FedEx (NYSE:FDX) – FedEx exceeded profit

forecasts for the quarter, posting an adjusted profit of $3.86 per

share, higher than the $3.45 per share expected by analysts

consulted by LSEG. However, the company’s revenue did not meet

estimates. FedEx also announced a $5 billion share buyback program.

FedEx shares rose 12.6% in pre-market trading.

Nike (NYSE:NKE) – The German Football

Association (DFB) announced that Nike will be its official supplier

from 2027, ending a long partnership with Adidas. The change comes

after Nike offered the best financial deal to outfit the national

teams until 2034. In the third fiscal quarter, Nike exceeded Wall

Street projections, with a profit of 77 cents per share and revenue

of $12.43 billion, surpassing the expectations of analysts

consulted by LSEG, who predicted 74 cents per share and revenue of

$12.28 billion. Nike observed a slowdown in its sales in China.

Shares are down -6.6% in pre-market trading.

Lululemon Athletica (NASDAQ:LULU) – In the

fourth fiscal quarter, Lululemon recorded earnings per share of

$5.29 and revenue of $3.21 billion, against estimates of $5.00 in

earnings and $3.19 billion in revenue. Net income was $669.5

million, and revenue grew about 16% from the previous year. Despite

exceeding expectations, the outlook was below estimates, with

growth stagnating in North America. Shares are down 12.7% in

pre-market trading.

Academy Sports & Outdoors (NASDAQ:ASO) –

Academy Sports & Outdoors reported earnings of $6.96 per share

and revenues of $6.159 billion last quarter, slightly below

forecast. Despite this, the CEO highlights a solid growth strategy

and expansion plans for more than 800 stores, maintaining a

positive outlook for the future.

Accenture (NYSE:ACN) – Accenture released the

results of the latest quarter on Thursday, with revenue of $15.80

billion, slightly below the average analyst estimate of $15.84

billion. The company also reported adjusted earnings of $2.77 per

share, surpassing the $2.66 per share estimate. Accenture lowered

its revenue forecasts for fiscal year 2024, now estimating growth

of 1% to 3%, compared to the previous projection of 2% to 5%.

Corporate highlights

Microsoft (NASDAQ:MSFT) – Microsoft agreed to

acquire AI startup Inflection for about $650 million in cash,

allowing it to use Inflection’s models and hire its team, including

co-founders. The models will be available on Azure, and investors

will receive a 1.5 times return on their investment.

Apple (NASDAQ:AAPL) – Antitrust proceedings and

potential infringements of the Digital Markets Act led to a drop in

Apple’s shares on Thursday, erasing about $113 billion in market

value. Regulators in the US and Europe have intensified

investigations into Apple, raising investor concerns about fines

and its dominance.

Meta Platforms (NASDAQ:META) – After more than

three hours of interruption, Meta Platforms’ Instagram was back

online for most users. About 400 interruptions persisted, most

related to login issues, after more than 5,000 initial reports.

Walt Disney (NYSE:DIS) – Nelson Peltz’s

campaign for a seat on Disney’s board gained momentum with the

endorsement of Institutional Shareholder Services (ISS), increasing

tension before the shareholder vote on April 3. While Disney

already had support from Glass Lewis and notable figures, ISS

criticized Disney’s performance and suggested that Peltz could

improve corporate governance, despite Disney‘s

opposition to his candidacy.

Spotify (NYSE:SPOT) – Spotify launched a

feature that reveals the magnitude of podcasters. Joe Rogan leads

with 14.5 million followers, highlighting his influence. Meanwhile,

BandLab celebrates 100 million users, highlighting the continued

success of the music platform.

Rush Street Interactive (NYSE:RSI),

DraftKings (NASDAQ:DKNG) – Rush Street is

considering strategic options, including a potential sale,

according to Bloomberg. The company, with brands such as BetRivers

and RushBet, approached potential buyers, including DraftKings.

Founded by Neil Bluhm, Rush Street operates in 15 states and three

countries, reporting sales of $691 million last year, despite

facing stiff competition from market leaders like DraftKings and

FanDuel.

Booking.com (NASDAQ:BKNG) – The Italian

Competition Authority (AGCM) has initiated an investigation into

Booking.com for possible anti-competitive practices, including

adjusting accommodation prices on the platform without the consent

of hotels, aiming to maintain competitiveness against more

advantageous offers from other sites.

Reddit (NYSE:RDDT) – Social media platform

stocks are down 3.1% in pre-market trading. On Thursday, Reddit

made its debut on the New York Stock Exchange, seeing a 48%

increase in its value on the first day of trading. ARK Invest, led

by investor Cathie Wood, acquired almost 10,000 Reddit shares.

These shares were added to the ARK Next Generation

Internet (AMEX:ARKW) and ARK Fintech

(AMEX:ARKF) ETFs, totaling an investment valued at $503,492.

Auna SA – Auna SA raised $360 million in its

initial public offering in the US, pricing shares below the

announced range. The healthcare provider in Latin America, with

hospitals and clinics in Mexico, Peru, and Colombia, sold 30

million shares at $12 each, below the range of $13 to $15.

Grifols (NASDAQ:GRFS) – The Spanish stock

market regulator, CNMV, found no significant errors in Grifols’

accounts, ruling out the need for revision, despite some

deficiencies that do not affect the representation of the company’s

financial reality. The investigation followed accusations from

Gotham City Research but confirmed the integrity of Grifols’

financial disclosures.

Alibaba (NYSE:BABA), Bilibili

(NASDAQ:BILI) – Alibaba offloaded nearly $360 million in shares of

the Chinese streaming platform Bilibili at a considerable discount,

part of a series of divestments as it seeks capital to invest in AI

and rejuvenate its business.

Best Buy (NYSE:BBY) – Best Buy shares advanced

1.94% in pre-market trading, reaching $82.00, following an upgrade

in rating by analysts at JPMorgan, who moved from “Neutral” to

“Overweight” and raised the target price from $89 to $101, as

reported by The Fly.

Dutch Bros (NYSE:BROS) – Shares of the

drive-through coffee chain fell about 5.4% in pre-market trading.

Dutch Bros announced the start of a secondary offering of its

shares, conducted by some shareholders associated with TSG Consumer

Partners LP. These shareholders plan to make 8 million shares

available, and Dutch Bros will not receive any

proceeds from the sale.

PepsiCo (NASDAQ:PEP) – PepsiCo has committed to

investing an additional $400 million in Vietnam to build two new

renewable energy-powered hubs, as announced by the Vietnamese

government on Friday. These investments come during a visit by

delegations from over 60 US companies to the country.

Boeing (NYSE:BA) – Heads of major airlines will

hold discussions with Boeing’s new board chairman, Larry Kellner,

about concerns stemming from issues at Alaska Airlines and in

production, seeking solutions for safety and quality issues.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines approved a new five-year work contract for 18,000 agents,

with an hourly wage rate of $38, 6.6% above United

Airlines (NASDAQ:UAL). The agreement shortens the time to

reach the top of the pay scale to 10 years of service, instead of

11.

American Airlines (NASDAQ:AAL) – Last month, an

American Airlines Boeing 737-800 went off the runway due to a brake

failure, related to incorrect maintenance, as stated by US

investigators on Thursday. The incident occurred at Dallas-Fort

Worth International Airport, and none of the 104 passengers was

injured, with the pilots using thrust reversers to slow down.

United Airlines (NASDAQ:UAL) – United Airlines

Holdings will allow up to five MileagePlus associates to share and

redeem miles in a joint account starting Thursday, without

affecting membership status. Loyalty programs gained momentum

during the pandemic, expanding similar options in other

airlines.

Tesla (NASDAQ:TSLA) – Tesla reduced the

production of electric cars at its factory in China, in response to

slow growth in new energy vehicle sales and intense competition.

The automaker instructed employees at the beginning of the month to

work five days a week, reducing the production of the Model Y and

Model 3.

Aston Martin (USOTC:ARGGY) – Adrian Hallmark,

former CEO of Bentley, was hired by Aston Martin to stabilize the

iconic luxury car manufacturer, replacing Amedeo Felisa. Hallmark,

with extensive experience in the automotive industry, will lead the

company’s transformation, facing financial challenges and seeking

solutions for recovery.

Goldman Sachs (NYSE:GS) – Goldman Sachs Asset

Management announced it raised over $700 million for the Union

Bridge Partners I fund, part of the company’s $340 billion External

Investment Group. This fund will collaborate with external

managers, targeting investment opportunities in public and private

markets, focusing on sectors such as hospitality, software, and

music royalties. This initiative reflects Goldman Sachs’ strategy

to expand its private credit portfolio to $300 billion over five

years.

Santander (NYSE:SAN) – Santander announced that

its shareholders are expected to receive over $6.5 billion in

dividends and buybacks this year, driven by a strong start. CEO Ana

Botin anticipates a 9% increase in first-quarter revenue compared

to the previous year, maintaining annual targets.

Bank of America Corp (NYSE:BAC) – In

anticipation of the Federal Reserve’s policy meeting, US stocks saw

significant outflows, pushing the S&P 500 index to new highs.

US equity funds experienced withdrawals of about $22 billion, the

largest figure since December 2022, according to Bank of America,

citing data from EPFR Global. Bank of America strategist Michael

Hartnett warned about the gains, suggesting signs of a possible

bubble, contrasting with the optimistic view of other analysts.

JPMorgan Chase (NYSE:JPM) – The head of

JPMorgan Chase in China for private banking, Grace Lin, will retire

after 8 years at the institution. Her successor will be announced

shortly. The change is part of a broader reorganization in the

bank’s leadership, including appointments in the Asia region.

BlackRock (NYSE:BLK) – A senior BlackRock

executive expressed dismay over the Texas state fund’s decision to

withdraw $8.5 billion in assets, urging the fund’s administrators

to reconsider. The dispute highlights concerns about the use of ESG

criteria in investing.

Capital One (NYSE:COF), Discover

Financial Services (NYSE:DFS) – The $35.3 billion merger

between Capital One and Discover Financial will be scrutinized by

investors and will face resistance from antitrust advocates and

Democratic lawmakers, who believe it will increase costs for

consumers and threaten financial stability. The Biden

administration’s Justice Department is ramping up scrutiny of bank

mergers.

First Citizens BancShares (NASDAQ:FCNCA) –

Goldman Sachs rated First Citizens BancShares as a buy with a

target price of $1,950, highlighting its potential for low- to

mid-teens return. Now the 16th largest bank in the US, with assets

of $213.6 billion, the bank is praised for its recovery and growth

in the banking sector, especially after acquiring parts of Silicon

Valley Bank.

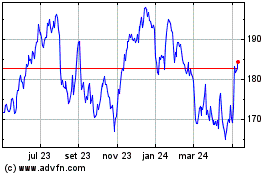

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

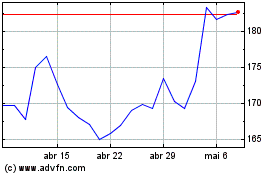

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024