurous

Journeys Capital Partners for $210 million, its first brand

purchase in over 20 years. Hilton sees

consolidation opportunities due to pressure in the hospitality

industry.

US Steel (NYSE:X) – On Friday, Japan’s Nippon

Steel announced that, under the proposal to acquire US

Steel, there would be no layoffs or factory closures until

September 2026, subject to specific conditions. The company is

advancing in the regulatory review of the deal and is committed to

completing it.

Madrigal Pharmaceuticals (NASDAQ:MDGL) – The

first drug for obesity-related liver disease was approved in the US

on Thursday, boosting Madrigal Pharmaceuticals‘

shares by 24.40% in pre-market trading on Friday, as the developer

of the drug Rezdiffra. The annual price is expected to be about

$50,000, generating optimistic sales expectations.

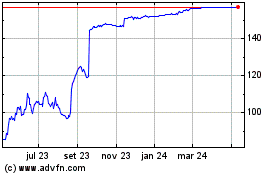

Splunk (NASDAQ:SPLK)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Splunk (NASDAQ:SPLK)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025