Bitcoin swung to over $71,000 in anticipation of the halving

Bitcoin (COIN:BTCUSD) climbed to over $71,000 on Tuesday

morning, marking a weekly peak, as we approach the anticipated

block reward halving. After briefly hitting the mark of $71,582.96,

the price retreated and stabilized around $70,181.55 at the time of

writing. The appreciation comes amidst a recovery phase for the

cryptocurrency, following a slump influenced by inflation and an

incident at BitMEX, along with growing anticipation for the April

halving, which will cut miners’ rewards in half, potentially

impacting Bitcoin’s supply and price.

Recovery in Bitcoin ETFs after the slump

On Monday, the Bitcoin ETFs listed on Nasdaq saw an inflow of

$15.4 million, breaking a five-day streak of withdrawals, data from

Farside revealed. Fidelity’s ETF (AMEX:FBTC) led with $261.8

million, followed by BlackRock’s (NASDAQ:IBIT) with $35.5 million.

Other funds such as Bitwise (AMEX:BITB), Invesco Galaxy

(AMEX:BTCO), Franklin (AMEX:EZBC), and Valkyrie (NASDAQ:BRRR)

recorded inflows between $11 million and $20 million each. In

contrast, Grayscale’s ETF (AMEX:GBTC) faced outflows of $350

million. In the previous week, the ETFs recorded a cumulative

outflow of $887.6 million.

BlackRock warns: explosive growth of Bitcoin may slow down

According to BlackRock (NYSE:BLK), the era of astronomical gains

for Bitcoin (COIN:BTCUSD) might be coming to an end as the

cryptocurrency matures and becomes institutionalized, especially

with the introduction of ETFs. Robert Mitchnick from BlackRock

signals that, while growth prospects remain, the previous frenetic

pace of appreciation is unsustainable. He also predicts a decrease

in Bitcoin’s volatility, attributing this to improved price

discovery efficiency brought by institutional investors and ETFs,

potentially altering Bitcoin’s characteristic market cycles.

Hong Kong gears up for cash-redeemable Bitcoin ETFs

The Securities and Futures Commission of Hong Kong is set to

allow spot Bitcoin ETFs with cash redemption options in the second

quarter, according to a Bloomberg Intelligence study. This move,

yet unprecedented, promises to differentiate Hong Kong’s ETFs from

their American counterparts, offering tax and liquidity advantages.

With the Asian crypto asset market surpassing the American in

volume, this innovation could attract significant new investments

to the sector.

APT hits an all-time high with new innovations

The native token of Aptos (COIN:APTUSD) appreciated to an

all-time high, reaching the value of $19.26. This advancement

occurred after Aptos Labs, focused on blockchain development,

launched several innovative initiatives, including a new

passwordless transaction signing methodology and a collaboration

with Google Cloud (NASDAQ:GOOGL) to enrich games with Web3

technology. Additionally, the Aptos blockchain recently released

24.8 million APT tokens, expanding its impact on the market.

WAX and AWS form a strategic alliance for blockchain games

The WAX blockchain platform, geared towards the gaming universe

and ranked among the most active, partnered with Amazon Web

Services (NASDAQ:AMZN) to incorporate its network into the Amazon

Managed Blockchain. This collaboration aims to facilitate the

development of decentralized applications by simplifying the

deployment of nodes on the WAX blockchain through the AWS console.

Following the announcement, the value of the WAX token registered a

significant increase, highlighting the potential of this union to

boost Web3 adoption in the gaming sector.

SEC demands a billion-dollar fine from Ripple Labs

In a legal action, the SEC requests that Ripple Labs

(COIN:XRPUSD) be fined almost $2 billion for alleged violations of

U.S. securities laws. The SEC proposes a total penalty of $1.95

billion, breaking down the amount into $876 million in restitution,

$198 million in pre-judgment interest, and an additional $876

million as a civil penalty. The case, initiated in December 2020,

focuses on Ripple’s sale of XRP, with the company and its legal

counsel preparing a response for next month, following a partial

decision in favor of Ripple last July regarding XRP sales.

KuCoin and founders face charges from the U.S. Department of

Justice

The U.S. Department of Justice charged cryptocurrency exchange

KuCoin and its founders, Chun Gan and Ke Tang, with failing to

comply with anti-money laundering regulations. The allegations

include operating a money transmission business without a license

and failing to comply with the Bank Secrecy Act. The indictment

highlights that KuCoin, contrary to its claims, served a broad

customer base in the U.S. and allegedly facilitated over $9 billion

in money laundering, neglecting customer identity controls and

reporting of suspicious transactions.

Galaxy Digital changes the game with annual profit of US$296

million in 2023

Galaxy Digital (TSX:GLXY) reported a net profit of $296 million

in 2023, contrasting with a loss of $1 billion the previous year,

showcasing a recovery in the crypto sector. The positive

performance includes a profit of $302 million in the last quarter,

reversing previous losses. Furthermore, the assets under management

grew from $1.7 billion to an impressive $10.1 billion by February

2024, reflecting a substantial increase in confidence and

investments in the company.

Bakkt reduces losses in 2023 with revenue growth

Bakkt (NYSE:BKKT), a cryptocurrency company of the NYSE, closed

2023 with $780 million in revenues and a loss of $226 million,

improving 89% from the previous year. The acquisition of Bakkt

Crypto contributed to the revenue increase, while expenses reflect

investments in crypto and acquisitions. Despite a decline in

trading volume, Bakkt projects a 555% jump in revenue for 2024,

accompanied by equivalent growth in costs.

Arkon Energy aims for Euronext Amsterdam listing after merger

Arkon Energy, an American company specializing in data center

infrastructure and mining, seeks to enter the Euronext Amsterdam

stock exchange through a merger with Cayman Islands-based BM3EAC

Corp. A 90-day exclusivity agreement was established on February 21

to finalize the merger terms. If successful, Arkon, located in

Hannibal, Ohio, would be a pioneer in its field on the Euronext,

expanding its operational capacity to 307 MW with plans for

expansion in the U.S.

London Stock Exchange announces crypto ETN market for May

The London Stock Exchange (LSE:LSEG) will introduce a market for

Bitcoin (COIN:BTCUSD) and Ethereum (COIN:ETHUSD) Exchange Traded

Notes (ETNs) on May 28, starting to accept orders from April 8,

pending approval from the UK Financial Conduct Authority. Aimed at

professional investors, ETNs are designed to replicate the

performance of specific indices or benchmarks, acting as debt

securities.

SWIFT advances with innovative solution for CBDCs

After a six-month trial, SWIFT unveiled multiple uses for its

pioneering CBDC solution, which is not a CBDC itself but a

connector to facilitate interactions between existing CBDCs.

Essentially, the solution uses DLT and smart contracts to ensure

trustworthy transactions, with potential applications in digital

commerce, securities, and more. This significant test involved 38

institutions and over 750 transactions, marking it as one of the

largest CBDC experiments to date.

Tether ventures into artificial intelligence with new division and

recruitment

Tether (COIN:USDTUSD), known for its leadership in the

stablecoin market, is advancing into the field of artificial

intelligence by creating a division dedicated to developing

open-source AI models. Aiming to apply these models to practical

solutions, Tether is recruiting experts, including a head of

research and an AI engineer. This move broadens Tether’s foray into

AI, following a previous investment in Northern Data, and aims to

promote AI technology that respects privacy.

Angle launches stablecoin with yield based on real assets

Angle introduced USDA, its new dollar-linked stablecoin, on

Tuesday, standing out for offering yields from its real backing

assets and DeFi lending operations. Supported by U.S. Treasury

bonds and tokenized bills, USDA provides its users the opportunity

to earn rewards by staking their tokens in the protocol. Angle aims

to attract investors in a growing stablecoin market by

differentiating itself through profits from its collateral assets,

unlike others like USDT and USDC. The company also plans to create

a blockchain-based currency exchange ecosystem, promising cost-free

conversions between euro and dollar.

El Salvador increases Bitcoin reserves under Bukele’s management

El Salvador, a pioneer in the official adoption of Bitcoin since

2021, increased its stock of the cryptocurrency to 5,700 BTC, as

announced by President Nayib Bukele. This increase, of

approximately 10 bitcoins since mid-March, values the country’s

reserves at over $400 million, considering the current Bitcoin

(COIN:BTCUSD) price above $70,000. Bukele also revealed that the

national Bitcoin reserves were moved to secure storage,

highlighting El Salvador’s commitment to strengthening its position

in the crypto ecosystem and attracting foreign investments with

favorable policies.

Energy transformation in Argentina: from residual gas to Bitcoin

In the wine-producing region of Mendoza, Argentina, Texas

entrepreneurs Brent Whitehead and Matt Lohstroh are revolutionizing

the use of residual energy. According to a CNBC report, they

utilize excess gas from oil fields in the world’s second-largest

shale gas reserve, Vaca Muerta, converting this otherwise wasted

resource into electricity to power intensive Bitcoin mining

operations. This method not only capitalizes on Bitcoin’s

(COIN:BTCUSD) rising value but also offers a sustainable solution,

significantly cutting CO2 emissions by repurposing natural gas that

would otherwise be flared.

Nissan accelerates towards the digital future

Auto industry giant Nissan (USOTC:NSANY) is advancing into

the digital era with its foray into the Metaverse, as evidenced by

its filing of four patents related to Web3 in the U.S. This move

signals Nissan’s entry into innovative digital territory,

encompassing everything from virtual reality and NFTs to blockchain

technology, paving the way for virtual stores and NFT marketplaces.

With a forward-looking vision, Nissan not only reinforces its

pioneering stance in adapting to digital trends but also sets a new

standard for automotive marketing in the virtual space.

0G Labs raises $35 million for AI blockchain

0G Labs, a specialist in modular blockchain for decentralized

artificial intelligence applications, secured $35 million in

initial funding. With support from notable investors such as Hack

VC and Animoca Brands, the company aims to build a diverse

shareholder base. This pre-seed funding, structured as a future

equity agreement with token warranties, will propel the development

of a modular system that enhances data accessibility and management

on blockchain, promising to revolutionize the field with high speed

and reduced costs. 0G Labs plans to launch its test network soon,

with the mainnet scheduled for July, standing out in a growing

landscape of modular blockchain.

Gunzilla Games secures $30 million for new Battle Royale game

Gunzilla Games, the creator of the highly anticipated “Off the

Grid,” secured $30 million in funding led by CoinFund and

Avalanche’s Blizzard Fund. The game, a free-to-play Battle Royale,

will be released for PlayStation, Xbox, and PC, distinguishing

itself by allowing full ownership of in-game assets and a

player-driven economy. The company plans to elevate AAA gaming

experiences with the integration of blockchain technology,

promising immersive gameplay and a decentralized in-game

economy.

OrdinalsBot raises $3 million to boost Bitcoin ecosystem

OrdinalsBot, a key platform in the Bitcoin ecosystem, announced

the raising of over $3 million in initial investments to expand its

operations and innovations. Led by DACM, with support from entities

such as Eden Block and Nural Capital, the round brings the total

funding to $4.5 million. The company, which gained prominence

following the success of the Ordinals protocol, aims to strengthen

its team and develop new solutions for users and developers in the

Bitcoin world, promising to extend the functionalities and reach of

its offerings in the sector.

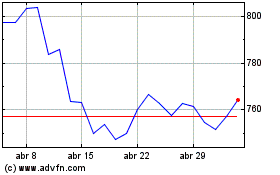

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024