Bitcoin’s fall affects market and traders with forecast of more

instability

Bitcoin (COIN:BTCUSD) faced a sharp decline in value over the

last 24 hours, hovering around $64,329.32 at the time of writing.

The negative movement, possibly intensified by the new adoption of

Bitcoin ETFs, dragged along other cryptocurrencies and related

assets. Amidst this volatility, optimistic traders saw over $440

million being liquidated. This resulted in significant losses in

long positions across various cryptocurrencies, with Binance and

OKX concentrating most of these liquidations. This period also

witnessed record withdrawals from the Grayscale Bitcoin Trust ETF

(AMEX:GBTC), signaling potential future market oscillations.

Adding to the analysis, Fernando Pereira, an analyst at Bitget,

comments on the expectation of a 20% to 30% reduction in Bitcoin’s

value around the halving event. According to Pereira, “in the

days surrounding the halving (either before or after), we should

see a pullback of 20% to 30%, due to the significant increase in

small players entering the market, which ends up providing

liquidity for large players to realize their profits for the

year.”

On Monday night, Bitcoin experienced a brief devaluation on

BitMEX, reaching $8,900, while on other platforms, the value

remained above $60,000. The abrupt decline was followed by a quick

recovery to $67,000 ten minutes later. At the peak of the BitMEX

incident, Bitcoin maintained a global average price of

approximately $67,400. Speculation on social media suggests that

the drop was triggered by the sale of over 850 BTC by a large

entity on BitMEX, significantly impacting the market.

In other related news, MicroStrategy (NASDAQ:MSTR), known for

its substantial investment in Bitcoin, added 9,245 BTC to its

portfolio for $623 million, with an average cost of $67,400 per

bitcoin. Under the leadership of Michael Saylor, the purchase was

funded by a convertible bond offering and excess funds, bringing

its total bitcoins to 214,246, equivalent to over 1% of the total

bitcoin supply. Despite the acquisition, the recent drop in the

value of bitcoin negatively impacted MicroStrategy’s stock

price.

Gradual reduction in fees on Grayscale’s Bitcoin ETF promises

compliance with market maturity

Michael Sonnenshein, CEO of Grayscale, foresees a decrease in

fees for its Bitcoin ETF (AMEX:GBTC), aligned with the maturation

of the sector. As reported by CNBC, the expectation is that,

following the trend of other markets, the GBTC’s 1.5% fee will

decrease as the fund grows. Despite the continued record outflows,

Grayscale maintains its leadership in the sector with GBTC and

plans to launch a new product with lower fees, awaiting SEC

approval, without impacting current holders with additional

taxes.

Bitcoin ETFs drive access and growth in the crypto market,

according to BlackRock and Grayscale executives

Tony Ashraf from BlackRock (NYSE:BLK) and Michael Sonneshein

from Grayscale highlight that bitcoin ETFs are meeting the growing

demand for cryptocurrencies, facilitating the entry of new

investors into the sector. During the Digital Asset Conference in

London, Ashraf pointed out that ETFs unlocked pent-up demand, while

Sonneshein noted “explosive growth” in these products. They

identified three main factors for this phenomenon: macroeconomic

and demographic changes, maturation of the crypto industry, and

advances in regulatory environment.

Citi and BNDES collaborate with Hyperledger Foundation on

enterprise blockchain solutions

Citi (NYSE:C) and the Brazilian Development Bank (BNDES) have

joined the Hyperledger Foundation to advance the development of

blockchain-based enterprise solutions. Unlike public blockchains,

corporate blockchains are restricted to authorized users.

Hyperledger, which already has 134 members, including IBM

(NYSE:IBM) and American Express (NYSE:AXP), aims to promote

blockchain technology innovation among enterprises. Additionally,

the foundation announced the creation of a working group focused on

financial services, with participation from major entities like

Accenture (NYSE:ACN) and Visa (NYSE:V).

BVM launches open AI on blockchain to revolutionize cryptographic

applications

The Bitcoin Virtual Machine (BVM) is introducing an innovation

in the crypto space with the launch of truly open AI, allowing

artificial intelligence models to be implemented directly on the

blockchain. This initiative paves the way for the integration of AI

into decentralized cryptographic networks, enabling the creation

and use of AI algorithms within the blockchain ecosystem.

Collaboration with platforms like Filecoin (COIN:FILUSD) and

Polygon (COIN:MATICUSD) aims to provide storage infrastructure for

these advanced models, promising to drive new innovations in the

industry.

RippleX announces integration of Real-backed stablecoin on XRP

Ledger

RippleX, the development arm of Ripple (COIN:XRPUSD), has

announced the addition of the BRLA Token, a stablecoin linked to

the Brazilian Real, to the XRP Ledger, marking a significant step

for the platform and its ecosystem. This novelty promises more

stable and efficient transactions, both locally and globally. BRLA

Digital, behind the initiative, aims to transform the Brazilian

financial sector by offering a simplified and cost-effective method

for commercial operations. RippleX praises the initiative,

highlighting the potential of the BRLA Token to innovate commercial

transactions in Brazil.

Libre launches on-chain operations facilitating tokenization of

alternative assets with Polygon support

Libre, a new Web3 platform focused on institutions, has debuted

in the on-chain ecosystem, enabling the tokenization of alternative

assets. This advancement was made possible after a successful

cross-chain transaction on Polygon (COIN:MATICUSD). Developed in

partnership between WebN incubator and Laser Digital, a subsidiary

of Nomura Holdings (NYSE:NMR), Libre collaborated with major

managers like Brevan Howard and Hamilton Lane, aiming at tokenizing

alternative investments. The platform also promises access to

renowned money market funds and plans to launch secured lending

services, further expanding its offerings to the institutional

market.

Luxor Technology and Bitnomial launch first hashrate futures in the

US

Luxor Technology, focused on Bitcoin mining, in partnership with

Bitnomial, has introduced the first hashrate futures in the US,

aiming to protect revenues for miners ahead of the upcoming bitcoin

halving in April. These futures, settled in cash, are based on

“hashprice,” indicating revenue per unit of hashrate. Offered on

exchange for greater liquidity and security, these contracts aim to

mitigate revenue risks amid volatility and changes in hash

rate.

Galaxy Digital poised to launch cryptographic ETPs in Europe in

partnership with DWS

Under the leadership of Michael Novogratz, Galaxy Digital

(TSX:GLXY) is gearing up to launch new cryptographic investment

products in Europe soon, in collaboration with asset manager DWS.

Leon Marshall, CEO of the European division, announced at the

Digital Asset Summit in London that these ETPs, including ETFs and

possibly ETNs, will be accessible through traditional brokerage

accounts, expanding access to digital assets on the continent.

Japan’s largest pension fund explores investments in Bitcoin and

other non-traditional assets

Japan’s Government Pension Investment Fund (GPIF), recognized as

the largest global pension fund, is gathering data on “illiquid

assets” like bitcoin to assess potential inclusions in its

diversified portfolio. Currently focused on stocks, bonds, and

other traditional investments, GPIF seeks to expand into

alternative assets, including agricultural lands and

cryptocurrencies, although it has not yet confirmed investments in

bitcoin.

Grab integrates cryptocurrency payments in Singapore in partnership

with Triple-A

Superapp Grab (NASDAQ:GRAB), known for its transportation,

delivery, and digital payment services in Asia, now accepts

cryptocurrencies for wallet top-ups in Singapore, thanks to

collaboration with Triple-A, a licensed provider of cryptographic

payments. Initially available in Singapore, this initiative allows

payments in five cryptocurrencies, including Bitcoin (COIN:BTCUSD)

and Ethereum (COIN:ETHUSD). Grab will monitor user receptivity to

potentially expand these services, marking a significant step in

integrating the crypto economy into daily life.

Genesis agrees to pay $21 million to SEC to settle lawsuit related

to Gemini Earn

Genesis Global Capital, hit by bankruptcy, has agreed to pay $21

million to resolve SEC charges related to securities law violations

through its involvement with the failed Gemini Earn program. The

SEC announced this conclusion after a New York judge rejected

attempts by Genesis and Gemini to halt the progress of the lawsuit

initiated in January 2023. Genesis’s payment of the fine, which

declared bankruptcy shortly after being accused by the SEC, will be

made only after the settlement of all other debts approved by the

bankruptcy court.

Coinbase gains support in legal battle against SEC for clear rules

in crypto sector

Coinbase Global (NASDAQ:COIN), supported by allies like Paradigm

and the Crypto Council for Innovation, is legally challenging the

SEC for its refusal to establish specific regulations for

cryptocurrencies. This coalition argues that the SEC’s current

approach, which treats crypto assets as if they were traditional

financial products, is incompatible with the decentralized nature

of the technology. The dispute intensifies after the SEC rejected

Coinbase’s request to create a regulatory framework, leading the

company to seek a judicial turnaround.

Binance’s Changpeng Zhao initiates free educational project: Giggle

Academy

Changpeng Zhao, co-founder of Binance, has announced Giggle

Academy, a new nonprofit educational initiative focused on reducing

educational disparities, especially for those without access to

formal education. The online platform aims to complement

traditional education with innovative and stable content. Zhao,

involved in legal challenges in the US, sees this project as his

most significant contribution to the future, despite facing travel

restrictions and a possible prison sentence.

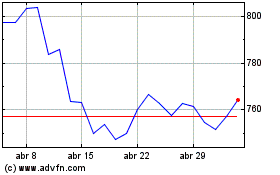

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024